Fenway Sports Group recently notched up 15 years at Liverpool, whose value has exploded since that fateful day in October 2010.

FSG planted their flag on Merseyside just before UEFA introduced Financial Fair Play, a few years after Roman Abramovich’s era-defining takeover of Chelsea, and in the midst of the American billionaire class’s love affair with English football. It was a seismic period which has shaped the game in 2025.

On the pitch, Liverpool have twice triumphed in the Premier League after a three-decade hoodoo, as well as reaching three Champions League finals (winning the second in 2019) and winning the FA Cup, three League Cups and one Club World Cup.

![]() Join our newsletter for news & smart analysis.

Join our newsletter for news & smart analysis.

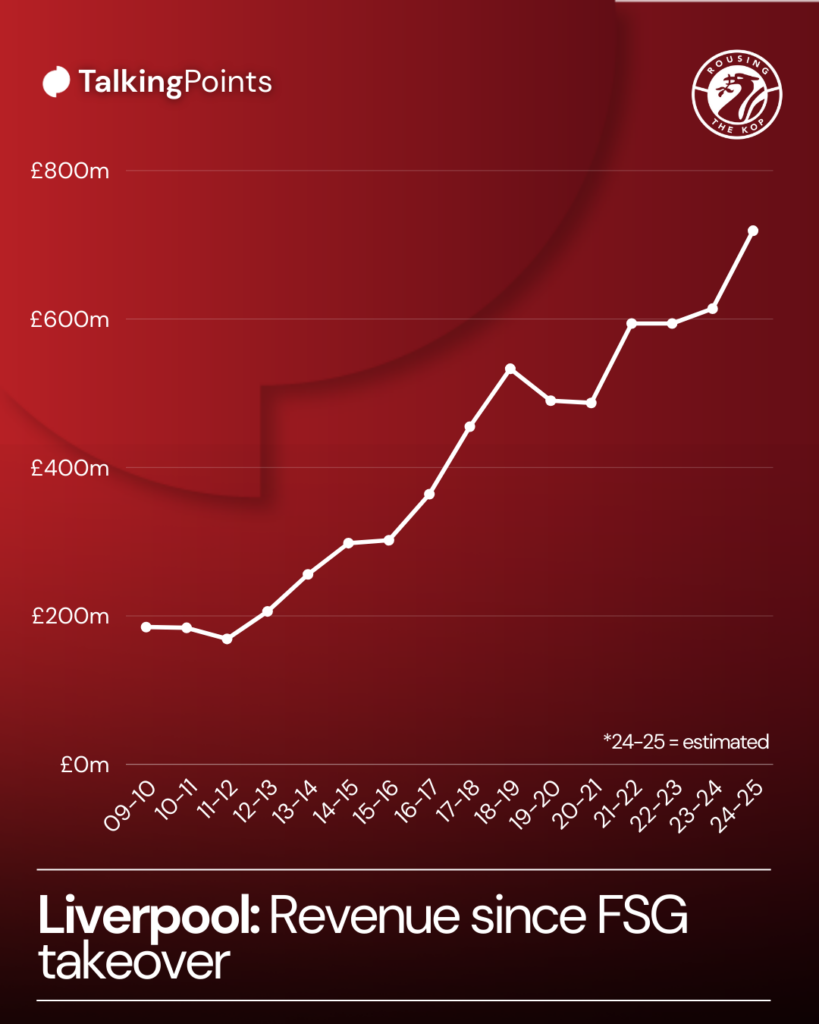

In that time, John Henry, Tom Werner, Mike Gordon and the rest of the 29-strong list of investors in FSG have put precisely no money into the football side of the club. Every penny the Reds have spent in the last 15 years, including the £450m fit that saw Alexander Isak, Hugo Ekitike and Florian Wirtz arrive over the summer, has come from their own matchday, commercial and media revenue streams.

Liverpool’s revenue is BOOMING! 🚀

Where do FSG rank among the best owners in football?

Credit: Adam Williams/GRV Media/Rousing The Kop

Credit: Adam Williams/GRV Media/Rousing The Kop

👇 Join the debate; share your insight. Use the comment button on the bottom left to have your say

Fenway have instead paid to transform the club’s infrastructure and invested countless thousands of man hours in monetising Liverpool’s intellectual property at home and, ever increasingly, abroad.

