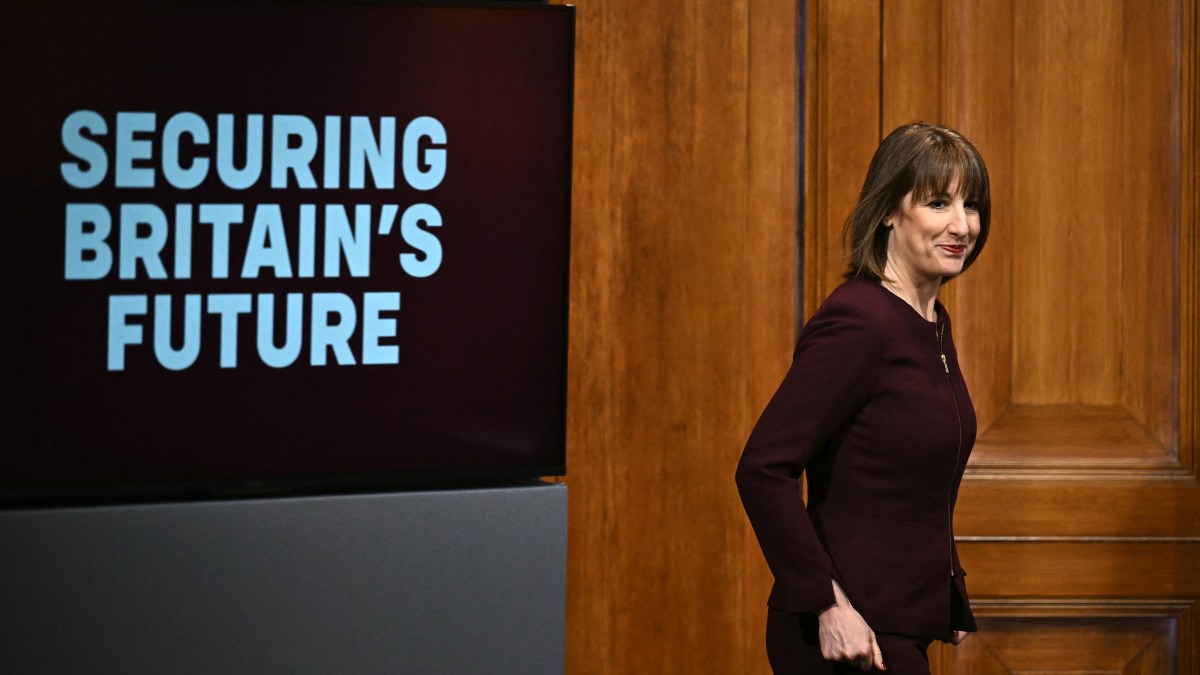

UK unemployment may climb to an eleven-year high in 2026 amid a “moribund” economy that will require at least two interest rate cuts to stimulate growth and offset Rachel Reeves’s tax increases.

That is the bleak assessment of 48 leading economists questioned by The Times for its annual Economists Survey, who predicted that growth would remain lacklustre and heavily reliant on government spending despite further reductions to borrowing costs by the Bank of England.

Amid a labour market that has been damaged by the chancellor’s £25 billion payroll tax raid and sluggish consumer spending since the pandemic, 67 per cent of the economists surveyed said that unemployment would end 2026 at between 5 per cent and 5.5 per cent.

If the jobless rate were to reach the upper bound of that forecast, it would exceed any level seen during the Covid-19 crisis and hit its steepest rate since 2015. Fifteen per cent predicted it could jump to between 5.5 per cent and 6 per cent, up from its actual present level of 5.1 per cent, already the highest in nearly five years.

Fhaheen Khan, senior economist at Make UK, said: “Businesses have been flanked with higher employment costs from multiple directions, from higher national insurance contributions to higher minimum wages, alongside the cost of preparing for more indirect employment costs arising from the Employment Rights Bill.”

Nina Skero, chief executive of the Centre for Economics and Business Research, said: “Hiring will continue to be suppressed by the dismal growth outlook, the recently increased employer-paid taxes, and, in some sectors, by the now exceptionally high minimum wage.”

A majority of 58 per cent of economists said that UK GDP growth would be between 1 per cent and 2 per cent in 2026, broadly in line with last year’s figure, but only kept afloat by additional government investment and spending announced by the chancellor in her first two budgets.

Rate cuts by the Bank of England will also assist economic activity and offset a tightening of fiscal policy, respondents said. The bulk of the £26 billion of tax increases announced by Reeves in the November budget will not kick in for several years.

“The public sector is likely to do more heavy lifting than we saw in the 2010s, through government spending and investment,” Alpesh Paleja, deputy chief economist at the CBI, said.

Paul Dales, chief UK economist at Capital Economics, said that 80 per cent of growth in 2026 will come from the public sector while “private sector activity will be weak”.

“Our moribund economic performance will continue,” Jagjit Chadha, professor of economics at the University of Cambridge, said.

More than eight in ten of the economists surveyed predicted that the Bank will lower interest rates at least twice in 2026, with one forecasting that rates could drop to as low as 2.5 per cent from 3.75 per cent presently. Just one economist said that the central bank would increase rates once by 0.25 percentage points, which would be the first rise since 2023.

“Concerns at the Bank of England about the upside risks to inflation look overblown,” James Smith, developed markets economist at ING, said, adding that rates would fall twice in 2026.

• UK unemployment rate rises to 5.1%

However, Dario Perkins, managing director of global macro at TS Lombard, said that “growth can beat the consensus” if the Bank of England winds up cutting interest rates faster than expected. Rates were lowered four times last year and twice in 2024 from a peak of 5.25 per cent.

Nearly three quarters of respondents said that UK inflation would be at or within striking distance of the Bank’s 2 per cent by the end of this year, dragged down from its present level of 3.2 per cent by lower household energy bills and slower wage growth amid a weakened labour market.

Respondents were broadly optimistic over the prospects for the global economy this year, with 56 per cent forecasting growth of between 2 per cent and 3 per cent, and 42 per cent expecting growth of between 3 per cent and 4 per cent.

Three quarters believed that the US economy will expand by at least 2 per cent this year, while a majority of 65 per cent of economists predicted that China would fall short of its annual 5 per cent growth target in 2026. The eurozone was predicted to expand at a similar pace to the UK economy.