France Nutraceuticals Market Summary

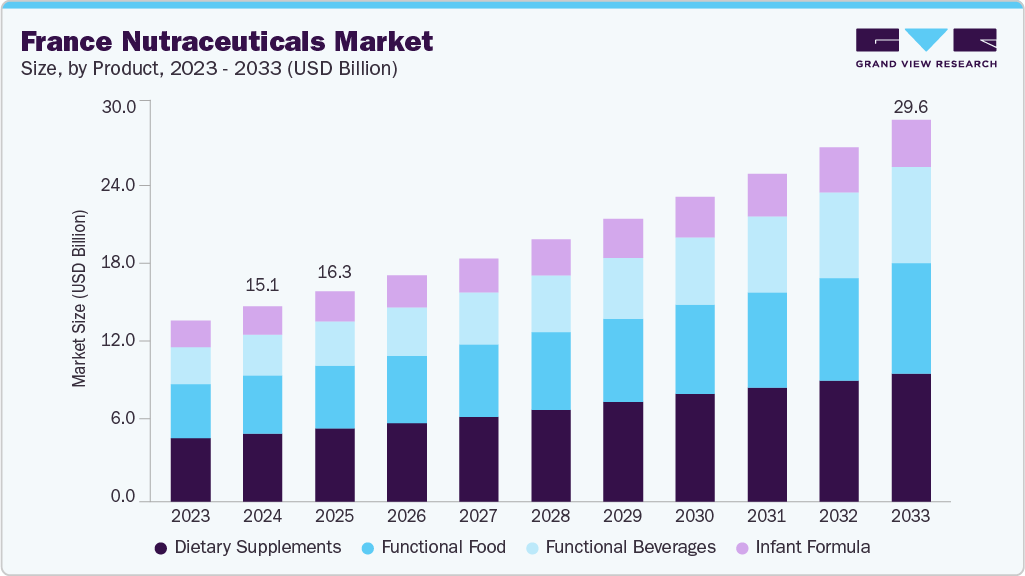

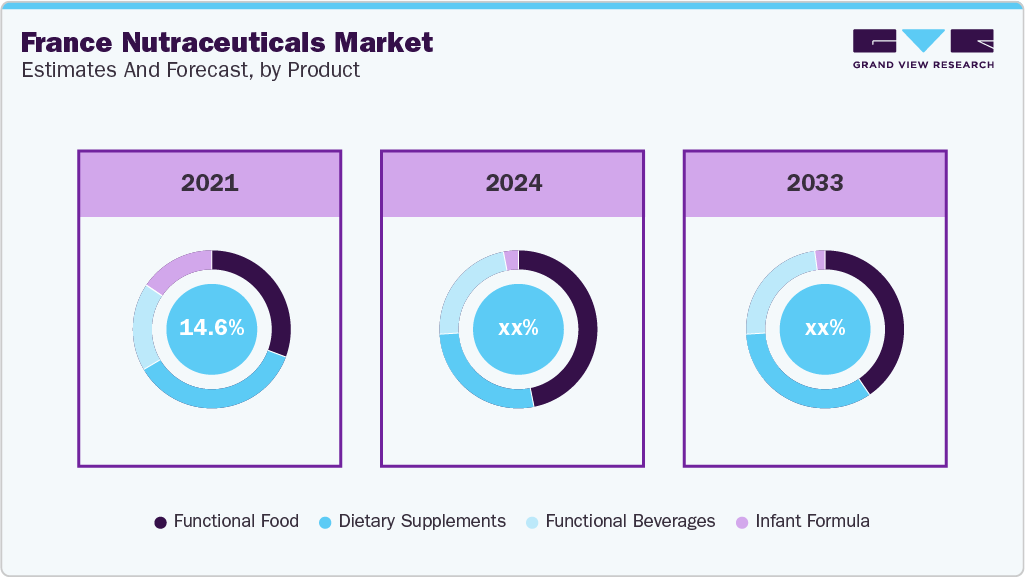

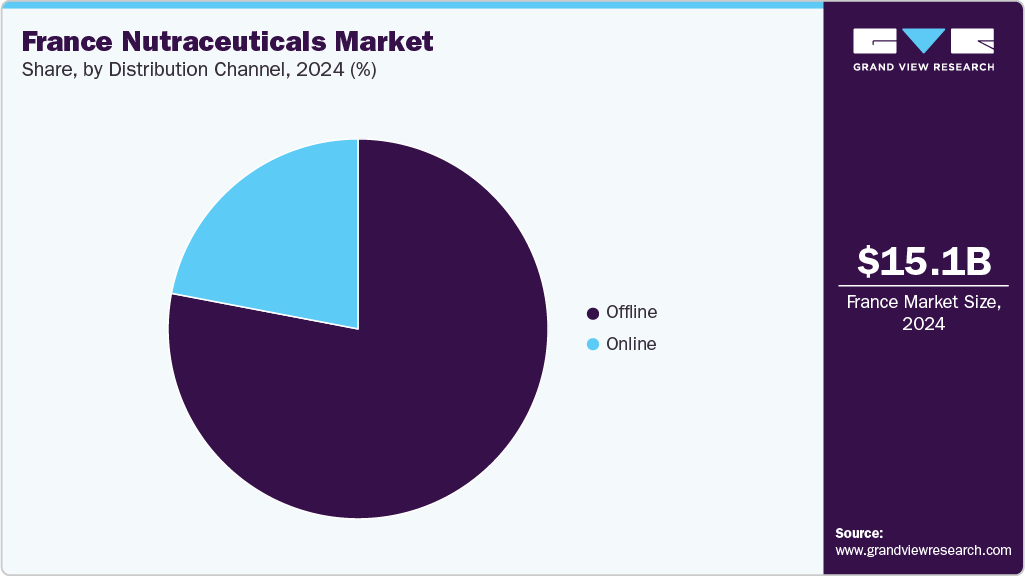

The France nutraceuticals market size was estimated at USD 15.13 billion in 2024 and is projected to reach USD 29.58 billion by 2033, growing at a CAGR of 7.7% from 2025 to 2033. This market is primarily driven by increasing consumer awareness