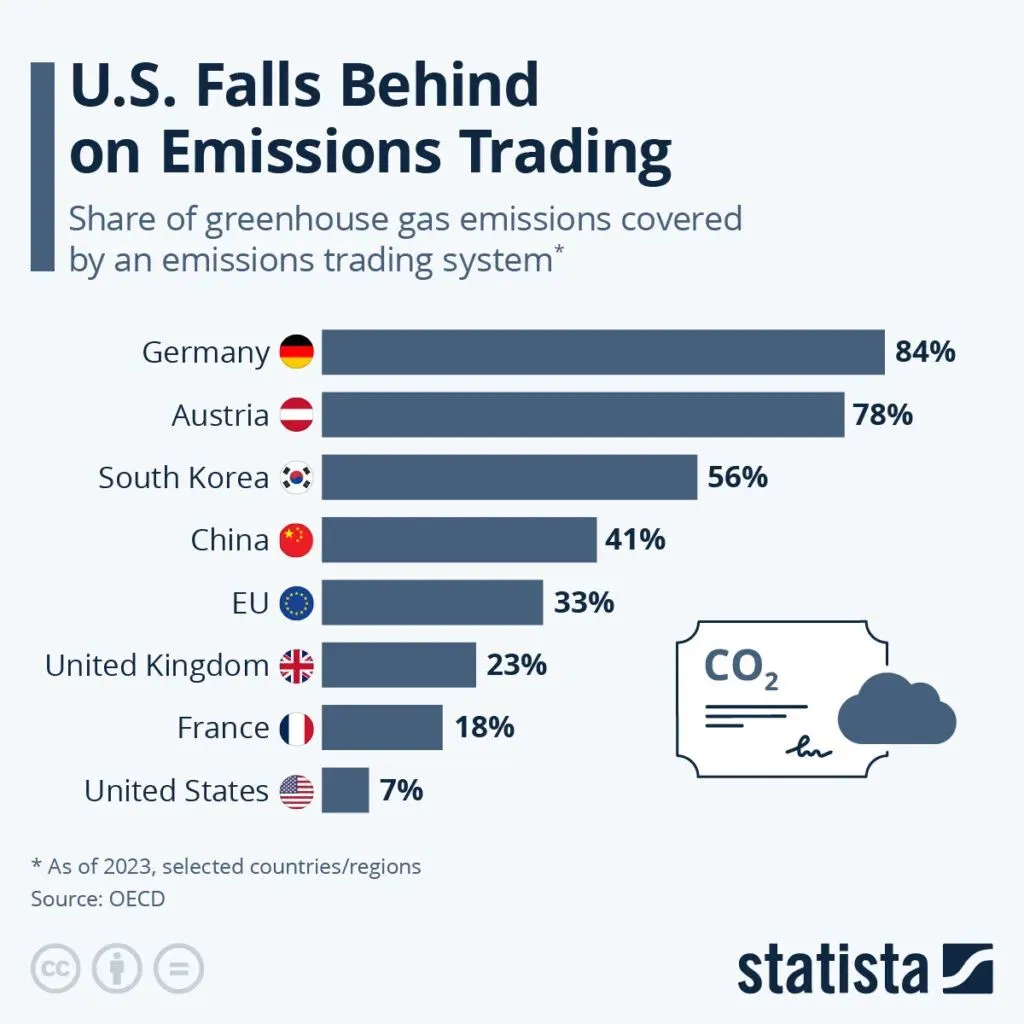

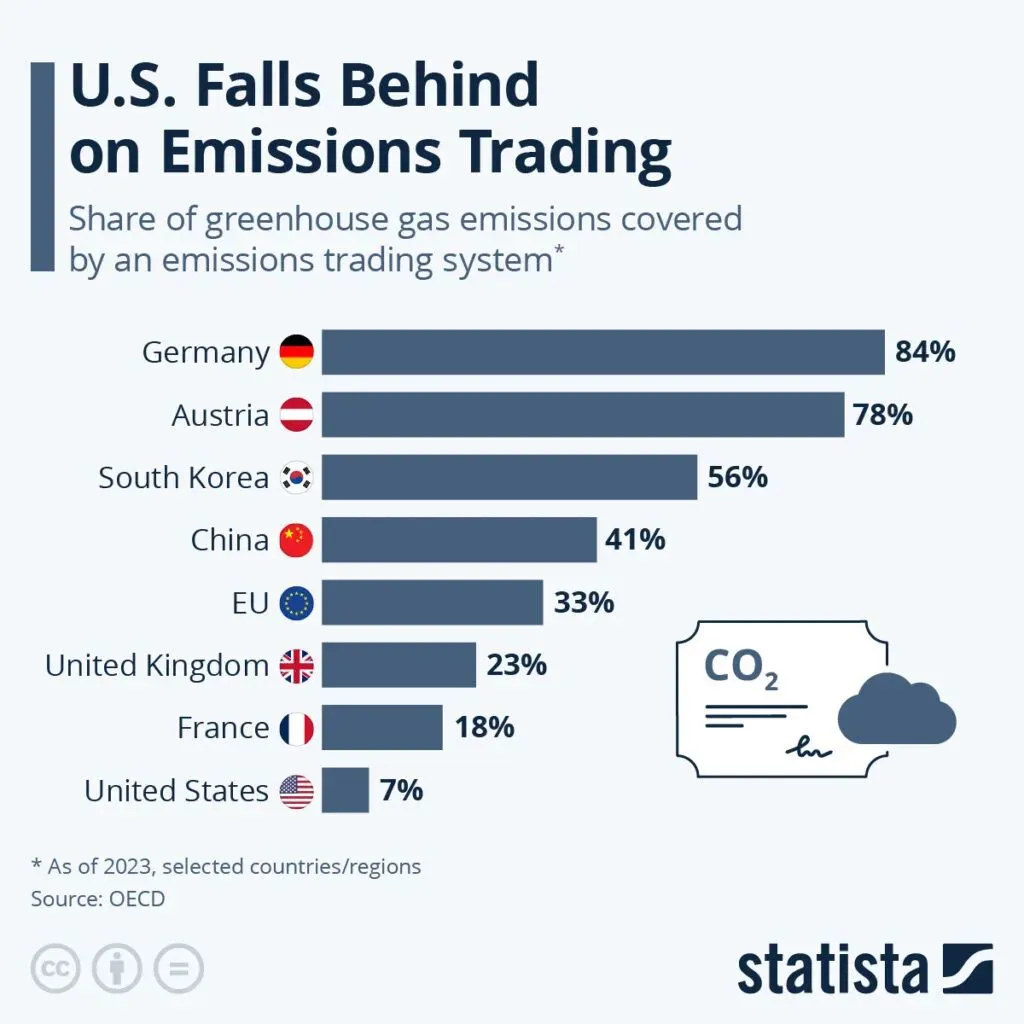

Only Iceland and Japan cone lower in investing in the market-based climate tool.

In 2023, just 7 percent of U.S. greenhouse gas emissions were covered by an emissions trading system, one of the lowest shares among the 79 countries analyzed.

Europe’s largest economy, meanwhile, is betting big on emissions trading: 84 percent of Germany’s greenhouse gas emissions were covered by an emissions trading system in 2023.

The country’s success lies in the combination of two systems: the European Emissions Trading System (EU ETS 1), which covers emissions from power plants, industrial facilities, aviation, and shipping, and the national emissions trading scheme (nEHS), which includes transport, heating, and waste.

According to data from the German Emissions Trading Authority, each system covered just over 40 percent of total emissions in 2023, jointly driving progress toward the country’s climate goals.

In many other countries, emissions trading plays a far smaller role, often because their climate targets are less ambitious or because they rely on other tools, such as direct CO₂ taxes or indirect fuel taxes. What matters in the end, experts say, is that emissions come with a price tag, creating an incentive to cut pollution and invest in cleaner alternatives.

The OECD’s analysis takes a broad view of carbon pricing, including not only explicit mechanisms like CO₂ taxes and emissions trading but also fuel consumption taxes, while subtracting fossil fuel subsidies.

Even under this wider lens, Germany remains among the global leaders in carbon pricing. Only South Korea, Luxembourg, and Singapore achieve a higher level of emissions coverage, according to the OECD.