2h agoTue 21 Oct 2025 at 11:13pmMarket snapshot

- ASX 200: -0.6% to 9,037 points

- Australian dollar: -0.4% to 64.9 US cents

- Wall Street: Dow Jones (+0.5%), S&P 500 (+0.1%), Nasdaq (-0.1%)

- Europe: FTSE (+0.3%), DAX (+0.3%), Stoxx 600 (+0.2%)

- Spot gold: -5.4% to $US4,122/ounce

- Silver: -7.4% to $US48.60/ounce

- Oil (Brent crude): +0.5% at $US61.32/barrel

- Iron ore: -0.4% at$US103.50/tonne

- Bitcoin: -1.5% to $US109,201

Prices current around 10:15am AEDT

Live updates on the major ASX indices:

2m agoWed 22 Oct 2025 at 1:52amWhat role Australia plays in global gold market

As the third largest miner of gold and with one of the largest gold reserves in the world, Australia is no doubt a beneficiary of a surging price of gold.

The Commonwealth and WA government will be material beneficiaries of higher prices, the Commonwealth Bank says, with revenue likely at least $1 billion higher annually over the next two years if the current gold price is sustained.

In 2024-25, Australia mined almost 300 tonnes of gold, the majority in WA and most of which is exported.

Around three-quarters of Australia’s gold exports have ended up in China, the UK, India, Singapore or the US in recent years.

While Australia also imports a large amount of gold, it is a net exporter with export values over three times larger than import values in 2024-25.

The Commbank says it expects higher gold prices to transmit through the Australian economy in two ways: higher national income and higher investment.

Despite the pullback in its price overnight, gold is still trading at above $US4,000 an ounce.

19m agoWed 22 Oct 2025 at 1:35amAustralian consumers’s stress level up again after easing due to falling inflation

NAB‘s latest consumer sentiment survey has shown that Australian consumer stress is rising again after easing to a 2-year low due to falling inflation.

However, stress levels remain below the series average, according to the survey.

“Though price dynamics continue to influence a range of spending behaviours, consumers were a little less restrained with their expenditure in the September quarter,” the bank said.

“This easing allowed households to spend more, though spending growth remains concentrated in specific areas, with a focus on value.

“Consumers are still struggling with a lack of clarity on the future path of the economy, contributing to the decline in overall sentiment.”

NAB has also found that, while two in three Australians now expect house prices to continue to rise over the next year, one in two believe inflation, taxes, and other government charges will increase.

Over one in three believe unemployment will lift, and fewer expect interest rates to decrease, it says.

36m agoWed 22 Oct 2025 at 1:18am

Expert tips for used-car buyers to spot odometer tampering

If you’ve been thinking about buying a used car recently, knowing how to spot odometer tampering can be super helpful.

Experts have told the ABC that tampering with odometers is widespread in the used-car industry.

My colleagues Mackenzie Colahan, Nicole Dyer and Kelly Higgins-Devine have more.

52m agoWed 22 Oct 2025 at 1:02amGold’s structural case remains intact despite overnight correction: analyst

Further on gold, Cameron Glesson, senior investment strategist from Betashares, said it wasn’t surprising to see a pullback overnight considering gold’s record-breaking rally.

“Given the state of play in the US and geopolitical risks more broadly, the longer-term case for gold remains strong,” he said.

“China’s central bank has been consistently buying gold, providing structural support, yet gold still only makes up about 8% of its total foreign reserves, well below the global average of around 22%.

“This year investors have been playing catchup, with strong gold bullion ETF inflows after several years of outflows.

“Perhaps some investors have got a bit ahead of themselves, as US-China trade tensions appear to be easing, for now.

“But gold is a hedge against concerns around Fed independence, ballooning US government debt and a continued decoupling of the world’s largest powers.

“These forces aren’t going anywhere soon and, in some cases, may even accelerate.”

