Demand for Canned Foods in USA 2025 to 2035

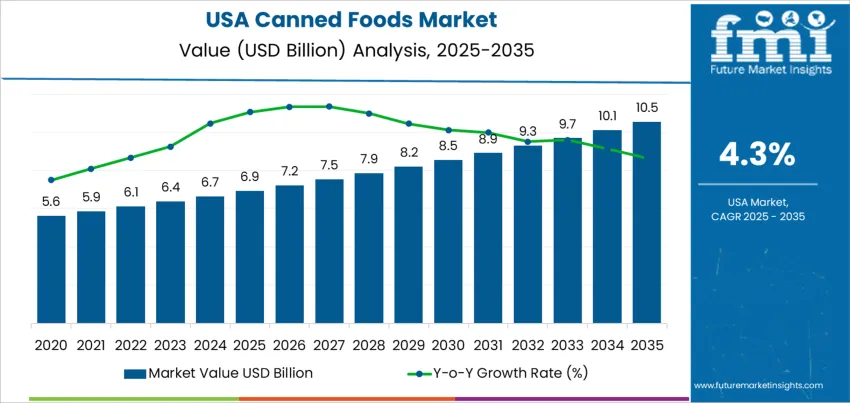

The demand for canned foods in the USA is valued at USD 6.9 billion in 2025 and is forecasted to reach USD 10.5 billion by 2035, reflecting a CAGR of 4.3%. Growth is driven by rising consumption of convenient, long-shelf-life packaged foods and strong penetration in emergency storage, institutional feeding, and budget-focused retail channels. The category remains relevant due to stable pricing, lower waste generation, and improvements in nutrient retention during processing. Canned fruits and vegetables represent the leading product type due to high household USAge frequency and broad availability through grocery, club, and discount stores. Producers focus on clean-label positioning, reduced sodium-sugar formulations, and retort process optimization to preserve flavor, color, and firmness.

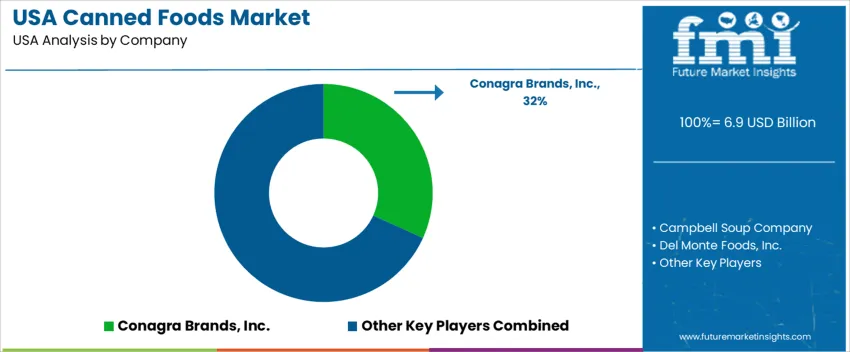

Demand is concentrated in the West, South, and Northeast, supported by large distribution networks and steady reliance on ready-to-eat staples across diverse income groups. Private-label expansion and regional produce sourcing initiatives continue to influence procurement strategies. Key suppliers include Conagra Brands, Inc., Campbell Soup Company, Del Monte Foods, Inc., Kraft Heinz Company, and Bonduelle SA, with priorities centered on cost-efficient production, recyclable metal packaging, and SKU availability suited to retail and foodservice requirements.

Quick Stats for USA Canned Foods Demand

- USA Canned Foods Sales Value (2025): USD 6.9 billion

- USA Canned Foods Forecast Value (2035): USD 10.5 billion

- USA Canned Foods Forecast CAGR (2025–2035): 4.3%

- Leading Product Type in USA Canned Foods Demand: Canned Fruits and Vegetables

- Key Growth Regions in USA Canned Foods Demand: West USA, South USA, Northeast USA

- Top Players in USA Canned Foods Demand: Conagra Brands, Inc., Campbell Soup Company, Del Monte Foods, Inc., Kraft Heinz Company, Bonduelle SA

What is the Growth Forecast for Canned Foods Industry in USA through 2035?

