Researchers from Northumbria University and the University of London have called for the UK banking industry to ‘design out’ economic abuse, after a six-month study identified how banking products, services and technologies are intentionally weaponised by abusers.

The report published by the authors of the research – Designing Out Economic Abuse in the UK Banking Industry: A Call To Action – also presents potential ways of preventing the abuse, including ‘safe mode’ for online banking, separate checks for joint mortgage holders, coerced signature detection and lending flags customers can add to their accounts that are visible to the bank, with messages such as ‘don’t lend to me’.

Led by Dr Clare Wiper at Northumbria University, in collaboration with Dr Belén Barros Pena at City St George’s, University of London and Dr Kathryn Royal at the national charity Surviving Economic Abuse, the research brought together six victim-survivors and six banking professionals from five major UK banks as partners in the design process.

The participants worked collaboratively to identify how financial products are being misused to perpetrate economic abuse, and to develop ideas for interventions which they hope could prevent harm. The report calls on UK banks to help feasibility test the proposed interventions and develop workable protections.

“This research demonstrates the power of bringing together lived experience and industry expertise to tackle a problem that affects millions of people across the UK – disproportionately women,” Dr Wiper, an assistant professor in criminology, explained.

“Many current banking responses to economic abuse are largely reactive – taking place after harm has occurred. Our participants have shown that banks have significant opportunities to be more proactive, and that this isn’t always about massive investment or revolutionary technology – sometimes it’s about asking one additional question during joint account opening or ensuring that digital banking features are designed with victim-survivor safety in mind.”

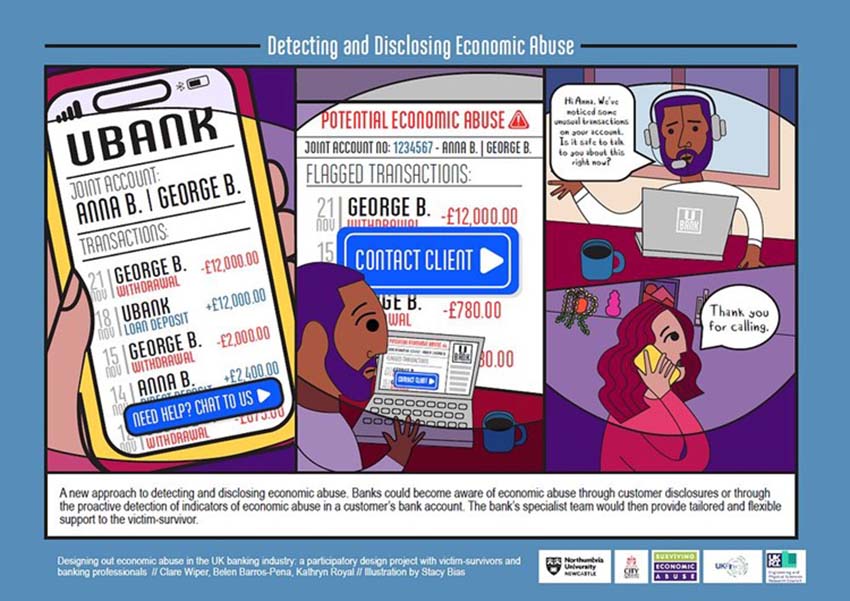

Victim-survivor participants identified two priority interventions in the research: detecting and disclosing economic abuse through proactive detection of unusual patterns, with specialist trauma-informed staff to provide flexible support, and joint account protection and education, with a change in terms and conditions so account holders can be treated in the same way as tenants in common in joint home ownership.

Over four million women across the UK experienced economic abuse from a current or ex-partner in the last year. “From our work with victim-survivors, we know that abusers routinely misuse financial products and services to control, intimidate and cause lasting harm,” said Dr Kathryn Royal, senior research officer at Surviving Economic Abuse.

“This research shows that the most effective solutions to economic abuse emerge when survivor expertise is placed at the heart of design. By bringing victim-survivors and banking professionals together, with survivors leading the way, this project demonstrates how banks can move beyond reactive responses and proactively design economic abuse out of their systems.”

The report also acknowledges what it says are the significant challenges faced by the banking sector, including regulatory restrictions, technological advancements that aid abusers’ misuse of banking infrastructure, and difficulties responding to abusive customers without putting victim-survivors at increased risk of harm or retaliation.

“This research shows how our always-on, fast and convenient financial technologies have unintended consequences and can be misappropriated for harmful purposes,” said Dr Belén Barros Pena, an interaction designer and researcher from City St George’s, University of London.

“In their current form, financial technologies are not designed to frustrate or prevent such harms. To change this, we must ensure victim-survivors have a voice and can contribute to technology-making processes.”

According to Dr Royal, the report offers a “timely and practical roadmap for change”.

“Financial services firms have a real opportunity to create safer, more inclusive financial products that work for everyone,” she concluded.

“At Surviving Economic Abuse, we stand ready to work with the sector to turn survivor insight into action and prevent economic abuse before it starts.”

Designing Out Economic Abuse in the UK Banking Industry: A Call To Action

Illustration by Stacy Bias