of health and wellness, particularly in preventive healthcare and immune support. As lifestyle-related health issues increase, more consumers are turning to dietary supplements and functional foods to maintain their overall well-being.

Key Market Trends & Insights

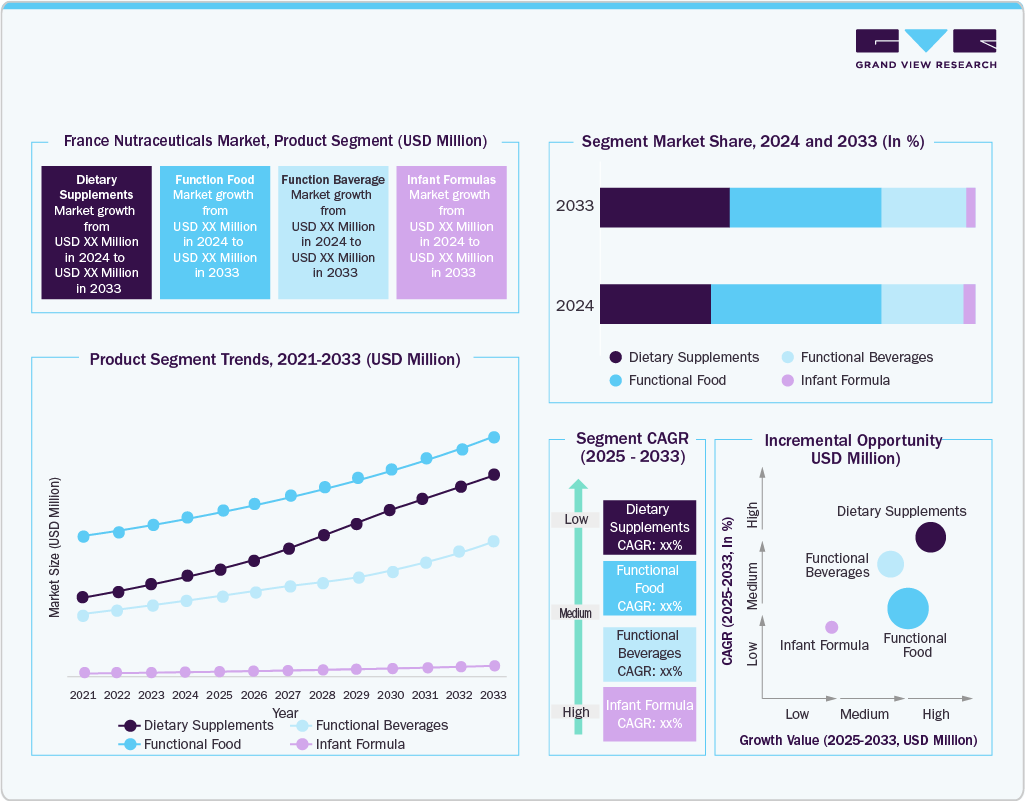

- By product, the dietary supplements segment held the highest market share of 35.0% in 2024.

