From a new limit on salary sacrifice schemes to changes to cash ISA rules, here are all of the measures Reeves announced that could hit you and your retirement savings

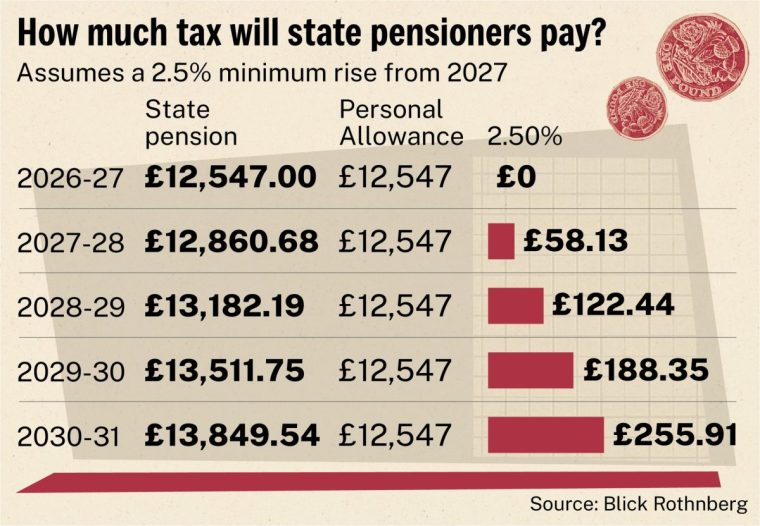

Rachel Reeves’s second Budget saw a freeze to income tax thresholds, as well as confirmation of a state pension increase, meaning 10 million retirees are set to pay income tax on their state pension by 2030.

A longer-than-expected freeze in the tax-free personal allowance – to 2030/31 – is likely to result in even more pensioners being brought into the tax net than expected.

Currently, around 8.7 million pensioners pay income tax. Even though the state pension age will rise from 66 to 67 over the next two years, the number of pensioners paying income tax will rise to at least 9.3 million in 2029/30, according to analysis from consultancy firm LCP.

New FeatureIn ShortQuick Stories. Same trusted journalism.

But, an extra year of thresholds being frozen makes it highly likely that 10 million pensioners – more than three quarters of all pensioners – will be taxpayers in 2030/31.

It is one of the major changes affecting pensioners.

One of the other most significant confirmed pension reforms is a cap on salary sacrifice contributions, while personal-tax thresholds remain frozen.

Changes to cash ISAs were also unveiled, but other popular pension features, including the tax-free lump sum and pension tax relief, remain as they are.

Below, we take a look at the biggest changes and how they impact you.

More pensioners paying income tax

Reeves extended the freeze on income tax thresholds, keeping the personal allowance at £12,570 and the higher-rate threshold at £50,270 until 2030/31.

This will drag more people into paying tax, including those on the state pension alone, who by 2027, will see their payments increase to over £12,570 in line with the triple lock agreement. The agreement ensures the state pension increases each year in line with the highest of average earnings, inflation or 2.5 per cent.

The state pension in April will rise by 4.8 per cent in line with average wages, which means the new state pension – for those who reached state pension age after April 2016 – will increase to £241.30 a week, or £12,547.60 a year, a rise of £574.60.

Meanwhile, the basic state pension – for those who reached state pension age before April 2016 – will go up to £184.90 a week, or £9,614.80 a year, a rise of £439.40.

Former pensions minister and partner at LCP, Sir Steve Webb, said the combination of the tax freeze with the state pension rise will make 10 million pensioners taxpayers in 2030/31 – more than three quarters of all pensioners.

Sir Steve said: “The extremely long freeze in tax thresholds, coupled with substantial increases in the rate of the state pension, means that the number of pensioners paying income tax has surged.

“It stood at 6.5 million pensioner taxpayers in 2020/21, around 8.7 million now, and a likely 10 million in 2030/31 – an increase of more than half.

“This is a fundamental shift in the way the tax system treats retirees. Having to deal with HMRC is going to be the norm for pensioners in future.”

Salary sacrifice has a new cap

Reeves has introduced a £2,000 annual cap on pension contributions made through salary sacrifice.

When most people sacrifice some of their wages into their pension, they do not pay income tax or national insurance (NI) on that part. Their employer does not pay NI on the contributions either.

Higher earners often use salary sacrifice because lowering their pay can move them into a lower tax band or mean they owe tax on a smaller amount of their income.

Contributions above that level will incur NI at 8 per cent for lower earners and 2 per cent for higher earners.

The new cap targets a practice that has grown in popularity among employers and higher-earning staff, allowing both to cut NI bills while putting more money into pensions.

The Treasury argued that some workers were using salary sacrifice arrangements to funnel large portions of their pay through pensions purely to maximise tax advantages.

Employees affected may see take-home pay fall once NI is applied to contributions above the threshold. Employers could also face higher costs as the NI saving is reduced, raising concerns some may scale back or scrap schemes entirely.

According to the Office for Budget Responsibility’s report, the measure is expected to raise £4.7bn in 2029/30 and £2.6bn in 2030/31.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said this will “make people feel that bit poorer” and could reduce pension contributions.

She added that the cost to employers could be substantial, with annual NI bills rising by £75 for someone earning £50,000 and £450 for someone on £100,000.

Cash ISA changes

From 6 April 2027, the maximum subscription to a cash ISA will fall to £12,000 per year, though over-65s will retain a £20,000 allowance.

Existing ISA balances are unaffected.

Rob Hillock, head of personal financial planning at financial services consultancy Broadstone, said this was a “smart move”.

He said: “Protecting the full cash ISA allowance for over-65s is a smart move that will enable pensioners to de-risk as they enter retirement, recognising a greater need for more accessible and lower-risk savings, but further limits tax efficient vehicles for those under 65 looking to save securely.”

However, many of those who max out the £20,000 limit, who will now see this cut by £8,000, will be frustrated by the change.

Mineworkers pension reserves

The Government will transfer the British Coal fund investment reserve to its members, unlocking £2.3bn in reserves for additional retirement payments.

This follows last year’s transfer of £1.5bn from the mineworkers pension scheme, which led to an average weekly increase of £29 for members.

Areas unchanged

Despite speculation, the tax-free lump sum remains at 25 per cent, meaning retirees can still withdraw up to £268,275 tax-free depending on the size of their pot.

Likewise, pension tax relief remains tiered, offering 20 per cent for basic-rate taxpayers and up to 45 per cent for higher earners.

For now, these decisions maintain familiar incentive structures and avoid the administrative upheaval a reform would have required – though some advisers warn that changes may only have been delayed rather than abandoned.