If you wait for a day when you feel zero fear, you may never start. (AI image) If you’ve ever opened an investing app, seen a zig-zag line, felt your stomach drop and quietly closed it—congratulations, you are perfectly normal.You work hard for your money. You’ve heard horror stories about stock market losses, “this fund went down 20%,” and uncles who “lost everything” in some scheme. Then someone like me says, “Just start an SIP and think long term.”Your brain reasonably replies: “Very nice. But what if I lose money?”Let’s separate feeling from fact.What are you actually afraid of?When people say “I’m scared of the market,” it’s usually a mix of:

If you wait for a day when you feel zero fear, you may never start. (AI image) If you’ve ever opened an investing app, seen a zig-zag line, felt your stomach drop and quietly closed it—congratulations, you are perfectly normal.You work hard for your money. You’ve heard horror stories about stock market losses, “this fund went down 20%,” and uncles who “lost everything” in some scheme. Then someone like me says, “Just start an SIP and think long term.”Your brain reasonably replies: “Very nice. But what if I lose money?”Let’s separate feeling from fact.What are you actually afraid of?When people say “I’m scared of the market,” it’s usually a mix of:

- I don’t understand this.

Jargon, charts, acronyms. When we don’t understand something, we assume danger. - I can’t afford a big loss.

The fear that one wrong step will wipe out years of saving. - I don’t trust the system.

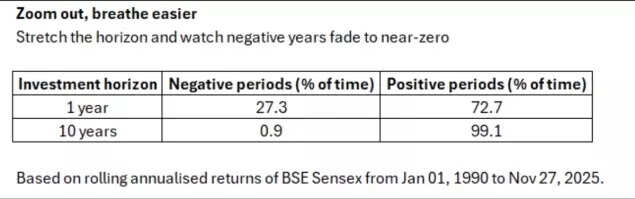

Scams, defaults, frauds—headline writers don’t go hungry.All fair worries. But the numbers tell a calmer story.What the data quietly saysDay-to-day, the market looks like a heart monitor. Over longer periods, it looks much more boring.

Zoom out, breathe easier

The translation in plain English:

- In the short term, ups and downs are routine.

- Over 10–15 years, a diversified equity investment has usually rewarded patience.

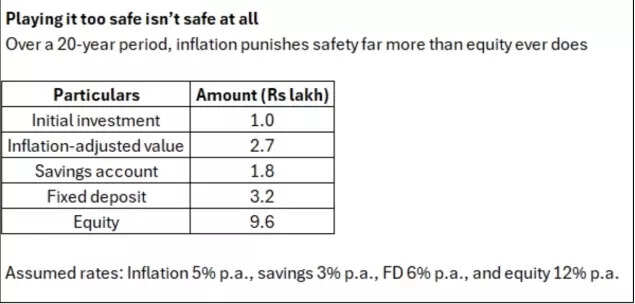

There are no guarantees, but the risk of temporary loss is far higher than the risk of permanent loss—provided you behave sensibly.And then there is the villain we don’t see: inflation.The risk of doing “nothing”Keeping all your money in savings and FDs feels safe. But “safe” here means “slowly losing purchasing power”.Not investing is also a decision about risk. Just not the one you think.

Playing it too safe isn’t safe at all

Meet Rajesh, the nervous first-timerTake a typical 32-year-old salaried worker in Delhi. Call him Rajesh.

- Some money in the bank, a couple of FDs.

- Parents once bought a terrible product and lost money.

- Rajesh has been “about to start an SIP” for three years, but every time he reads “markets at all-time high” or “crash coming”, he postpones it.

The safest path isn’t always the straightest

Even with a couple of bad years, the investing Rajesh ends up with a far larger corpus. The non-investing Rajesh feels safe but quietly loses opportunity.His fear of seeing temporary ups and downs is pushing him towards a permanent gap.First fix: protect yourselfIf you’re genuinely scared of losing money, your first job is not to pick a mutual fund. It’s to make sure that one bad event doesn’t force you to sell at the worst time.Two simple steps:

- Emergency fund

- Keep 3–6 months of expenses in a boring, easy-access place.

- This is not for returns; it’s your “I can sleep at night” fund.

- Basic insurance

- Health insurance for hospital bills.

- Term life insurance if others depend on your income.

Once these are in place, the fear that “one illness / job loss will wipe me out” reduces sharply. You’re less likely to raid your investments in a panic.Second fix: start small and boringYour first investment should not try to impress you. It should try to survive you.

- Start with an amount you can ignore emotionally. Even ₹2,000–₹3,000 a month is fine.

- Use a simple, diversified fund—preferably a balanced / conservative hybrid if you’re very nervous, not a small-cap rocket.

During this period, do not stare at the NAV every day. Check once a quarter. Notice how you feel, but don’t act on every mood swing.The first 1–2 years are less about returns and more about training your nerves.Then let habit do the heavy liftingIf you manage to:

- Keep your emergency fund intact,

- Pay your SIP on time, and

- Not redeem every time there is a noisy headline, you’ve already done the hard part.

From there, the upgrades are easy:

- Increase your SIP as your income rises.

- Gradually tilt more towards equity if your goals are 10–15 years away.

Good investing is mostly this: boring, repeated, automated good behaviour.You don’t need courage. You need a plan.You don’t have to become a thrill-seeker to start investing. You don’t have to predict markets. You don’t have to enjoy risk.You just need to:

- Protect yourself from big shocks.

- Start with an amount and a product you can live with.

- Give time and compounding a chance to work.

Your fear is valid. Respect it. But don’t let it run the show.If you wait for a day when you feel zero fear, you may never start. If you start with a sensible plan despite the fear, that small, boring SIP might quietly turn into the bravest financial decision of your life.(Dhirendra Kumar is Founder and CEO of Value Research)