On Friday, Fenway Sports Group will dispatch a team of Liverpool delegates to a meeting of Premier League club executives.

The Premier League holds these meetings periodically, culminating in an annual general meeting (AGM) after the season has reached its crescendo. Typically, Liverpool are represented at these summits – either virtually or in person, at a London location – by FSG chairman Tom Werner or club CEO Billy Hogan.

While Hogan is obviously involved in day-to-day operations at Anfield, it is rarer for FSG’s top brass, consisting of Werner, John Henry, Sam Kennedy and Mike Gordon, to have boots on the ground in the UK on Liverpool business.

![]() Join our newsletter for news & smart analysis.

Join our newsletter for news & smart analysis.

Werner’s presence at these summits, therefore, is emblematic of just how significant they are deemed by the regime in Boston.

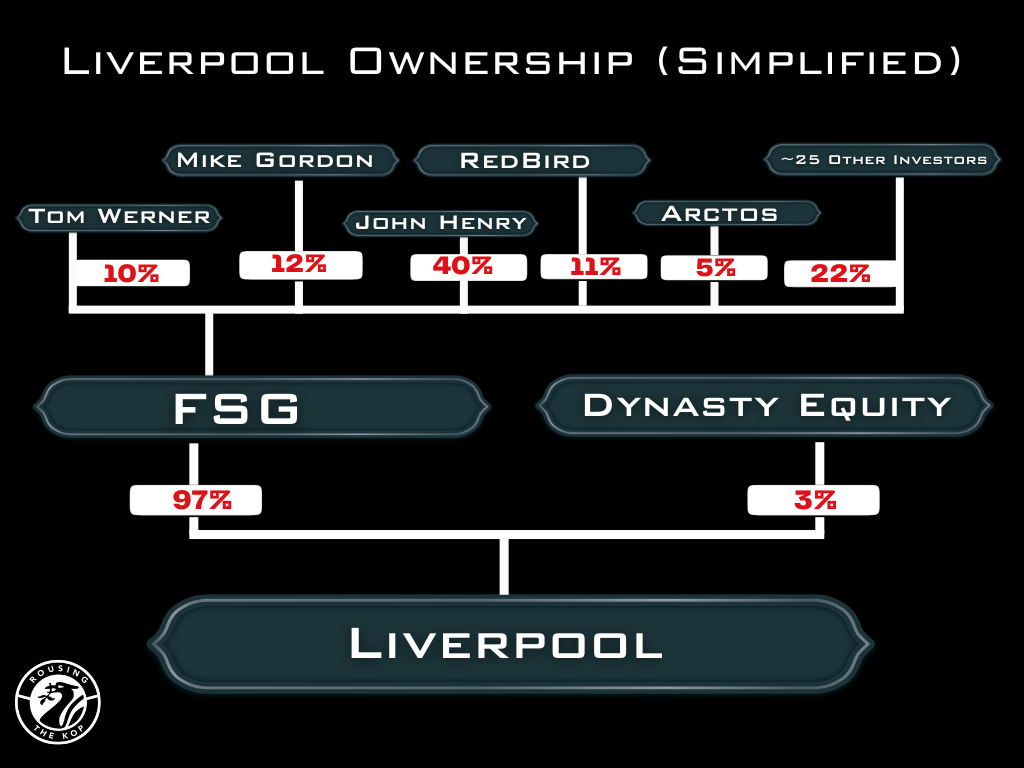

Liverpool ownership structure chart

Liverpool ownership structure chart

Credit: Adam Williams/Rousing The Kop/GRV Media

Premier League shareholders’ meetings are where the big, macro topics of finance and governance are deliberated. The decisions made in these salubrious hotel conference rooms shape FSG’s grand vision for the club, for better or for worse.

Or, at least, that’s the idea. Recent owners’ meetings have been somewhat anticlimactic, with an impasse over the biggest issue of the day: PSR, formerly known as Financial Fair play or FFP.

PSR, or Profit and Sustainability Rules, isn’t an immediate concern for Liverpool, who spent around £450m gross and £250m net in the summer transfer window. However, for FSG, the spending rules will likely dictate the scale of the eventual return on investment they are targeting at Anfield.

And on Friday, Werner, Kennedy or whoever Fenway have tasked with representing them at the latest Premier League shareholders’ meeting will cast their vote on the future of the spending rules.