Demand for canned foods in the United States displays a clear peak-to-trough pattern shaped by shifts in consumer behavior and purchasing priorities. Peaks are linked to periods when affordability, long shelf life, and pantry-stocking needs rise. Adoption strengthens during economic uncertainty and instances of supply-chain disruption because canned categories provide stable, low-waste meal options. Consumer interest in protein-rich canned meat, beans, soups, and vegetables supports peak cycles, particularly when household spending tightens.

Trough phases appear when fresh and frozen alternatives gain preference. Increased focus on nutrition transparency and reduced sodium leads consumers to shift toward perceived healthier options. Younger demographics often choose refrigerated or ready meals with premium positioning, which temporarily lowers canned food demand. Growth resumes as brands focus on reformulation and convenience enhancements including clean-label processing, recyclable packaging, and line extensions with global flavors. The overall trend reflects a resilient category that reaches peaks during cost-sensitive consumption periods, followed by troughs during strong economic confidence and shifts toward fresh-forward eating habits.

USA Canned Foods Key Takeaways

Metric

Value

Why is the Demand for Canned Foods in the USA Growing?

Demand for canned foods in the USA is increasing because consumers value their long shelf life, convenience and affordability. Canned vegetables, beans, soups and ready-made meals meet the needs of busy households, single-person dwellings and students who prefer minimal preparation. The extended shelf stability of canned foods supports pantry stocking and emergency-preparation plans, which remains relevant for many households. E-commerce grocery delivery and subscription meal-kit services support consistent demand by offering canned and shelf-stable foods that ship well and reduce spoilage risk during transport. Manufacturers expand variety with ethnic flavors, plant-based recipes and premium ready-to-eat options that appeal to evolving dietary preferences.

Economic factors influence uptake; during periods of price pressure or economic uncertainty, canned foods remain a budget-conscious choice for many families. Canned goods also support food banks, shelters and institutional food programs because they deliver reliable nutrition and durable storage. Constraints include competition from fresh and frozen food products that consumers may perceive as higher quality. Some shoppers limit canned food use due to concerns about sodium content, texture changes or environmental impact of packaging. Brands may also avoid canned formats for premium or gourmet items where fresh presentation is preferred.

Which Product Types, Labels, and Distribution Channels Lead Demand for Canned Foods in the United States?

Demand for canned foods in the United States continues to expand as consumers prioritize shelf-stable convenience, cost control, and nutritional assurance during routine and emergency food planning. Household stocking habits remain influenced by long shelf life, minimal preparation needs, and variety across meal components. Brands differentiate through clean-label positioning, reduced sodium contents, and sustainable packaging. Growth also reflects consistent procurement by foodservice and institutional buyers operating bulk meal programs.

