Brussels (Brussels Morning Newspaper) January 17, 2026 – The European Union proposes the ‘Made in Europe’ law to address industrial decline across member states. The initiative seeks to enhance competitiveness through simplified regulations and funding for strategic sectors. European Commission President Ursula von der Leyen announced the plan amid concerns over factory closures and offshoring.

The legislation targets key industries including clean technology, pharmaceuticals, and advanced manufacturing. It introduces a single regulatory window for investments exceeding €500 million. Implementation aims for faster permitting processes, reducing approval times from years to months.

Core Provisions of Made in Europe Law

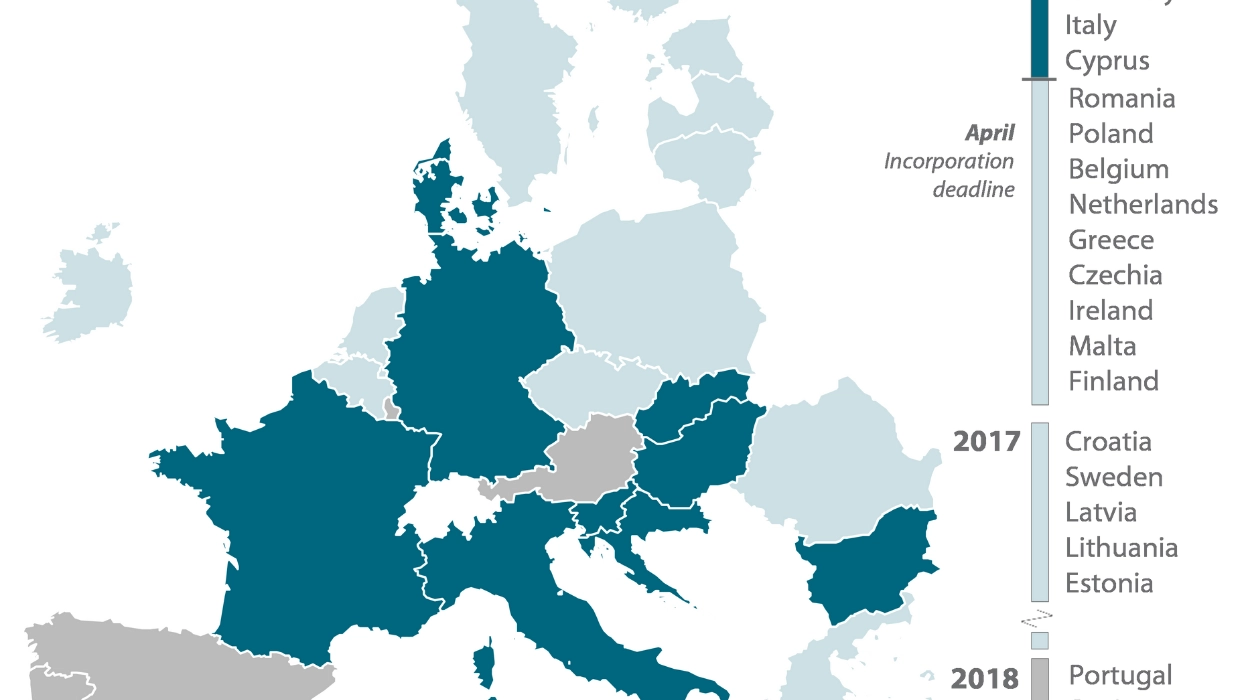

Credit: ECA.

Credit: ECA.

The law establishes a ‘Made in Europe’ label for products meeting EU production standards. Companies qualifying receive priority access to public procurement contracts worth billions annually. Subsidies support reshoring of critical supply chains disrupted by global tensions.

Strategic projects gain fast-track status under the initiative. This covers battery production, semiconductor fabs, and green hydrogen facilities. The Commission allocates €100 billion from existing funds like the Innovation Fund and Recovery Facility.

