Millions of “current account coasters” are missing out on around £20billion in savings interest rate boosts, according to new research.

According to savings app Spring, the estimated 29 million Britons who leave surplus money in current accounts earning little to no interest.

It is estimated £20billion in interest is lost every year from £526billion sitting idle in current and savings accounts earning minimal returns.

The average current account balance, after bills and essentials, stands at £2,067 each month, Spring’s research highlights.

Savers are missing out billions of pounds in interest, new research claims

GETTY

Furthermore, around a third of consumers (34 per cent) consistently keep a current account balance of more than £5,000.

Younger age groups are most likely to leave money in current accounts, with 73 per cent of 18-24 year olds doing so compared to 57 per cent of 35-44 year olds.

Men (58 per cent) are slightly more likely than women (51 per cent) to leave money languishing in bank current accounts.

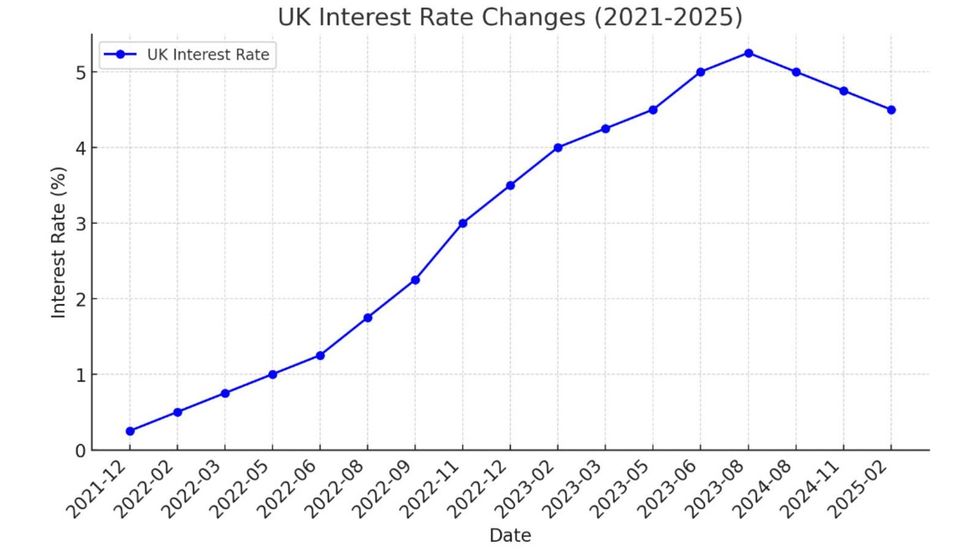

A new savings app called Spring launches today, offering an easy access account with a competitive 4.30 per cent AER interest rate with no restrictions.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Spring connects directly to existing current accounts in seconds, allowing users to move money effortlessly between accounts.

Unlike many high street savings options, Spring promises no hidden surprises, bonus rates, restrictions or fees. Spring uses Open Banking technology to connect to customers’ existing current accounts, enabling seamless transfers between accounts.

Users can withdraw money whenever they need it, with Spring offering genuine easy access to savings.

The app addresses common barriers between saving and spending, with research showing 23 per cent of people keep money in current accounts as a rainy-day fund.

Another 10 per cent simply haven’t got round to moving their money into higher-paying savings accounts. The average interest rate offered by the big five high street banks on pure easy access accounts stands at only 1.25 per cent.

Derek Sprawling, Spring Managing Director of Savings, said: “High street banks are offering little to no interest on savings while making it unnecessarily difficult to access better alternatives, resulting in the rise of ‘current account coasters’.”

LATEST DEVELOPMENTS:

“Spring combines easy access and competitive rates in an innovative app that seamlessly integrates with the customer’s existing current account transforming the UK’s relationship with saving, eliminating existing barriers between saving and spending.

“Unlike most high street easy access savings accounts, there are no hidden surprises with Spring – no bonus rates, restrictions or fees.

“You don’t need to move your current account; just enjoy a competitive rate, unlimited withdrawals and easy access to your money whenever you need it. Just download it, connect it and watch your money grow.”