30m agoThu 23 Oct 2025 at 2:44amMarket snapshot

- ASX 200: flat at 9,032 points (live numbers below)

- Australian dollar: flat at 64.84 US cents

- S&P 500: -0.5% to 6,699 points

- Nasdaq: -0.9% to 22,740 points

- FTSE: +0.9% to 9,515 points

- EuroStoxx 600: -0.2% to 572 points

- Spot gold: -0.3% to $US4,078/ounce

- Brent crude: +2.33% to US64.05/barrel

- Iron ore: flat at $US105.15/tonne

- Bitcoin: + 0.64% to $US108,296

Prices current around 1:45pm AEDT

Live updates on the major ASX indices:

3m agoThu 23 Oct 2025 at 3:12am

Consumers weighting for ‘bargains’

Super Retail Group held its AGM today.

Its brands include automotive retailer Supercheap Auto, outdoor and leisure retailers Macpac, and BCF, and sporting retailer Rebel.

E&P Capital has offered up its thoughts on Super Retail Group.

It sees sales driven by promotional campaigns.

“While sales growth in the past 2 months has softened slightly, the key trading window for 1H26 is the Black Friday/Christmas period and industry feedback / data continues to suggest that consumer spending remains clustered around key promotional events,” E&P Capital retail analyst Kade Madigan noted.

“As such, we continue to expect an improvement in the momentum of consumer spending through November/December.

“[Super Retail Group’s] share price has been weak across the last 6 weeks, impacted by the recent change in management.

“We would expect that today’s update being in line with consensus expectations should provide comfort that recent movements in management personnel have not significantly disrupted operational momentum at the divisional level,” she said.

15m agoThu 23 Oct 2025 at 3:00am

Fitch on interest rate outlook

BMI (a unit of Fitch Solutions) has just published its outlook for Australia’s interest rates.

Its key views are listed below:

- We expect the Reserve Bank of Australia to ease rates by a further 25bps to 3.35% by the end of FY2025/26.

- We think that inflation will accelerate above the 2-3% target range in the coming months, limiting space for rate cuts.

- Australia’s improving economic trajectory compared with other developed markets will allow the currency to strengthen to USD0.68 by end-2025 and USD0.70 by end-2026.

30m agoThu 23 Oct 2025 at 2:45am

BHP on US/Australia critical mineral agreement

US President Donald Trump and Australian Prime Minister Anthony Albanese signed a critical minerals agreement aimed at countering China on Monday.

“I think, it’s a little bit early to actually see the outcomes of what we see as a good meeting between the prime minister of Australia and the president of the United States,” BHP Chair Ross McEwan said.

“But I think it was a very good meeting to start those conversations.”

40m agoThu 23 Oct 2025 at 2:35am

BHP CEO flags ‘difficult decisions’

BHP Group’s CEO said the company may be forced to take “difficult decisions” for its metallurgical coal business in Australia if there were no regulatory changes to support it.

The world’s biggest mining company held its annual general meeting today.

BHP last month said it would suspend operations and cut 750 jobs at a Queensland coking coal mine it shares with a unit of Mitsubishi, blaming low prices and high state government royalties that have dented its returns.

“Without change, there’s without doubt going to be more difficult decisions that are going to be made,” CEO Mike Henry said at the miner’s annual general meeting.

53m agoThu 23 Oct 2025 at 2:22am

Love of economics

David – I love economics too…for Me it was Mrs Smith from Year 11. She was delightfully quirky & left me with the mind set of “don’t take the theory’s to literally (Because its likely to sound absurd), pay attention to the background lesson”…took that mindset into my economics degree. Best of all she asked two philosophical questions & made a statement that broke some conventional trains of thought, that had really helped later on.

– allan

G’day Allan,

Thanks for sharing.

The thing that got me over the line was this:

“It’s curious isn’t it class,” Mr Devin said, “10% of the world’s population is dying of obesity and the bottom 10% are dying of starvation”.

