The Best of My Own Advisor 2025

Hey Investors,

To start putting a wrap on 2025, I thought I would highlight some of my favourite posts and links to various articles: the Best of My Own Advisor 2025.

Enjoy the reading and let me know if you have a favourite below as well!

Before I share those best of posts and links from 2025, I want to share a sincere thank you to all of you, who follow along, subscribe to my newsletter, who make this site enjoyable to run some 16 years later…

This site continues to generate well over 1 million pageviews every year and 2025 was no exception.

I like your banter.

I appreciate when you respectfully disagree with me. I learn from that.

I thank you for your compliments.

I appreciate your words of inspiration and motivation.

I enjoy learning new things from you.

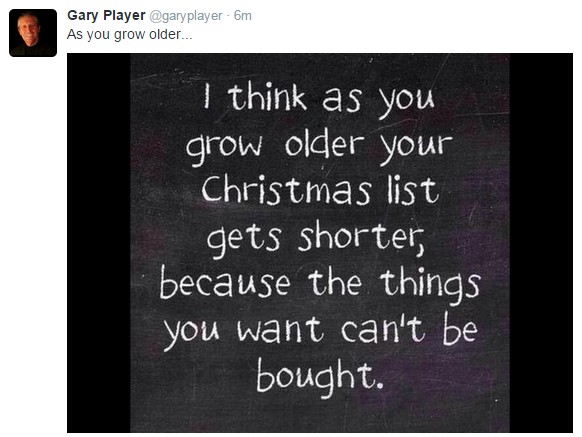

While I may get to a few blogposts between now and early 2026, the most important message to share at this time of year is this: a very Merry Christmas and Happy Holidays to you and your family.

This time of year always makes me think of this – how true:

The Best of My Own Advisor 2025

January:

I shared a few portfolio updates to start the year this past January – including how I ditched some U.S. stocks in favour of other assets including Canadian stocks.

I continue to have a heavy bias to stocks vs. bonds so I wondered if you really need bonds in retirement?

February:

I reviewed some financial predictions this month and reminded myself that they tend to get it wrong – often. Exhibit A:

March:

To put it mildly, I’m not a fan of the current U.S. administration and related antics so I wondered if I should change my investing approach.

April:

This month I shared some free calculators and tools to calculate your own retirement number.

I continue to support all DIY investors, with automatic discounts, if they need any help here.

May:

I updated our Financial Independence Budget this month and forecasted some spending needs for 2026.

June:

Do you have to choose between income investing and total return in your portfolio? Why not do a mix of both?

July:

Thanks to many reader questions over the last year or so, I decided to post How We Invest.

August:

I posted this free case study about a couple who had $1 million invested in their RRSPs – and what they could spend. A great start to retirement for them…

September:

In the fall I wondered what might be the right amount of cash to keep in our portfolio? Would 5% be too little? Would 10% be about right? Maybe 15%+ would be better?

There was also this suggestion to start retirement spending with a 2% retirement withdrawal rate. My goodness, just seems far too low to me…

October:

My wife retired from work in October 2025. I announced my intention to retire from work at the end of March 2026. In my preparations for retirement, I questionned the advice from Vanguard on moving towards a 30/70 portfolio mix. I won’t be doing that. You?

November:

Despite the markets roaring in 2025 year to date, I wondered if it made any sense to continue buying stocks even when markets are at all-time-highs. Turns out, it’s still a great idea – read on.

Weekend Reading – How to invest when the stock market is overvalued

December:

This month I posted my interview with DIY stock investor and author Henry Mah. He continues to believe income investing can work very well at any age to deliver cashflow for life.

Beyond The Best of My Own Advisor 2025

2026 could be an interesting year for many reasons – including how I/we navigate retirement and move from savers to spenders. Over 20 years ago, early retirement was just a dream. Well, time flies when you’re having fun. Retirement reality is going to set in very soon.

Did we save enough?

Will dividends and distributions cover most of our spending needs?

Will I/we ever work again?

I look forward to sharing what happens during another year of running this site – the journey that started with a dream earning cashflow from our portfolio to retire early in 2009 continues next year…

With thanks/attribution – The Behavior Gap.

I hope you get to realize some investing dreams in 2026 too.

A very Happy Holidays to you and your family.

Mark

My name is Mark Seed – the founder, editor and owner of My Own Advisor. As my own DIY financial advisor, I’ve reached financial independence. Now, I share my lessons learned for free on this site. Join the newsletter read by thousands every week.