There’s a lot of negativity on Germany currently. Some of that’s justified. The energy shock that followed Russia’s invasion of Ukraine is still weighing on manufacturing and consumer confidence remains remarkably depressed. But there’s also signs that business sentiment is gradually improving – especially on a forward-looking basis – and it’s starting to look like manufacturing and exports are bottoming out. There’s certainly structural challenges to the growth model, but a lot of what’s been holding back growth is cyclical. That negative impulse is starting to fade.

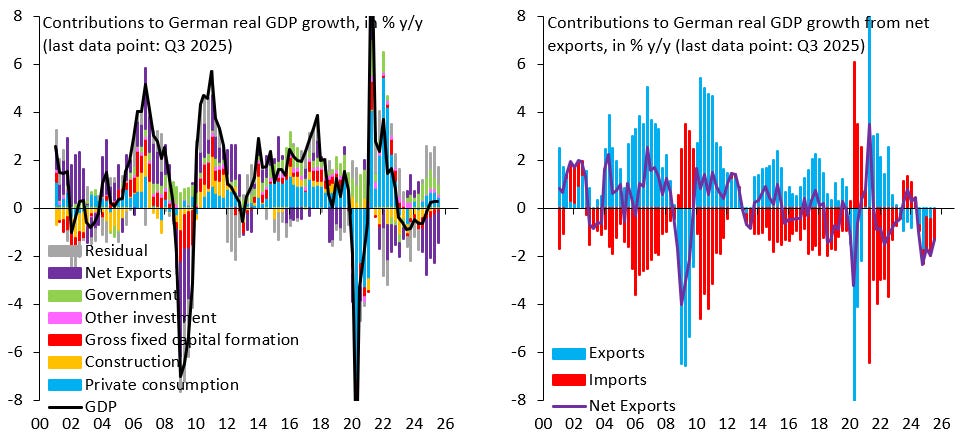

The left chart above decomposes year-over-year GDP growth (black line) into its underlying drivers. Russia’s invasion of Ukraine took a severe toll on Germany and a lot of that shock is still making its way through the economy. But this chart – which is making the rounds – tends to overstate the negative, because the negative drag from net exports (purple bars) isn’t actually about exports, but recovering imports. The right chart decomposes the purple bars in the left chart into the contribution from exports (blue bars) and imports (red bars). The contribution from exports in Q3 ‘25 is flat for the first time in many quarters, so it’s a rebound in imports that’s driving the overall negative contribution to GDP from net exports.

Germany is certainly not out of the woods yet. But markets are putting way too much emphasis on structural drivers and ignoring that cyclical forces have also weighed on growth. That cyclical drag is starting to fade. There’s a clear improvement in business sentiment, especially in forward-looking components, as the left chart above shows. It also looks like domestic manufacturing orders for consumer goods have bottomed, as the right chart above shows. These are just two examples from a growing array of data that suggest that Germany is starting to find its feet.

Coverage of Germany tends to be too negative. That’s because Germany is so widely disliked that a strong “Schadenfreude” factor kicks in whenever the country is on the back foot. This is especially true for discussion within the EU, where countries from the high-debt South never miss an opportunity to highlight German weakness. That stuff is noise and best ignored.