Mr Glesson said it’s a timely reminder for investors about maintaining a diversified portfolio.

“While gold was down, equities and bonds were flat,” he said.

“Over the course of 2025 gold has remained one of the best hedges against periods of weakness in the share market.”

Gold ETFs have seen $1.3 billion in net flows since the start of 2025, pushing funds under management in the asset class to $9.6 billion, according to Betashares.

1h agoWed 22 Oct 2025 at 12:46am

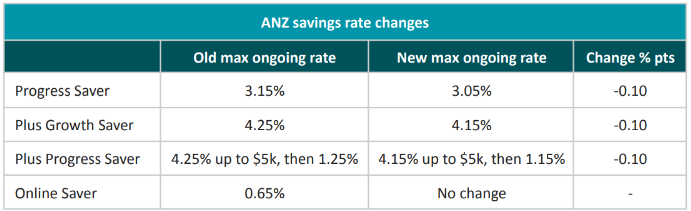

ANZ chips away at savings rates ahead of November RBA meeting

ANZ has cut rates on its key savings accounts by 0.1 percentage points, even though the cash rate has remained on hold since August, according to Canstar.

Here are the latest updates on its savings rates:

(Canstar.com.au)

(Canstar.com.au)

Canstar.com.au data insights director Sally Tindall said ANZ’s decision to trim savings rates ahead of the November RBA meeting was a timely reminder that banks could, and did, adjust their rates.

“While the latest round of cuts from ANZ may disappoint many of its savings customers, across the banks that have recently changed rates, it’s more of a mixed bag,” she said.

“Some banks, such as Westpac, have shaved back their base rates, boosting their bonus ones instead, while others, such as NAB, have nudged headline rates up.”

ANZ was not the only bank giving savings rates an unexpected haircut, Canstar said.

Rate tracking by Canstar.com.au shows that in the last five weeks a handful of banks have cut some savings rates,

including:

- Bendigo Bank decreased its Reward Saver bonus rate by 0.05 percentage points.

- Westpac, St George, Bank of Melbourne, and Bank SA cut the base rate on their bonus saver accounts by

0.15 percentage points, but boosted the bonus rate by the same amount, impacting customers who don’t meet

the monthly terms and conditions. - IMB cut the bonus rate on its main savings accounts by 0.25 percentage points, increasing the new customer

4-month introductory rate by the same amount instead.

1h agoWed 22 Oct 2025 at 12:28am’A dash for the profits window was inevitable’: NAB strategist on the gold sell-off

If you want even more commentary about gold prices, you’re in luck!

(I imagine you’d be quite interested if you were one of the people who joined the very long queues to buy or sell gold recently).

Here’s what Ray Attrill, NAB’s head of FX Strategy, is saying about today’s big fall in the gold price:

“There’s a classic market adage that goes something like ‘when financial news moves from the business pages to the front page, the top is near’. Wednesday’s correction in the gold (and silver) price might be best seen in this context,” he said.

“Given the parabolic nature of the run up since September and the knowledge that much of the latest buying spree has been from retail or other private sector investors via ETFs ($26b worth in September alone) a dash for the profits window was inevitable at some point soon, temporary or otherwise.

“Even with the overnight shakeout, gold is still up 57% year to date, far outpacing Bitcoin (17%) or any of the major global stock indices (the latter led by the Hang Seng up 30% year to date, and the Nikkei 24%).”

