Europe remains the world’s top travel destination, attracting millions of visitors each year to its cultural landmarks, diverse regions, and natural beauty. The continent’s diversity also drives strong intra-European travel, reinforcing a shared sense of European identity and local prosperity.

Tourism is a powerful economic engine for the EU: accounting for an estimated 5.1% of gross value added, or around €764 billion in 2023, and supporting more than 20 million jobs. Europe is home to most of the world’s leading leisure destinations, from France and Spain to Italy, Greece, and Austria.

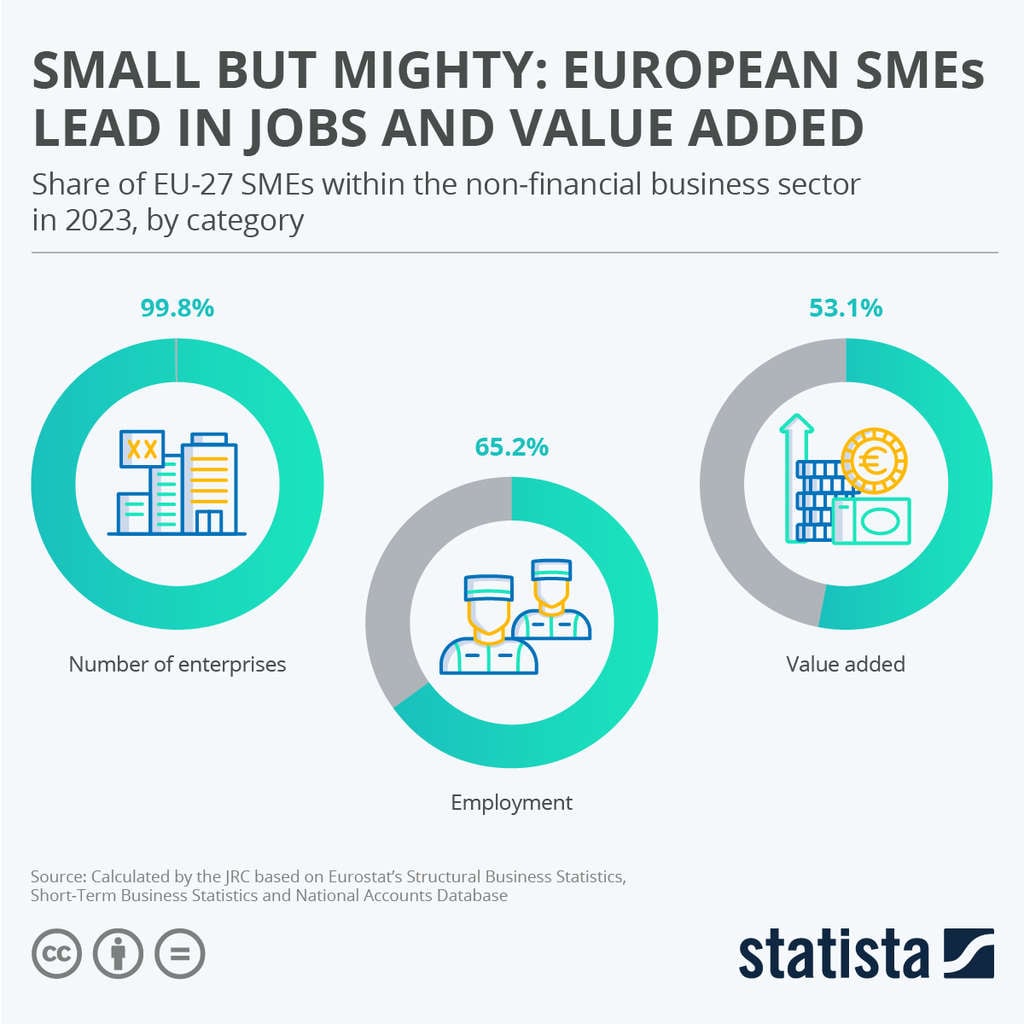

Within this ecosystem, small and medium-sized enterprises (SMEs) are the primary source of dynamism and resilience. In 2023, the EU-27 counted 25.8 million SMEs, representing 99.8% of all enterprises in the non-financial business sector and employing 88.7 million people (65% of the total workforce). While they account for just over half of value added, reflecting the economies of scale enjoyed by larger firms, SMEs remain essential for diversity, innovation, and regional cohesion across Europe’s tourism landscape.

