One of the most direct threats involves remote management from China of products embedded in European critical infrastructure. Manufacturers have remote access to install updates and maintenance.

Europe has also grown heavily reliant on Chinese tech suppliers, particularly when it comes to renewable energy, which is powering an increasing proportion of European energy. Domestic manufacturers of solar panels have enough supply to fill the gap that any EU action to restrict Chinese inverters would create, Langerová said. But Europe does not yet have enough battery or wind manufacturers — two clean energy sector China also dominates.

China’s dominance also undercuts Europe’s own tech sector and comes with risks of economic coercion. Until only a few years ago, European firms were competitive, before being undercut by heavily subsidized Chinese products, said Tobias Gehrke, a senior policy fellow at the European Council on Foreign Relations. China on the other hand does not allow foreign firms in its market because of cybersecurity concerns, he said.

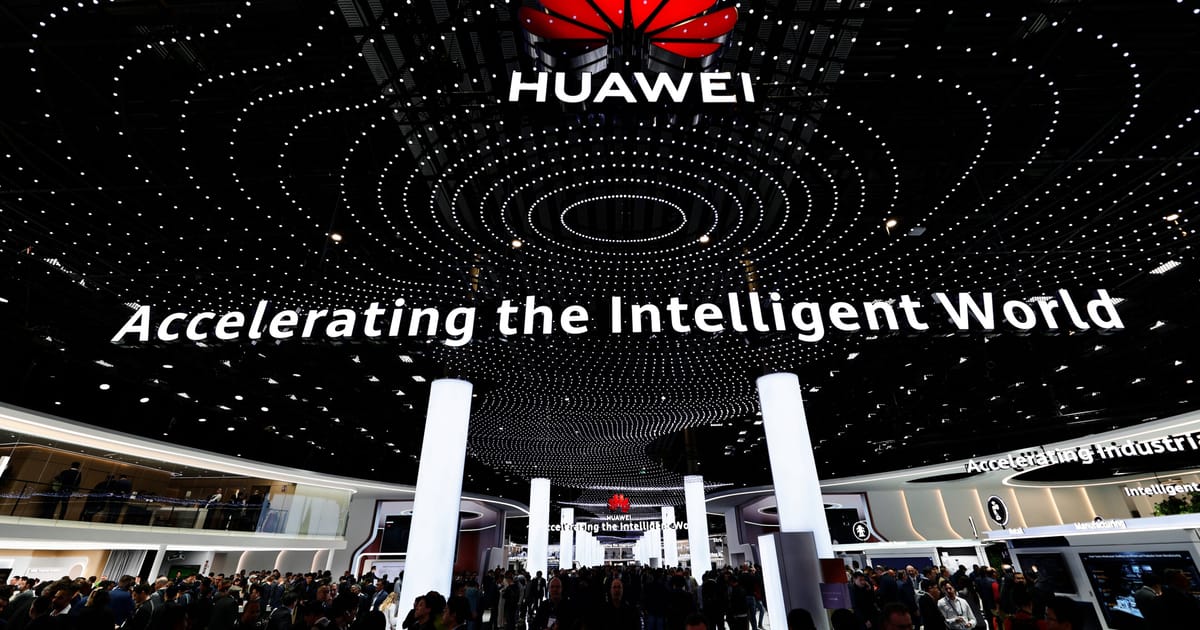

The European Union previously developed a 5G security toolbox to reduce its dependence on Huawei over these fears.

It is also working on a similar initiative, known as the ICT supply chain toolbox, to help national governments scan their wider digital infrastructure for weak points, with a view to blocking or reduce the use of “high-risk suppliers.”

According to Groothuis and Lexmann, “binding legislation to restrict risky vendors in our critical infrastructure is urgently required” across the European Union. Until legislation is passed, the EU should put temporary measures in place, they said in their letter.

Huawei did not respond to requests for comment before publication.

This article has been updated.