United Kingdom Defence Market Outlook

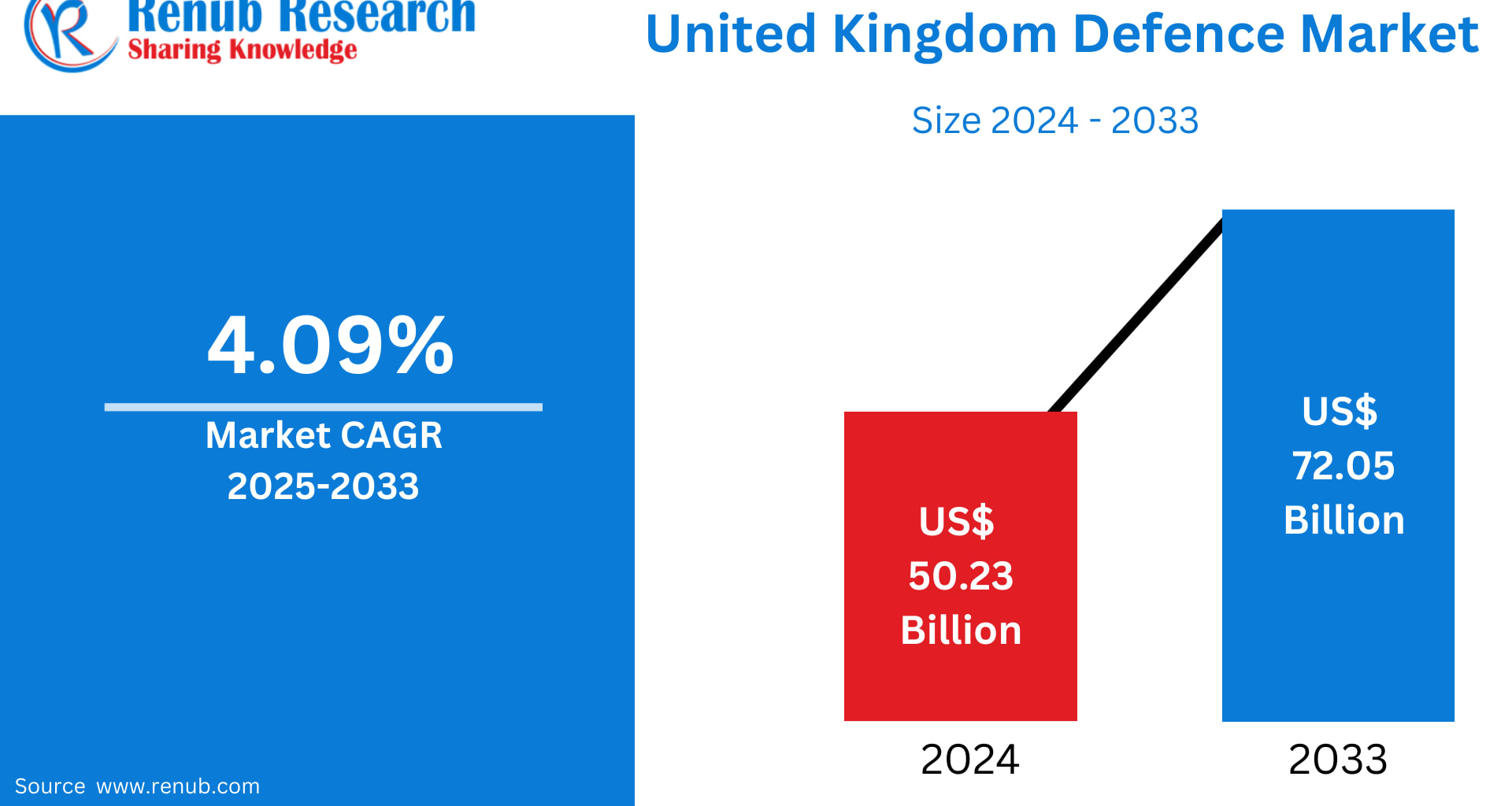

The United Kingdom Defence Market is poised for steady and strategic expansion over the coming decade. According to Renub Research, the market is expected to grow from US$ 50.23 billion in 2024 to US$ 72.05 billion by 2033, registering a CAGR of 4.09% during 2025–2033. This growth is underpinned by rising defence expenditure, accelerated modernization programs, rapid adoption of advanced technologies, and evolving global security challenges.

Public and political interest in defence policy has intensified amid geopolitical instability, cyber threats, and regional conflicts. At the same time, the defence sector remains a cornerstone of the UK economy, supporting high-skilled employment, innovation, exports, and industrial resilience.

Growth Drivers in the United Kingdom Defence Market

Growing Defence Budget and Modernization Initiatives

The UK government has made defence a strategic priority, steadily increasing allocations for military modernization. The Ministry of Defence reported defence spending of £55 billion in 2023/24 under its core definition. Broader NATO-aligned measurements place total defence-related expenditure at £64.5 billion in 2024.

Key modernization initiatives include:

Next-generation combat aircraft

Advanced naval vessels and submarines

Digital command-and-control systems

Cyber and space defence capabilities

These investments aim to enhance operational readiness, improve interoperability with allies, and ensure long-term technological superiority.

Increased Geopolitical Tensions and NATO Commitments

Rising geopolitical tensions—particularly Russia’s actions in Eastern Europe and growing security concerns in the Indo-Pacific—are reinforcing the UK’s defence posture. In 2024, the UK’s defence spending reached 2.3% of GDP, exceeding NATO’s 2% benchmark, with plans to increase this to 2.5% by 2030.

