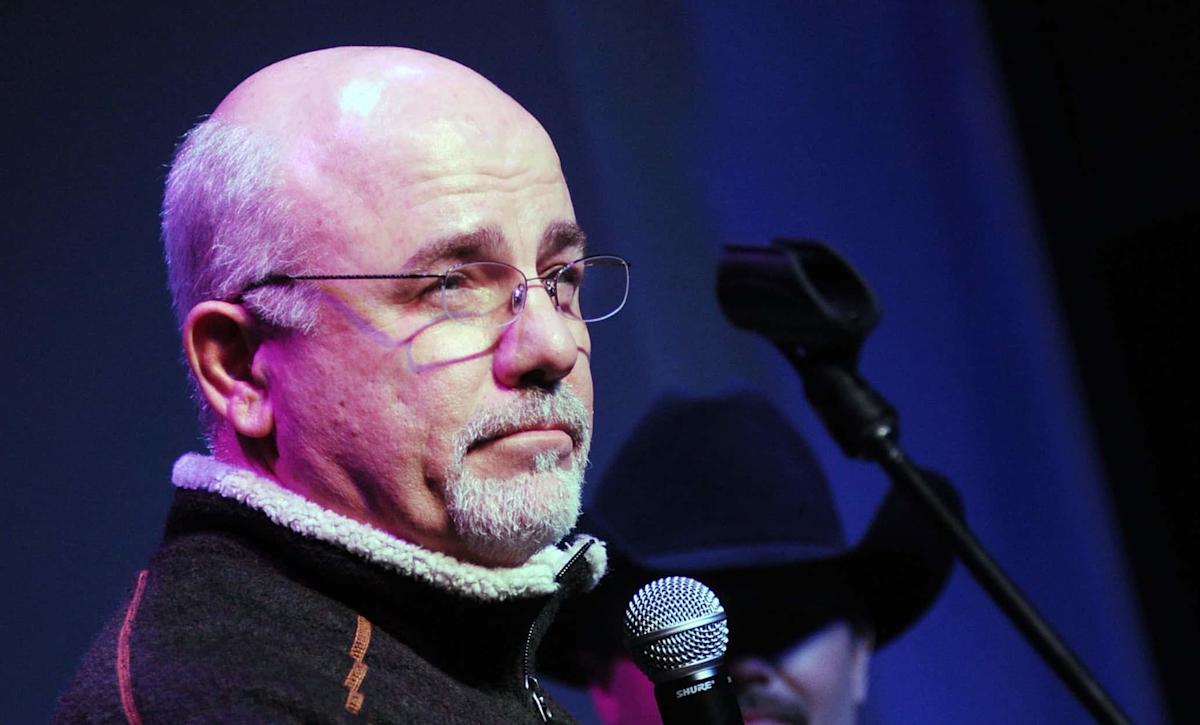

Rick Diamond/Getty Images)

-

Many people already believe that Dave Ramsey’s 8% rule is an excellent plan for retirement.

-

The challenge is that Dave’s rule leaves almost no room for error when it comes to investing heavily in the stock market.

-

Instead of depending on an 8% annual withdrawal rate in retirement, consider exploring other, more sustainable strategies.

-

A recent study identified one single habit that doubled Americans’ retirement savings and moved retirement from dream, to reality. Read more here.

If you’re a fan of personal finance guru Dave Ramsey, it shouldn’t surprise you that there are some differing opinions from other financial personalities. On the one hand, you want advice from people like Suze Orman, Jim Cramer and the like to help you understand all of the different roads that are open to you for investing, saving, budgeting and more.

On the other hand, if you solely want to live in the Ramsey world, that’s fine — millions of people look to Ramsey for advice on how to retire early and retire well. That said, Dave’s 8% retirement rule is definitely a controversial one, as it advocates taking a big risk and hoping for even bigger returns.

A highly controversial strategy, the 8% rule can be summed up as Ramsey recommending that retirees allocate 100% of their assets to equities. From there, these soon-to-be-retirees or retirees would then withdraw 8% per year of the portfolio’s starting value, with each year’s withdrawal adjusted based on inflation.

