Abi, 37, has a warning for anyone considering the payment method “The schemes can be really helpful when you are really desperate and need to get by, but it can quickly spiral if you are not careful”(Image: Abi)

“The schemes can be really helpful when you are really desperate and need to get by, but it can quickly spiral if you are not careful”(Image: Abi)

A Yorkshire woman has warned others to “not follow in her footsteps” after falling into £3,000’s worth of debt using Buy Now Pay Later schemes.

Abi, 37, from Sheffield, has “dedicated” the last few years of her life to helping the community. She frequently delivers food parcels to the homeless in South Yorkshire, despite having multiple disabilities, and attends classes on Tuesdays with the hope of one day teaching others how to be barbers.

Yet she explained that no amount of “being a good person” can stop you from falling into bad habits – including taking advantage of Buy Now Pay Later schemes (BNPL), such as Clearpay, Zilch, and Klarna.

Abi said: “I struggle with ADHD and Autism, but I am not lazy. If I can help people, then I will. When people hear about the amount of debt I am in due to the schemes and then learn that I also receive Universal Credit, they seem to develop a prejudice against it. But genuinely, all it takes is one month where the dishwasher isn’t working or one birthday, and then anyone could be in the same situation as me.”

Abi explained that her journey with debt started when she was 18. She explained how she had “little support” when she was growing up, receiving her first debt-relief order in her teens.

Despite help from her grandparents in her youth – for which she is “eternally grateful” – they were able to support her less and less as they grew older. Abi said: “I admit, then when I was younger, I was stupid with money because I had less support. But the debt I am in now is because I have struggled to get a credit card.”

“I admit, when I was younger, I was stupid with money because I had less support”(Image: Abi)

“I admit, when I was younger, I was stupid with money because I had less support”(Image: Abi)

Abi said she turned to BNPL schemes when she divorced in 2019. Due to a second debt relief order Abi decided to get a Klarna credit card – quickly racking up around £3,000 in bills.

Abi said: “Occasionally I would use it for smaller purchases like food or bus passes, but it was mostly for things like my new cooker and tickets to Tramlines – expensive things which had to be immediately bought or replaced, but that I fully intended to pay off in instalments.”

However, the bills “kept piling up,” leaving her with a whopping three-grand bill owed across multiple BNPL sites. Now owing only less than one thousand to Klarna and £600 to Zilch, Abi has warned others who “may be struggling” to “think carefully” before turning to the schemes.

Abi said: “I know it sounds obvious, but it is not free money, and you also have to consider late fees. A large portion of my debt is due to late fees. Because I have ADHD, I can miss payments sometimes so it is really important to be on top of it.

“If it works for you – like it did originally for me – then they can be really helpful when you are really desperate and need to get by, but it can quickly spiral if you are not careful.”

Abi has since said she is “proud” to have paid off a portion of her debts and looks forward to finishing school. Abi said: “I am not taking the mick with money, I am trying to sort my own life myself. It’s just something I wish I had been really told about sooner.”

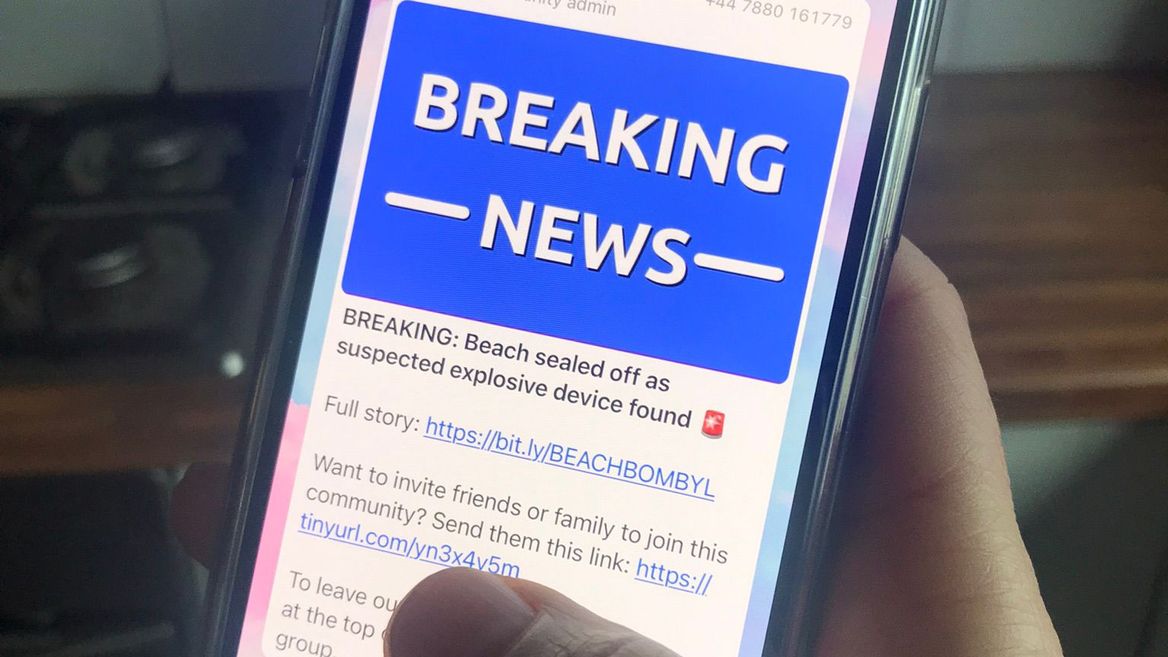

Get breaking news in Yorkshire straight to your phone

Get breaking news in Yorkshire straight to your phone

Get all the latest big and breaking Yorkshire news straight to your mobile via WhatsApp by clicking here.

If you don’t like our community, you can leave any time. We also treat members to special offers, promotions, and adverts from us and our partners. Read our privacy notice here.

A spokesperson for Clearpay said: “Clearpay advises shoppers to buy only what they can afford, reschedule repayments if needed, and use email and text message reminders to make sure payments are made on time and there is money in their account.

“If customers are experiencing financial hardship, we encourage them to contact us so that we can work with them to arrange a tailored repayment plan. We do not report to credit reference agencies.”

A spokesperson for Zilch said: “Zilch is an FCA regulated credit provider on a mission to eliminate the high-cost of credit. We have built a consumer payments platform that is flexible, offering customers the ability to Pay now or Pay later. We do not charge late fees to our customers and instead reward their responsible use of our products.

“We have industry-leading affordability safeguards in place and work closely with all credit reference agencies to improve financial outcomes for our customers and ensure they are using our product responsibly.”

Klarna has been contacted for further comment. Speaking with the BBC over BNPL schemes, a spokesperson for Klarna says the firm would welcome new regulation by the Financial Conduct Authority (FCA) next year, and its “products are designed to help consumers avoid getting trapped in debt”.

Get all the latest and breaking South Yorkshire news straight to your inbox by signing up to our newsletter here.