Small but Mighty: European SMEs Lead in Jobs and Value Added— Source: Statista

Small but Mighty: European SMEs Lead in Jobs and Value Added— Source: Statista

Persistent sentiment gap: why SMEs lag behind chains

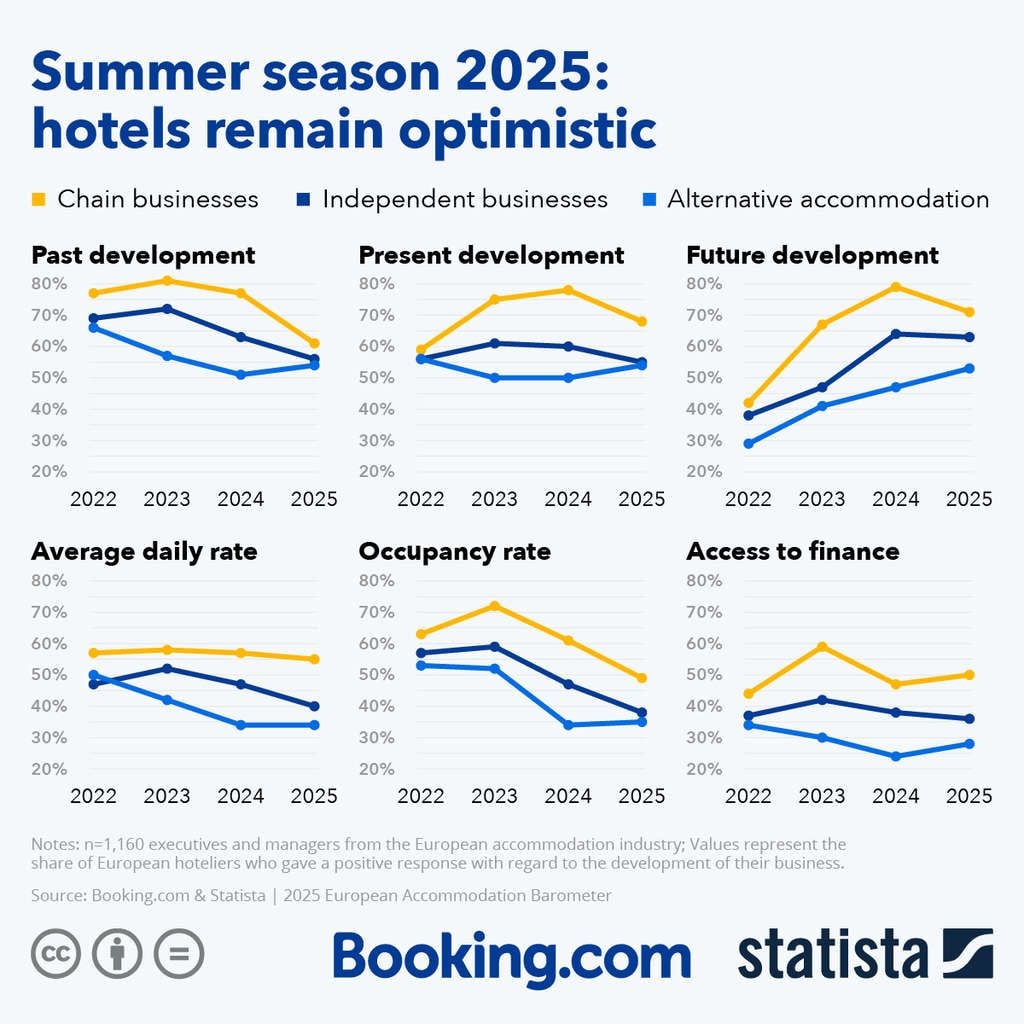

Across Europe, independently owned properties make up roughly four in five accommodations, and nearly all of these (95%) are SMEs. The industry’s diversity is real, but so is the divergence in how different players experience competing in it. The latest Accommodation Barometer findings show that larger and chain-affiliated hotels consistently report stronger business sentiment across nearly all metrics, from current economic conditions to expected performance and pricing trends.

In 2025: Hotels Remain Optimistic— Source: Statista & Booking.com

In 2025: Hotels Remain Optimistic— Source: Statista & Booking.com

This sentiment gap reflects structural differences in access to capital or other resources and operating conditions rather than differences in capability or ambition. Chain hotels, even those below the EU’s formal threshold for “large enterprises”, benefit from brand recognition, lower borrowing costs, proprietary technology, global marketing, and loyalty programs that deliver a steady flow of guests. Smaller, independent properties, by contrast, face higher costs of capital and the pressure to sustain visibility in increasingly globalized markets, which constrains their ability to invest and compete.

Access to finance remains the most visible dividing line. While larger hotels report relatively easy access to funding, SMEs still face tighter credit conditions and smaller margins for experimentation. Unless this gap narrows, differences in financial flexibility will continue to influence how quickly businesses can modernize.

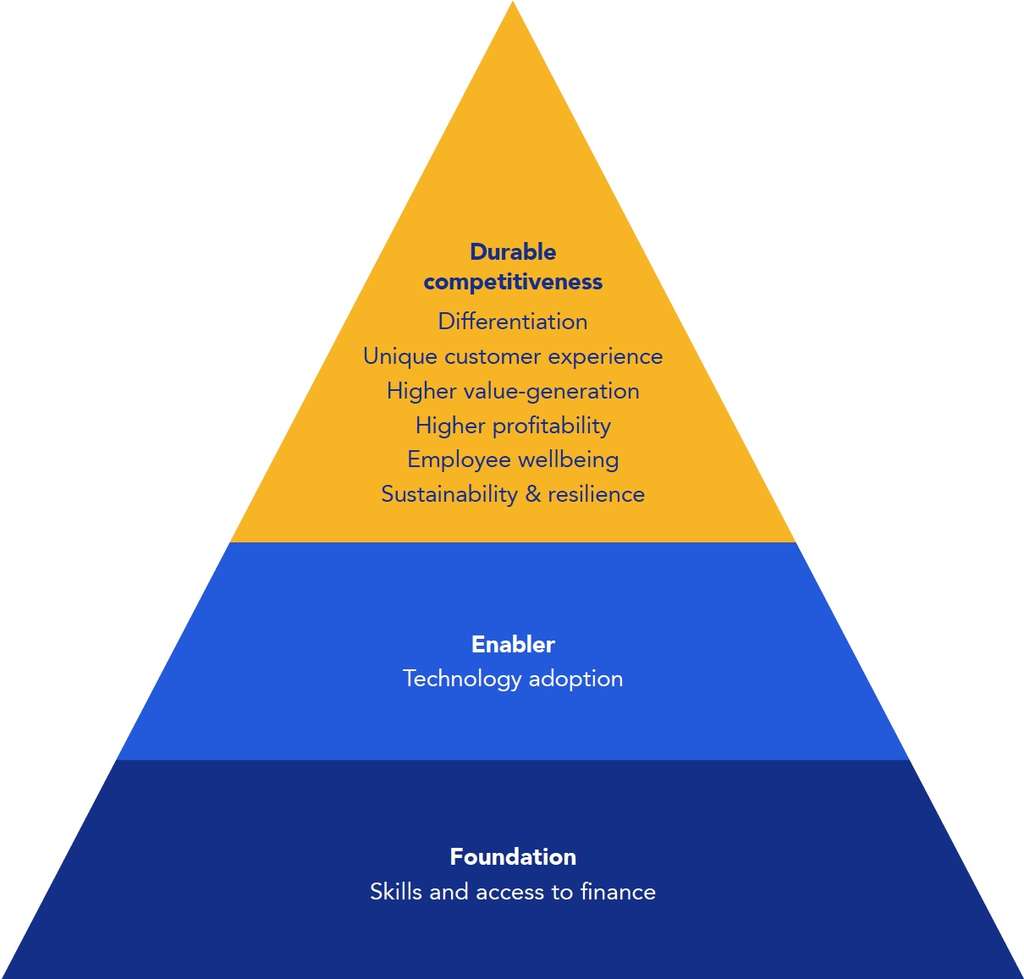

A pyramid of durable competitiveness in Europe’s accommodation industry

Europe’s resilience and equity depend on a more competitive SME base — this is especially true for tourism. Yet the path to competitiveness is often framed narrowly. A better lens is a Maslow-style hierarchy for SMEs — a pyramid that clarifies what must come first, what enables progress, and what lasting success looks like.

At the foundation are skills and access to finance. Without vocational and digital capabilities — and reliable, affordable capital — SMEs cannot modernize or scale. This is the groundwork on which everything else rests.

The enabler is technology adoption. AI and automation are not luxuries but practical levers that raise productivity, personalize service, and save costs. Crucially, they help smaller players compete on fairer terms with larger, better-capitalized peers.

Pyramid of durable competitiveness — Source: Statista & Booking.com

The apex is durable competitiveness: steady innovation, distinctive value creation, and clear differentiation, anchored in sustainability and employee well-being. In Europe’s accommodation and wider experience economy, this is how SMEs move from surviving to thriving: creating more value for travelers, employees, and communities alike.

In short, strengthening SME competitiveness is a blueprint for Europe’s prosperity: build skills and financing, enable tech adoption, and unlock a cycle of innovation and inclusive growth.

Technology adoption: A driver of productivity, innovation, and the key enabler of competitiveness

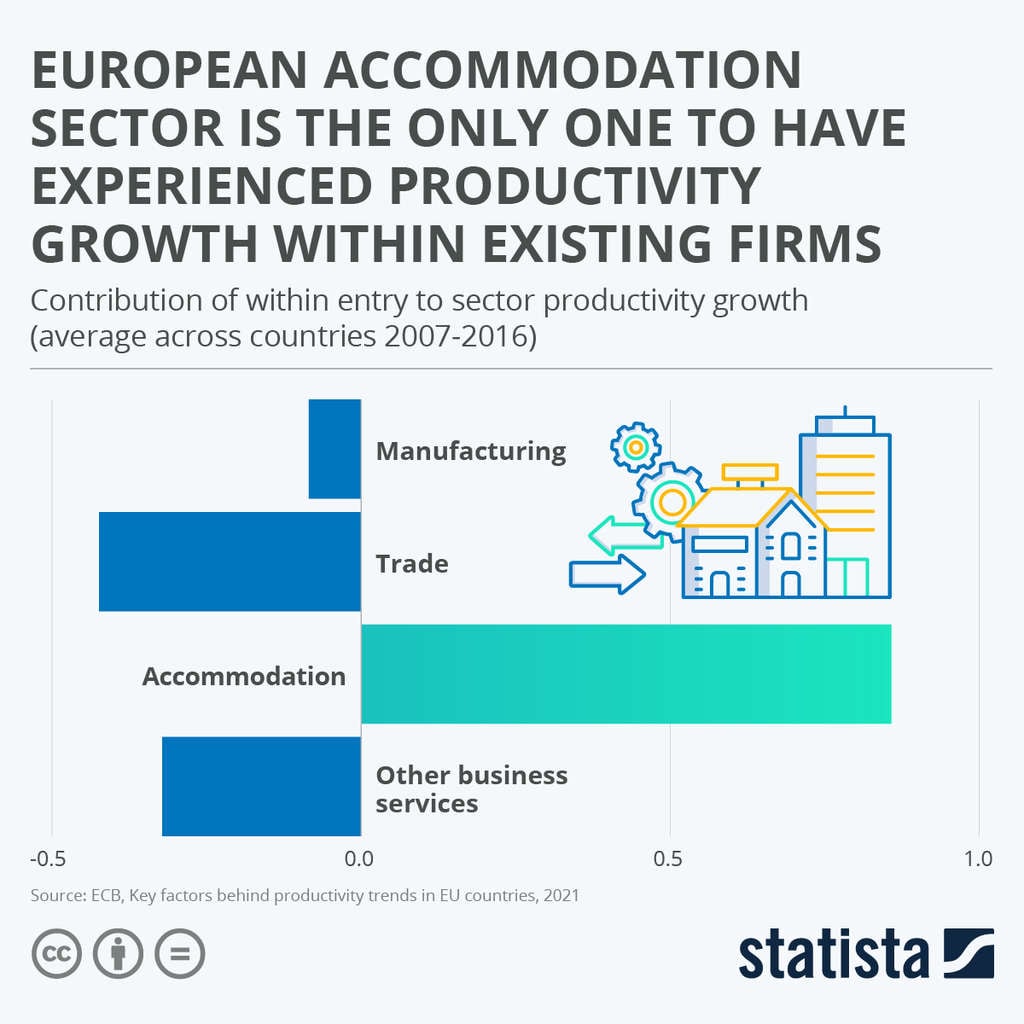

A 2021 report by the European Central Bank (ECB) showed that within-firm productivity growth has been mostly negative across most industries between 2007 and 2016, with the exception of the accommodation industry.

The rise of online travel platforms coincides with the productivity gain in the accommodation sector, which shows how strategic technology adoption can unlock gains even in sectors long viewed as low-tech. In accommodation, partnering with digital platforms became a pivotal growth lever, enabling smaller players to reach and compete in global markets. The sector’s progress underscores how technological integration can drive sustained productivity improvements.

European Accommodation Sector is the Only One to Have Experienced Productivity Growth Within Existing Firms— Source: Statista

European Accommodation Sector is the Only One to Have Experienced Productivity Growth Within Existing Firms— Source: Statista

Small and independent accommodations especially value the support they receive from online travel platforms, which offer them a multitude of benefits. In a study conducted by EY Parthenon, 96% of respondents indicated that online travel platforms increased their visibility to customers worldwide. A further 91% agreed that they were able to generate more bookings by being listed online, while clear majorities reported that online travel platforms improved performance through insights and analytics, allowed 24/7 multi-language customer service for travel, and also reduced hotel operations.

By amplifying reach and operational efficiency, technology partnerships have become a driver of productivity growth in a sector.

From digital lag to digital lift: how technology can level the playing field

A new wave of travel technologies — from artificial intelligence and data analytics to augmented and virtual reality — is reshaping the accommodation industry. Perhaps the enhancement of the traveler experience with personalized recommendations and immersive previews is what comes to mind first, but behind the scenes, these tools are transforming operations.

AI-driven pricing and forecasting improve revenue management; analytics help optimize performance and reduce waste; and AR/VR (augmented reality/virtual reality) support staff training and facility maintenance.

Together, these technologies don’t just reshape traveler experience — they make businesses run better, turning experiential upgrades into measurable gains in efficiency and productivity.

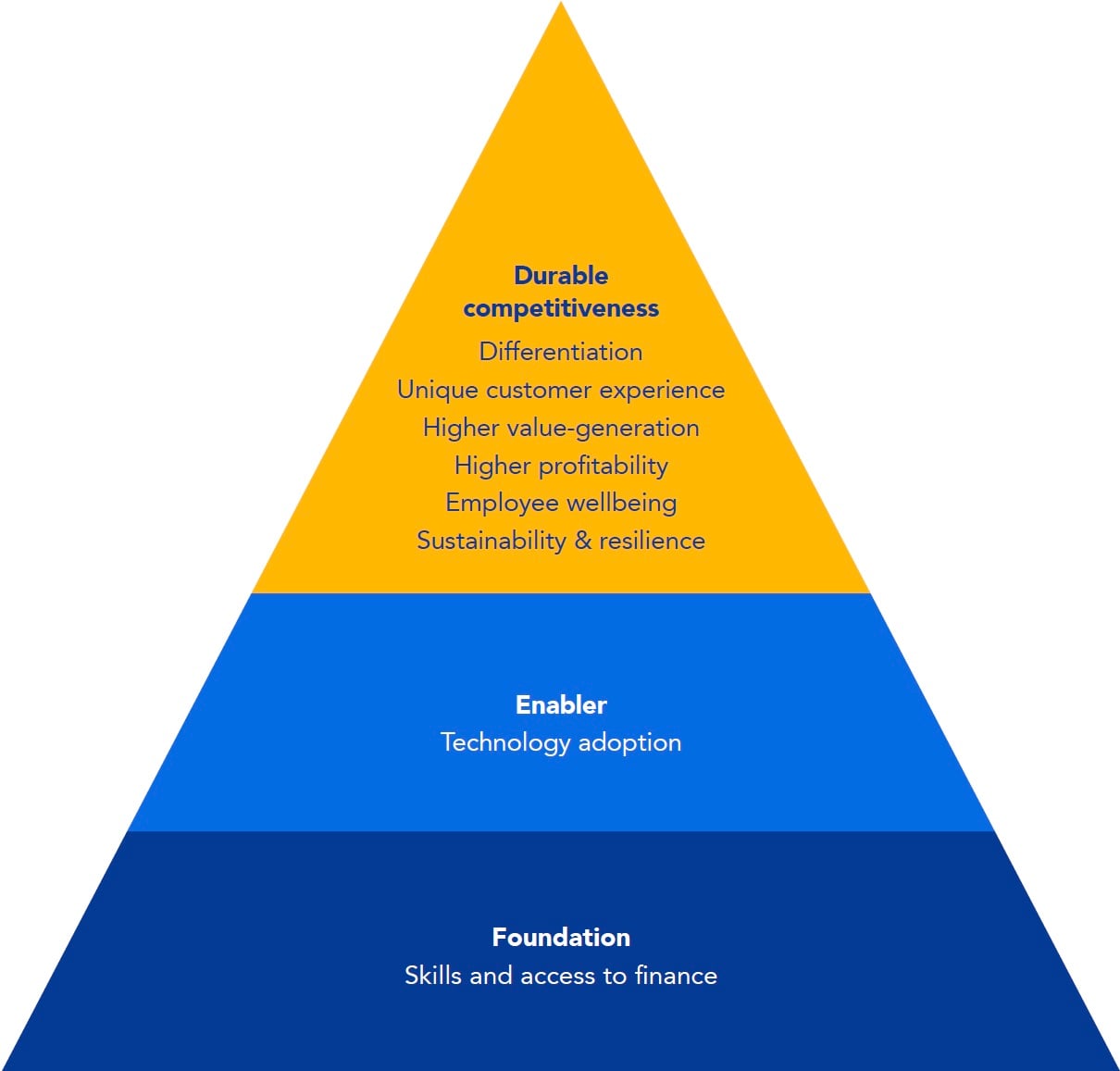

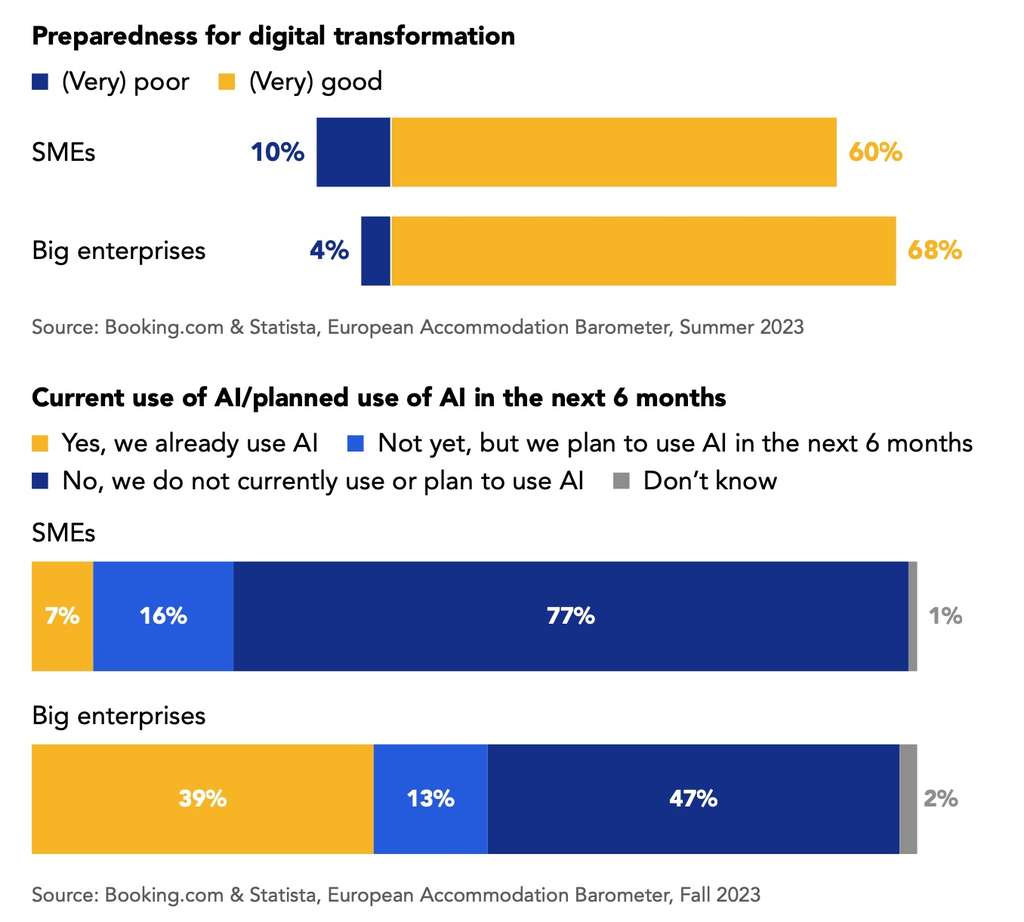

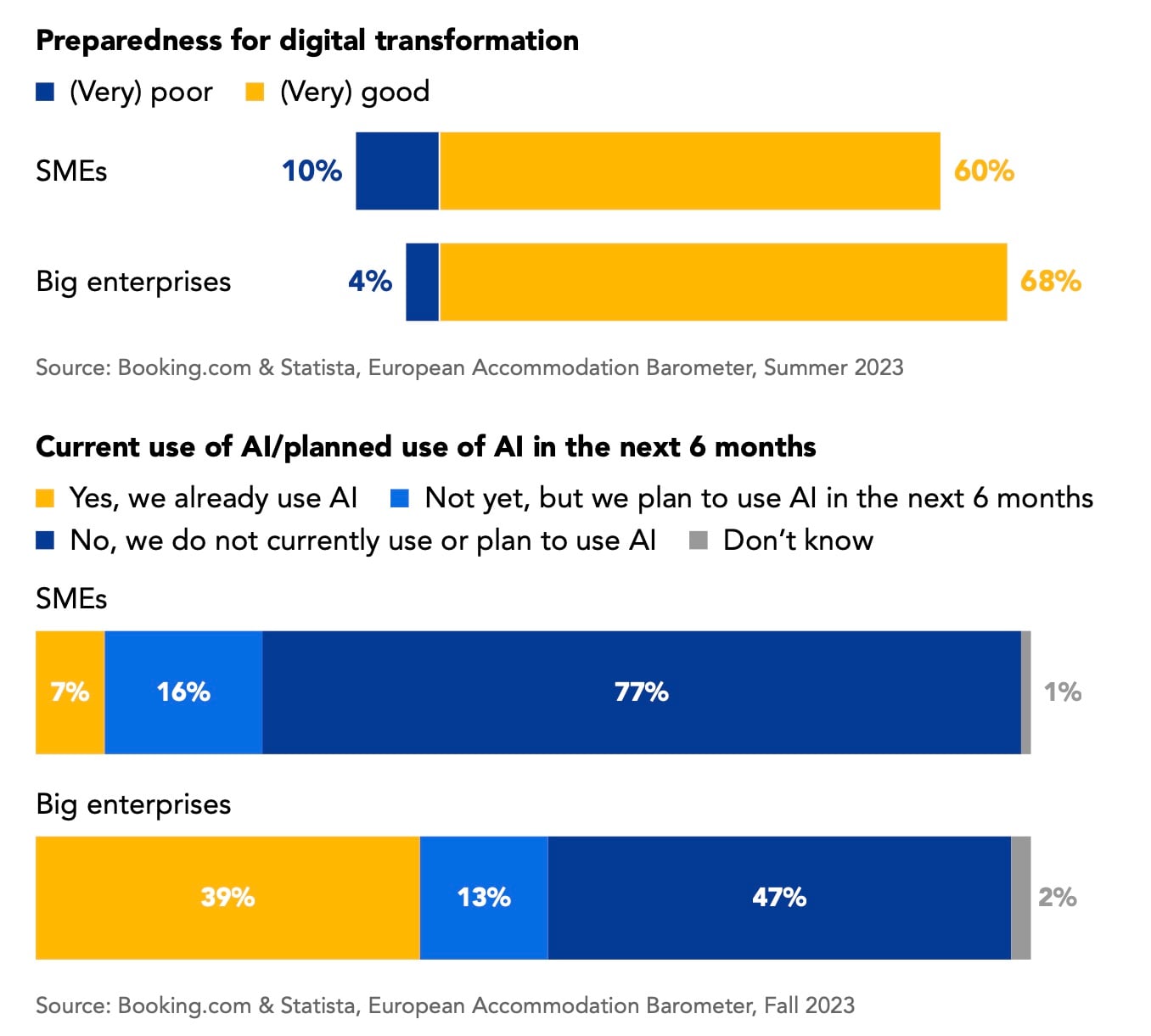

Preparedness for digital transformation— Source: Statista & Booking.com

Yet, many accommodation SMEs have not fully captured these benefits. The Accommodation Barometer shows that above two-thirds of properties with 250 employees or more reported (very) good preparedness for digital transformation, compared to around 60% of smaller businesses. The gap is even more pronounced in the use of AI: 39% of large accommodations reported some level of AI implementation in 2023, versus only 7% of SMEs.

High implementation costs, integration challenges, and a shortage of technical expertise remain the main barriers to adoption. Awareness also plays a role — many small operators are uncertain where to start or how to measure the return on technology investments. Addressing these constraints is critical if SMEs are to translate untapped potential into durable competitiveness.

Finance and skills: the dual bottleneck to SME digitalization

The barriers to SME digital adoption often trace back to two enduring challenges: access to finance and access to skilled talent. Both are essential to innovation — and both remain unevenly distributed across Europe’s accommodation sector.

