The US dollar has continued to trade at weaker levels during the Asian trading session after the sell-off at the end of last week. The dollar index hit a high of 99.563 on Thursday but has since dropped back below the 99.000-level. The main trigger for the reversal lower for the US dollar was the threat from President Trump on Friday to impose a “massive increase” of tariffs on imports from China. He plans to impose 100% tariffs from 1st November in response to China’s recent new export restrictions on rare earth minerals which are critical for electronics, defence and EV industries. President Trump also stated that the US will impose export controls on “any and all critical software though did not specify which technologies would be affected. It marks a new phase of escalation for the trade conflict between China and the US which has triggered a sell-off for risk assets at the end of last week. The S&P500 equity index declined sharply on Friday by -2.7% and the 10-year US Treasury yield fell by around 10bps. In the FX market, the commodity currencies have underperformed amongst G10 (AUD & NOK) and emerging market currencies (BRL, COP & CLP) alongside Asian currencies (KRW).

However, the initial moves have partially retraced overnight after President Trump has attempted to dampen concerns. He posted “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. the U.S.A wants to help China, not hurt it!!!”. Similarly, Vice President JD Vance has called on Beijing to “choose the path of reason”. He noted that “It’s going to be a delicate dance, and a lot of it is going to depend on how the Chinese respond”. “If they respond in a highly aggressive manner, I guarantee you, the president of the United States has far more cards than the People’s Republic of China. If however, they’re willing to be reasonable, then the US would, too.” President Trump has also partially backtracked on his initial threat not to meet President Xi at upcoming APEC Summit in South Korea, and might still attend.

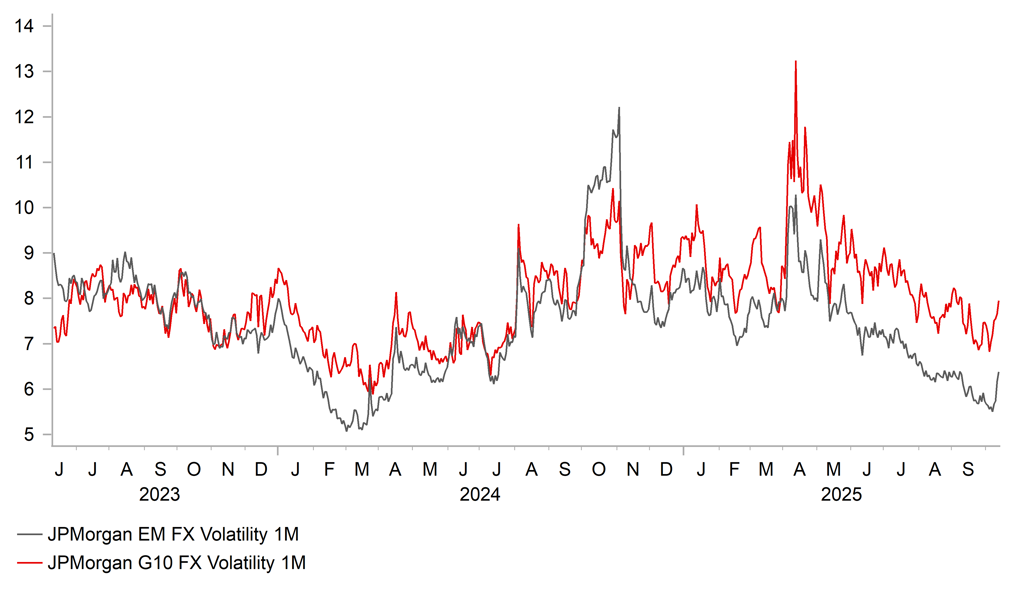

The renewed threat of higher tariffs from President Trump are clearly intended to force China to backdown and reverse recent rare earth minerals. Market participants had been hoping that the worst of the trade conflict between China and the US was in the past. A trade truce reached earlier this year is still in place until 10th November which had lowered US tariffs on imports from China to 30% down from 145%. As part of that trade truce China lowered tariffs on imports from the US to 10% down from 125%. If President Trump follows through on his new plan to raise tariffs on imports from China by 100% it would lift the overall tariff rate back up closer to the highs from earlier this year at the worst point of the trade conflict. However, we remain hopeful that the 100% tariff won’t be implemented and even if it is then it is unlikely to last long. As we saw earlier this year neither side can tolerate such high tariffs for long and the comments from President trump over the weekend again point towards a path for de-escalation. As a result, the trade threats may just contribute a more volatile FX market in the near-term and trigger some unwind of carry trades.

FX VOLS PICK-UP FROM RECENT LOWS

Source: Bloomberg, Macrobond & MUFG GMR