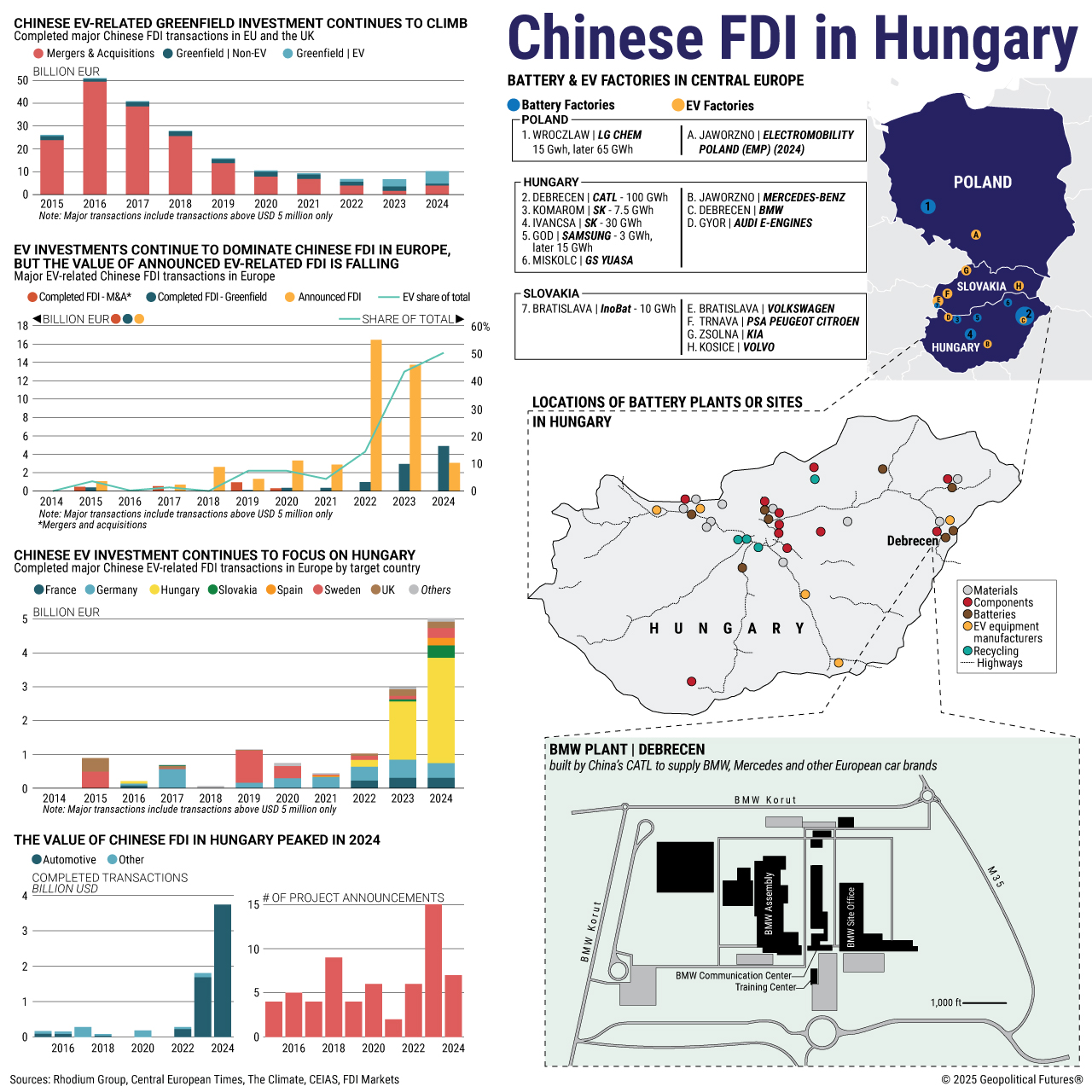

After years of decline, Chinese foreign direct investment in Europe is rising again. The rebound reflects pressure on Chinese firms to expand abroad as they face tariffs, slowing economic growth, overcapacity and fierce competition at home. The electric vehicle sector dominates this new wave. Central and Eastern Europe, especially Hungary and Slovakia, have become major destinations for Chinese EV investment. Beijing views the region as a base to reinforce existing operations in Western Europe and deepen its reach across the Continent.

Automotive projects accounted for more than half of all Chinese FDI in Europe in 2024, totaling 5.2 billion euros ($6 billion). They also made up 83 percent of new facility construction by Chinese firms in Europe. Of the top five Chinese investors, only Tencent operates outside the EV sector. The others – CATL, Gotion, Envision and Geely – are battery manufacturers. CATL has led Chinese investment in Europe for five consecutive years and represented 16 percent of all Chinese FDI in Europe in 2024.

Europe still struggles to build an independent supply chain amid China’s entrenched dominance, yet signs suggest the investment surge may slow. Growth in 2024 came mostly from projects already under construction, while new EV project announcements dropped 79 percent, with several canceled or blocked by local authorities. Major developments – especially in Hungary – will keep investment flowing for now, but after its 2024 peak, Chinese capital may shift toward other sectors such as information technology or renewable energy.

Geopolitical Futures (GPF) was founded in 2015 by George Friedman, international strategist and author of The Storm Before the Calm and The Next 100 Years. GPF is non-ideological, analyzes the world and forecasts the future using geopolitics: political, economic, military and geographic dimensions at the foundation of a nation.