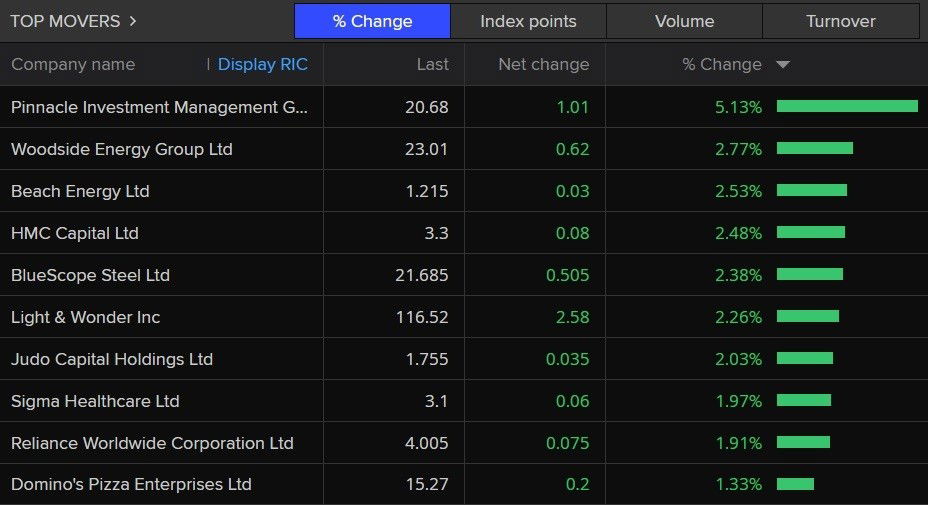

1h agoWed 22 Oct 2025 at 12:15amWoodside Energy and Pinnacle among the few stocks that have risen

Only 38 out of 200 stocks have actually risen this morning on the ASX 200.

One of today’s best performers is Woodside Energy which saw its share price rise 2.7% to a two-week high.

That was after Woodside raised its production forecast for the current financial year, even as its September quarter revenue fell 9.4% due to lower oil prices.

The company seeing the biggest increase to its share price is Pinnacle Investment Management which jumped 5.2% in morning trade.

That was after the company revealed plans to purchase a 13% stake in Advantage Partners, a Japan-based private equity firm.

Energy stocks are among today’s best performers. (Refinitiv)1h agoWed 22 Oct 2025 at 12:02amAustralian market’s losses worsen, ASX down 1%

Energy stocks are among today’s best performers. (Refinitiv)1h agoWed 22 Oct 2025 at 12:02amAustralian market’s losses worsen, ASX down 1%

The Australian share market’s losses have worsened after the first trading hour.

The ASX 200 is now down 1% to 9,008 points, with three-quarters of companies on this index trading lower — so that’s most of them down.

The broader All Ords index has also dropped 1% to 9,295 points.