He was referring to inequality or the haves and have nots, and, at the time, the developed world and the developing world.

It resonated with me like nothing else.

DT

1h agoThu 23 Oct 2025 at 2:00am

Financial markets quiet … with one outlier

Wall Street pulled back modestly last night by Asian markets seem to be holding up reasonably well … with the exception of the Nikkei 225.

It’s down over 1% at 1pm AEDT.

On that front it’s worth watching the Japanese 10-Year bond yield.

Analysts say the bond market could draw money from Wall Street if the risk-free rate approaches 2%

It’s currently 1.65%.

1h agoThu 23 Oct 2025 at 1:46am

Gotta love economics

OK this a little bit of a personal post from me.

I love economics.

I fell in love with it in year 11 — helped by a great teacher, Terry Devin.

I wish the same for other students.

The Reserve Bank has published its latest Bulletin.

It devotes a section to the progress of the uptake of economics in high schools… because it recently dropped off a cliff.

Here’s an excerpt from the RBA October Bulletin.

“The RBA’s 2024 student survey finds that students across New South Wales continued to view the field of economics as relevant and beneficial to society; however, perceptions of the study of Economics in Years 11 and 12 remained less favourable.”

“New insights from the 2024 survey highlight the role of early exposure to Economics through the Years7–10Commerce elective, particularly following the introduction of a core economics topic into the 2019 Commerce syllabus.

“This early engagement is associated with greater student interest, confidence and understanding of Economics.

“Notably, the largest improvements were observed for students from lower socio-economic backgrounds, who are under-represented in Economics.

“These findings suggest that an increased focus on efforts to give more Years7–10students the opportunity to engage with Economics could help to broaden participation and improve perceptions of the subject among a more diverse cohort of Years 11–12students.”

You can read more on the RBA’s website.

1h agoThu 23 Oct 2025 at 1:30am

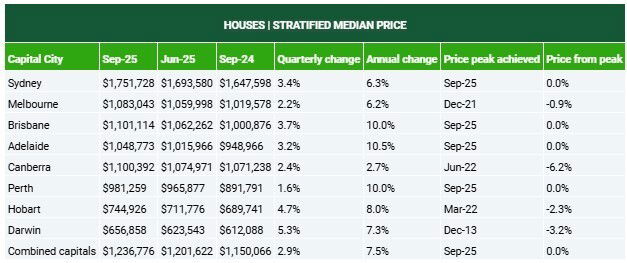

House prices outpace wage growth by so much you probably want to look away

The wildness of our market is in full effect. Sydney’s median house price jumped 3.4% last quarter, an increase of $58,148.

If that percentage seems familiar it’s because it’s same as the backwards looking Wage Price Index of how much wages are rising by.

But the WPI is going up by 3.4% a year, not per quarter.

2h agoThu 23 Oct 2025 at 1:10am

Important keg news for keg consumers

Hi team,

Popping in with breaking news in the ‘filling kegs with alcohol’ category of important updates.

Loading

Our competition regulator has opposed keg pooling supplier MicroStar’s (KegStar) proposed bid to buy the assets of Konvoy, another cog in the keg market.

MicroStar is known as Kegstar. It and Konvoy are the only suppliers of ‘keg pooling services’, which let brewers rent kegs on a short-term basis to supply booze on tap to pubs and clubs around the nation.

Accomplished economist Dr Philip Williams AM, who chairs the ACCC’s Mergers Review Committee, is a former Professor of Law and Economics at the University of Melbourne and holds a Masters in economics from Monash University and a PhD from the London School of Economics probably didn’t see this one coming in his career, but that’s what happens when you devote your life to public service.

Here’s what he said:

“Our investigation has found that MicroStar acquiring the assets of Konvoy, the only other provider of keg pooling services in Australia, would be likely to substantially lessen competition.”

“Without competitors, MicroStar could increase prices above a competitive level and reduce services or quality of service for customers.