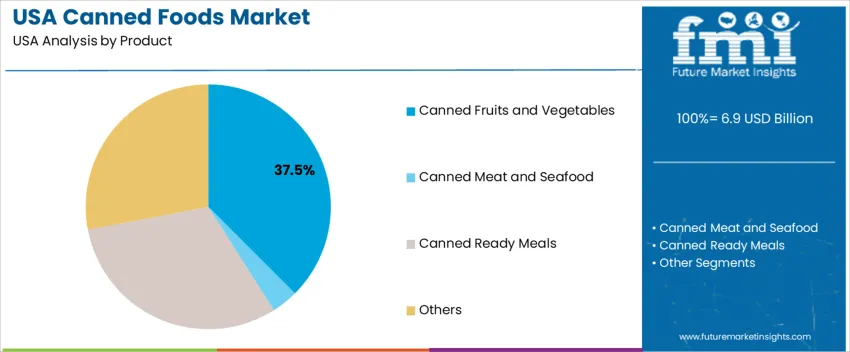

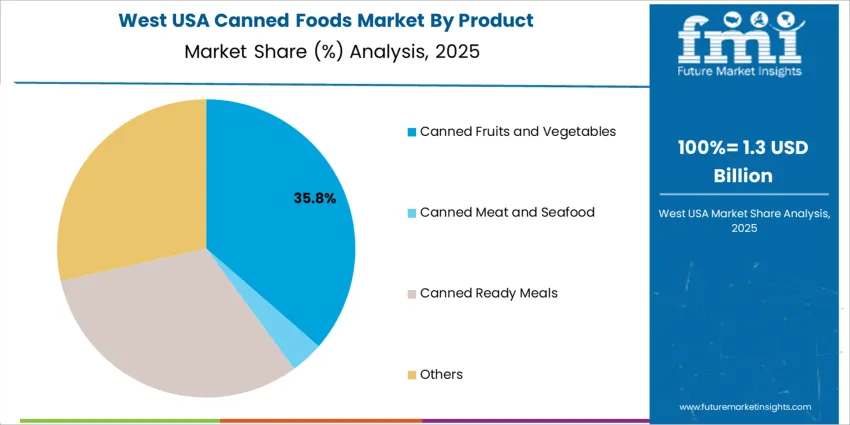

By Product, Canned Fruits and Vegetables Hold the Largest Share

Canned fruits and vegetables represent 37.5%, supported by affordable produce availability and year-round menu use across households and institutional kitchens. Canned ready meals account for 31.0%, aligned with demand for fast, heat-and-serve entrées and meal kits offering predictable portioning. Other canned formats hold 28.0%, covering items like beans, soups, sauces, and broths that support pantry stocking and meal versatility. Canned meat and seafood represent 3.5%, positioned as protein-dense but more selective in purchase frequency. Product trends reflect preference for multi-use cooking staples and expanded adoption of plant-forward canned meal combinations.

Key Points:

- Fruits and vegetables remain core pantry staples across USA households

- Ready meals drive convenience purchasing and predictable meal planning

- Protein-based canned goods serve niche but essential consumer needs

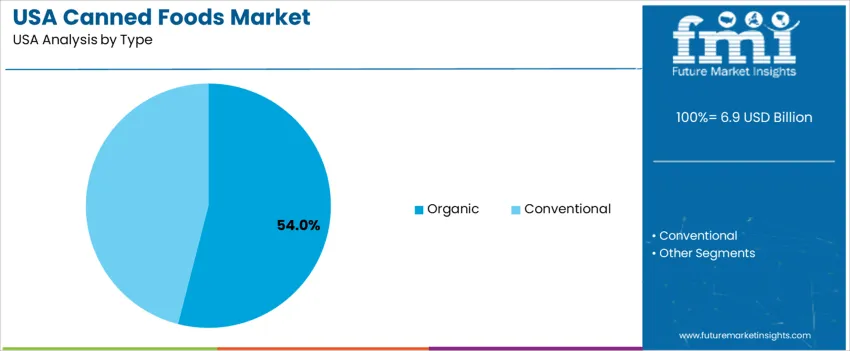

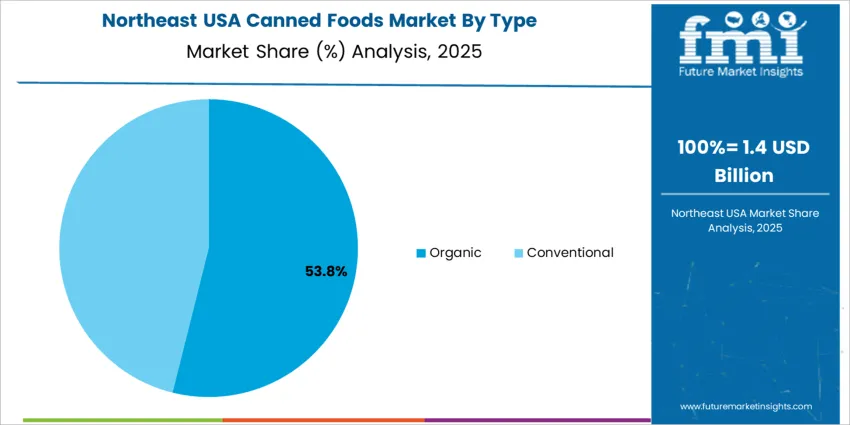

By Type, Organic Products Lead Demand

Organic canned foods account for 54.0%, driven by clean-label buying behavior and preference for low-additive preservation methods. These products support health-conscious households seeking transparency on ingredient sourcing and reduced synthetic content. Conventional products hold 46.0%, maintaining strong price-sensitive demand and wider SKU availability. Canning technology advances support reductions in additives while sustaining food safety standards across both product groups. Label choices reflect dietary expectations linked to sustainability and balanced nutrition.

