Europe Costume Jewelry Market Size

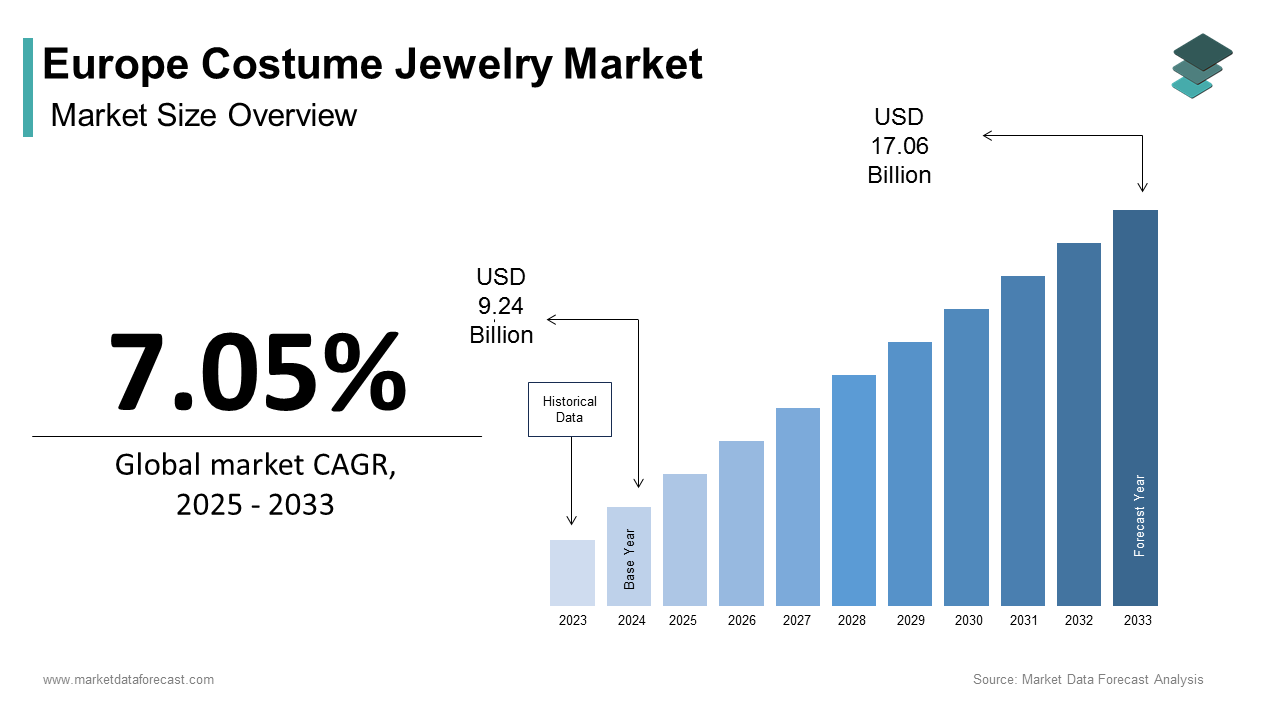

The Europe costume jewelry market size was calculated to be USD 9.24 billion in 2024 and is anticipated to be worth USD 17.06 billion by 2033, growing from USD 9.89 billion in 2025 at a CAGR of 7.05% during the forecast period.

Costume jewelry is non-precious wearable accessories crafted from base metals, alloys, synthetic stones, glass, and recycled materials designed for fashion expression rather than intrinsic material value. This segment occupies a distinct cultural and commercial space where rapid style cycles, sustainability consciousness, and affordability converge. As per the European Environment Agency, the textile and accessory sector generates over 16 million tons of waste yearly, prompting heightened scrutiny of material sourcing anend-of-lifefe management. The European Commission’s Circular Economy Action Plan now explicitly includes fashion accessories under extended producer responsibility schemes, requiring brands to disclose the material composition and recyclability of their products. In this context, costume jewelry is evolving from a transient fashion accessory into a design category increasingly evaluated on ethical production transparency and circular potential, which is reflecting broader European consumer values around conscious consumption and aesthetic democratization.

