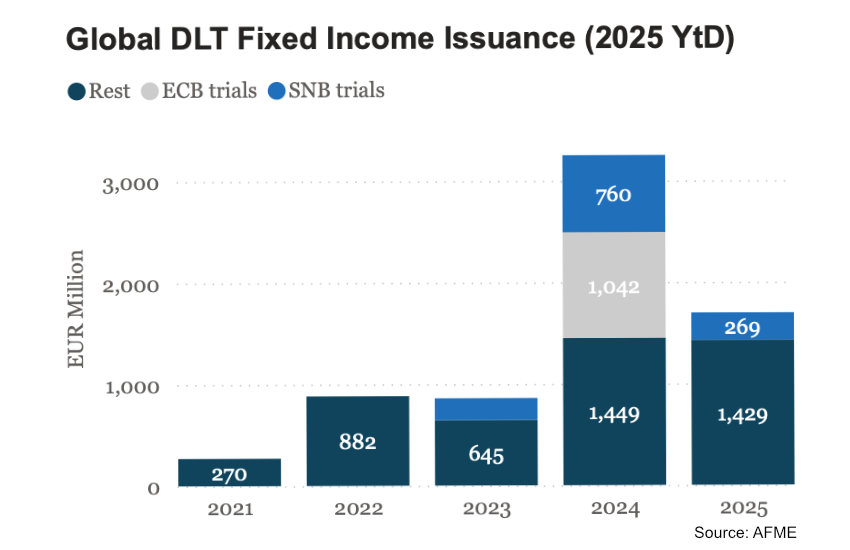

The Association for Financial Markets in Europe (AFME) published its semi annual progress report on the adoption of DLT in capital markets. The report highlights the strong growth in US-led sectors such as stablecoins, repo and tokenized money market funds. By contrast, the report shows a decline in fixed income issuance, especially bonds, and attributes this to the Eurosystem’s wholesale DLT settlement trials that ended in November 2024. The trials had accounted for almost a third of 2024’s figures.

Several participants in the European settlement trials were hoping that the European Central Bank would allow the trials to roll on in order to maintain momentum. That didn’t happen, although the central bank has announced that Project Pontes will launch in a pilot phase in late 2026, with other trials possible before then.

Total fixed income issuance was €3.25 billion ($3.8bn) in 2024 according to AFME figures, dropping to €1.7 billion ($2bn) for the first three quarters of 2025. The number of issuances has declined from 55 to 24 during the same periods.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: AFME