Key Points:

- Organic products benefit from stronger wellness perception and label trust

- Conventional remains important for value-focused purchasing

- Ingredient transparency reinforces brand competitiveness

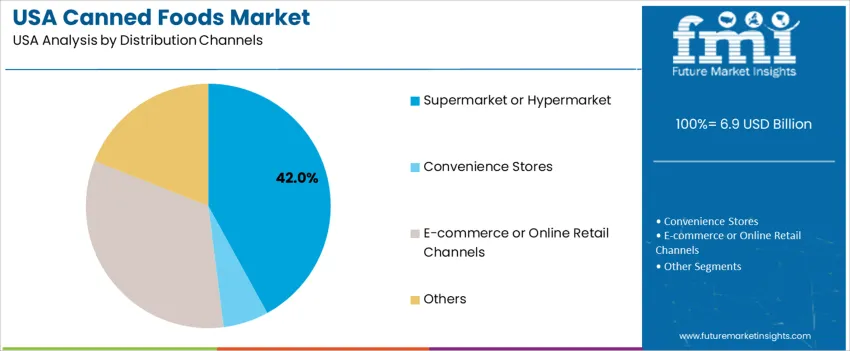

By Distribution Channel, Supermarkets and Hypermarkets Lead Demand

Supermarkets and hypermarkets represent 42.0%, serving as primary procurement points for meal planners and bulk pantry stocking initiatives. E-commerce channels account for 33.0%, enabled by subscription services, value pack delivery, and omnichannel grocery integration. Other physical channels represent 19.0%, supplying institutional and local retail outlets. Convenience stores account for 6.0%, supporting grab-and-go and emergency meal needs. Channel performance aligns with broad physical accessibility and digital adoption for routine replenishment.

Key Points:

- Large retail chains drive competitive pricing and high product rotation

- Online distribution expands through bundled delivery and auto-reorder systems

- Alternative channels serve local and institutional purchasing requirements

What are the Drivers, Restraints, and Key Trends of the Demand for Canned Foods in the USA?

Growth of convenience cooking, increased demand for shelf-stable products and rising interest in affordable, long-lasting pantry staples are driving demand.

In the United States, canned foods remain popular for busy households seeking quick meal solutions. Single-serve and family-size cans of beans, soups, vegetables, tuna and pasta help consumers manage meal planning with minimal preparation. Economic uncertainty and tight household budgets encourage purchases of affordable canned staples that last long without refrigeration. Natural disasters and emergency preparedness habits also support stockpiling of canned goods. Foodservice providers and institutional kitchens (schools, shelters, cafeterias) rely on canned ingredients for consistent availability and low waste. These factors sustain reliable demand across retail and institutional channels.

Health and nutrition concerns, competition from fresh and frozen alternatives and evolving dietary preferences restrain demand.

Some consumers perceive canned foods as less nutritious or lower in quality compared with fresh or frozen, especially given sensitivity to sodium content in soups and processed meals. Growing interest in fresh, organic produce and minimally processed foods reduces demand in segments focused on premium nutrition. Recycling challenges for metal cans and concerns over BPA in can linings create hesitation among health-conscious shoppers. These factors contribute to moderate growth rather than expansion in all industry segments.

Shift toward low-sodium, organic and ready-meal canned offerings, increased innovation in protein-rich and plant-based cans and rising emphasis on sustainable packaging define key trends.

Manufacturers are expanding low-sodium and no-salt-added canned lines to meet dietary recommendations and consumer health awareness. Organic canned vegetables, beans and plant-based meal options gain popularity among environmentally conscious and wellness-oriented buyers. Ready-meal cans combining protein, vegetables and grains offer convenient, balanced meals for office workers and single households. Brands are improving can lining materials and increasing use of recyclable steel or aluminum to address environmental and health concerns. These developments indicate continued, evolving demand for canned foods across the United States grocery and foodservice industries.

Analysis of the Demand for Canned Foods in the USA by Region

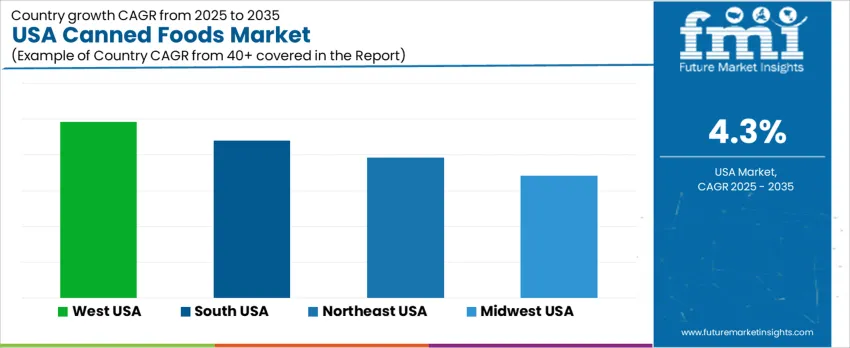

Demand for canned foods in the United States is increasing as consumers prioritize longer shelf life, affordability, and convenient meal preparation. Retail formats continue to expand their canned fruit, vegetable, soup, seafood, and ready-meal offerings due to stable year-round consumption. Emergency-preparedness habits reinforce volume purchasing, while foodservice channels rely on canned ingredients for operational predictability. Growth levels reflect regional differences in lifestyle, household structures, and storage space. The West USA leads at 4.9% CAGR, followed by the South USA at 4.4%, the Northeast USA at 3.9%, and the Midwest USA at 3.4%. Category performance depends on distribution efficiency, private-label penetration, and compliance with nutritional labeling preferences.

Region

CAGR (2025-2035)

How is the West USA driving demand for canned foods?

The West USA grows at 4.9% CAGR, supported by strong retail distribution networks and high consumer uptake of shelf-stable food options across California, Washington, and Oregon. Diverse population demographics drive demand for global-flavored canned meals, sauces, and beans. Outdoor recreation and travel culture create opportunities for portable canned proteins such as tuna, salmon, and ready-to-eat meals. Earthquake-readiness planning maintains a consistent baseline for pantry stocking habits. Retailers focus on premium canned vegetables and organic fruit lines, aligning with regional nutritional preferences. Supply chains benefit from proximity to major ports, improving access to imported canned seafood and packaged Asian staples. Product evaluations emphasize BPA-free packaging adoption, sodium-reduced formulations, and transparent ingredient sourcing.

- Diverse cuisine trends expanding canned meal options

- Emergency-readiness behaviors reinforcing pantry stocking

- Organic and reduced-sodium lines meeting wellness expectations

- Port-driven logistics enabling varied product availability

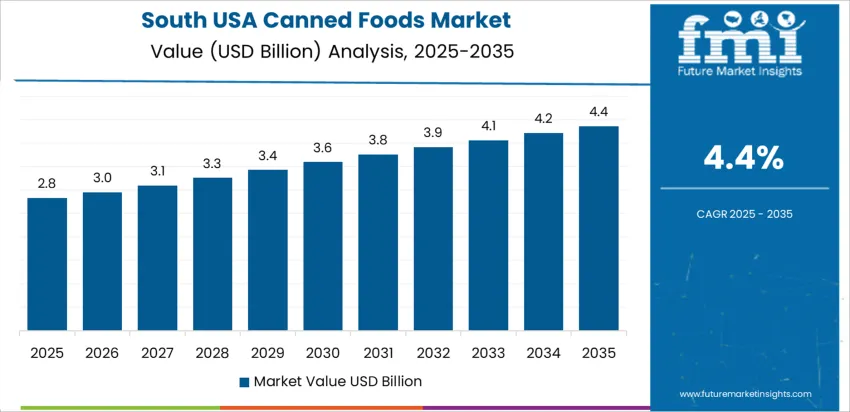

How is the South USA shaping category expansion?

The South USA records 4.4% CAGR, driven by large household sizes, value-focused buying behavior, and integration of canned goods into regional cooking styles. Demand increases for canned tomatoes, beans, and vegetables used in batch cooking and comfort-food recipes. Retailers promote multi-pack formats aligned with budget-oriented purchasing. Foodservice operators rely on canned bases for menu items where flavor consistency across seasons is important. Regional distribution hubs in Texas, Georgia, and Tennessee streamline supply for grocery chains and convenience stores. Manufacturers prioritize canning technologies that support texture stability and reduced food-waste risk. Category decisions balance affordability with clean-label requests among younger consumers.

- Value-pack purchasing supporting household food budgets

- Menu integration across Southern comfort-food traditions

- Distribution hub strength enabling steady category flow

- Performance of canned produce guiding procurement choices

How is the Northeast USA influencing canned-food selection?

