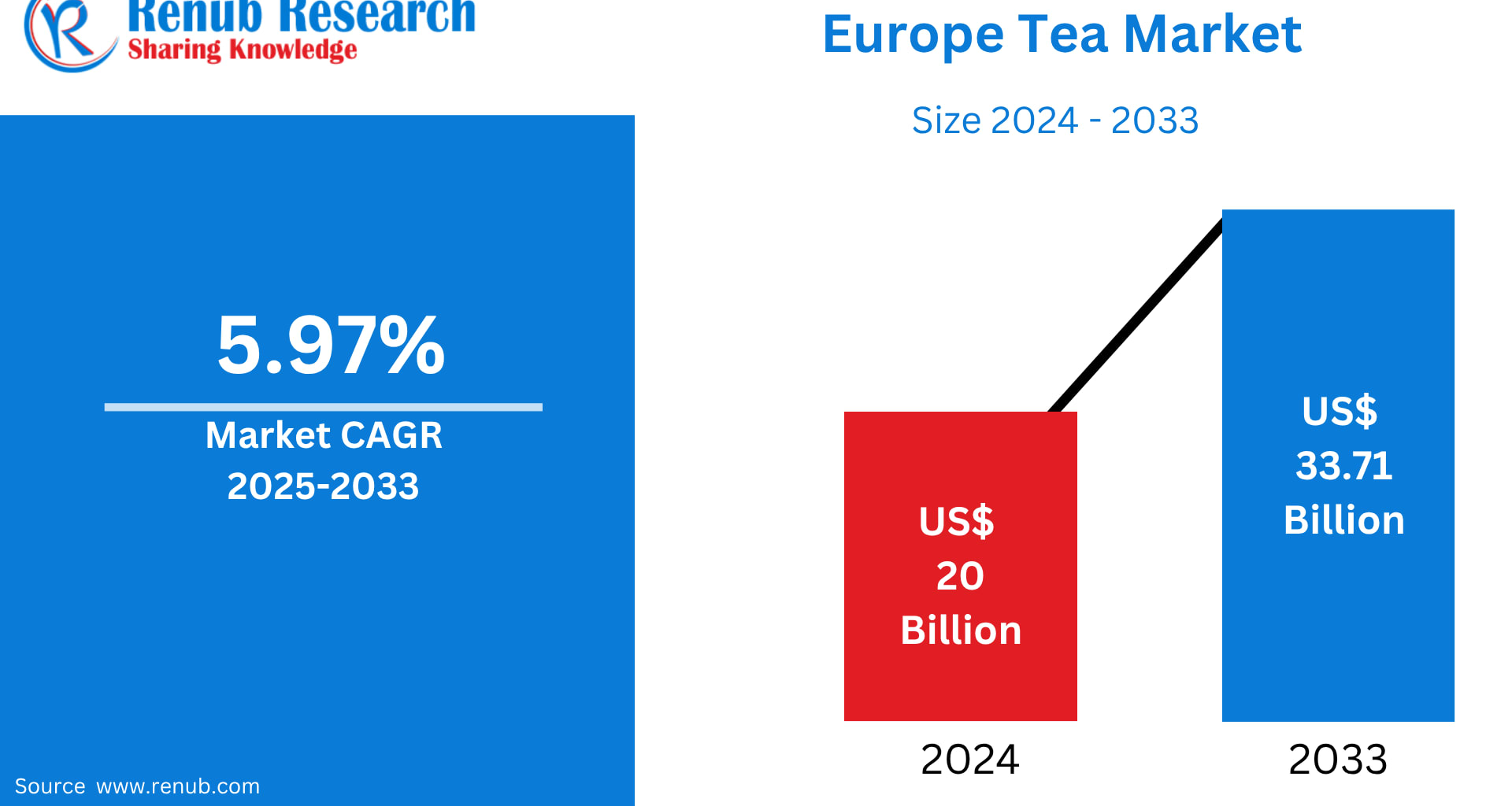

The Europe Tea Market is entering a dynamic new phase marked by stronger consumer focus on health, sustainability, premium blends, and digital retail experiences. According to Renub Research, the Europe Tea Market is anticipated to grow from US$ 20 billion in 2024 to US$ 33.71 billion by 2033, expanding at a CAGR of 5.97% between 2025 and 2033.

