By Peter Dougherty

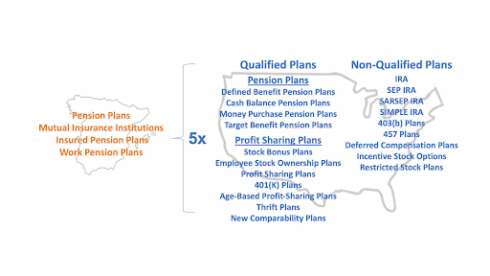

COMPANIES in the US can offer a wide range of retirement plan options that provide tax advantages to themselves and their employees.

In fact, they’re so numerous it’s hard to keep track of them all without a road map.

First, there are qualified plans and non-qualified plans. Within the qualified plan category, there are both Pension plans and Profit-sharing plans, that are further divided into defined contribution plans and defined benefit plans.

Peter Dougherty: MBA in finance

Peter Dougherty: MBA in finance

MS in Spanish taxation

BS in economics

European Financial

Planner in Spain

Chartered Retirement

Planning Counselor®

in U.S.

Author of two financial planning books

Defined contribution plans can be either Pension or Profit-sharing. Defined benefit plans? They’re always Pension plans.

US companies can also establish non-qualified retirement plans, which are typically cheaper and easier to manage.

There’s also a non-qualified plan that has nothing to do with the employer – the IRA (Individual Retirement Account).

This lets individuals save for their own retirement while still enjoying tax breaks.

It’s especially popular with freelancers and self-employed workers who don’t have access to employer-sponsored plans. Even employees with workplace retirement plans can utilize IRAs too, depending on their situation.

Confusing? Yes. It’s as if the US constructed a five-lane retirement plan highway.

In Spain, on the other hand, it appears that someone painted a single bike lane and called it a day (if the superior rail travel system of Spain vs the US is an indicator; however, even a Spanish bike lane might be a better means of transportation).

The list of options for tax-advantaged retirement savings is much shorter in Spain. The options are limited to:

- Pension plans

- Non-profit mutual insurance institutions

- Insured pension plans

- Workplace pension plans

In broad terms, the United States has five times more tax-advantaged plans available for retirement savings than Spain does.

Retirement Plans: Spain vs US

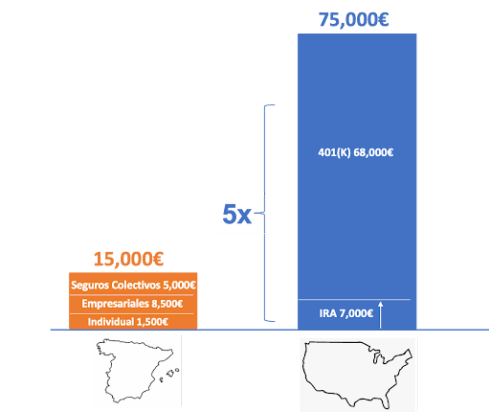

Coincidentally, depending on the $/€ exchange rate of the day, a typical 50-year-old employee in the United States can contribute approximately five times more money to a retirement plan that gives immediate tax advantages than a similar employee can in Spain.

Potential Yearly Savings: Spain vs US

The UK is in the middle ground. It’s as if they’ve built a flexible and easy to navigate two-lane road with a convenient roundabout. Key options include:

- Workplace pensions

- Personal Pension Plans (PPP) and Stakeholder Pensions

- Self-Invested Personal Pensions (SIPPs)

- Defined Benefit Pensions

- Additional Voluntary Contributions (AVCs)

- Lifetime ISAs (LISA)

Differences between retirement plans in the US and Spain are not simply a technical policy detail. They can affect how people save and how much they accumulate for retirement.

The wider range of choices in the US can lead to more tailored savings strategies, a culture where savings feels ‘normal’ and potentially larger retirement savings pools.

On the other hand, they require higher financial literacy of retirement plan participants. And as more than one person has suggested, the wide range of retirement plans in the US may simply reflect more politicians wanting their name on something.

Peter Dougherty is a Financial Planner at BISSAN Wealth Management in Spain. He holds an MBA in finance from Columbia University in New York and an MS in Spanish taxation (Máster en Fiscalidad y Tributación) from Nebrija University in Spain. He is certified as a European Financial Planner (EFP) in Spain and as a Chartered Retirement Planning Counselor® and Investment Adviser Representative in the United States.

For more information: https://www.financial-planning-in-spain.com

Click here to read more Business & Finance News from The Olive Press.