MARKET DRIVERS Rise of Social Media-Driven Micro Trends Accelerates Purchase Cycles

The pervasive influence of Instagram, TikTok, and Pinterest is compressing fashion cycles and amplifying trend virality, which is driving the growth of Europe costume jewelry market. Short-form video content and influencer styling showcase new pieces daily, creating immediate desire and fear of missing out among digitally native consumers. According to the European Youth Observatory, over 74% of European women aged 16 to 29 discover new jewelry styles through social media, with 58% purchasing within 48 hours of seeing a viral post. Fast fashion retailers like H&M and Primark now integrate real-time social listening into their design workflows, launching limited edition capsule collections every three to four weeks to capitalize on these micro trends.

Growing Demand for AffordableSelf-Expressionn Among Young Consumers

The identity exploration and personal styling, which prioritize experiential and expressive consumption over asset accumulation is additionally expelling the growth of Europe costume jewelry market. According to a 2023 Eurobarometer survey, 81% of Europeans aged 18 to 30 view fashion accessories as essential tools for communicating individuality values and subcultural affiliation. With average monthly disposable income for this cohort ranging between 200 and 400 euros in most EU countries, as per Eurostat, costume jewelry offers high visual impact at low financial risk by enabling frequent style rotation without significant expenditure. In Spain and Poland, where youth unemployment remains above 25%, costume jewelry provides accessible luxury that satisfies aesthetic desire without economic strain. Brands like & Other Stories and ASOS report that their highest engagement rates come from jewelry collections priced between 12 and 28 euros, which align with weekly discretionary spending thresholds identified by the European Consumer Organisation. This democratization of adornment ensures sustained relevance in an era where self-presentation is a core social currency.

MARKET RESTRAINTS Stringent EU Chemical and Material Safety Regulations Increase Compliance Costs

The European Union’s rigorous regulatory framework governing hazardous substances in consumer goods imposes significant compliance burdens on costume jewelry manufacturers, particularly small and international suppliers. This factor is restricting the growth of Europe costume jewelry market. The REACH regulation restricts over 200 substances, including nickel, cadmium,m and lead, common in low-cost alloys with strict migration limits to prevent skin contact risks. According to the European Chemicals Agency, over 12000 batches of imported fashion jewelry were rejected at EU customs in 2023 due to non-compliance with nickel release thresholds exceeding 0.5 micrograms per square centimeter per week. Testing alone can cost between 150 and 300 euros per material component, as noted by the European Fashion Accessories Federation, making it prohibitive for micro brands. Furthermore, the EU’s General Product Safety Regulation requires comprehensive technical documentation, traceability, and incident reporting, which many small online sellers fail to maintain. In 2023, Germany’s Federal Institute for Risk Assessment issued 47 safety alerts for costume jewelry containing allergenic dyes or sharp components. These enforcement actions disrupt supply chains and erode consumer trust in cross-border e-commerce, where oversight is fragmented.

Volatility in Raw Material Prices and Supply Chain Disruptions

The instability due to fluctuating costs and availability of key inputs, such as base metals, synthetic resin,s and specialty finishes, is additionally hampering the growth of Europe costume jewellery market. Brass and zinc core alloys for casting are heavily influenced by global commodity markets and energy prices, which spiked during the 2022 energy crisis. According to Plastics Europe, the cost of acrylic and ABS resins used in faux gemstones rose by 38% between 2021 and 2023 due to natural gas dependency in polymer production. Simultaneously, geopolitical tensions disrupted the supply of critical components, as over 70% of global zirconia (used in simulated diamonds) originates from China and Ukraine, as per the European Raw Materials Alliance, with shipments delayed during 2022 and 2023. These pressures squeeze margins for European assemblers, who operate on thin profitability, typically 15 to 25%, as confirmed by industry data from Italy and Spain. Unlike luxury brands, they cannot easily pass costs to price-sensitive consumers.

