Gambling

is big business in the land of the free and the home of the brave.

Even

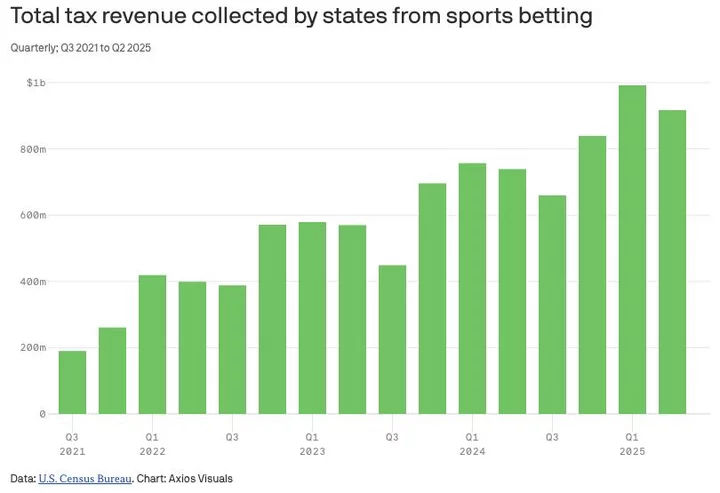

the government is reaping growing revenues from gambling.

According

to the U.S. Census Bureau, sports betting tax revenue was near $200

million midway through 2021. Four years later it’s around $1

billion.1

Consequently,

it’s not just sports betting that is on the rise. You can now put

money on politics, policies, and cultural moments like who will win

Best Picture or how many times Elon Musk will tweet via Polymarket.

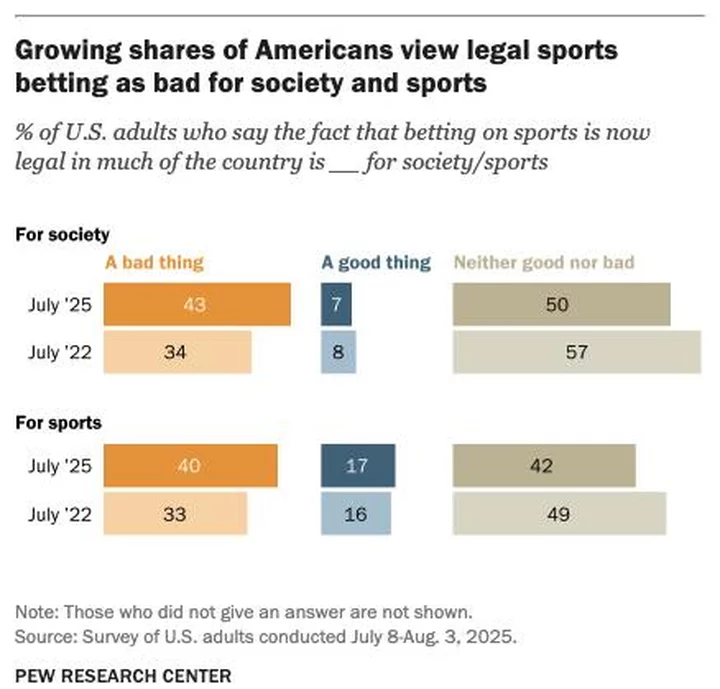

All

this legal wagering is becoming a problem for some. Though not all

gamblers are addicts, some are enslaved to it. The National Problem

Gambling Helpline has spiked in comparison to where it was just a few

years ago2, and more and more Americans view it as a

growing problem and bad for society.3

Economist

Kyla Scanlon believes that gambling is not simply something that

people do at casinos or on phone apps. The entire economy is now a

casino. She identifies “gambling throughout the economy — in

markets, policy and how we talk about the future”.4 She

points to things like cryptocurrency, memecoins, tariff political

theatre, and big bets by tech companies on AI to justify her claim.

I

don’t think it’s just the thrill gambling offers the consumer and

the increasing ways to scratch that itch that are contributing to the

effect of widespread betting on a society. It may also be driven by a

seductive neurotransmitter: dopamine.

