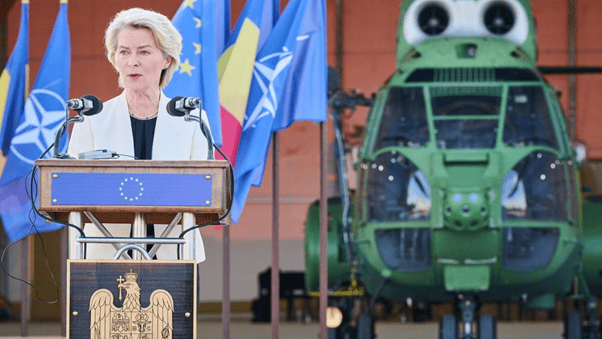

Photo. European Union, 2025

Profound transformation and shift in mindset toward agility, speed, collaboration, and risk-taking—these are the central ambitions of the EU Defence Industry Transformation Roadmap unveiled by the European Commission this week. The document lays down the steps necessary to unleash the potential of disruptive innovation and new defence players, drawing both on lessons from Ukraine and on Europe’s own structural shortcomings.

The roadmap was released alongside a new Military Mobility package. Both initiatives were already announced in October’s Defence Readiness Roadmap 2030, which aims to prepare EU countries to effectively deter and repel Russian aggression by 2030. In this framework, the European defence industry is seen as one of the key strategic resources needed to achieve this goal.

Europe must learn from Ukraine

The roadmap’s point of departure lies in the lessons from the Ukrainian defence industry, whose innovation ecosystem is presented as a model to follow. Dual-use solutions, software-defined weapons, modularity, and open architectures are considered key factors behind Ukraine’s battlefield successes, and ones that the European industry must likewise cultivate.

The Commission emphasises the speed, agility, and responsiveness of Ukraine’s New Defence sector, which enables near-real-time integration of battlefield feedback and thus exceptionally short innovation cycles. It attributes this to a high degree of decentralisation and to the close link between R&D, procurement, and the military.

Because of the importance of the Ukrainian experience, the EU plans to further strengthen its presence there by establishing an EU Defence Industry Office in Kyiv to monitor military-technological developments and frontline defence innovation.

Critical role for disruptive technologies and New Defence

The roadmap identifies the major disruptive technologies that the European defence industry must harness to secure future military superiority. These include, of course, AI, but also quantum technologies—which hold vast potential for precise navigation, secure communications, and superior computing—as well as space-based capabilities and advanced cyber tools.

The roadmap assigns a central role in the development of these technologies to new defence actors, positioning them as the cornerstone of a transformed European defence industry. These „New Defence” players are mostly SMEs, small mid-caps, startups, and scale-ups—more than 230 of which have been founded in Europe since 2022. They operate according to a fundamentally different model than established large companies, characterized by rapid iteration and a far greater risk-taking.

Four challenges: transformative solutions?

The roadmap identifies four critical structural challenges facing new defence actors within the European defence ecosystem and outlines measures to address them in order to unlock their full potential.

The first of them is the chronic lack of capital along the investment journey of defence companies. The document stresses that this prevents many start-ups from scaling up and risks pushing some of them towards foreign investors, thereby undermining the EU’s security and defence interests.

The document concludes that the EU can no longer limit itself to nurturing early-stage New Defence companies; it must support them throughout the full pathway to industrial-scale production, mobilising all available public and private financing. Accordingly, it calls for a €1 billion Fund of Funds to deliver growth capital to innovative defence SMEs and scale-ups by early 2026.

Second, the Commission acknowledges the „very slow and cumbersome” defence innovation cycle, which risks leaving Europe behind other players. It highlights the difficulties of entering the market, with the so-called „valley of death” eliminating many promising start-ups. Contributing factors include insufficient and costly manufacturing capacity, as well as differing legal regimes for the certification and validation of technologies across Member States.

In this dimension, the EU will launch a pilot instrument for agile rapid defence innovation (AGILE), designed to help firms deliver new solutions within 6–12 months. It will also facilitate access to EU infrastructures, including the Commission’s JRC facilities and AI Factories/Gigafactories. Crucially, the EU will propose mutual recognition schemes and more coherent regulatory frameworks among Member States for defence technologies, drawing on the concept of a „28th Regime” designed to create a harmonised set of rules for European businesses.

Another problem resides in the barriers that New Defence firms face when trying to access defence contracts—an issue that is critical for their survival and growth. Large, established actors are often better positioned to compete for these contracts, while public authorities frequently prefer companies that are already known and tested. New entrants also face significant knowledge and information gaps, which are compounded by lengthy and complex defence procurement processes.

To secure more contracts for new entrants, the EU will launch EUDIS Tech Alliances—a network that brings defence startups and scale-ups together with end-users around the SAFE priority capability areas. The Commission will also prioritise purchasing services from new dual-use companies, particularly in the space sector. Notably, it will encourage Member States to allocate at least 10% of their armament procurement budgets to emerging and disruptive technologies.

Lastly, the EU addresses the labour and skills shortages in the defence sector, noting a „critical talent challenge” in attracting and retaining professionals with the competencies needed for disruptive technologies. In this context, the Commission will help Member States upskill around 12% of the aerospace and defence workforce each year and reskill 600,000 workers for the defence industry by 2030.

If implemented, these measures could prove genuinely transformative, even revolutionary. The EU seeks to reshape not only the functioning and structure of the European defence industry, but also the way we think about it. This would open a new structural window of opportunity for new actors and innovative solutions to enter and establish themselves, while pushing established firms to compete and invest more—hopefully to the great benefit of Europe’s defence capabilities.