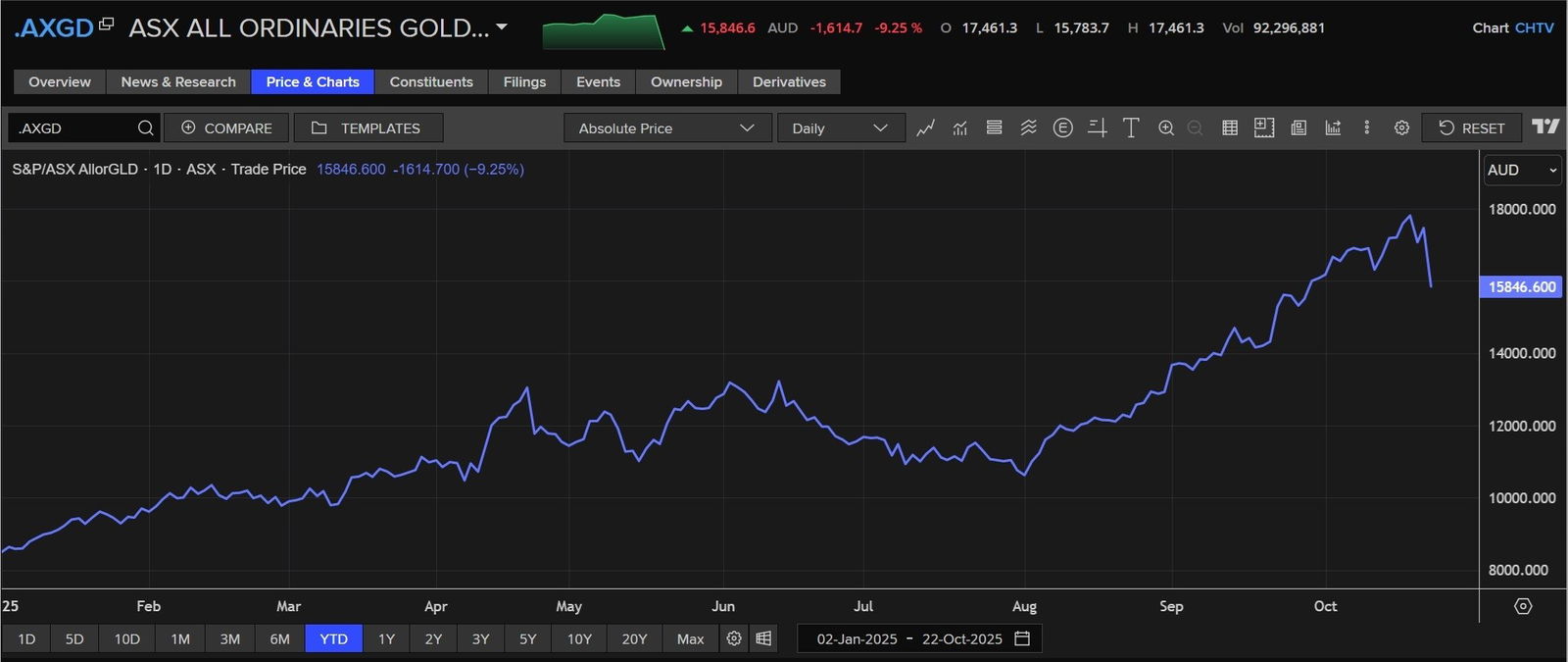

1h agoTue 21 Oct 2025 at 11:57pmAustralian gold stocks are still near their most expensive levels ever

Despite today’s sharp falls, those who bought gold mining stocks when the year began will still be enjoying lucrative gains.

The All Ords gold index has plummeted by more than 9% today.

But this index, which tracks the value of Australian gold mining stocks, as you may have guessed, is still up 88% in the year to date!

The broader share market isn’t doing anywhere near that well. To put thing into perspective, the ASX 200 index is up 10.5% since January.

And when dividends are factored in the ASX Gross Total Return index has risen 13.5% since the start of the year.

So if you were thinking of ‘buying the dip’, you can see it’s really not much of a dip given the value of Australian gold stocks (in general) are still near record highs.

Australian gold stocks remain near record highs. (Refinitiv)2h agoTue 21 Oct 2025 at 11:43pmASX gold miners plunge, partly due to optimism about US-China trade talks

Australian gold stocks remain near record highs. (Refinitiv)2h agoTue 21 Oct 2025 at 11:43pmASX gold miners plunge, partly due to optimism about US-China trade talks

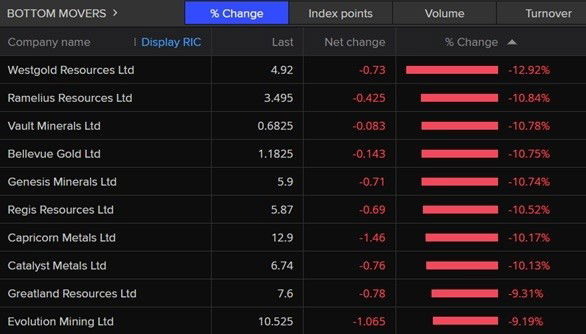

When we look at today’s bottom 10 stocks, the worst performers, all of them are gold miners.

Shares of Evolution Mining, Vault Minerals, Bellevue Gold and Westgold Resources are down anywhere between 9% and 13% this morning.

That’s because the spot price of gold itself has dropped more than 5% — its worst trading day since 2020.