MARKET OPPORTUNITIES Integration of Recycled and Bio-Based Materials Appeals to Eco-Conscious Shoppers

The shift toward circular design in fashion accessories for brands to differentiate through sustainable material innovation is expected to create new opportunities for the growth of Europe costume jewelry market. Consumers are increasingly scrutinizing environmental footprints, 62% of EU shoppers now consider material origin a key purchase factor, according to the European Consumer Organisation. The European Environment Agency confirms that jewelry made from post-consumer recycled metal reduces carbon emissions by up to 85% compared to virgin material. Italy’s National Association of Goldsmiths reports that over 300 small jewelry workshops now use certified recycled silver and brass supplied by urban mining initiatives that recover metals from electronic waste. Furthermore, the EU Ecolabel scheme is developing criteria for fashion accessories, which will reward products with verified recycled content and non-toxic finishes. With Gen Z consumers willing to pay up to 22% more for sustainable fashion, as per a 2023 Eurobarometer study, this ethical premium creates a viable path for value addition beyond price competition in a crowded market.

Expansion of Direct-to-Consumer and Personalization Platforms

The digital transformation of retail enables costume jewelry brands to bypass traditional intermediaries and build direct relationships with consumers through personalized e-commerce experiences. The expansion of direct-to-consumer and personalization platforms is ascribed to bolster the growth of Europe costume jewellery market. DTC brands leverage customer data to offer bespoke engraving, modular designs, and limited edition drops that foster emotional connection and brand loyalty. According to the European E-Commerce Association, over 55% of independent jewelry brands in Europe now operate primarily through owned websites supplemented by social commerce rather than wholesale. In Sweden, the brand Layered uses an online configurator allowing customers to mix chains, pendants, and gem colors, creating over 10000 unique combinations, resulting in 40% higher average order value as confirmed by national retail analytics. The rise of made-to-order production also reduces inventory waste, aligning with circular economy principles. Additionally, platforms like Shopify and BigCommerce offer integrated tools for localized language tax compliance and EU consumer law adherence,e making cross-border DTC feasible even for micro businesses.

MARKET CHALLENGES Intensifying Competition from Ultra-Fast Fashion and E-Commerce Giants

The global ultra-fast fashion retailers and e-commerce marketplaces that leverage scale, speed, and algorithm-driven pricing to dominate consumer attention are one of the major challenges for the growth of Europe costume jewelry market. Companies like Shein, Temu, and Amazon offer thousands of jewelry SKUs priced below 5 euros with next-day delivery, creating a race to the bottom that small European designers cannot match. According to the European Retail Federation, ultra-fast fashion players accounted for 31% of online costume jewelry sales in Europe in 2023, up from 12% in 2020. These platforms use real-time data to replicate trending styles within days, often without regard for design originality or labor standards. In France and Italy, national craft councils documented over 200 cases of design copying in 2023, where independent creators saw their unique pieces duplicated and sold at a fraction of the price. Moreover, algorithmic visibility on marketplaces favors high-volume sellers with aggressive discounting, making it difficult for ethical or artisanal brands to gain traction. Without stronger IP enforcement or consumer education on design provenance, the market risks becoming saturated with homogenizedlow-qualityy products that erode the cultural and aesthetic diversity that once defined European costume jewelry.

Lack of Standardized Sustainability Labeling Confuses Consumers

Despite high consumer interest in eco-friendly fashion, the absence of harmonized environmental claims for costume jewelry leads to greenwashing and eroded trust. The lack of standardized sustainability labelling is also impeding the growth of EEurope’scostume jewelry market. Terms like “eco,” “green,” and “sustainable” are used inconsistently across brands with no mandatory verification or lifecycle assessment requirements. According to the European Consumer Organisation, 68% of EU shoppers find it difficult to verify sustainability claims on fashion accessories due to vague language and missing data on material origin or end-of-life recyclability. In 2023, the European Commission’s sweep of online retailers found that 42% of “eco-friendly” jewelry listings lacked substantiating evidence, violating the Unfair Commercial Practices Directive. This opacity disadvantages genuinely sustainable brands that invest in certified recycled materials or take-back programs. Italy’s Fashion Chamber notes that only 15% of small jewelry makers can afford third-party certifications like GRS or OEKO-TEX due to cost and complexity. The upcoming EU Green Claims Directive aims to mandate scientific proof for environmental labels by 2026, but until then, the market remains fragmented.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

