Representational image. Credit: Canva

Representational image. Credit: Canva

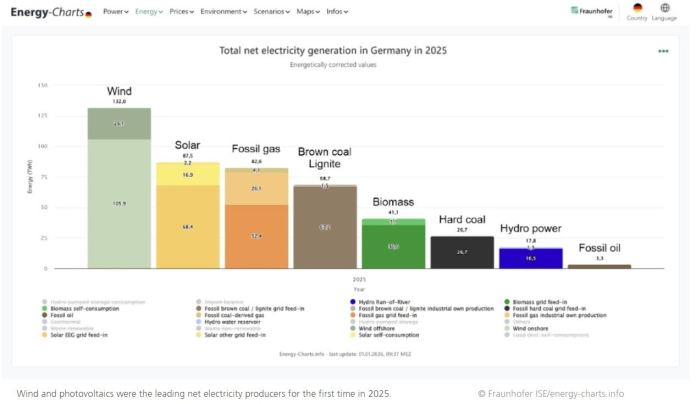

Solar power emerged as one of the biggest highlights of Germany’s electricity sector in 2025, marking a historic shift in the country’s public power generation mix. For the first time, solar power overtook lignite and became the second-largest source of net public electricity generation, closely following wind power. Overall, renewable energy maintained a strong position, contributing 55.9 percent of Germany’s net public electricity generation, the same share as in 2024, according to data from the energy-charts.info platform of the Fraunhofer Institute for Solar Energy Systems ISE.

In 2025, photovoltaic systems generated around 87 terawatt hours (TWh) of electricity. Of this, about 71 TWh was supplied to the public grid, while a significant 16.9 TWh was directly consumed by producers themselves. Compared to the previous year, solar power generation increased by roughly 15 TWh, or 21 percent. This strong growth pushed photovoltaics ahead of lignite for the first time. By the end of the year, Germany’s installed solar capacity reached 116.8 gigawatts (GW) in DC terms, with around 16.2 GWDC added during the year. However, to stay on track with targets for 2026, annual solar installations will need to rise further to around 22 GW.

Wind power remained Germany’s largest net electricity producer in 2025, even though overall generation declined slightly. Total wind power production reached 132 TWh, around 3.2 percent lower than in 2024 due to weaker wind conditions. Onshore wind contributed about 106 TWh, while offshore wind added around 26.1 TWh. During the year, Germany installed 4.5 GW of new onshore wind capacity and only 0.29 GW offshore. As a result, total installed wind capacity reached 68.1 GW, well below the planned 76.5 GW target for 2025, highlighting continued challenges in wind expansion.

Beyond wind and solar, other renewable sources showed mixed performance. Biomass power generation increased to around 41.1 TWh, up from 37 TWh in 2024, with most of this electricity fed into the grid. Hydropower generation dropped sharply to 17.8 TWh from 22.3 TWh the previous year. This decline was linked to much lower rainfall, with precipitation levels in Germany falling 27 percent compared to 2024 and remaining well below the long-term average.

Altogether, renewable sources, including solar, wind, water, biomass, and geothermal energy, produced about 278 TWh of electricity in 2025. Of this total, 256 TWh was fed into the public grid, and 22 TWh was consumed internally. While renewable generation increased by around 6 TWh year-on-year, it still fell far short of the official target of 346 TWh for 2025. The main reason for this gap was the slower-than-planned expansion of wind power, particularly onshore wind, which has a larger impact on total electricity output due to higher full-load hours. High levels of solar self-consumption and more grid-friendly but lower-yield system orientations also played a role.

Battery storage saw especially rapid growth during the year. Large fluctuations in electricity prices made batteries more attractive, while falling battery costs, driven by scaling in the mobility sector, supported new investments. The capacity of large-scale battery storage systems increased by 60 percent, from 2.3 GWh to 3.7 GWh in 2025. In total, Germany now has just under 25 GWh of installed battery storage capacity, with nearly 20 GWh coming from home storage systems. According to Fraunhofer ISE, Germany could require between 100 and 170 GWh of battery storage by 2030.

Fossil fuel-based electricity generation remained broadly stable. Lignite-based net electricity generation fell by 3.9 TWh to 67.2 TWh, reaching levels last seen in 1961. Hard coal generation rose slightly to 26.7 TWh, while natural gas plants increased output, producing 52.4 TWh for public supply and 26.1 TWh for industrial self-consumption. This rise in gas generation helped offset declines in lignite.

Carbon dioxide emissions from Germany’s electricity generation were estimated at 160 million tonnes in 2025, the same as in 2024 and 58 percent lower than in 1990. Electricity imports declined, with Germany importing 76.2 TWh and exporting 54.3 TWh, resulting in a net import surplus of 21.9 TWh, lower than the previous year. Meanwhile, electricity prices on the exchange rose, with average day-ahead prices increasing to €86.55 per MWh, reflecting tighter market conditions despite the growing role of renewables.

Like this:

Like Loading…

Related

Discover more from SolarQuarter

Subscribe to get the latest posts sent to your email.