“The correction in the gold price has been partly driven by optimism about US‑China trade talks,” according to Commonwealth Bank currency strategist Carol Kong.

“President Trump said the upcoming in‑person meeting with President Xi would yield a ‘good deal’ on trade. But there is a possibility the meeting between the presidents may not occur,” she said.

“Given the many issues at play, we consider an extension to the deadline for a trade deal is more likely than a comprehensive trade agreement.”

Gold mining stocks are falling sharply. (Refinitiv)

Gold mining stocks are falling sharply. (Refinitiv)

Generally, the value of gold surges when people are nervous about the global economy as they pile into safe haven assets.

When the opposite happens, ie. increased optimism, the price of gold tends to fall and riskier investments, such as shares, tend to rise.

The gold price is also falling because prices have surged by around 60% since the year began, so it was inevitable there’d be some profit taking at some point, ie. cashing out while you’re ahead.

Ms Kong also says “hopes of a de‑escalation” between the US and China could boost the Australian dollar.

2h agoTue 21 Oct 2025 at 11:21pmASX opens with 0.7 per cent drop as gold miners tank

The Australian share market has started its day moderately lower after gold prices recorded their worst single-day fall in five years.

That weighed on the share price of gold miners which are dominating the list of today’s worst performing stocks.

The ASX 200 was down 0.7% to 9,035 points, by 10:20am AEDT.

Meanwhile, the broader All Ordinaries index fell 0.7% to 9,322 points.

Spot gold dropped more than 5% to $US4,118 an ounce.

2h agoTue 21 Oct 2025 at 11:03pm

TWU welcomes Rex sale but wants protections

The Transport Workers Union is seeking a meeting with the buyer of Regional Express and is calling for assurances “vital regional routes” will be safe guarded, along side workers’ pay and conditions.

Rex has found a buyer in US company Air T, after the airline entered voluntary administration last July.

“The federal government and its support of the potential buyer have ensured the protection of thousands of jobs and critical infrastructure for regional Australia, but it must attach conditions of decent jobs and guarantees of routes and services to this support,” the TWU said in a statement.

“With little known about Air T’s plan for Rex’s critical routes, there are still significant questions here around jobs and the continuation of services long-term,” said the union’s national secretary Michael Kaine.

The TWU says bargaining is ongoing for Rex ground workers.

3h agoTue 21 Oct 2025 at 10:53pm’Plenty of money to be made from desperate governments’: Alan Kohler on the US-Australia minerals deal

The critical minerals deal that Australia struck with the United States has been hailed as a diplomatic win for Anthony Albanese.

The prime minister says the agreement includes investment plans for projects in Australia worth up to $US13 billion ($US8.5b).

The objective of this deal is to provide the US with an alternative source of rare earth minerals (in time).

However, China will continue to have a virtual monopoly over the world’s supply and processing of these commodities which are crucial for the manufacture of missiles, electric vehicles, computers — basically anything that runs on power.

Alan Kohler filed this report about how it could take decades for this deal to pay off.

Loading…3h agoTue 21 Oct 2025 at 10:33pm’Flood risk’ properties are worth $42 billion less: PropTrack and Climate Council report

PropTrack and the Climate Council have published a report showing the impact of floods on housing values.

More than two million homes (or 17%) of Australia’s residential properties face varying degrees of “flood risk”, according to their research.

At least 70% of those properties have seen their values drop.

Collectively, in regions where floods caused property values to fall, their values are $42.2 million less compared to what they would’ve been if there were no flood risk.

“The largest share of homes in areas exposed to flood risk nationally are situated in Queensland (40%), followed by New South Wales (30.1%),” the report found.

The researchers also found that while flood-prone home values increase over time, they “often do so from a lower base and at a slower pace”.

One of the report’s key researchers, Climate Council economist Nicki Hutley, spoke about the findings on Radio National Breakfast this morning.

If you’d like to hear more, I can certainly recommend listening to her interview with the program’s host Sally Sara.

