China is facing a shortfall in its oil supplies following Donald Trump’s military strikes on Venezuela and the capture and removal of the oil-rich nation’s president and his wife.

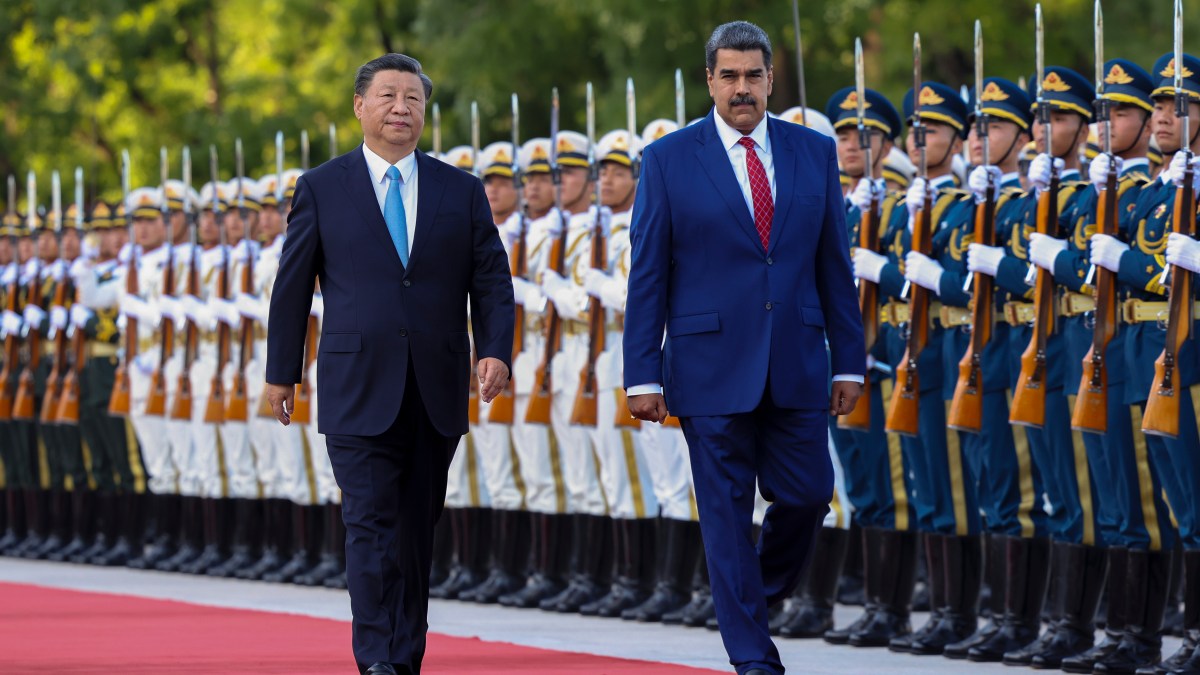

America’s intervention follows months of tension with president Nicolas Maduro over allegations of drug trafficking. But the attack still took the country by surprise and analysts will now be tracking the implication on oil prices.

Although Venezuela has the world’s largest proven oil reserves, its ability to sell oil has been restricted by US sanctions in place since 2019. However, the restrictions do not apply to China, which has become a major importer of oil from the Latin American country. Beijing relies on Venezuela for about 4 per cent of its total supply.

Venezuelan imports to China had already started to become restricted before Christmas when America seized tankers, which it argued were transporting sanctioned oil. But the weekend invention by Trump will further restrict supply.

• Maduro captured after US strikes — follow the latest developments live

Simon French, chief economist at Panmure Liberum, said that while the impact on global oil supplies and prices would be limited, China, the world’s second-biggest consumer of oil after the US, would have to look for alternative supplies.

“China buys oil from Venezuela. So how might they choose to secure that supply?” said French.

Oil prices fell 20 per cent in 2025 as a result of a glut of supply from Opec producing countries and the subdued price is being credited with expectations for a fall in global inflation this year.

Jordan Rochester, head of fixed income strategy at Japanese bank Mizuho, said that if there is a regime change in Venezuela, in the longer-term there could be an increase in global supply of oil if sanctions are lifted. In the meantime, he expected a “short-term impact spike in volatility in oil on Monday”.

An oil tanker last month at the El Palito refinery in Puerto Cabello, Venezuela

JESUS VARGAS/GETTY IMAGES

The markets will also be looking for broader implications from Trump’s intervention in Venezuela. Questions may now arise about whether America would be prepared to back the uprisings taking place in Iran, French said.

• Irwin Stelzer: Why Trump is toasting the fall of the dollar

Investors did not rule out a risk that markets could be unsettled by fresh geopolitical turmoil at a time where there is a debate about whether stock markets are facing a bubble from investment in AI.

Neil Birrell, chief investment officer at fund manager Premier Miton, said: “Markets overall are fragile. Valuations are high, there’s plenty of talk about bubbles bursting and something else that comes along and creates uncertainty makes that fragility even more of an issue”.

The FTSE 100 hit 10,000 for the first time on Friday, the first trading day of 2026, after the biggest gains last year since the aftermath of the banking crisis.