7.05%

Segments Covered

By Product Type, Mode of Sale, End User, And Region

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

Swarovski, Pandora, Claire’s, Lovisa, Accessorize, H&M, Zara, Mango, Pilgrim, Thomas Sabo, Chanel, Dior, Gucci, Prada, Folli Follie

SEGMENTAL ANALYSIS By Product Type Insights

The necklaces and chains segment was the largest by holding 34.3% of the Europe costume jewelry market share in 2024, with their high visibility, versatility, and strong alignment with evolving social media aesthetics and layering trends. The visual prominence of necklaces in digital self-presentation on platforms like Instagram and TikTok, where the upper torso and neckline are central to video framing. According to the European Youth Observatory, fashion content featuring jewelry in 2023 reported that layered chains, pendants, or statement collars were driving immediate purchase intent among viewers aged 16 to 30. The “quiet luxury” and “balletcore” trends that dominated European fashion in 2023 emphasized delicate gold-tone chains often worn in multiples, with a style adopted by influencers across France, Italy, and Sweden. Retailers responded rapidly .H&M launched over 120 new necklace SKUs in Q2 2023 alone, as confirmed by its sustainability and product report. Furthermore, necklaces offer high design flexibility, allowing brands to integrate seasonal motifs, cultural symbols, or personalized elements like initials at minimal cost. This blend of digital visibility, cultural resonance, and low production complexity ensures necklaces remain the cornerstone of costume jewelry demand. Unlike earrings, which need precise sizing, necklaces are universally wearable and symbolically rich, making them ideal for birthdays, anniversaries, and milestones. In Germany, the Federal Statistical Office reported that over 45 million costume necklaces were purchased as gifts in 2023, representing nearly half of all gifting-related jewelry transactions. Major retailers like Zalando and Amazon dedicate entire seasonal sections to “gift necklaces” featuring symbolic charms, hearts, or birthstones.

The earrings segment is projected to expand at a CAGR of 9.7% during the forecast period with the mainstream adoption of curated ear aesthetics, where individuals wear multiple earrings, across lobe, hhelixx and cartilage to create personalized compositions. According to the European Fashion Accessories Federation, over 68% of women aged 18 to 35 in Western Europe now have at least three piercings per ear, with 42% actively styling “ear stacks” using mix-and-match studs, hoops, and drops. This trend has transformed earrings from single statement pieces into modular collectible systems. In Sweden, national health data from the Public Health Agency shows that ear piercing rates among adolescents increased by 28% between 2020 and 2023, directly expanding the addressable market. Brands like Missoma and Astrid & Miyu have capitalized by offering “earring sets” with coordinated but non-identical pieces priced 25 to 40 euros, encouraging repeat purchases. The expansion of earrings into men’s and non-binary fashion is also leveraging the growth of the segment. Once considered exclusively feminine, earrings are now widely embraced across genders in urban centers like Berlin, Amsterdam, and Copenhagen. Luxury and streetwear brands, including Gucci, Balenciaga, and Weekday, now include unisex earring lines in their collections, signaling cultural normalization. This inclusivity broadens the consumer base while aligning with European values of self-expression and identity fluidity.

