More than 220,000 claimants were subject to state pension overpayments in 2024/25, DWP estimates show

Hundreds of thousands of pensioners have incurred over £100m in debt due to “official errors” in 2024/25 by the Department for Work and Pensions (DWP), The i Paper can reveal.

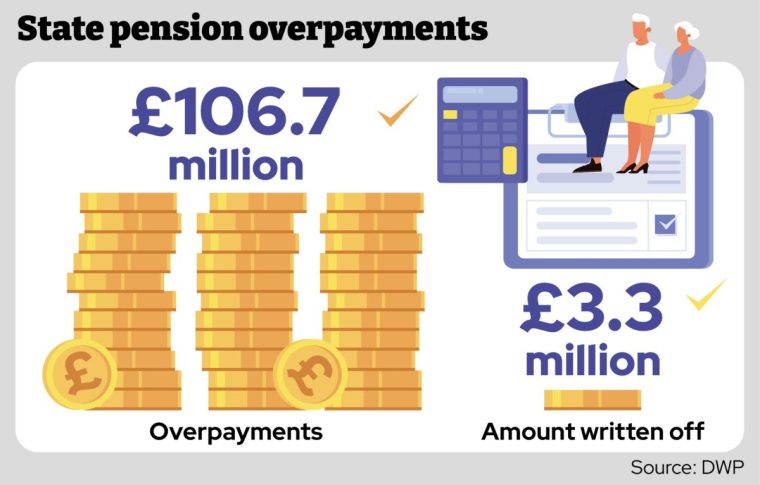

DWP estimates show that more than 220,000 claimants were subject to state pension overpayments worth about £109m in 2024/25.

But official figures obtained by The i Paper through a freedom of information request show that just 2,861 overpayments worth around £3.3m were written off by the department, with the remaining amount being incurred as debt by state pensioners.

This marks a significant increase from 2023/24, when state pension overpayments amounted to an estimated £20m, of which £4.76m was written off.

The DWP defines an “official error” overpayment as one which “is not as a result of a failure to disclose or misrepresentation by the claimant but instead as a result of a departmental error”.

A spokesperson for the department reiterated its commitment to bring forward the “biggest crackdown in a generation” on fraud, error and debt.

This will be enforced through measures introduced in the Fraud, Error and Recovery Bill, which is set to “save the taxpayer £1.5bn over the next five years”, the spokesperson added.

The DWP’s estimates on state pension overpayments are based on sampling of a limited number of claims. But according to the amounts written off, the average overpayment amounted to approximately £1,160 per claimant in 2024/25.

Over £100m has been wrongly paid to state pensions due to the DWP error

Over £100m has been wrongly paid to state pensions due to the DWP error

Responding to The i Paper‘s findings, Dennis Reed, director of the Silver Choices charity supporting the elderly, said: “The DWP is on shaky legal ground in demanding repayments of state pensions or benefits caused by its own incompetence, particularly if the errors go back some time.”

He argued that claimants should “not be saddled with large debts because the department can’t get its poor administration sorted out”, advising those who are overpaid to avoid making “an immediate repayment and state that the responsibility for the error rests with the DWP”.

The i Paper revealed in May that universal credit claimants incurred more than £490m in debt due to more than 680,000 DWP errors in 2023/24.

Lucy Bannister, head of policy and influencing at Turn2Us, a charity supporting people facing financial insecurity, said: “Like our NHS, our social security system was set up to be there for all of us. It should give us security when we’re not well and help us bounce back when life takes a turn.

“Claimants should never be penalised for DWP administrative errors. They cause severe distress – often forcing households to choose between essentials like heating or food.

“A rise in errors like these also increases fear and mistrust in the DWP, making it harder for work coaches and assessors to work with claimants to identify the support they need.

“For the government’s ongoing reforms to be successful, it needs to prioritise rebuilding trust and treating everyone with dignity and respect.”

The Public Authorities (Fraud, Error, and Recovery) Bill, introduced into the Commons in January, will include measures to help prevent overpayments and safeguard taxpayer money.

One example is the “eligibility verification measure”, which will require banks to share limited data on claimants who may be receiving an incorrect payment. This will not give DWP access to benefit claimants’ bank accounts.

A DWP spokesperson said: “We are determined to tackle fraud, error and debt, and through our Fraud, Error and Recovery Bill we are bringing forward the biggest crackdown in a generation.

“Thanks to our reforms we will save the taxpayer £1.5bn over the next five years, as part of wider plans that will save £9.6bn by 2030.”