This momentum reflects not only Europe’s longstanding tea culture but also a new wave of demand led by wellness-oriented consumers, specialty tea startups, and innovative retail channels reshaping how Europeans buy and consume tea.

Tea is one of Europe’s most cherished beverages—steeped in tradition yet continuously reinvented. Derived from the leaves of Camellia sinensis, tea comes in many varieties including black, green, white, oolong, and herbal blends. Each form carries unique flavor notes, caffeine levels, and processing styles.

Herbal infusions such as chamomile, peppermint, hibiscus, and rooibos—naturally caffeine-free—have gained mainstream popularity as daily wellness beverages.

Tea is not only enjoyed for its comforting flavor and aroma but also for its well-documented health benefits. Rich in antioxidants like catechins and polyphenols, tea supports digestion, immune function, cardiovascular health, and mental relaxation. Herbal infusions remain deeply associated with natural healing—often used for sleep, cold relief, digestive issues, and stress management.

Within Europe, tea’s popularity spans major markets such as the United Kingdom, Ireland, Germany, France, and Russia. While black tea remains the most consumed category, green, herbal, and organic teas are fast gaining momentum. The rise of meditation, relaxation rituals, and wellness routines has further propelled the market, giving rise to premium tea salons, artisanal blends, and curated tea experiences.

Growing emphasis on sustainable sourcing, fair-trade certifications, and eco-friendly packaging is also redefining consumer expectations. As more Europeans replace sugary drinks with healthier options, tea continues to cement its position as a versatile, low-calorie beverage offering both comfort and health benefits.

Key Growth Drivers Fueling the Europe Tea Market

1. Rising Health & Wellness Awareness

Across Europe, consumers are replacing high-sugar beverages and even traditional coffee with healthier tea alternatives. Green tea, functional teas, and herbal infusions are gaining traction for their perceived benefits—ranging from detoxification and improved metabolism to immunity and mental calm.

COVID-19 played a pivotal role in accelerating this trend, pushing households to seek natural, immunity-enhancing beverages.

March 2024: Twinings launched a new line of functional tea blends designed for European consumers, infused with botanicals aimed at supporting immunity, digestion, and sleep.

As wellness becomes a lifestyle rather than a trend, tea’s role as a natural health beverage will continue to expand.

2. Surge in Specialty, Premium & Organic Tea

Premiumization is transforming the European tea landscape. Consumers—especially millennials—are experimenting with:

Single-origin teas

Luxury blends

Artisanal loose-leaf teas

Organic and ethically sourced varieties

Specialty tea houses, curated subscription boxes, and immersive store experiences are elevating tea into a lifestyle category.

January 2024: Unilever PLC introduced a premium organic tea collection with innovative eco-friendly packaging aimed at the health-conscious European audience.

This shift has opened new opportunities for boutique brands that emphasize authenticity, craftsmanship, and storytelling.

3. Rapid Expansion of E-Commerce & Digital Retail

Europe’s online tea market has witnessed exponential growth driven by convenience, variety, and influencer-driven discovery. Platforms offer access to rare, international, and niche brands not easily found in supermarkets.

Subscription models—offering monthly curated tea boxes—have become particularly popular among younger drinkers.

In the UK, online tea sales surged 70% in 2022, according to the British E-commerce Association.

Digital retail’s ability to personalize recommendations and deliver targeted wellness messaging has made it a critical distribution channel shaping the future of the industry.

Key Challenges in the Europe Tea Market

1. Market Saturation & Competition

Western Europe’s tea market is mature, with numerous local and global players battling for visibility. Price competition, limited shelf space, and strong brand loyalty create barriers for new entrants.

In markets like the UK, where tea drinking is deeply rooted, growth has plateaued. Brands must differentiate through premiumization, storytelling, health claims, or sustainability to remain competitive.

2. Volatile Raw Material Costs & Climate Impact

Tea production depends heavily on climatic conditions. Erratic weather in major producing nations—India, Kenya, China, and Sri Lanka—can lead to:

Crop damage

Cost fluctuations

Supply-chain disruptions

Rising shipping and energy costs further pressure European importers. Balancing affordability with ethical sourcing and sustainability commitments remains a key challenge across the industry.