3h agoTue 21 Oct 2025 at 10:11pmIndustry warns building houses in Australia slower than it was a decade ago, construction targets missed

Addressing planning constraints and investing in skilled labour is essential as Australia continues to fall behind in its aim to build 1.2 million homes in five years, construction industry experts say.

Analysis of the latest Australian Bureau of Statistics (ABS) building activity by Master Builders Australia shows building a new detached house is 35.8 per cent slower than it was a decade ago.

Since 2014-15, time frames for apartments and townhouses have ballooned even further, with an increase of 54.1 per cent and 27.6 per cent respectively.

For more, here’s the story by Claudia Williams:

4h agoTue 21 Oct 2025 at 9:53pmMiners confident China’s stranglehold on rare earths can be broken

The bosses of Australia’s critical minerals and rare earths miners couldn’t be happier after Anthony Albanese’s meeting with Donald Trump yesterday resulted in a signed deal.

Both Australian and the United States have committed at least $US1 billion to develop projects in the next six months, and pledged a combined investment of $US8.5 billion over the longer term.

The objective is to erode China’s dominance of the world’s critical minerals market (eventually).

Our chief business correspondent Ian Verrender joined The Business host Kirsten Aiken to unpack the deal in last night’s episode.

Kirsten also interviewed the CEOs of Arafura Rare Earths (Darryl Cuzzubbo), Australian Strategic Minerals (Rowena Smith) and PLS, formerly known as Pilbara Minerals (Dale Henderson).

Loading…4h agoTue 21 Oct 2025 at 9:40pmOuter suburban property markets are booming: Cotality report

Cotality’s latest report also shows seven-figure property price tags becoming increasingly common outside traditional prestige areas.

The report found that properties with a seven-figure price tag accounted for 30.8% of the national sales over the year to September, more than double the 15.2% they comprised in the same period in 2020.

Cotality economist Kaytlin Ezzy said the million-dollar benchmark is losing some of its relevance as membership in the seven-figure club reaches record highs.

“Five years ago, just 14% of Australian suburbs were members of the million-dollar club, with the majority concentrated in Sydney’s prestigious Northern Beaches, Eastern Suburbs, and North Sydney and Hornsby regions,” she said.

And while these outer ring areas also have there fair share of million dollar properties, not all centres are booming.

At the other end of the spectrum, Regional Victoria was the only capital city or state region to record a net decline in million-dollar markets.

In September, only 11 of 278 suburbs analysed had a median value at or above the $1 million mark, one suburb fewer relative to this time last year.

4h agoTue 21 Oct 2025 at 9:29pmA third of Australia property markets now worth $1 million or more

Cotality has published its latest Million Dollar Markets Report.

Among the report’s key findings:

- One in three property markets across Australia now have a median value of $1 million or more (a new record-high).

- The number of million-dollar suburbs has surged 143% over the past five years.

- Brisbane led the capitals and rest of state regions, recording the largest net change in million-dollar markets over the year.

- This was followed closely by Sydney (where 70% of its property markets now exceed the $1 million median).

- Despite the rise in million-dollar markets, affordability and equality are worsening.

The report notes that a household on an average income with a 20% deposit would need to spend over 50% of pre-tax earnings to service a mortgage on a $1 million home.

4h agoTue 21 Oct 2025 at 9:12pm

Critical minerals recap and Melbourne’s property market: Alan Kohler’s finance report

In case you need a refresher on what’s happening with shares of Australia’s critical minerals and rare earths companies, I can certainly recommend Alan Kohler’s finance report.

Alan also had an interesting chart on how Melbourne is “leading the nation” when it comes to housing affordability – ie. property values going almost nowhere.

“For the past four-and-a-half years, Melbourne house prices have been unchanged, while the national median has gone up about 30%,” he said.

“All we need now is for the rest of the country to follow Melbourne’s lead and for housing to be a bad investment.”

Loading…