Aside from the approximately £130m they made from the sale of about three per cent of the club to the private capital firm Dynasty Equity in 2023, FSG are also yet to directly take any money from Liverpool.

The Dynasty Equity deal – whose proceeds were ultimately used to pay down bank debt at Anfield – valued the club at just shy of £4.5bn, which is an astonishing 1,400 per cent markup on the £300m or so they spent to acquire it from George Gillett and the late Tom Hicks a decade and a half ago.

So, looked at through an investors’ lens six time zones away at the owners’ headquarters in Boston, the 2010 takeover has been a wild, riotous success. However, there have been some unforgivable missteps on the way. Chiefly, the European Super League.

Photo by James Baylis – AMA/Getty Images

Photo by James Baylis – AMA/Getty Images

That plot in 2021 was co-authored by FSG and had been in the works for years. It wasn’t a momentary lapse, as some might have you believe, but rather a calculated gamble that backfired big-time. In the short term, at least. Ultimately, Fenway have got their way with the revised, more lucrative Champions League format.

The owners keep their cards close to their chest. Depending on the sources one asks, FSG’s decision to invite offers for the club in 2022 was either a direct response to them having to rewrite their entire business plan after the collapse of Super League, a covert way of stress-testing their valuation of the club, or a combination of both.

But as we approach 2026, are Liverpool’s owners any closer to an eventual exit?

Could Pittsburgh Penguins sale be roadmap for FSG’s potential Liverpool exit?

FSG have had their hands full in the second half of 2025.

Results have now stabilised somewhat and Arne Slot’s position appears a lot safer than it did a month ago, but it has been a pretty cataclysmic start to 2025-26 all told.

Elsewhere, FSG have also been navigating the complex sale of their NHL franchise, Pittsburgh Penguins.

Fenway bought the Penguins for $900m in 2021 and, today, it has been confirmed that they have sold them for about $1.7bn, or £1.3bn.

Tom Werner was clear about FSG’s vision from the start

If and when Fenway leave, who do you want to see take over?

Tom Werner TalkingPoints creative

Tom Werner TalkingPoints creative

Credit: Winslow Townson/Getty Images

👇 Join the debate; share your insight. Use the comment button on the bottom left to have your say

FSG were not particularly popular with fans of the Penguins, but the nearly 100 per cent markup in just a few years with relatively little external investment is seen as excellent business in the industry.

It’s a classic case of capital appreciation: buy low, increase asset value, sell high.

One day, will they do the same at Liverpool? Or is the ultimate aim to make them consistently and independently profitable enough that the dividends outweigh a potential multi-billion pound sale?

“Liverpool are a flagship brand for FSG but if a sovereign wealth fund comes in with a £10bn offer, they would snap your hand off,” says Kieran Maguire, football finance lecturer at University of Liverpool and well-connected host of the Price of Football podcast.

“However, it would have to be delusional money. They could get 12 times the purchase price now, but there is no indication that they are interested in that, after all.

Photo by Carl Recine/Getty Images

Photo by Carl Recine/Getty Images

“They are very, very smart operators. They are looking for the big leap forward in terms of revenue generation, which is going to come through something transformative. What that something is, we don’t know.

“Meta are espousing the virtues of their AI glasses, for example. There has been some suggestion about holographic stadiums that can take the product abroad. They are looking at all the benefits of these technologies, so why hand across the potential financial benefits to somebody else?

“They don’t need to make a profit. They are under no pressure themselves from a financial perspective, so I think they are happy to sit on the asset until that breakthrough moment arrives. On the back of that, they could potentially sell.

“There is no downside to continuing the current position. FSG continue to get all the plaudits of being ultra-smart owners, which increases the value of not just Liverpool but their other sports assets too.

“Cash-wise, they are strong. What are they going to do with the cash they get for Liverpool? Let’s say someone comes in and offers £8bn, which would probably get them thinking about a sale, you have to do something with it. There is no point just leaving it sitting in a bank.

“To a certain extent, value is being held up through a similar mechanism to what we’re seeing in crypto: people believe something big is set to happen. It’s a bit klondike-like.”

Join Our Newsletter

Receive a digest of our best Liverpool content each week direct to your mailbox