By Mode Of Sale Insights

The online stores segment was the largest by capturing a significant share of the Europe costume jewelry market in 2024, with the alignment of digital channels with thefast-paced trend-drivenn nature of costume jewelry and the shopping behaviors of its core demographic. The seamless integration of social media discovery and instant purchase is also levelling up the growth of the segment. Platforms like Instagram, TikTok, and Pinterest now feature shoppable tags and in-app checkout, allowing users to buy featured jewelry within seconds of viewing content. Fast fashion retailers like ASOS and Zalando leverage algorithm-driven personalization to display trending pieces based on browsing history, location, and seasonal events, increasing basket size by 35%, as confirmed by internal retail analytics. The immediacy of e-commerce also supports micro trend cycles, when a viral style emerges, brands can list new SKUs within 48 hours and ship across Europe in 2 to 3 days via integrated logistics networks. The superior product discovery and comparison capabilities of online platforms are also to levelup the growth of Europe costume jewellery market. Unlike brick-and-mortar stores constrained by physical display limits, e-commerce websites can showcase thousands of SKUs with zoomable images, 360-degree views, and user-generated content. According to a 2023 study by the European Consumer Organisation, 74% of shoppers prefer online browsing for jewelry because it allows side-by-side comparison of materials, pricing, and reviews for low trust high variety categories like costume jewelry. Additionally, online returns are hassle-free. EU consumer law mandates 14-day free returns for distance sales, giving buyers confidence to experiment. In France, the Directorate General for Competition Policy reported that online return rates for costume jewelry hover around 22% but drive 30% higher repeat purchase rates due to reduced purchase anxiety.

The online stores segment is expected to witness the fastest CAGR 11.4% from 2025 to 2033 with the proliferation of mobile-optimized shopping experiences that cater to impulse and trend-driven purchases. According to Eurostat, many Europeans aged 16 to 45 use smartphones as their primary e-commerce device, and costume jewelry, being low-cost and visually oriented, is ideally suited for mobile browsing. Retailers have responded with aapp-onlydrops augmented reality ttry-onand one tap checkout via Apple Pay or Google Pay, reducing cart abandonment by 28%, as per a study. In Italy, national telecom data from AGCOM shows that 4G and 5G coverage enables seamless high-quality video shopping, even in rural areas, expanding digital access beyond urban centers. The seamless cross-border fulfillment enabled by EU harmonization and regional logistics hubs is also leveling up the growth of the segment. Companies like Shein, Temu, and independent DTC brands use centralized warehouses in the Netherlands and Poland to deliver to 27 countries within 3 to 5 days. Furthermore, platforms like Shopify and Etsy handle local language tax compliance and consumer law automatically, lowering entry barriers for micro brands.

By End User Insights

The women segment was the largest by holding a dominant share of the Europe costume jewelry market in 2024, with the historical, cultural, and socio-economic factors that position jewelry as a primary tool for female self-expression, adornment, and social-signaling. The deep integration of jewelry into female identity construction from adolescence through adulthood. Costume jewelry offers an affordable way to experiment with trends, express mood, or mark life stages without the permanence or cost of fine jewelry. Furthermore, workplace norms in Europe increasingly permit expressive accessories, unlike in more conservative regions, by enabling daily wear. The targeted marketing and product development focused on female consumers, which is also enhancing the growth of the segment. Brands design collections around female-centric themes, lunar cycles, birthstones, empowerment slogans, and size ranges that fit average female anatomy. Retail environments, both online and physical, are curated for female browsing behaviors with emphasis on color coordination, gifting suggestions, and seasonal storytelling.

The men end-user segment is likely to register the fastest CAGR of 12.3% during the forecast period. The redefinition of masculine aesthetics in urban European culture, where jewelry signifies individuality rather than vanity, is significantly boosting the growth of Europe costume jewelry market. According to Eurostat, 31% of men aged 18 to 29 in Western Europe now regularly wear at least one piece of costume jewelry, up from 12% in 2018, with chains ear, rings, and signet rings leading adoption. This shift is amplifiehigh-profileofile male footballers like Kylian Mbappe, musicians like Rosalia’s collaborators, and actors in European cinema consistentlyshowcasinge layered chains and ear cuffs in media appearances. Retailers have responded; Weekday, H&M, and Zara all launched dedicated men’s jewelry lines in 2023 featuring minimalist chains, silicone rings, and magnetic studs designed for active lifestyles. The rise of gender neutral and unisex jewelry collections that deliberately avoid traditional feminine coding is elevating the growth of the segment. Brands like Courbet in France and A Kind of Guise in Germany offer geometric pendants, matte black finishes, and industrial materials that appeal to a broad spectrum of gender identities. According to the European Fashion Accessories Federation, 24% of new jewelry launches in 2023 were explicitly labeled unisex, with sales split nearly evenly between male and female buyers.