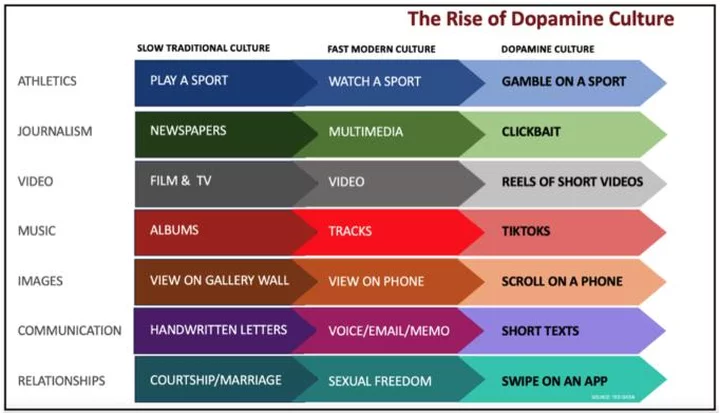

Let’s

be honest, even if you aren’t high on gambling, you may be drunk on

dopamine.

One

writer, who served on the faculty of Stanford, compares the

differences between slow traditional culture, fast modern culture,

and dopamine culture — of which gambling is a part — along with

their impacts on anything from athletics to relationships.5

As a

financial advisor and one who spends time thinking and talking to

people about their finances and how to build wealth, I could add a

whole row on this kind of culture’s impact on investing:

-

SLOW TRADITIONAL CULTURE: Read about financial markets in a newspaper

the day after the news happened or watch it on the 6 o’clock news. -

MODERN CULTURE: Watch it 24/7 on CNBC from market experts and call

your stockbroker. -

DOPAMINE CULTURE: Watch it, read it, click it, swipe it from a

TikTok, Instagram Reel, Facebook post, or YouTube video from people

creating financial media who might have an MBA from a reputable

university or who might live in their mom’s basement straight out

of high school. A constant stream of amateurs and experts on finance

from any algorithm that fits your political, religious, and cultural

tastes is at your fingertips. Pull up your trading app that lets you

buy/sell at the push of a screen or swipe of a finger, as if you are

playing a video game.

Dopamine

investors make financial decisions based on the immediate present. An

investment decision about your financial future is reduced to a

swipe. Don’t think first and act later. Feel first and act

immediately.

In

the investing world, day-traders get this chemical rush often. One

writer for Morningstar, a global investment research firm, put

it this way:

On a neurochemical level gambling, day trading and speculation are

not very different. Behavioural economist Sarah Newcomb says “there

are certainly legitimate reasons for the occasional trade. Some

trading is the result of long-term planning and the execution of a

solid strategy. However, repeated studies, including Morningstar’s

annual Mind the Gap report, demonstrate that investors who actively

trade tend to underperform the market.”6

Long-term

investors, on the other hand, will need durability over dopamine.

They have more in common with gardening than gambling.

Resilience

and durability are something that our culture could use a bit more

of.

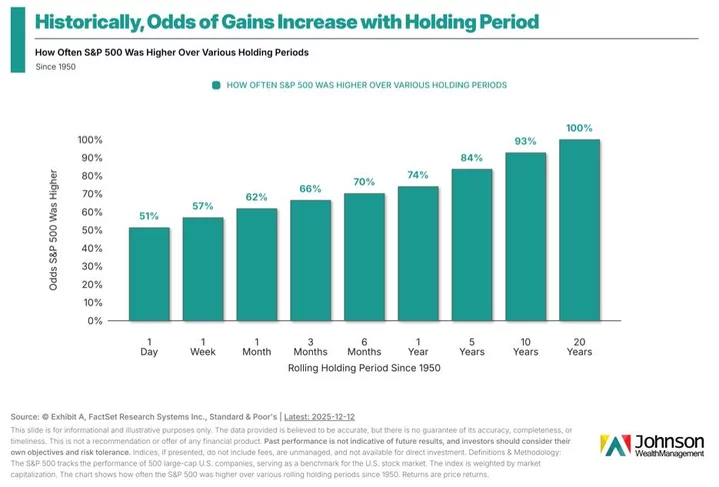

I’m

not naive. I know that investing in the stock market has often been

compared to gambling.

That

critique is not always valid, though.

While

investing in the stock market for a day compares to a coin flip,

investing in it for decades increases to high probabilities of

success. In fact, the S&P 500 (America’s largest publicly

traded companies) has been 100% positive across every 20-year period

since 1950.

This

is not to say that investors will not experience large drawdowns.

They most certainly will.