Between February 2022 and the end of 2024, the UK committed over US$ 9 billion in military aid to Ukraine, highlighting its central role in collective defence. The 2023–2033 Defence Equipment Plan earmarks approximately US$ 355 billion for equipment procurement and sustainment, with strong emphasis on cyber resilience, digital warfare, and next-generation platforms.

Technological Advancements and Defence Innovation

Innovation is at the heart of the UK defence market. Rapid integration of artificial intelligence, autonomous systems, robotics, advanced sensors, and cybersecurity solutions is reshaping military capabilities across land, sea, air, space, and cyber domains.

In 2024, the UK launched a landmark initiative to develop sovereign hypersonic strike capabilities, supported by over 90 industry and academic partners under the Hypersonic Technologies & Capability Development Framework (HTCDF), valued at more than US$ 1 billion. This initiative underscores the UK’s ambition to remain at the forefront of advanced military technologies.

Challenges in the United Kingdom Defence Market

Budget Constraints and Cost Overruns

Despite rising defence budgets, financial pressures remain a challenge. Large-scale procurement programs—such as submarines, aircraft carriers, and advanced aircraft—often face cost overruns and schedule delays. Balancing innovation, capability enhancement, and affordability continues to test defence planners.

Supply Chain Vulnerabilities and Technological Dependence

The UK defence industry relies on complex global supply chains, particularly for semiconductors, propulsion systems, and advanced electronics. Disruptions caused by geopolitical tensions or trade uncertainties can affect production timelines and costs. Reducing dependence on foreign technologies while maintaining efficiency is a growing strategic priority.

Segment Analysis of the United Kingdom Defence Market

United Kingdom Fixed-Wing Aircraft Market

The fixed-wing aircraft segment is driven by demand for advanced fighter jets, transport aircraft, and surveillance platforms. Flagship programs include the F-35 Lightning II fleet and the future Tempest combat air system. These aircraft are central to air superiority, intelligence gathering, and NATO operations.

The UK plans to invest heavily in aviation assets under its long-term equipment strategy. Defence spending in 2023 reached US$ 74.9 billion, marking a 15% increase year-on-year, with aviation receiving a significant share.

United Kingdom Naval Vessels Market

Naval power remains a cornerstone of UK defence strategy. Investments focus on:

Aircraft carriers

Advanced destroyers and frigates

Nuclear-powered submarines

High-profile programs such as the Dreadnought-class submarines and Type 26 frigates strengthen the Royal Navy’s global reach. Increasing focus on Indo-Pacific deployments further elevates the importance of sustained naval investment.United Kingdom Army Defence Market

The Army segment covers armored vehicles, artillery, battlefield communication systems, and soldier modernization. Programs such as the Challenger 3 main battle tank upgrade and AI-enabled surveillance systems highlight a shift toward networked, data-driven land warfare with enhanced mobility and protection.

United Kingdom Air Force Defence Market

The Royal Air Force (RAF) focuses on combat aircraft, missile systems, intelligence platforms, and unmanned aerial vehicles (UAVs). As of May 2024, 33 F-35B Lightning II aircraft were operational, with plans to expand the fleet to 74 units. These jets significantly enhance carrier strike capabilities and reinforce the UK’s role in joint operations with allies.

Regional Insights into the United Kingdom Defence Market

London Defence Market

London serves as the administrative and strategic heart of the UK defence ecosystem. It hosts major government departments, defence headquarters, corporate offices, and research institutions. Policy formulation, procurement decisions, and international defence collaborations are largely coordinated from the capital.

Scotland Defence Market

Scotland plays a vital role in naval shipbuilding, submarine operations, and air defence. Shipyards along the River Clyde construct advanced vessels such as the Type 26 frigates, while strategically located bases support North Atlantic surveillance and deterrence missions.

East of England Defence Market

The East of England is a major aerospace and air force hub, home to key RAF bases and defence electronics suppliers. The region’s strong industrial-academic collaboration supports innovation in avionics, radar systems, and aerospace engineering.

South West United Kingdom Defence Market

The South West is renowned for its naval and aerospace heritage. Devonport Dockyard in Plymouth, the largest naval base in Western Europe, anchors the region’s defence economy. The area also hosts advanced research, training, and maintenance facilities critical to maritime and aviation operations.

Market Segmentation Overview

By Type

Fixed-Wing Aircraft

Rotorcraft

Ground Vehicles

Naval Vessels

C4ISR

Weapons & Ammunition

Protection & Training Equipment

Unmanned Systems

By Armed Forces

Army

Navy

Air Force

By Region

London

South East

North West

East of England

South West

Scotland

West Midlands

Yorkshire and the Humber

East Midlands

Others

Competitive Landscape and Key Players

The UK defence market is highly competitive and innovation-driven. Major players operate across aerospace, naval systems, land platforms, electronics, and advanced weapons.

Key Companies Profiled

BAE Systems plc

Lockheed Martin Corporation

RTX Corporation

Airbus SE

Babcock International Group PLC

MBDA

QinetiQ Group plc

Cobham Ultra SeniorCo S.à r.l.

Northrop Grumman Corporation

The Boeing Company

Each company is analyzed across five viewpoints: overview, key personnel, recent developments, SWOT analysis, and revenue performance.

Final Thoughts

The United Kingdom Defence Market stands at a critical juncture, shaped by strategic investment, technological transformation, and global security imperatives. With defence spending projected to reach US$ 72.05 billion by 2033, the UK is reinforcing its role as a leading military power and trusted NATO ally.

While challenges such as cost pressures and supply chain vulnerabilities persist, sustained innovation, strong industrial capabilities, and long-term policy commitment position the UK defence sector for resilient growth. For investors, policymakers, and industry stakeholders, the coming decade offers significant opportunities as the UK adapts its defence architecture to an increasingly complex world.