- Based on application, the weight management & satiety segment held the highest market share in 2024.

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.13 Billion

- 2033 Projected Market Size: USD 29.58 Billion

- CAGR (2025-2033): 7.7%

France, one of the key economies in the European Union (EU), accounts for nearly 16.6% of the EU’s total GDP. With a diverse population, France has experienced significant changes in consumer trends and lifestyle preferences across urban areas in recent years. In 2024, individuals aged 15 to 29 accounted for 17.6% of the total population. This consumer group is expected to contribute to the growing demand for nutraceuticals in France.

Consumers are becoming more selective about the ingredients in their products, showing a clear preference for clean-label and plant-based options. There is a growing shift away from synthetic ingredients, with an increasing demand for nutraceuticals derived from natural sources, such as fruits, vegetables, herbs, and botanicals. Advancements in extraction and processing technologies are helping manufacturers develop more effective and easily absorbed formulations from these natural ingredients. In addition, ethical and sustainable production practices are gaining importance, as consumers are increasingly concerned with product quality and the methods used to produce those products. These factors collectively shape purchasing decisions and drive growth in the nutraceuticals market.

The growing awareness of personalized nutrition and the importance of gut health are key factors driving demand in the nutraceuticals market. Consumers are shifting away from generic solutions and increasingly seeking products tailored to their specific needs, based on genetics, lifestyle, and individual health goals. At the same time, increased research on the gut microbiome’s impact on overall health has led to rising interest in probiotics, prebiotics, and other supplements that support digestive health. These trends are further supported by advances in diagnostic tools and personal health-tracking technologies, which help individuals make more informed and customized choices about their nutritional intake.

Consumer Insights

Rising health consciousness, demographic trends, and the growing popularity of active lifestyles are shaping consumer behavior in the French nutraceuticals market. France has a strong fitness culture, supported by 65% of the French population participating in sports at least once a week, reflecting strong national enthusiasm for physical activity. France has over 167,000 sports clubs with 15 million members. This active population increasingly seeks products that support energy, endurance, muscle recovery, and overall wellness, driving demand for protein-based and performance-enhancing nutraceuticals.

French consumers are also showing a growing interest in preventive health, with increased adoption of supplements that support immunity, gut health, heart health, and cognitive function. With rising environmental and ethical awareness, the demand for plant-based and vegan nutraceuticals is expanding. In addition, the market is experiencing a notable increase in the consumption of prenatal and infant nutrition products, particularly in urban areas where working professionals are seeking convenient and reliable health solutions for themselves and their families.

Urban consumers in France are increasingly turning to digital channels for nutraceutical purchases. E-commerce platforms are gaining popularity due to the convenience of home delivery, access to product reviews, detailed descriptions, and promotional offers. This shift in purchasing behavior is prompting more brands to expand their presence online and invest in digital marketing strategies to reach health-focused, tech-savvy consumers.

Product Insights

The dietary supplements segment accounted for a revenue share of 35.0% in 2024, driven by rising health awareness and a growing focus on preventive healthcare. Consumers are increasingly using supplements to support their immunity, manage stress, boost energy levels, and maintain overall wellness. The segment also benefits from the aging population’s demand for products that support bone, heart, and joint health. In addition, the availability of a wide range of supplement formats such as capsules, gummies, and powders, along with strong distribution through pharmacies, health stores, and online platforms, contributes to steady market growth.

The functional beverages segment is expected to experience a 10.0% growth rate from 2025 to 2033. Busy lifestyles and a growing preference for convenient, on-the-go nutrition encourage consumers to choose functional beverages. Additionally, product innovation, such as introducing beverages fortified with vitamins, minerals, probiotics, and plant-based ingredients, is attracting a broader customer base. In February 2024, Danone inaugurated its new plant-based beverage facility in Villecomtal-sur-Arros, France, dedicated to producing oat-based drinks for the Alpro brand. These trends, combined with effective marketing strategies and the expansion of distribution channels, contribute to the robust growth of this segment.

Application Insights

The weight management & satiety segment held the largest revenue share of the France nutraceuticals market in 2024 due to increasing consumer concerns about obesity and related health issues. Rising health awareness, growing focus on preventive healthcare, and the desire for effective solutions to control weight are driving demand for nutraceutical products that support weight management and satiety. For instance, in January 2025, Valbiotis announced the launch of its new dietary supplement, Valbiotis PRO Metaboli Health, in France in February 2025.