Dave’s advice is based on the idea that the market should see an average annual return of around 12%, which is great news if you are 100% invested. That being said, there is no question that the rule is heavily dependent on the market achieving double-digit returns every year, regardless of the actual likelihood in any given year. That’s not even mentioning that the strategy is risk-on, meaning there’s little-to-no balance and safety between equities and fixed income (e.g., debt securities like CDs, Treasurys, municipal or corporate bonds).

Let’s say that in your first year of retirement, you have a portfolio that’s 100% invested in equities with of principal of $500,000. If you pull out money based on the 8% rule, you would start with $40,000. Now, if you factor in 3% inflation, you are moving to pull $41,200 in year two, $42,436 in year three, etc., with the hope that you are earning more than you are spending.

Photo by Anna Webber/Getty Images for SiriusXM

This advice has been hotly debated in recent years due to its reliance on double-digit returns, especially if the market declines early in retirement, as retirees withdraw funds. In such cases, there is less money available for growth, and it takes longer to recover the lost funds. This is known as a sequence risk, and it could cripple your ability to live out Ramsey’s rule even if you see larger averages down the road.

Story Continues

Separately, conventional thinking suggests that the 4% rule, which isn’t without its detractors, is more reliable — based on academic research — to lead to greater portfolio success over a 30-year retirement period. On the plus side, you have the S&P 500, which has returned an average of 12% to 14% annually over the last 10 years, including reinvested dividends. This lends some merit to Ramsey’s argument, but it overlooks the possibility that the market could quickly turn and the country could enter a potential recession, which would immediately harm anyone trying to adhere to the 8% schedule.

Let’s not forget that inflation also plays a role here and cannot be ignored. This means that 8% leaves very little room for error as far as your investing strategy.

If I had the opportunity to sit down with any one of Ramsey’s followers and discuss this, the first thing I want to mention is that the 8% rule is too aggressive. I’ll say this with complete confidence, even as you can find plenty of supporting evidence that the market returns between 10% and 12% annually, especially based on S&P returns.

The issue is that this doesn’t account for inflation, which means that, based on current inflation rates, the real return is more likely to be between 7% and 9%. It’s for this reason that I would amplify the message that 8% leaves someone almost no room for error if they want to adhere to this strategy. I would also like to point out that once you factor in inflation, taxes, and fees, before you even consider market volatility, it becomes clear why you might earn closer to 6% on average in the end.

If someone asked me point-blank if the 8% rule can work, here’s how I would respond. Yes, in some cases, albeit rare ones, the 8% rule can work, and it’s even more true if you are talking to someone with a shorter spending horizon, likely someone who retired later in their 70s.

Alternatively, if you have someone who has Social Security and or a pension plus the money they are withdrawing from investments, the 8% rule can work with the additional income flow. However, I would urge caution here, especially if you hope to have a 25–30 year retirement window. There is no way around saying it, but the math isn’t guaranteed to work and likely won’t for just about everyone.

Alternatively, I might want someone to look at different strategies, such as adjusting their withdrawals up or down based on market performance, so they are living somewhere inside the 4% and 8% window. Another option I would strongly recommend for most people is to secure all your essentials with guaranteed income sources, such as a pension or annuity, and then utilize the market for extras like travel and entertainment.

At the end of the day, my big takeaway for everyone is that the 8% rule sounds excellent on paper, but in practice, it’s hard to guarantee success. The last thing anyone wants is to run out of money when they need it the most, so sticking to this rule for now might be the best option.

Of course, the absolute best move is to talk to a fiduciary financial advisor who can give you both qualified and expert advice on how to build a portfolio that works for your needs.

Most Americans drastically underestimate how much they need to retire and overestimate how prepared they are. But data shows that people with one habit have more than double the savings of those who don’t.

And no, it’s got nothing to do with increasing your income, savings, clipping coupons, or even cutting back on your lifestyle. It’s much more straightforward (and powerful) than any of that. Frankly, it’s shocking more people don’t adopt the habit given how easy it is.