Eight men have gone on trial at Manchester’s Minshull Street Crown Court Minshull Street Crown Court(Image: Getty Images)

Minshull Street Crown Court(Image: Getty Images)

A group used stolen identities to claim for £25 million on bogus tax rebates, prosecutors allege.

Muhammed Usman Saeed, 40, is alleged to have organised the conspiracy, employing a number of others to work for him.

Mr Saeed; Nasir Xsayf-Allah; Bharat Sisodia; Kishor Sisodia; Aroosa Mughal; Sudir Cheedella; Imam Azmi and David Ness are all charged with an offence of conspiring to cheat the public revenue.

They each deny the offence and are on trial at Minshull Street Crown Court. Jurors heard that the case revolved around tax fraud, namely corporate tax.

“Although this case is not about tax, it’s about money and greed,” said prosecutor Mark Monaghan.

He described the offence as a ‘clever and well planned attempt to trick HM Revenue and Customs (HMRC) to make a payment out to Mr Saeed to a total of £25 million’.

Join our Court and Crime WhatsApp group HERE

“These were complex detailed plans that needed quite a lot of organisation, and all of the defendants had parts to play,” Mr Monaghan continued.

“The organising and arranging was done by Mr Saeed, assisted by Nasir Xsayf-Allan, who the Crown says was his right-hand man. That with his team he had worked for him at premises he rented especially for this.”

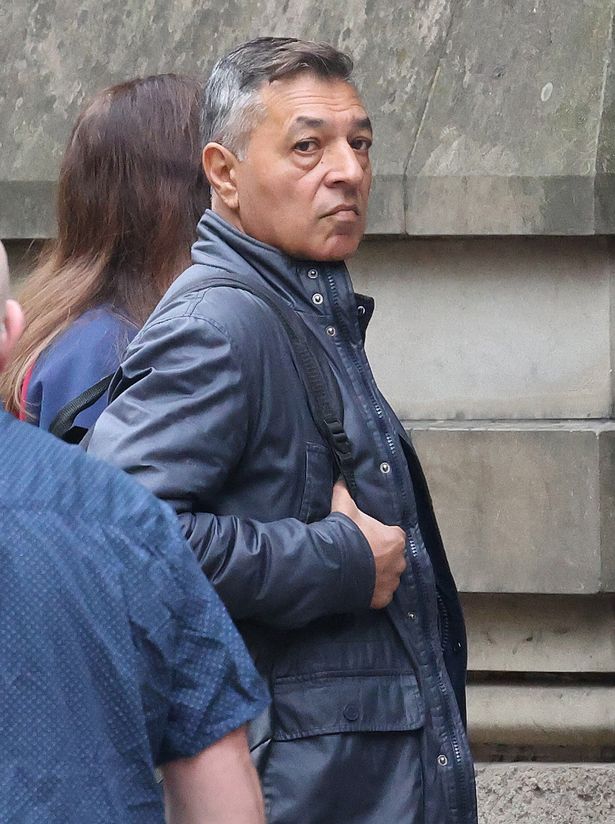

Nasir Xsayf-Allah(Image: Manchester Evening News)

Nasir Xsayf-Allah(Image: Manchester Evening News)

Prosecutors allege that the fraud began with ‘hundreds’ of stolen identities, taken from a recruitment firm, without the individual’s knowledge.

Mr Saeed is alleged to have bought over three hundred ‘off the shelf businesses’ and the team working to register a number of the stolen identities as directors of the companies.

“We say that Mr Saeed realised there was a process to get a tax rebate from HMRC if the companies spent money on research and development,” the prosecutor continued.

“The plan was to set up lots of companies, three hundred plus, use the names as directors (who were real people but had no idea what he was doing) and use them to claim a big rebate and a cheque from the taxman for ‘research and development’.”

To keep up the image that money had been spent on research and development, the group provided ‘made up figures’ and accompanying documents to support the claims, it is alleged.

Jurors heard that these were then uploaded into Companies House, the government’s company information website, to provide ‘plausibility’.

“We say that Mr Saeed had realised that doing this over a relatively short time for hundreds of companies was far too big a job for one man,” Mr Monaghan continued.

“He created a business. It operated from premises at Broadstone Mill in Stockport. The business was called Ziko Infinity Business Services.”

As a result, the 300 businesses allegedly bought by Mr Saeed had their addresses changed to Broadstone Mill.

The court heard that the team was made up of a number of individuals including four who prepared documents to submit to Companies House, as well as collecting Unique Tax Reference codes for each business.

They were alleged to have been Imam Azmi and Arooza Mughal. Two others, Nicole Garcia and Wayne Garcia have previously pleaded guilty to cheating the public revenue at an earlier hearing, jurors were told.

The four would allegedly get the UTR codes to apply for the tax rebate, prepare forms and set up two-factor authentication to further support plausibility. They would claim to be acting as directors of companies under the stolen names, and suggest they had ‘lost’ the codes.

The codes would then be sent by post to the company address, which was Broadstone Mill, prosecutors said.

Later, when authorities searched the premises, they discovered 19 mobile phones scattered around, each with different names attributed to them. They also discovered that Mr Saeed had kept a record of the claims being made using a spreadsheet, which dictated who was working on the claim and how far they had got with it, the court heard.

Bharat Sisodia(Image: Manchester Evening News)

Bharat Sisodia(Image: Manchester Evening News)

Four other defendants, namely Bharat Sisodia; Kishor Sisodia: Sudir Cheedella; and David Ness are alleged to have been ‘friends or acquaintances’ of Mr Saeed who had lots of business connections and who helped out in order to ‘get themselves a share of the fraudulently obtained tax’ by assisting in the directorships.

The court heard there were messages discovered on Mr Saeed’s phone between him and Mr Ness discussing a research and development claim. Three out of the four men were successful in their claim, with Bharat Sisodia getting £112,000; Kishor Sisodia getting £29,000 and Mr Cheedella getting £111,000, it was said.

“Not one of them was entitled to a single penny,” said Mr Monaghan.

The total amount the group were trying to claim was £25,245,853, jurors heard.

“This is not a victimless crime. To put that into perspective, the amount of money Mr Saeed was trying to get was the cost of running 20 critical care beds in a hospital for a year,” the prosecutor added.

Muhammad Usman Saeed, of Manor Lane, Harlington, London; Nasir Xsayf-Allah, 54, of Earle Road, Bramhall, Stockport; Bharat Sisodia, 60, of Sandringham Road, Sandiacre, Nottingham; Kishor Sisodia, 65, of Oakenshaw Road, Redditch; Aroosa Mughal, 31, of Greetland Drive, Blackley; Sudhir Cheedella, 50, of Waterview Close, Kent; Imam Azmi, 41, of Kelstern Avenue, Longsight; and David Ness, 47, of Old Tower Road, Glasgow, each deny cheating the public revenue.

The trial continues.