Liverpool’s budget under proposed new PSR system

At this week’s meeting, Liverpool will vote on the future of PSR, with two new proposals tabled by the Premier League:

- Squad Cost Ratio Rule

- Top-to-bottom Anchoring

The existing PSR system – which limits clubs to losing a maximum of £105m over a rolling three-year period, with adjustments for academy, infrastructure and women’s team spending – is also the agenda.

In Europe, a Squad Cost Ratio system already exists.

Photo by Michael Regan/Getty Images

Photo by Michael Regan/Getty Images

Clubs, like Liverpool, who compete in UEFA competition must limit their spending on first-team wages and transfer costs to within 70 per cent of revenue plus a three-year average on player sales. This is a calendar-year test, not a season-to-season one.

Based on Liverpool 2022-23 and 2023-24, plus projections for the 2024-25 accounts sourced from football finance expert Greg Cordell, the club’s 70 per cent cap would be in the around £572m.

With LFC’s 2024/25 financial period complete, I’ll provide some initial/rough *estimates* (w/ full write-up this weekend).

Key P&L metrics estimated to improve notably vs 2023/24:

– Rev of £714m (+£100m; +16.3%)

– Adj EBITDA of £140m (+£70m)

– Pre-tax profit of £48m (+£105m) pic.twitter.com/F034r55vXO— Greg Cordell (@gregorypcordell) June 10, 2025

View Tweet

The Premier League is proposing a more lenient ratio of 85 per cent. Under this system, Liverpool’s spending limit would be set at just under £694m. However, since the Reds are likely to play in Europe more often than not, it’s UEFA’s cap, not the Premier League’s, which is their focus.

Liverpool’s actual spend in 2023-24, assuming that around 75 per cent of their wage bill was attributable to the first team, was around £404.5m – £289.5m in wages and £115m in transfer amortisation, which also encompasses agents’ fees.

And while, as mentioned, UEFA’s is a calendar-year test, the illustrative figures above show that Liverpool clearly have plenty of headroom under both the European rules and their would-be domestic equivalent.

Even accounting for their enormous spending in the summer of 2025, the margin for error is still huge. Calculating any clubs’ position under the spending rules is complex, but at its core, the formula boils down to how much Club X or Club Y earns. And Liverpool, one of the world’s biggest brands, earn a lot.