REGIONAL ANALYSIS United Kingdom Costume Jewelry Market Analysis

The United Kingdom was the top performer of the Europe costume jewelry market by holding 18.3% of the share in 2024, with its influential fashion media, strong e-commerce infrastructure, and culturally progressive attitudes toward self-expression and gender fluidity. London serves as a global trend incubator where street style from neighborhoods like Shoreditch and Camden rapidly translates into mass designs. The UK processed over 320 million online fashion accessory orders in 2023, as per the Office for National Statistics, with costume jewelry among the top three categories by volume. British retailers like ASOS, Missoma, and Astrid & Miyu pioneered the “ear stack” and personalized jewelry movements now sweeping Europe. Furthermore, the UK’s high smartphone penetration, where 89% of adults own one, as per Ofcom, and advanced mobile payment adoption enable seamless impulse purchases. The UK maintains cultural and logistical integration with EU fashion cycles through digital channels and shared design talent.

France Costume Jewelry Market Analysis

France was ranked second by capturing 16.3% of the Europe costume market share in 2024, with its strong haute couture heritage,eritage strong artistic heritage, anal base and government support for creative industries. Paris Fashion Week sets seasonal jewelry trends that ripple across Europe, with costume interpretations appearing in Zara and Mango within weeks. Furthermore, France’s strict advertising standards prohibit misleading sustainability claims, encouraging authentic eco innovation, where 35% of new costume jewelry lines in 2023 featured recycled brass or bio resins, as confirmed by the French Federation of Fashion Accessories.

Italy Costume Jewelry Market Analysis

IItaly’scostume jjewelrymarket growth is likely to grow with its world-renowned craftsmanship, legacy fashion retail density, and cultural emphasis on personal adornment. Milan and Florence host hundreds of small workshops that blend traditional metalworking with contemporary design, many supplying private label collections to global retailers. Italy’s strong domestic manufacturing base ensures a rapid response to trends. Duringthe 2023 “balletcore” wave, Italian producers launched over 5000 new pearl motif SKUs within six weeks, as reported by the Italian Fashion Chamber.

Germany Costume Jewelry Market Analysis

GeGermany’sostume jewerly market growth is likely to grow with its emphasis on quality, transparency, and sustainability in consumer goods. German consumers favor minimalist, timeless designs over fast trends, with brands like KERBholz and Madeleine leading in wooden and recycled metal pieces. The country’s strong data privacy laws and consumer protection framework also shape e-commerce retailers, whomust clearly disclose origin composition and return policies, which builds trust in online purchases. Additionally, the gifting culture around Christmas and birthdays sustains consistent demand, withover 50 million costume jewelry items purchased as presents in 2023, according to the German Retail Federation.

Spain Costume Jewelry Market Analysis

SSpain’scostume jewelry market growth is likely to grow with its vibrant festival culture, warm climate, and high social media engagement among youth. Furthermore, Spain has one of Europe’s highest TikTok penetration rates, where 72% of teens use the platform daily, as per the Spanish Data Protection Agency makingg it a hotspot for viral jewelry trends. Retailers like Mango and El Corte IInglésleverage this by launching limited edition festival collections every spring and summer.

COMPETITION OVERVIEW

Competition in the Europe costume jewelry market is highly fragmented and dynamic, featuring a three-tiered structure of global fashion jewelry brands, regional retailers, and independent designers. Large players like Pandora and Fossil compete on brand storytelling, sustainability credentials, and omnichannel reach, while fast fashion giants such as H& M, Mango, and Zara dominate volume through ultra-responsive trend replication and pricing below 20 euros. Meanwhile, thousands of micro brands and artisanal workshops leverage e-commerce platforms like Etsy and Instagram to offer niche handmade or ethically positioned pieces that resonate with conscious consumers. The competitive landscape is further intensified by ultra-fast fashion entrants like Shein and Temu, which flood the market with low-cost imitations, often undermining original designs. Differentiation hinges less on product exclusivity and more on authenticity, material transparency, digital experience, and speed to trend.