“Higher prices for keg pooling would have a significant impact on many independent brewers.”

Complicating factor. Konvoy is in receivership and its assets might end up getting sold.

“Our view is that if the proposed acquisition does not proceed, the Konvoy business is likely to continue, whether under new or existing ownership; however, we recognise that liquidation of the assets is also a potential outcome.

“If Konvoy’s assets are liquidated, they would likely remain in the market and be available to new or emerging rivals to MicroStar, or to independent brewers.”

That’s your latest in beer/keg news.

More to come.

2h agoThu 23 Oct 2025 at 12:56am

Cost pressures and inflation: NAB survey

The National Australia Bank’s quarterly business survey is closely watched by the Reserve Bank.

One of the reasons for that is the NAB tracks price pressures in the economy.

These two lines from the survey report might give the RBA pause for thought:

“Leading indicators point to ongoing momentum with forward orders turning positive after 5 consecutive quarters of improvement and expected conditions over the next 3 & 12 months rose to multi-year highs.”

“However, the two biggest issues impacting confidence continue to be wage costs and margin pressure,” the NAB quarterly report stated.

The question is how willing businesses are to pass on these wage cuts to ease margin pressure.

Could it come in the form of higher prices? That has implications for inflation.

2h agoThu 23 Oct 2025 at 12:47amBusiness doing OK: NAB

The NAB Quarterly Business Survey is out (for 3rd quarter).

It surveys hundreds of businesses from across all sectors of the economy to find out how they’re performing, and what they think about the outlook.

Here are some of its key points:

- Business conditions rose by 5pts to sit at the highest level since Q2 2024 and are now above the long-run average. The rise was driven by gains in all subcomponents, led by profitability which rose from -4pts to +4pts.

- Business confidence continued its upward trend improving for the fourth consecutive quarter and is now in positive territory for the first time since Q4 2022

- Overall businesses in Q3 maintained positive momentum with both conditions and confidence in positive territory for the first time since 2022 despite some indicators implying that there are underlying capacity pressures which remain.

2h agoThu 23 Oct 2025 at 12:38am

DT reporting for duty

Hi Folks,

I’m on the blog … and I’m up for any curly questions you might have.

Let’s go.

DT

3h agoThu 23 Oct 2025 at 12:07am

BHP’s AGM opens in Melbourne this morning

Rhiana Whitson reporting from BHP’s annual meeting in Melbourne this morning. It’s the first time the mining company has held an AGM in the Victorian capital since 2017. It’s also former NAB boss Ross McEwan’s first as BHP chair.

BHP CEO Mike Henry told the meeting he and Rio Tinto has recently scored an Oval Office meeting.

Mr Henry told the AGM Australia is well placed to support the US in de-risking critical minerals.

There’s also been a question from the audience about recent reports that China would block BHP iron ore shipments in the midst of a pricing stand-off.

BHP Chair Ross McEwan wouldn’t comment on the talks with China “we are in commercial negotiations” that “happen every year.” He also said Q1 iron sales were broadly in line with the previous year.

BHP AGM opens

BHP AGM opens

I spoke to a few shareholders before the AGM kicked off who were keen to get more clarity on the talks with China than what’s been provided so far today.

3h agoThu 23 Oct 2025 at 12:04am

South Energy plans 100-megawatt battery project for Victoria’s Macedon Ranges

A private developer plans to build a large-scale battery energy storage facility on bushfire-prone land in the central Victorian town of Macedon.

South Energy will lodge plans next month for the Macedon Battery Energy Storage System (BESS) project — a 100-megawatt system featuring 128 lithium-ion battery containers on a five-hectare site along Black Forest Drive, about 3.5 kilometres from the township.

The facility would store surplus electricity from the grid and feed it back during peak demand, with capacity to power about 35,000 homes for up to four hours.

But Macedon Country Fire Authority (CFA) life member Peter Shaw said he was “not convinced” by the project’s proposed location.