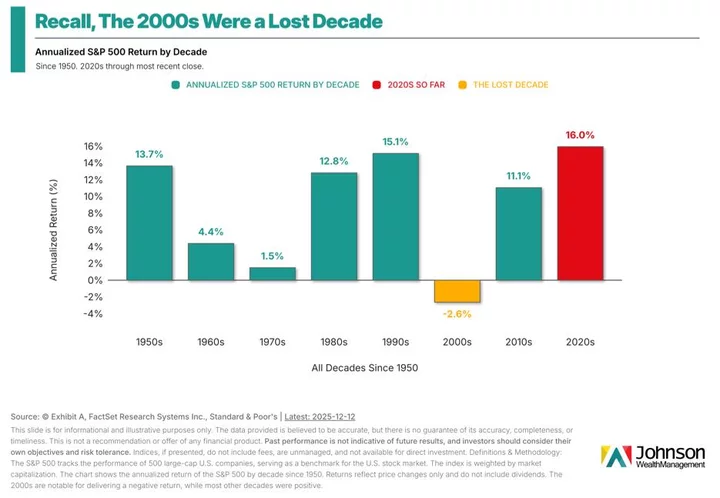

Investors

in the 2000s lost an entire decade.

Durability

matters.

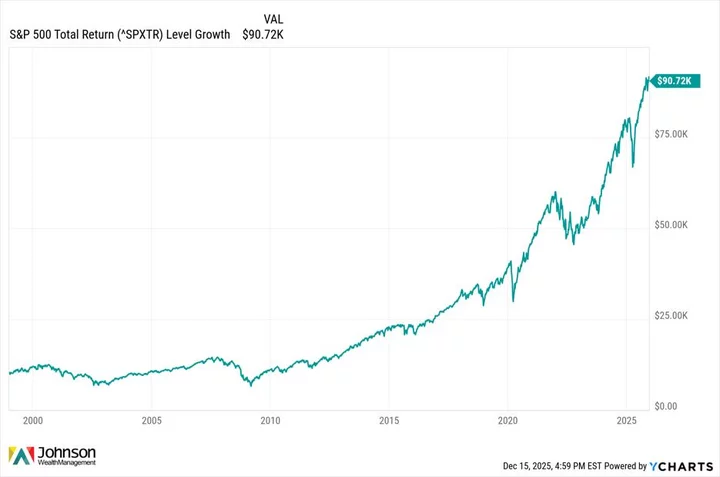

If

you had put $10,000 at the beginning in 1999 in the S&P 500 index

— enduring events like the tech bubble popping to 9/11 to the

Financial Crisis to the COVID crisis — that would have increased

nearly ninefold, totaling around $90,000.

How

do you become a durable investor in a dopamine culture?

You

may want to consider fasting.

Dr.

Anna Lembke, author of Dopamine Nation: Finding Balance in

the Age of Indulgence, gave an interview where she described what

this kind of fast looks like:

The intervention is basically, very simplified, and threefold.

1. Abstaining for a period of time from our drug of choice.

2. Learning to sit with discomfort, which is, of course, something

that many different traditions teach.

3. Intentionally doing things that are painful: things that are

physically hard and mentally hard.7

Nothing

sells nowadays like abstinence, discomfort, and hard things.

But

durable investors will need to abstain from the constant

drama coming through their devices. They need to learn to sit with

the discomfort of portfolio drawdowns and the constant hum of

negative what-if scenarios from financial media. They will need to do

hard things like cutting back on spending, paying off debt, adding to

savings, and investing based on their future desires, not only

their present ones.

Durability

may not be pleasurable in the moment. It may force you to say “No”

to reactive, impulse-driven investment decisions, but it just might

lead to long-term rewards.

Invest

like a gardener who is focused on a harvest that comes through all

kinds of seasons, not a gambler trying to get rich quick.

You

might get “lucky” gambling, but it won’t make you wise.

###

Sources:

1.

Chart from Axios article “The

high cost of the U.S. sports betting boom” published

by Erica Pandey on December 14, 2025.

2.

See Axios article above.

3.

Chart taken from Pew

Research Center published on October 2, 2025.

4.

NY Times, “It

is Trump’s Casino Economy Now. You’ll Probably Lose.”

Published on October 16, 2025.

5.

Ted Gioia, “The

State of the Culture, 2024” published February 18,

2024.

6.

Jessica Bebel, “Dopamine

Rushes: is Day Trading as Addictive as Gambling?”

published November 23, 2023.

7.

Mary Beth Maslowski interview with Dr. Anna Lembke on Psychiatry

Advisor on February 24, 2023: “Interview

with the Author of *Dopamine Nation: Finding Balance in the Age of

Indulgence”.

# # #

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.