In addition, innovations in product formulation and the availability of convenient supplements and functional foods are making it easier for consumers to integrate these products into their daily routines-this combination of health trends and product accessibility fuels strong growth in this market segment.

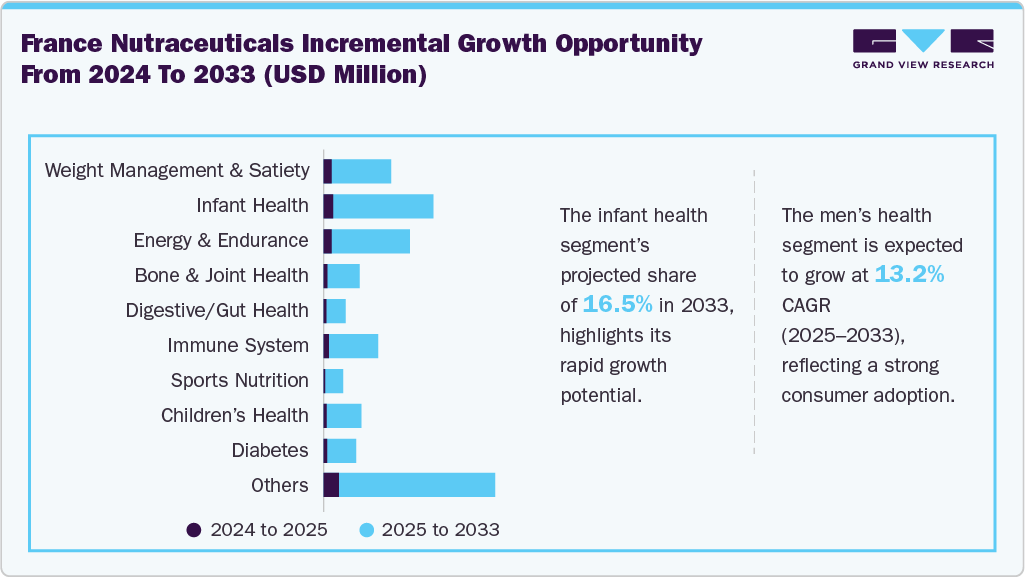

The men’s health segment is projected to experience the fastest CAGR from 2025 to 2033, driven by growing awareness of physical and mental well-being among men in France. There is a rising demand for supplements that support reproductive and sexual health, along with an increasing tendency among men to use nutraceuticals to address health concerns linked to stress, sedentary lifestyles, substance abuse history, and mental health challenges.

Distribution Channel Insights

The offline distribution segment dominated the France nutraceuticals market in 2024, largely due to the strong presence of pharmacies, health stores, supermarkets, and specialty retail outlets across the country. French consumers continue to place high trust in pharmacists and in-person recommendations when purchasing health-related products, particularly those involving supplements or wellness solutions. Offline channels offer personalized guidance, immediate product availability, and the ability to inspect products before purchase, enhancing consumer confidence. Additionally, the established infrastructure of retail chains and pharmacy networks ensures wide accessibility across both urban and rural areas, further supporting the growth of this segment.

The online segment is anticipated to experience the fastest CAGR from 2025 to 2033. The growing preference for convenient and time-saving shopping options drives this segment. Increasing internet penetration, the rise of e-commerce platforms, and changing consumer behavior, especially among younger and tech-savvy demographics, are fueling the shift toward online purchases.

Key France Nutraceuticals Company Insights

Some of the key players in the France nutraceuticals market include Amway Corp., Nestlé Health Science, Danone, and others.

-

Amway Corp. is a global company specializing in multiple product categories, including nutrition, beauty, home, and personal care. Its nutrition portfolio features offerings such as targeted food supplements, foundational food supplements, personalized solutions, sports nutrition products, and more.

Key France Nutraceuticals Companies:

- Amway Corp.

- Nestlé Health Science

- Danone

- HERBALIFE INTERNATIONAL FRANCE

Recent Developments

-

In May 2025, Laboratoires Expanscience launched its first nutraceutical active ingredient, Tulsinity Bio, marking its entry into the nutraceutical market. Extracted from organic tulsi leaves, the ingredient supports skin and mental well-being.

France Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.29 billion

Revenue forecast in 2033

USD 29.58 billion

Growth rate

CAGR of 7.7% from 2025 to 2033

Actuals

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Key companies profiled

Amway Corp.; Nestlé Health Science; Danone; HERBALIFE INTERNATIONAL FRANCE.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

France Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the France nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2021 – 2033)

-

Dietary Supplements

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Functional Food

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Billion, 2021 – 2033)

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 – 2033)