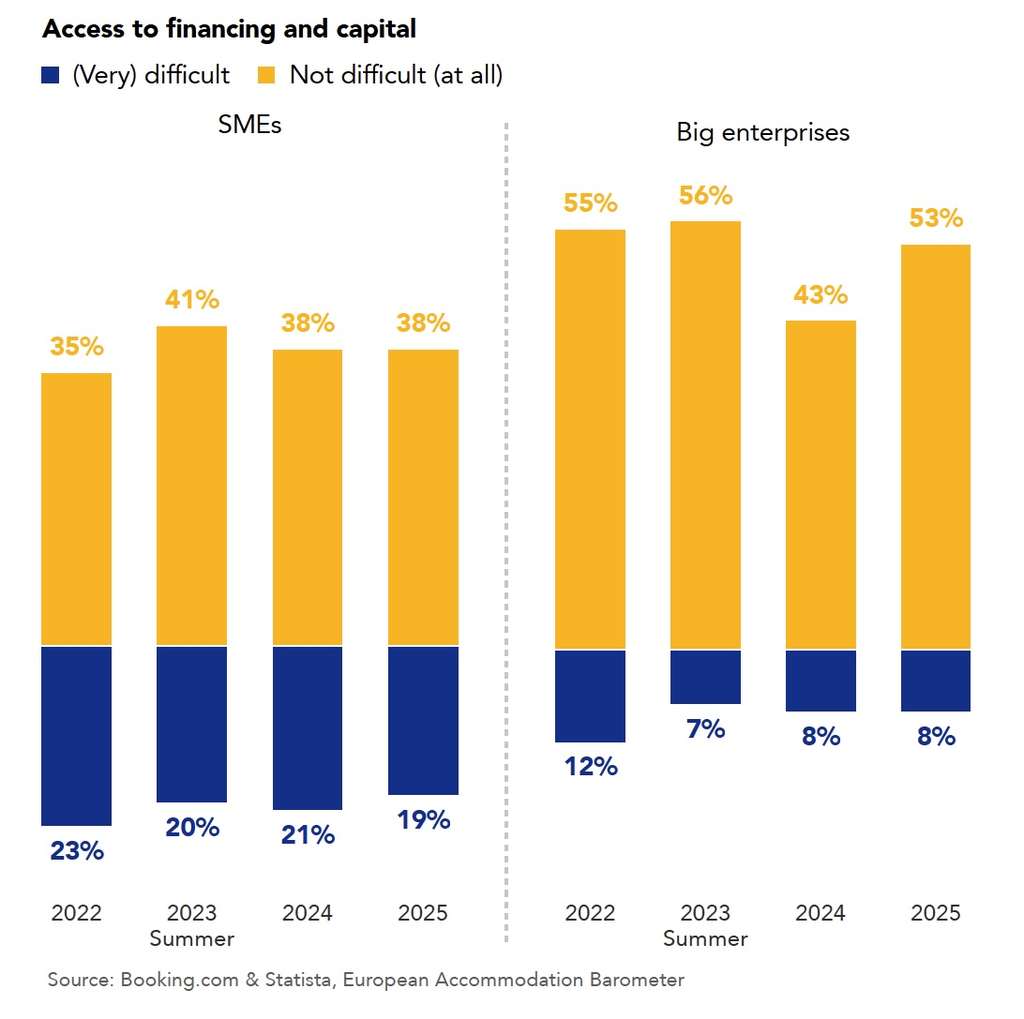

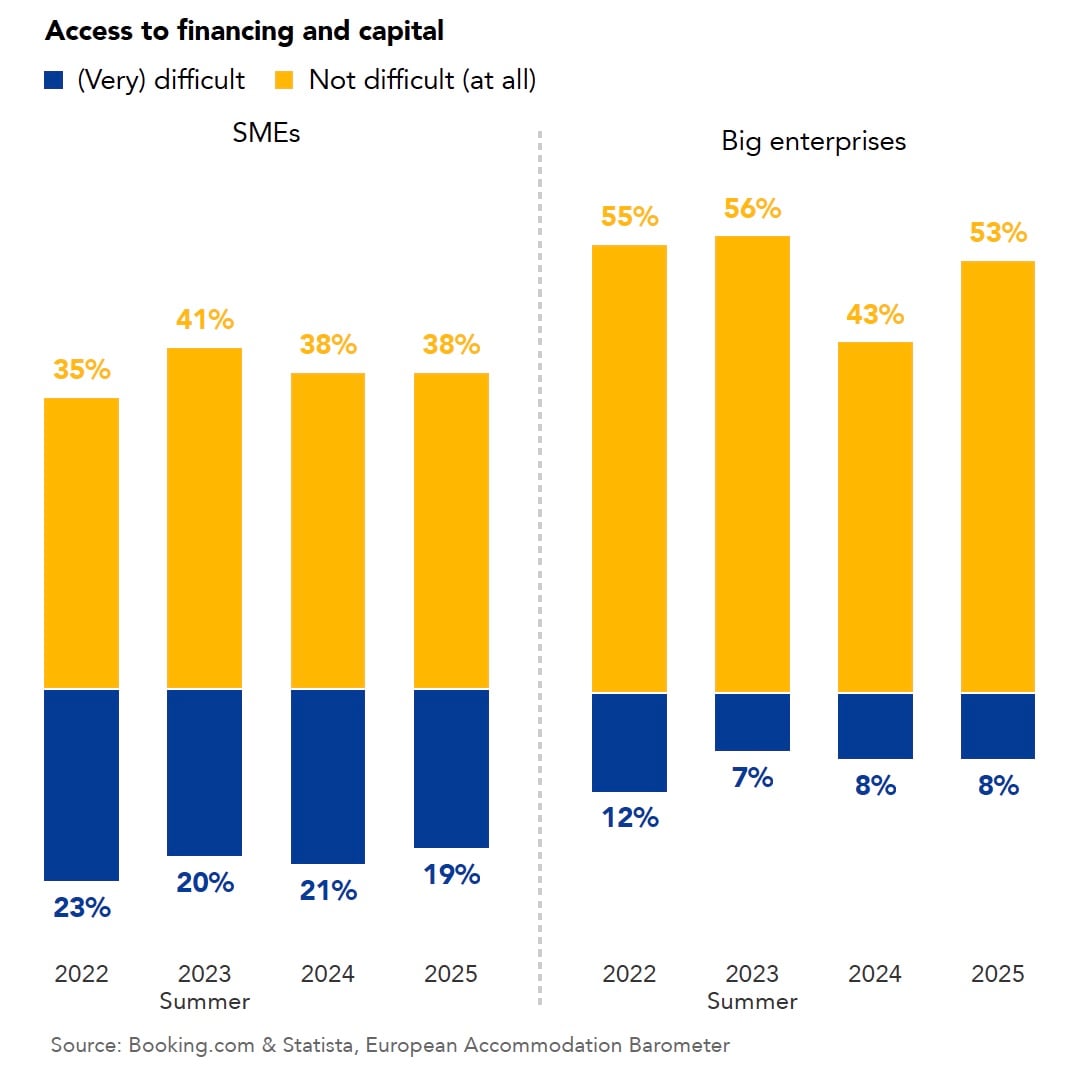

The Barometer findings show that the financing gap between small and large enterprises is among the widest sentiment divides and has changed little in recent years. In 2022, just 35% of accommodation SMEs reported easy access to capital, compared with more than half of larger hotels.

Three years later, the difference remains stark: for every SME that finds funding straightforward, two encounter difficulties — while among large properties, nearly seven report ease of financing for every one that struggles.

Access to financing and capital— Source: Statista & Booking.com

Larger enterprises typically benefit from established relationships with banks, better credit ratings, and greater collateral, making it easier for them to secure loans and investments. On the other hand, microenterprises often lack these advantages, relying primarily on self-financing and short-term credit.

As investing in digital transformation or proactively pursuing green initiatives is more costly to implement on a small scale, the inability to invest in these areas can put SMEs at a competitive disadvantage, limiting their growth and eroding long-term resilience. Bridging the financing gap is therefore critical to sustaining Europe’s tourism competitiveness.

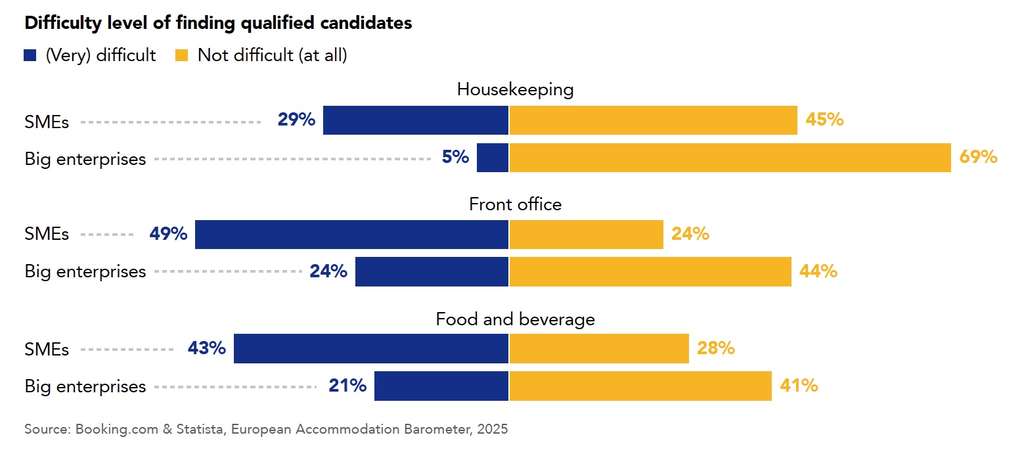

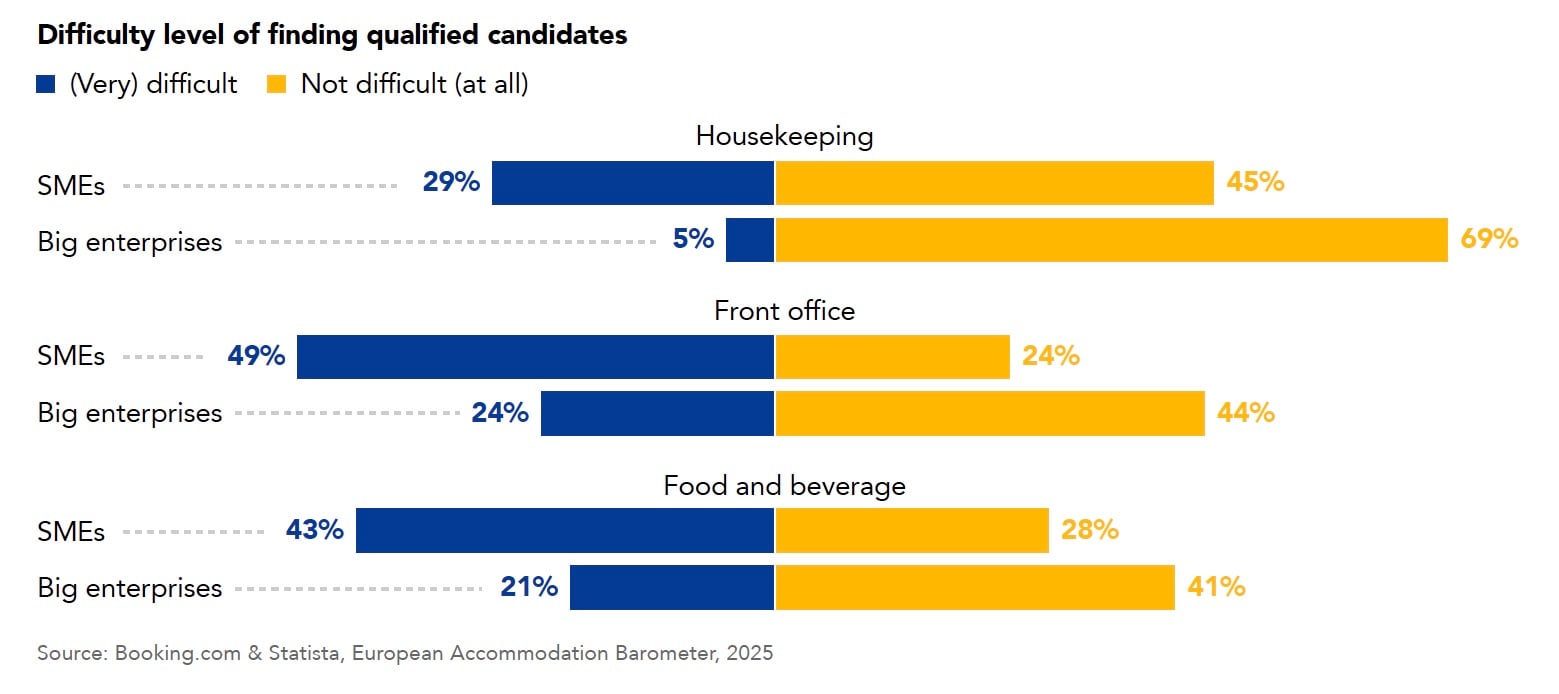

Skills shortages compound this challenge. SMEs report greater difficulty hiring qualified staff and investing in training. Nearly half (49%) of accommodation SMEs cite hiring difficulties for front-office positions, compared with only 24% of large hotels.

Difficulty level of finding qualified candidates— Source: Booking.com

When it comes to training, 48% of SMEs offer both internal and external programs, versus 73% of large enterprises; 14% of SMEs report having no training programs at all. As larger operators continue to invest more heavily in upskilling, the talent gap risks widening further.

To strengthen competitiveness, SMEs need both stronger vocational pipelines and improved access to capital. That means clearer visibility of financing options, simpler application processes, and practical support in deploying investments effectively. Only by tackling both constraints together can Europe’s accommodation SMEs fully capture and amplify the productivity gains of digital transformation.