“Macedon Ranges is one of the highest fire danger areas in Australia,” he said.

3h agoWed 22 Oct 2025 at 11:47pm

Market snapshot

- ASX 200: -0.3 to 9,004 points (live numbers below)

- Australian dollar: flat at 64.87US cents

- S&P 500: -0.5% to 6,699 points

- Nasdaq: -0.9% to 22,740 points

- FTSE: +0.9% to 9,515 points

- EuroStoxx 600: -0.2% to 572 points

- Spot gold: -0.19% to $US4,086/ounce

- Brent crude: $US62.59/barrel

- Iron ore: flat at $US105.15/tonne

- Bitcoin: $US107,678

Prices current around 10:45am AEDT

Live updates on the major ASX indices:

3h agoWed 22 Oct 2025 at 11:36pm

Here’s our housing problem, in numbers

Here are the figures.

Step back for a bit. Some of these are wild growth rates for an inert asset. These aren’t companies that have patented a new medicine, or created a new flavour of drink that’s proving popular.

These are dwellings, on a piece of land (really, the key part of the whole value) on cities on a small island.

I’m not passing judgement on the concept of wealth creation through property, and I’m lucky enough that I own a home.

(Although if we stopped making mortgage payments in the coming decades the bank would have a lot to say about that concept of ownership).

But it is illustrative of the tax settings in Australia, our need for more housing and the substantial demand for well-situated dwellings that are close to infrastructure and services.

Quarterly and annual changes in the value of houses (Domain)

Quarterly and annual changes in the value of houses (Domain)

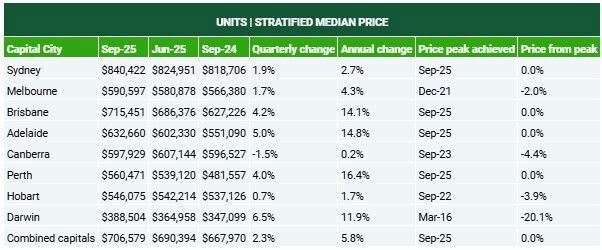

And the unit figures aren’t far off.

Quarterly and annual changes in the value of units (Domain)

Quarterly and annual changes in the value of units (Domain)

3h agoWed 22 Oct 2025 at 11:21pm

Breaking China’s iron grip on world’s supply of critical minerals

Our chief business correspondent, and someone who knows more about critical minerals than most, Ian Verrender, has written this morning about what the US is aiming for with its Australian critical minerals investment deal.

If there is any mystery over America’s historic agreement to partner with Australia this week on the supply of critical minerals, it is why it took so long, he writes.

A few weeks back, Beijing expanded the restrictions, this time including rare earths specifically used by the US defence sector.

If ever there was a catalyst for decisive action, that was it. For despite all the swagger and bluff about “a deal” with Ukraine over critical minerals or taking control of Greenland, the far more obvious destination to break China’s grip on critical minerals was always in full view. Right here, in Australia.

Read his full analysis:

4h agoWed 22 Oct 2025 at 11:11pmModest fall for ASX at the open

A few minutes into the local session and the ASX 200 is down 0.2% so far.

Obviously, it’s early days, but tech stocks, miners and financials are in the red.

But the energy sector is doing some heavy lifting to help stem the losses, so it could be a better day for the ASX than overseas markets.

4h agoWed 22 Oct 2025 at 11:03pm

Tesla installing production line for Optimus robots

Earlier we heard Elon Musk being asked about Tesla‘s robot production ambitions on the company’s quarterly earnings call.

Apart from some kind of frightening references to a robot army capable of overthrowing Musk as its leader, the company has said it is installing first generation production lines for its Optimus robots, in anticipation of large-scale production.

Musk says Telsa will probably unveil the third version of Optimus in the first quarter of 2026.

Optimus is a humanoid robot being developed by the company.

Back in April, Tesla flagged that production had been affected by China’s export curbs on rare earth magnets.

Loading