Segment Analysis of the Europe Tea Market

Europe Green Tea Market

Green tea is witnessing a substantial surge in demand due to its antioxidant-rich profile and metabolism-enhancing properties. Fitness-focused and urban consumers are driving this category. Available as loose-leaf, tea bags, and ready-to-drink products, green tea’s versatility has broadened its reach.

Europe Black Tea Market

Black tea remains Europe’s staple—especially in the UK, Ireland, and Russia. Known for its strong flavor and caffeine content, it continues to dominate household consumption. Premium black teas, flavored blends, and organic variants are helping the category maintain relevance amid rising competition from herbal teas.

Europe Loose Tea Market

Loose-leaf tea is gaining traction among tea connoisseurs due to its superior aroma and flavor. Seen as more natural and eco-friendly compared to tea bags, loose tea is thriving through specialty stores and online platforms.

Europe Tea Bags Market

Tea bags remain the most popular format for everyday convenience. The segment is dominated by established brands offering black, flavored, and herbal variants. Innovations such as biodegradable bags, pyramid sachets, and premium infusions are rejuvenating the category.

Application & Distribution

Europe Residential Tea Market

Home consumption remains the largest segment, reinforced by increasing wellness habits and pandemic-era lifestyle changes. Consumers gravitate towards bulk packs, organic blends, and herbal infusions.

Europe Specialty Stores Market

Boutique tea stores—especially in Germany, France, and the Netherlands—offer premium experiences with single-origin teas, botanical blends, and guided tastings. These outlets play a crucial role in shaping educated, discerning tea consumers.

Europe Online Tea Market

E-commerce continues to surge across all major markets. Online stores enable:

Access to global brands

Subscription models

Customized tea curation

Broader product comparison

Influencer marketing and wellness content amplify digital engagement.

Country-Level Insights

Germany Tea Market

Germany has one of Europe’s most diverse tea cultures, with strong demand for fruit, herbal, and green teas. Organic preferences run deep among younger consumers. Specialty stores and private labels contribute significantly to the market’s growth.

United Kingdom Tea Market

Tea is synonymous with British culture, with black tea still dominating daily consumption. However, green, herbal, and functional teas are rapidly emerging. Sustainability, premium blends, and ethical sourcing are central to modern consumer preferences.

Russia Tea Market

Russia remains one of Europe’s biggest tea consumers, with a strong preference for black and fermented teas. Young consumers are gravitating toward green, fruit, and herbal infusions. Despite economic fluctuations, local production and online retail have helped sustain market growth.

France Tea Market

France’s tea landscape is shaped by an appreciation for premium, beautifully packaged products. Green tea and herbal blends appeal strongly to wellness-focused consumers. Tea is seen as a lifestyle beverage, often linked to cafés, fine dining, and artisanal experiences.

Market Segmentation Overview

Product Type

Green Tea

Black Tea

Oolong Tea

Others

Packaging

Plastic Containers

Loose Tea

Paper Boards

Aluminium

Tea Bags

Others

Application

Residential

Commercial

Distribution Channel

Supermarkets & Hypermarkets

Specialty Stores

Convenience Stores

Online Stores

Others

Countries Covered

France, Germany, Italy, Spain, United Kingdom, Belgium, Netherlands, Russia, Poland, Greece, Norway, Romania, Portugal, Rest of Europe

Key Companies (with 5 Viewpoints Each)

Associated British Foods Plc

Tata Consumer Products Limited

Unilever

Barry’s Tea

Taetea Group

Final Thoughts

Europe’s Tea Market is undergoing a profound transformation, driven by lifestyle changes, wellness trends, and consumer appetite for premium, sustainable, and experiential products. With the market set to reach US$ 33.71 billion by 2033, the industry’s future is defined by innovation—ranging from functional botanicals and artisanal blends to eco-friendly packaging and immersive digital retail strategies.

Tea is no longer just a traditional household beverage in Europe—it’s a symbol of health, culture, luxury, and mindful living. Brands that embrace authenticity, sustainability, and wellness-driven storytelling are poised to lead the next decade of growth.