Building a stronger SME base: from support to self-sufficiency

To address the challenges accommodation SMEs face and support their digital transformation, several actions can make a tangible difference:

1. Align finance and skills development

Upskilling and access to capital must advance together. Capital without skills will not be deployed effectively, and skills without affordable financing cannot translate into innovation. Bridging both is essential for SMEs to move up the value-creation ladder — from digital adoption to durable competitiveness.

2. Broaden access to finance — public and private

SME investment should be enabled by both EU funding instruments (such as the Recovery and Resilience Facility and Cohesion Funds) and private-sector lending and equity finance. The priority is not to expand subsidies, but to improve visibility, accessibility, and coordination between public programs and market mechanisms. A better flow of information and streamlined procedures can empower smaller operators to choose the most suitable financing path for their growth.

Press enter or click to view image in full size

3. Build an open data infrastructure for SME support

The EU could develop an open API aggregating information on funding, training, and support programs for tourism SMEs and start-ups. Scaled-up companies with broad reach, such as online travel platforms, could integrate this data into their systems, delivering personalized and timely updates directly within SMEs’ existing workflows. This would expand reach, cut administrative burdens, and ensure that smaller businesses can access and act on opportunities when they arise.

4. Enable SME-platform collaboration

Recognize the value created by open digital platforms and ensure that regulatory frameworks foster, rather than inhibit, these partnerships. Platforms can serve as scalable partners in advancing digitalization and sustainability across Europe’s accommodation ecosystem.

5. Simplify compliance for smaller companies

Governments should streamline digital, sustainability, and other reporting requirements for SMEs to lower administrative hurdles to transformation. Barometer findings show that smaller businesses often perceive such policies as more burdensome than beneficial — unlike larger or chain-affiliated enterprises that have more resources to comply.

Europe’s advantage in the age of the experience economy

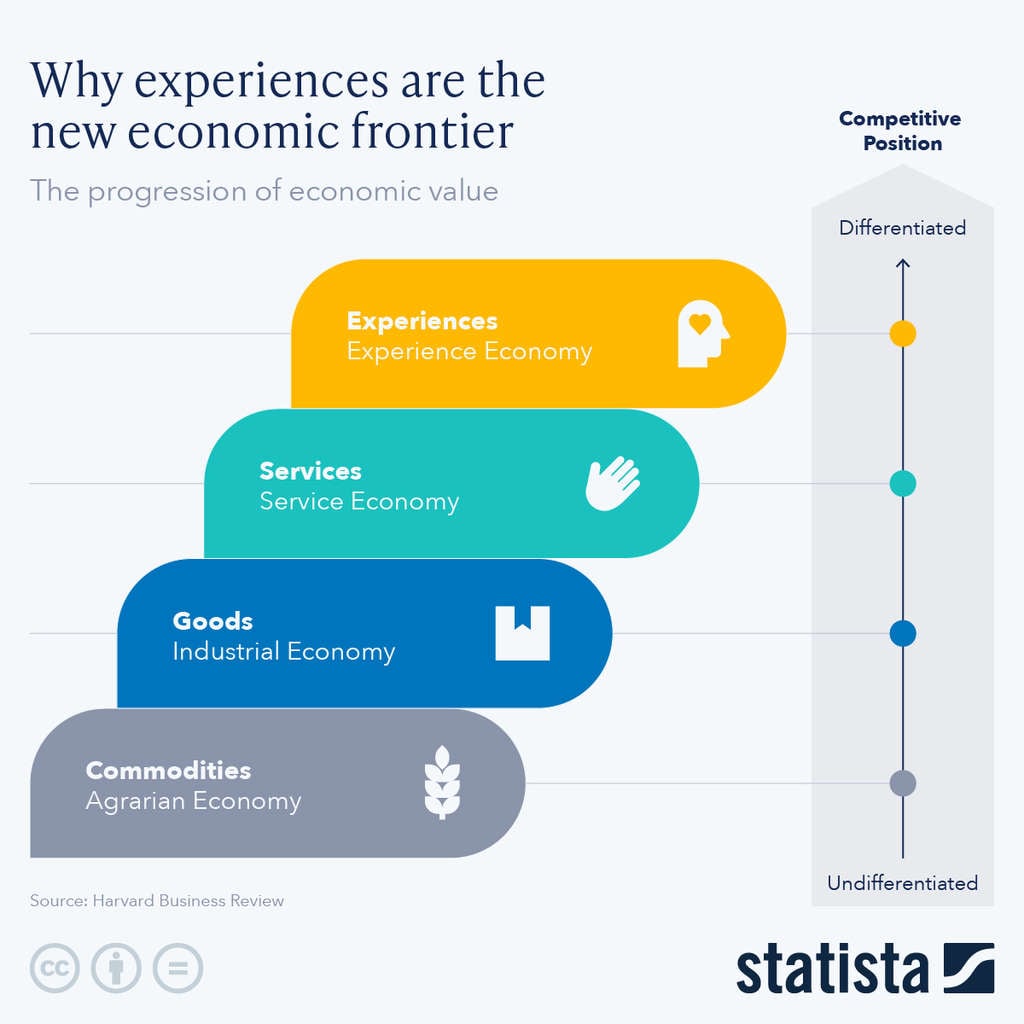

As the Harvard Business Review’s landmark article “Welcome to the Experience Economy” argues, economies evolve from extracting commodities to making goods, providing services, and ultimately staging experiences — each step adding personalization, immersion, and emotional resonance. Tourism exemplifies this shift.

Unlike sectors retrofitting for the experience economy, tourism was born into it. Leisure travel — distinct from transport, retail, or agriculture’s utilitarian origins — exists to deliver enjoyment, inspiration, and exploration. Its core value has always been experiential.

Why Experiences are the New Economic Frontier— Source: Statista

Why Experiences are the New Economic Frontier— Source: Statista

Accommodation SMEs also fully recognize this. When asked to name the biggest opportunities that can help further grow their business, some of the accommodations’ top answers are directly related to elevating the guest experience, such as investments in comfort and style/aesthetics, more personalized experiences, and introducing new services.

With the rise of the experience economy, Europe is uniquely positioned to lead the transition from mass tourism to quality tourism. The attainment of durable competitiveness will depend on the industry’s ability to deliver distinctive experiences while raising productivity through innovation and sustainable practices. This approach will generate greater value for both the wider economy and local communities — and hospitality SMEs are at the heart of this transformation.