KEY MARKET PLAYERS

A few major players of the Europe costume jewelry market include

- Swarovski

- Pandora

- Claire’s

- Lovisa

- Accessorize

- H&M

- Zara

- Mango

- Pilgrim

- Thomas Sabo

- Chanel

- Dior

- Gucci

- Prada

- Folli Follie

Top Strategies Used by the Key Market Participants

Key players in the Europe costume jewelry market prioritize sustainability by incorporating recycled metals, biobased materials, and circular take-back programs to meet EU environmental expectations. They invest in digital innovation, including virtual try-on, AR styling, and social commerce integration to enhance online engagement and reduce return rates. Companies launch limited edition capsule collections aligned with seasonal festivals, micro trends, and influencer collaborations to drive urgency and virality. Strategic omnichannel retailing blends physical store experiences with seamless e-commerce fulfillment, including same-day delivery and in-store returns. Additionally, they emphasize personalization through engraving modular designs and gifting curation to foster emotional connection and repeat purchases among style-conscious European consumers.

Leading Players in the Europe Costume Jewelry Market

- Pandora is a globally recognized jewelry brand with deep roots, offering a broad range of affordable luxury and costume jewelry centered on customizable charm bracelets and modern minimalist designs. The company serves millions of customers across 30 European markets through over 1700 concept stores and robust e-commerce channels. In 2023, Pandora accelerated its sustainability transformation by shifting 70% of its silver and gold usage to recycled sources and launching a circular take-back program in Germany, France, and the UK. The brand also introduced its “Lab Grown Brilliance” collection featuring lab-created gemstones set in recycled metals by aligning with EU consumer demand for ethical fashion. Pandora’s vertically integrated supply chain and data-driven trend forecasting enable rapid response to micro trends while maintaining consistent quality. Its emphasis on personalization, gifting, and emotional storytelling has solidified its role as a cultural touchstone in European costume jewelry and expanded its influence across North America and Asia.

- Signet Jewelers operates two of the UK’s most established jewelry retail chains,s H Samuel and Ernest Jones, by offering a wide assortment of costume and fashion jewelry tailored to British and European tastes. In 2024, Signet enhanced its omnichannel capabilities by integrativirtual try-ononn technology and same-day local delivery for online jewelry orders across major UK cities. The company also expanded its exclusive collaborations with European designers to launch limited edition capsule collections that celebrate regional aesthetics and seasonal events. By leveraging customer data from its loyalty programs, Signet personalizes promotions and replenishment reminders for gifting occasions like Mother’s Day and Christmas. Through localized assortment planning, digital innovation, and trusted retail presence,e Signet maintains strong relevance in Europe’value-consciousus yestyle-drivenen costume jewelry segment while contributing to Signet’s global retail leadership.

- Fossil Group is a key player in the Europe costume jewelry market through its portfolio of licensed and proprietary fashion accessory brands, including Fossil,l Michele, and Skagen. The company integrates jewelry design with its renowned watch collection,s creating cohesive lifestyle offerings that appeal to urban professionals anfashion-forwardrd consumers. Fossil strengthened its European footprint by launching a dedicated e-commerce platform for Southern Europe featuring localized styling, content, payment options, and sustainability disclosures. The company also introduced its “Renew” line of costume jewelry made from recycled brass anocean-boundnd plastics with packaging fully compliant withthe EU Single Use Plastics Directive. Fossil’s design studios in Milan and Basel ensure collections reflect continental trends while its partnerships with global fashion houses enable co-branded limited editions that drive social media buzz.

MARKET SEGMENTATION

This research report on the Europe costume jewelry market has been segmented and sub-segmented based on product type, mode of sale, end user, and region.

By Product Type

- Necklaces & Chains

- Earrings

- Rings

- Bracelets

- Cufflinks & Studs

By Mode of Sale

- Retail Stores

- Online Stores

By End User

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe