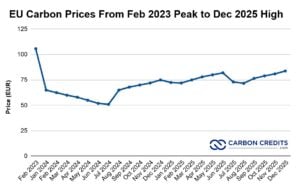

European carbon prices have risen notably in late 2025, reaching €83.79 per tonne on December 15, up 3% monthly and 30% year-over-year. The price of carbon permits in the EU’s main emissions trading system (EU ETS) recently hit multi-month highs. Companies are getting ready for compliance deadlines, and markets are responding to stricter policy signals.

EU carbon price benchmarks have been testing higher levels, reflecting increased market demand and confidence in the emissions cap tightening. This is lower than the record highs of over €100 per tonne seen in 2023. Still, the prices sent strong policy signals to cut greenhouse gas emissions.

The EU ETS sets a limit on emissions from sectors like power generation and heavy industry. Companies can trade allowances to meet their needs. As the cap is lowered over time, the number of available permits decreases, pushing prices up. This system encourages companies to reduce emissions in cost-effective ways and supports the EU’s climate goals.

In 2023, EU ETS auctioned allowances generated a record €783 billion, making it the world’s largest carbon market by turnover.

Higher carbon prices raise the cost of emitting greenhouse gases. This change can affect investment choices and operational practices. These price signals affect other EU climate policies.

One key policy is the Carbon Border Adjustment Mechanism (CBAM). Starting in 2026, CBAM will apply similar carbon costs to specific imported goods,requiring certificate purchases for 2026 imports starting in 2027.

CBAM aims to prevent “carbon leakage,” where production shifts to countries without strong carbon pricing, potentially undercutting emissions reductions in the EU.

Why EU Carbon Prices Are Rising Again

Several factors are driving the upward trend in EU carbon prices. Markets anticipate a tighter supply of carbon allowances as the EU strengthens its emissions caps.

Also, regulatory changes boost price momentum. This includes expanding covered sectors and strengthening the Market Stability Reserve, which absorbs excess allowances.

Research groups say average carbon prices may keep rising as we approach the decade’s end, based on current policies. BNEF forecasts ETS prices at €149 per tonne by 2030.

EU Climate Target: 90% Emissions Cut by 2040

The European Union has made a provisional political agreement on a new climate target for 2040. This comes alongside recent carbon market developments.

Lawmakers from the European Parliament and the Council agreed to reduce net greenhouse gas emissions. They set a binding goal of a 90% cut compared to 1990 levels. This target acts as an intermediate step toward the EU’s long-term aim of climate neutrality by 2050.

The agreed text includes certain flexibility mechanisms. Starting in 2036, member states can use high-quality international carbon credits. These credits can help meet up to 5% of the 2040 target. Yet, strict rules will ensure they support environmental goals. The agreement also confirms a one-year delay in applying the EU ETS to the buildings and road transport sectors.

The new target will guide future legislation and policy. It guides energy, industrial, and climate policy. It balances goals for cutting greenhouse gases with competitiveness and social fairness.

Key Elements of the 2040 Target Deal

The provisional agreement reflects several key decisions:

- A binding target to cut net greenhouse gas emissions by 90 percent by 2040 compared with 1990 levels.

- Flexibility options help member states meet the target. This includes using international carbon credits in a limited way.

- Enhanced provisions for domestic permanent carbon removals under the EU ETS.

- A reinforced mechanism for reviewing progress regularly and proposing adjustments where needed.

- A delayed start for ETS2, the system covering buildings and road transport, from 2027 to 2028.

These elements aim to guide the EU’s climate policy. They also recognize the economic and social challenges of reducing emissions significantly.

How Carbon Pricing Fits with the 2040 Target

Carbon pricing through the EU ETS remains central to achieving the bloc’s climate goals. The price of allowances directly influences the cost of emitting CO₂-equivalent greenhouse gases. As the emissions cap gets stricter, the EU ETS will cover more emissions and sectors. This will create greater incentives for reducing emissions.

Using international carbon credits in the 2040 framework shows how carbon market tools fit into long-term climate planning. Under the agreement, up to 5 percent of the total emissions cut for 2040 may come from high-quality international carbon credits. This approach gives member states more flexibility while maintaining a strong domestic reduction pathway.

Carbon pricing trends also interact with other EU measures. The CBAM adds carbon costs to some imported products. This pushes trading partners to adopt carbon pricing or emissions reduction policies that meet EU standards.

What Higher Carbon Prices Mean for Industry and Policy

A rising carbon price affects many aspects of the European economy. High-emission industries might face higher costs. This could push them to invest in cleaner technologies.

Meanwhile, policymakers aim to balance climate ambition with economic competitiveness and fairness. Flexibility mechanisms and phased implementation schedules help industries adapt. They also protect jobs and energy security.

The upcoming 2040 climate target will shape future rules, investment choices, and carbon pricing. It will also affect the EU ETS design and climate policies. Regular progress reviews will help the European Commission and member states check performance. They can also change policies if needed.

What Comes Next for EU Carbon Markets

The provisional agreement on a 90 percent emissions cut by 2040 represents a significant milestone in EU climate policy. It provides a long-term signal to markets, investors, and industries about the direction of the region’s climate ambition. At the same time, carbon prices rising to multi-month highs show how market mechanisms can support decarbonization goals.

These developments show how the EU blends regulatory goals with market tools. This mix aims for significant emissions cuts in the bloc. Continued policy implementation, periodic review, and alignment with international carbon market standards will shape how effectively these goals are met in the coming years.