Improved dealmaking conditions drove a surge in investment banking fees for most of the top US banks in the final quarter of last year, as investors look ahead to what could be a milestone year for IPOs. But the sector has geopolitical ructions and a White House keen on corporate intervention to contend with ahead of November midterm elections.

Goldman Sachs (US:GS) and Morgan Stanley (US:MS) were the winners from the banks’ fourth-quarter earnings season, with their shares up 9 per cent and 7 per cent, respectively, in the first weeks of 2026, as rivals’ stock prices have declined. JPMorgan (US:JPM), the biggest bank in the world by market value, has slipped on short-term headwinds as its bank-wide revenues continued to grow robustly.

Read more from Investors’ Chronicle

A dealmaking boom?

Potential upcoming US listings include rocket builder SpaceX, AI start-ups OpenAI and Anthropic, and mortgage-backed securities giants Fannie Mae and Freddie Mac. December saw the biggest American listing of last year with the IPO of medical supplier Medline (US:MDLN).

After challenging years of recovery since the pandemic, the US investment banking outlook has also been aided by eased capital requirements and lending rules, which has led to hopes for a longer-term boom.

Goldman Sachs chief executive David Solomon said “CEOs definitely believe that the art of the deal and scaled consolidation is possible now”, given the “very different environment from [a] regulatory perspective for M&A” under the new administration.

RBC Capital Markets analysts flagged the banks’ “strong [deal] backlogs which could be unleashed in a more constructive economic and market environment”.

This dynamic was evident in investment banking and equities trading growth at leading banks. Goldman reported a 25 per cent increase in investment banking revenue in the fourth quarter, year-on-year, driving the bank’s total net income up 12 per cent to $4.6bn (£3.4bn). At Morgan Stanley, investment banking fees rose by 44 per cent on advisory and fixed income underwriting fees growth, with its net income up 19 per cent to $4.4bn.

Goldman’s equity trading net revenue was also up by a quarter, to a record $4.3bn, while at Morgan Stanley this metric rose 10 per cent to $3.7bn.

Citi (US:C) also posted significant investment banking growth, with fees up 38 per cent, while Bank of America’s (US:BAC) ticked up 1 per cent.

However, JPMorgan was the odd one out among the major players as it posted a 5 per cent fee drop in the final quarter, as deals were shifted into this year. Its net income fell 7 per cent to $13bn.

