The pair say they treated saving as a game rather than a hardship as they invested thousands

“We drove a tiny car, lived in a two-bed flat in Basingstoke and invested everything in index funds,” Alan said.

Picture:

LBC

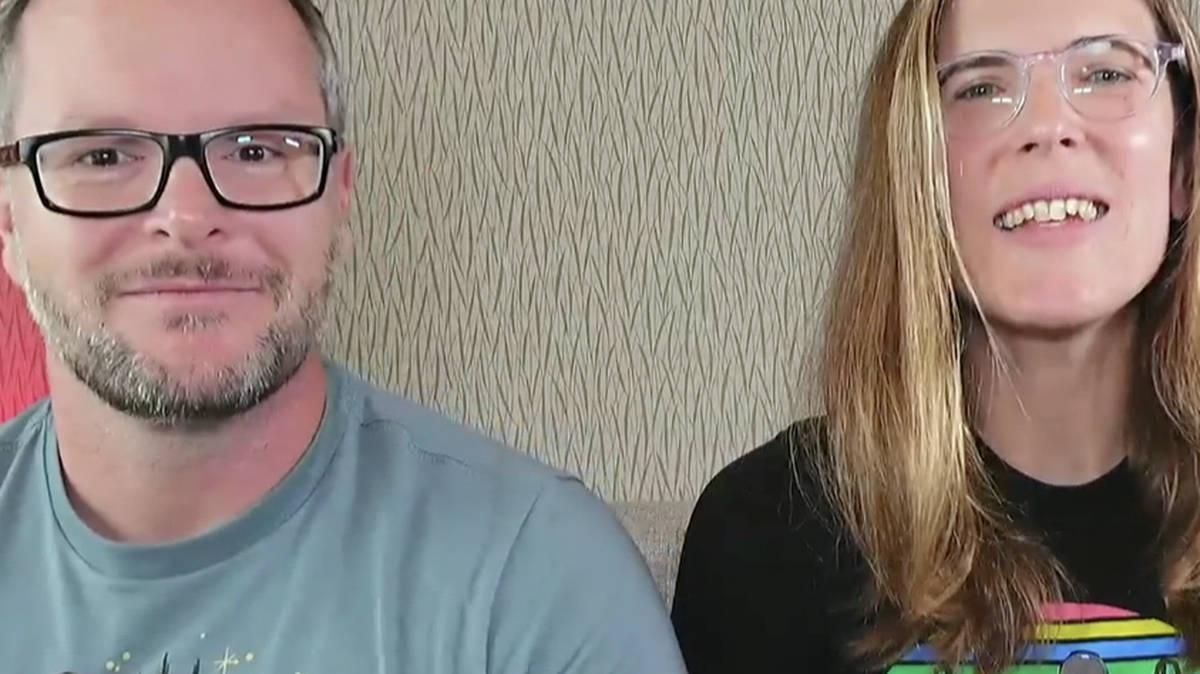

A couple who retired at 35 and 40 say ordinary families can follow the same steps to financial freedom – even without huge salaries or inheritances.

Speaking to Tom Swarbrick on LBC, Alan and Katie Donegan, co-founders of Rebel Finance School, insisted no one handed them a fortune to get started.

“We didn’t start with anything. We didn’t get a windfall, we didn’t get a big inheritance,” Katie said.

“We were laser focused on creating a gap between what we earned and what we spent and investing that difference for our future.”

Alan – who used to work as a landscape gardener before building his own business – said at his peak he earned nearly £80,000 while the couple’s best joint year was around £200,000, but they insist their real advantage wasn’t income, but discipline.

Read More: Retailers see unexpected slump in sales across October as Budget hits consumer confidence

Read more: Shock winter rise to energy bills will leave Brits paying £1,758 per year

“We kept our expenses down. We drove a tiny car, lived in a two-bed flat in Basingstoke and invested everything in index funds,” Alan said.

The pair say they treated saving as a game rather than a hardship.

Katie and Alan at the Tower of London receiving the British Empire Medal.

Picture:

Donegan

“People think this is this really sad life… No,” Katie added.

“There are so many ways to have fun without spending money. It wasn’t this deprivation that people think it is.”

They even kept their heating to a minimum. “Sometimes, if my mum was coming round,” Alan joked.

Katie added: “We hoped the neighbours downstairs would put their heating on as well.”

In April 2025, the pair were recognised for their work when they attended the Tower of London to receive the British Empire Medal for services to financial education.

They were selected in King Charles’ Birthday Honours list for helping thousands of people take control of their finances for free through their Rebel Finance School and say they’re determined to keep expanding that mission.

The couple, who do not have children, say that raising a family isn’t a barrier to achieving similar goals.

“There’s this myth… ‘you’re only successful because you don’t have kids’. What are you talking about?” Alan said.

“If that was true, everyone who doesn’t have kids would be financially independent.”

A key turning point was discovering index investing, after Alan previously lost his life savings in the dot-com bubble.

He now swears by keeping things simple.

“Invest in something like Vanguard FTSE Global All Cap… and don’t mess with it,” he said.

A trading board at the London Stock Exchange in April.

Picture:

Getty

Fees, the couple warn, can quietly eat away at your savings.

“You see a 1% fee on your investments – that is going to destroy your pot over time,” Katie said.

“Go and look at the fees on your investments.”

The couple reached financial independence in 2019, when Katie was 35 and Alan was 40.

“We had about a million invested, which at what’s called the 4% rule, you can live off 40 grand a year for the rest of your life without running out,” Alan explained.

And their pot didn’t stop growing. “Since we’ve retired, our investments have gone from 1 million to 2.5 in six years, which is crazy,” he added.

Their message to young listeners is simple: “Put your money in an index fund in a tax efficient way… and leave it to grow over time,” Alan said.

“You will retire so wealthy you won’t believe it.”

Tom Swarbrick said an investment session will take place on LBC next Friday, breaking down everything announced in the Budget.