The Northeast USA advances at 3.9% CAGR, driven by convenience-oriented consumption in metropolitan areas including New York, Boston, and Philadelphia. Consumers emphasize ready-to-heat canned soups, meals, and broths for fast preparation in compact kitchens. Retailers allocate space to imported specialty canned items supporting diverse culinary preferences in multicultural communities. Winter seasonality elevates demand for shelf-stable options that complement reduced fresh-produce availability. Health-focused buyers review sodium content, preservatives, and packaging certifications when evaluating brands. Distribution routes remain responsive to higher turnover in smaller-format stores.

- Convenience-driven purchases shaping product mixes

- Specialty imports supporting multicultural cuisines

- Seasonal shifts sustaining winter canned-food demand

- Health-criteria compliance guiding retail listings

How is the Midwest USA contributing to stable category volumes?

The Midwest USA experiences 3.4% CAGR, driven by traditional consumption of canned vegetables, fruits, and protein staples across Illinois, Ohio, Michigan, and Wisconsin. Bulk retailing formats such as club stores promote canned goods for family meal planning and storage efficiency. Local food manufacturers maintain strong production capacity for private-label offerings, emphasizing cost-competitiveness. Retailers support demand through promotions tied to home-cooking preferences and pantry-prepared meal routines. Procurement emphasizes packaging durability and reliable long shelf life to support storage in varying residential conditions. Adoption of canned categories remains steady rather than rapid, reflecting ingrained shopping behaviors.

- Private-label manufacturing sustaining cost-efficient supply

- Family-oriented consumption maintaining baseline demand

- Club-store volumes influencing procurement cycles

- Packaging reliability driving stocking confidence

What does the competitive structure for canned–food demand in the United States look like?

Canned-food demand in the United States remains anchored in shelf-stable meal kits, vegetables, beans, soups, and ready-to-eat sauces. Consumer demand is driven by convenience, long shelf life, and stable pricing, especially among value-conscious households and during economic uncertainty. Retailers and grocers prioritize consistent taste, nutritional labeling accuracy, and supply-chain reliability to avoid stock-outs during peak demand periods.

Conagra Brands, Inc. holds an estimated 31.8% share. Its portfolio includes widely distributed canned meals, beans, and vegetable products under well-known labels distributed across national grocery chains and club retailers. Broad SKU variety and in-house production support large-scale demand for stable products. Campbell Soup Company maintains strong presence through canned soups and meal-based products with national retail penetration and established brand loyalty. Del Monte Foods, Inc. contributes via canned vegetables and fruit items supplying both retail and institutional buyers such as food-service operations. Kraft Heinz Company participates through branded sauces, meal kits, and canned sauces that combine shelf stability with familiar taste profiles.

Bonduelle SA serves niche and premium segments offering imported or gourmet-style canned vegetables and legumes, appealing to consumers seeking variety and perceived quality distinction. Competition in the United States depends on consistency of taste, ingredient transparency, cost-efficiency of supply chains, and reliability of national distribution networks. Demand remains steady as consumers continue to value affordable, ready-to-use canned foods for pantry storage and quick meal preparation.

Key Players in USA Canned Foods Demand

- Conagra Brands, Inc.

- Campbell Soup Company

- Del Monte Foods, Inc.

- Kraft Heinz Company

- Bonduelle SA

Scope of the Report

Items

Values

USA Canned Foods Demand by Segments Product:

- Canned Fruits and Vegetables

- Canned Meat and Seafood

- Canned Ready Meals

- Others

Type:

Distribution Channels:

- Supermarket or Hypermarket

- Convenience Stores

- E-commerce or Online Retail Channels

- Others

Region:

- West USA

- South USA

- Northeast USA

- Midwest USA

Frequently Asked Questions

How big is the demand for canned foods in USA in 2025?

The demand for canned foods in USA is estimated to be valued at USD 6.9 billion in 2025.

What will be the size of canned foods in USA in 2035?

The market size for the canned foods in USA is projected to reach USD 10.5 billion by 2035.

How much will be the demand for canned foods in USA growth between 2025 and 2035?

The demand for canned foods in USA is expected to grow at a 4.3% CAGR between 2025 and 2035.

What are the key product types in the canned foods in USA?

The key product types in canned foods in USA are canned fruits and vegetables, canned meat and seafood, canned ready meals and others.

Which type segment is expected to contribute significant share in the canned foods in USA in 2025?

In terms of type, organic segment is expected to command 54.0% share in the canned foods in USA in 2025.