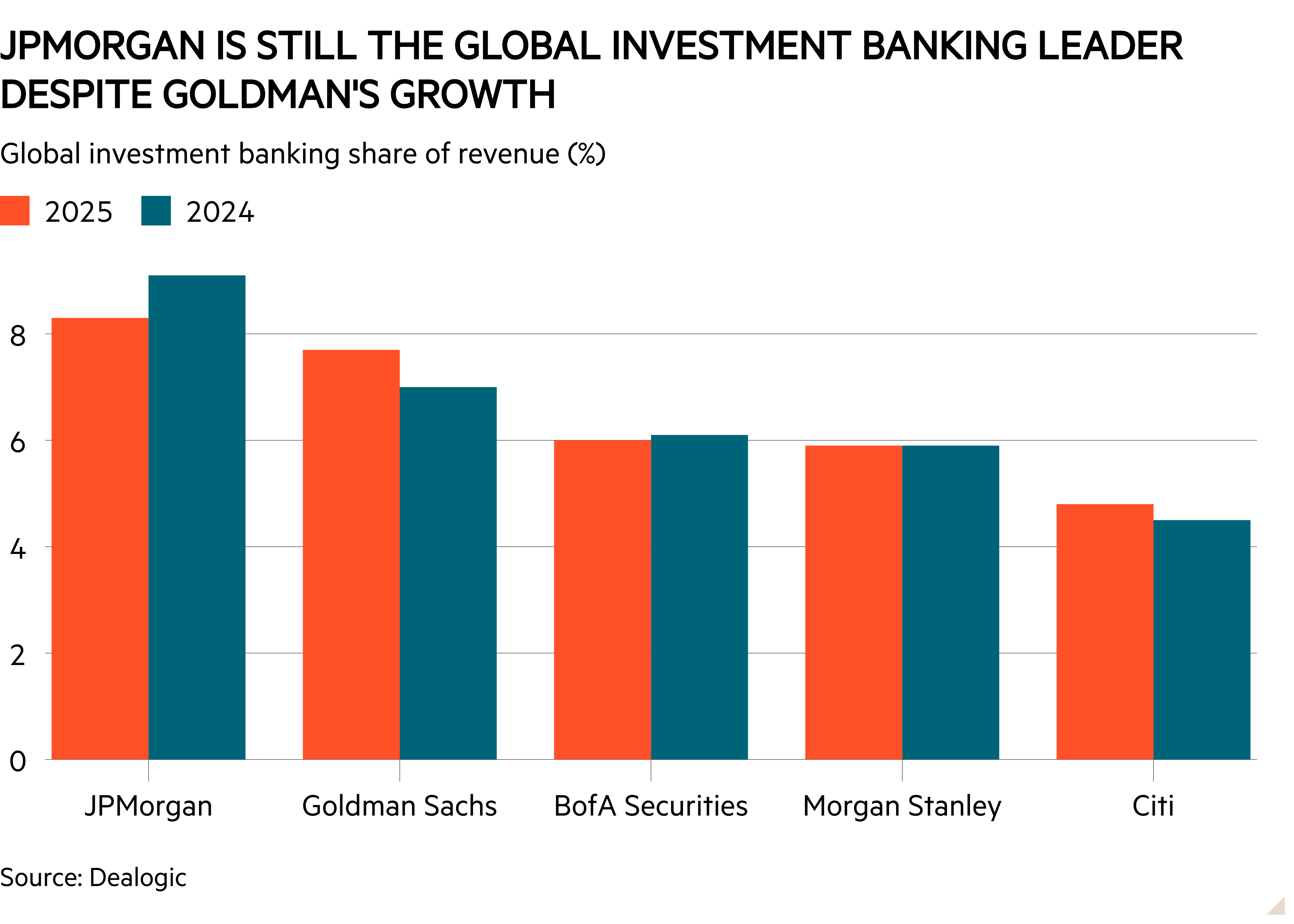

Goldman Sachs and Morgan Stanley have the greatest relative exposure to investment banking, at almost 18 per cent and 14 per cent of consolidated core revenue, respectively, according to RBC Capital Markets. But JPMorgan’s more than 8 per cent market share means it has firmly retained its global investment banking crown.

JPMorgan, which grew total net revenue by 7 per cent, saw client assets rise by a fifth to $7.1tn as it targets growth to $10tn. Its net interest income was up 7 per cent in the fourth quarter, and asset and wealth management (AWM) net revenue climbed 13 per cent to a new record.

Morningstar analyst Sean Dunlop said AWM has “some of the strongest growth prospects across the bank’s sprawling footprint and is a key driver of our forecast for 110 basis points of margin expansion over the decade to come”. He described the $10tn target as “very achievable”.

JPMorgan accounted for a $2.2bn credit reserve after taking Apple’s (US:AAPL) $20bn credit card portfolio from Goldman Sachs. The transition, announced earlier this month, is expected to complete in around two years.

Trump drama

The broader optimism linked to the potential IPOs listed above could be outweighed by a potential trade war between the US and the EU amid President Donald Trump’s threats to take control of Greenland.

The banks could also face damage from political moves amid concerns around the cost of living.

The shares of JPMorgan and Citi were hit in advance of the earnings season when President Trump called for a 10 per cent cap on credit card interest rates (an unlikely move which would need Congressional action). London-listed Barclays (BARC) also got a share price knock from the idea because of its American credit card operations.

Meanwhile, Trump’s long-running spat with Federal Reserve chair Jay Powell took a damaging turn this month when the Department of Justice initiated a criminal investigation against him.

JPMorgan chief executive Jamie Dimon warned Trump against undermining the Fed, as it could ultimately deliver higher rates and inflation, but also praised the “stimulus coming from the One Big Beautiful Bill”. He added that “deregulation is a plus in general, not just for banks, but banks will be able to redeploy capital”.

Bank valuations look, in some cases, full. JPMorgan and Goldman Sachs both trade on a price-to-tangible book value ratio of 2.7 times for this year, while the 3.5 times at Morgan Stanley is well above its five-year average.

Morningstar’s Dunlop argued that while JPMorgan’s “2026 outlook appears healthy, we continue to worry that the market is awarding peak cycle multiples (2.9 to 3 times tangible book value) to peak cycle results, which leaves shares unappealing at current prices”.