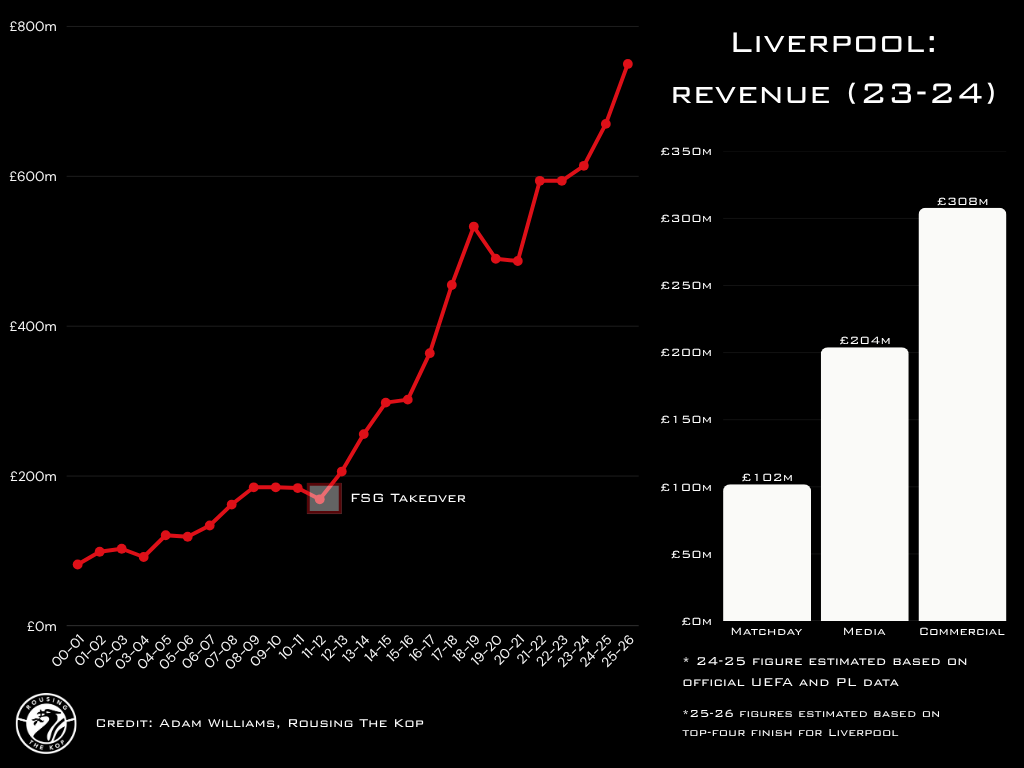

Liverpool revenue chart

Liverpool revenue chart

Credit: Adam Williams/Rousing The Kop/GRV Media

The suggestion from experts such as Liverpool University’s Kieran Maguire, therefore, is that FSG will likely want to pull up the drawbridge behind Liverpool, so that ambitious, well-resourced clubs – the likes of Newcastle United and Aston Villa – cannot consistently compete on the pitch without breaching the rules.

By extension, if rival clubs are limited in what they can spend, Liverpool themselves will be forced to spend less to keep pace, which will deliver consistent profits and, eventually, a bigger sale price for FSG.

We’ll hear from Maguire on an adjacent subject shortly.

Top-to-bottom anchoring meanwhile would tie club spending to a multiple of what the Premier League’s bottom-placed club earns in central financial distributions, i.e., prize money. At present, it looks like a 5x multiple, which – based on 2023-24’s figures – would have set the limit at £546m.

So, again, even though the variance between the Premier League-proposed Squad Cost Ratio limit and top-to-bottom anchoring is around £148m, Liverpool would have ample room for manoeuvre under all the systems on the slate.

The anchoring proposal has been met with resistance by player unions, agencies and several clubs, with potential legal challenges on the horizon.

At this stage, it looks unlikely to proceed. In its current proposed form, at least. Premier League voting rules require a two-thirds majority for a motion to pass, so seven clubs acting as a bloc effectively have a veto.

The two Manchester clubs and Chelsea are opposed, Arsenal’s scepticism appears to be growing, Newcastle United, Aston Villa, and Nottingham Forest are against it for obvious reasons, and recent reports suggest that Brighton, Bournemouth, Brentford and a handful of others are leaning towards ‘no’.

Rousing The Kop will bring more reaction and analysis to Friday’s vote.

FSG’s stance on spending rules revealed in Getafe takeover collapse

Elsewhere on Planet FSG, Liverpool’s owners’ masterplan to take over a club in Spain appears to have hit the buffers once again

The American regime have held discussions with at least five clubs in the country, following aborted discussions about buying French side Bordeaux in the summer.

10. Liverpool

Liverpool are a fascinating case in terms of multi-club links

They’re currently trying to buy a sister club and have held talks w/ Spanish side Malaga. They also walked away from a would-be takeover of Bordeaux last year

But FSG’s football links run deeper…

— Adam Williams (@Adam___Williams) June 12, 2025

View Tweet

A would-be deal to acquire La Liga side Getafe is the latest to fall through. Several outlets have now reported that FSG have now walked away from the deal. A Qatari group, JTA, are said to be closing in on a deal having secured the blessing of the club president, Angel Torres.

In a report by Spanish outlet Marca, one of the reasons that Fenway decided against proceeding was La Liga’s Squad Cost Limit – the league’s equivalent of PSR.

FSG are said to believe that Getafe’s limit – which is set at about £45m this season – is not sufficient to deliver the kind of investment and growth that is desired in Boston.

There is perhaps something of a paradox here. FSG are broadly in favour of stricter PSR in the Premier League if it inhibits the growth of competitors, but they have also seemingly bucked at restrictive spending rules.

At the very least, it is a tactic admission that their stance on financial controls is, as Price of Football podcast host Kieran Maguire put it in exclusive conversation with Rousing The Kop put it, “based entirely on self-interest.

Photo by Liverpool FC/Liverpool FC via Getty Images

Photo by Liverpool FC/Liverpool FC via Getty Images

“It’s not personal; it’s business. It’s the same philosophy that they had with Project Big Picture and the European Super League.

“In their view, is their space for Getafe to be one of the clubs that is competing regularly in Europe? To achieve that, they need to spend more. Once you get there, it can be self-sustaining because the European revenues count towards your La Liga cap.

“FSG won’t take a punt on another club. They aren’t going to risk the brand that they have built with Liverpool by getting involved with another club for the sake of it. Also, they are smart enough to realise that the benefits of the multi-club model are unproven. If they proceed, it will be a very deliberate plan.”