Background on Industrial Challenges

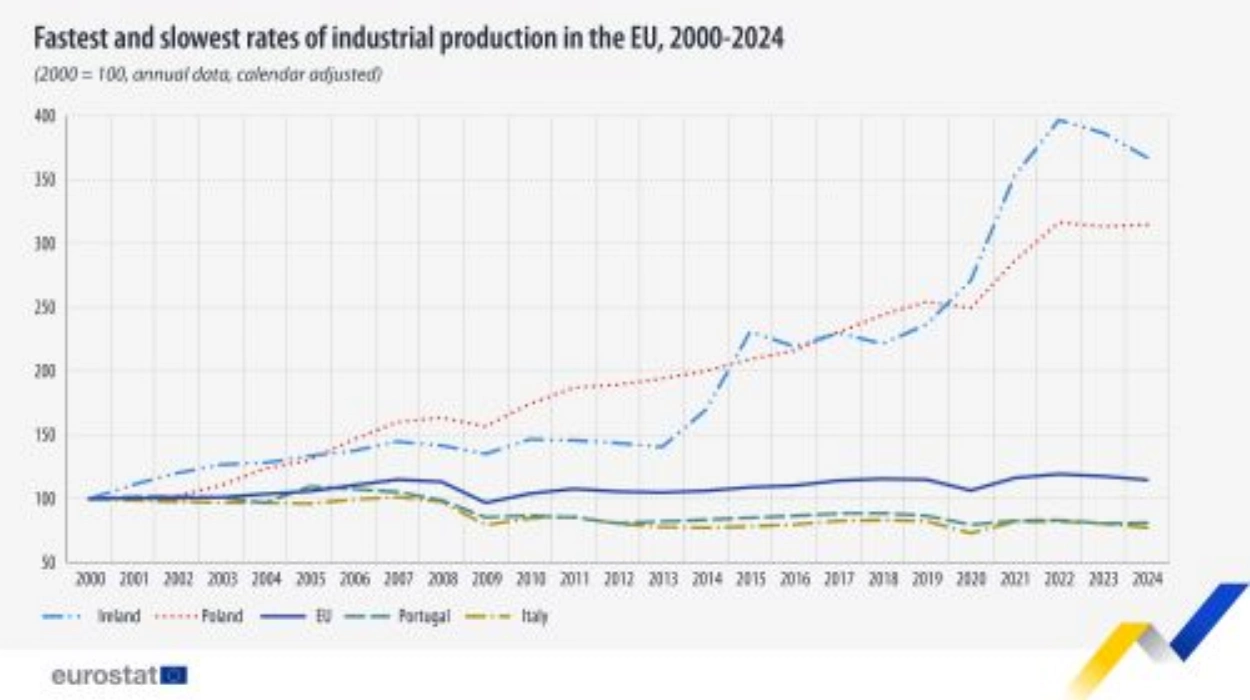

Credit: Eurostat (sts_inpr_a)

Credit: Eurostat (sts_inpr_a)

EU industrial output fell 7 percent in 2025, per Eurostat data from prior reports. Germany reported over 200,000 manufacturing job losses since 2023. France and Italy faced similar declines in automotive and steel sectors.

China’s dominance in electric vehicles and solar panels prompted the response. EU import dependency reached 90 percent for certain critical minerals. Von der Leyen highlighted these figures in her January State of the Union address.

Regulatory Simplification Measures

A key feature unifies 27 national permitting regimes into one EU process. Projects above €500 million threshold bypass fragmented approvals. Digital platforms handle applications, targeting 90-day decisions.

The law repeals 100 redundant directives identified in a 2025 regulatory fitness check. SMEs gain exemptions from certain reporting obligations. This reduces administrative burdens estimated at €50 billion yearly.

Funding and Investment Framework

Credit: defencefinancemonitor.com

Credit: defencefinancemonitor.com

€50 billion mobilises private investment via guarantees from the European Investment Bank. Public-private partnerships target €300 billion total by 2030. Horizon Europe budget increases 20 percent for industrial R&D.

Member states commit national co-financing matching EU contributions. Priority sectors align with the 2025 Net-Zero Industry Act. Semiconductors receive €43 billion under Chips Act expansion.

Strategic Sectors Targeted

Clean tech leads with 40 percent of funding allocation. Wind turbine and electrolyser manufacturing expand capacity to 100 GW by 2030. Pharma sector counters US Inflation Reduction Act subsidies.

Battery gigafactories aim for 1 TWh annual output. Chemical industry decarbonises via hydrogen integration. Defence production ramps up post-2025 security strategy.

Political Support and Opposition

Von der Leyen secured backing from 20 member states in Coreper meetings. Germany and Netherlands endorse strongly, citing export gains. France demands safeguards for agriculture-related industries.

Parliament negotiations begin February 2026. Greens push for stricter labour standards. Socialists seek SME protections in final text.

Comparison with Existing Initiatives

Net-Zero Industry Act sets 2030 targets for net-zero tech. Critical Raw Materials Act secures mineral supplies. Made in Europe integrates these into one framework.

US CHIPS and IRA Acts spurred €200 billion private EU investments since 2023. China’s Made in China 2025 prompted reciprocal measures.

Implementation Timeline

Commission tables formal proposal on February 1, 2026. Council adopts by qualified majority in Q2. Parliament co-decides under ordinary procedure.

Pilot projects launch mid-2026 in six member states. Full rollout by 2028 with annual progress reports. Monitoring via Eurostat industrial production index.

Member State Reactions

Germany’s Habeck calls it “renaissance for European industry”. Italy’s Giorgetti pledges €20 billion counterpart funding. Poland eyes defence sector benefits.

Spain requests more focus on renewables. Eastern states seek infrastructure upgrades. Nordic countries emphasise circular economy integration.

Global Context and Trade Implications

Plan responds to US tariffs averaging 20 percent on EU exports. Aligns with WTO rules via non-discrimination clauses. Avoids state aid conflicts through approved schemes.

China trade deficit hit €400 billion in 2025. Law promotes diversification without decoupling. India and ASEAN partnerships complement efforts.

Expected Economic Outcomes

Commission models predict 2 million jobs created by 2030. GDP uplift of 1.5 percent annually. Export growth of 15 percent in targeted sectors.

SMEs comprise 60 percent of beneficiaries via simplified access. Regional disparities address through cohesion funds. Annual review adjusts priorities.

Legislative Path Forward

Ordinary legislative procedure applies. Trilogue meetings scheduled Q3 2026. Entry into force targeted January 2027.

Von der Leyen links success to 2030 competitiveness goals. Competitiveness compass guides metric tracking.

Brussels Morning is a daily online newspaper based in Belgium. BM publishes unique and independent coverage on international and European affairs. With a Europe-wide perspective, BM covers policies and politics of the EU, significant Member State developments, and looks at the international agenda with a European perspective.