The State of Israel cannot win the future while highly and insanely taxing the people who build and support it. High friction, high ideology, high costs—that is the French model, and it bleeds talent. The alternative is obvious and strategic: cut growth-killing taxes, keep defense ironclad, and turn Israel into the Middle East’s most irresistible production state—more Abu Dhabi, less Paris.

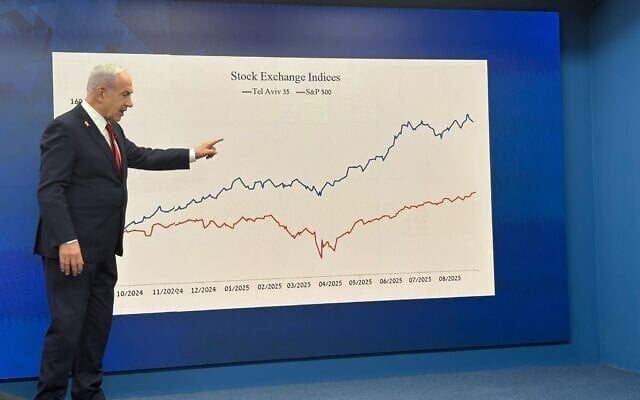

The timing is perfect. In 2026 the economy is snapping back hard. Growth has returned to the mid-3% range after wartime contraction, inflation has cooled back toward the central bank’s target, reserves remain among the strongest per capita in the OECD, and capital confidence is visibly recovering.

Hence, this is the window to reset the rules. Not austerity. Not slogans. A clean, pro-builder tax reform that rewards work, investment, and scale—while fully funding the IDF. Security is non-negotiable; waste is. You do not weaken deterrence by growing the economy—you harden it.

Thus, a larger and faster economy throws off more absolute shekels for missile defense, cyber, procurement, and readiness even at lower rates. Doubtlessly, deterrence scales with output.

Current data is unequivocal: the high-tech sector remains central to the economy, generating approximately one-fifth of GDP (over half of all exports), and most private R&D investment. Nevertheless, firms are increasingly shifting incorporation, intellectual property, and senior management abroad in response to tax and regulatory incentives. This pattern reflects revealed preference rather than ideology. Jurisdictions that reduce marginal tax rates while maintaining fiscal credibility tend to attract greater economic activity and achieve higher overall tax revenues in the long run.

The proof is regional. The United Arab Emirates did not hollow out the state by lowering taxes; it multiplied throughput, venture inflows, logistics density, and defense-adjacent industry. Capital intensity rewards speed, predictability, and low friction.

At the same time, lower friction does more for Israel’s image than 10 PR campaigns—money talks. Builders vote with wire transfers. Thence, a lean, fast, competitive Israel attracts founders, engineers, and—yes—diaspora capital that already loves the country but prefers to park its money in Cyprus. When capital comes, cities clean up, services improve, and infrastructure gets built. Soft power follows hard competence. And growth does the reputational work that diplomacy cannot.

Geopolitically, this is leverage. The Gulf does not want speeches; it wants capacity. A low-tax, rules-stable Israel becomes the natural partner for Saudi Arabia and the UAE in agriculture resilience, AI scale, and defense co-production. Fewer bottlenecks at home mean faster joint ventures abroad. Pre-cleared rules for IP, exports, and taxation turn normalization from ceremony into supply chains. That is sustainability through output, not optics.

And here is how it gets done without touching defense.

In my opinion, you have got to cut top marginal personal and capital-gains rates in stages while broadening the base and killing distortionary carve-outs so collections rise with activity, not ideology.

On the other hand, make founder-friendly capital rules that lightly tax exits only if proceeds are not reinvested domestically, while exempting reinvested gains and employee equity rollovers when IP and payroll stay in Israel.

Simultaneously, legislate a multi-year defense funding floor indexed to GDP, outside annual bargaining, so growth automatically finances the shield.

To make all this work, you also have to replace bureaucratic delay with national build-fast lanes—one-stop licensing, fixed timelines, approvals by default—so time-to-market collapses.

Certainly, all this offers a clear diaspora capital passport with predictable rates, instant onboarding, and zero retroactive surprises. Also, push for zero-base non-security spending, digitize procurement, and sunset programs that do not show output; kill waste, not capability.

Unmistakably, the diaspora will feel that they are being invited to build something not to unnecessarily get punished. Say “come and flourish—we won’t convert success into exile; that way your capital strengthens our nation.” The UAE mastered this psychology. Israel could also do it without losing its soul—or its shield.

At the structural level, if Israel does not cut fiscal friction and scale its productive base now, then—given the rising cost curves of advanced weapons, manpower, and strategic autonomy—the notion of full military independence within the next decade is not merely optimistic, it is geopolitically implausible: no middle power sustains sovereign deterrence without a fast-growing, capital-dense economy to finance it.

Bottom line: Israel does not need to be nicer. It needs to be irresistible. Cut the friction, protect the defense core, and let growth do what diplomacy cannot—lock in power.

Jose Lev Alvarez is an American–Israeli scholar specializing in Israeli security doctrine and international geostrategy.

Lev holds a B.S. in Neuroscience with a Minor in Israel Studies from The American University (Washington, D.C.), completed a bioethics course at Harvard University, and earned a Medical Degree.

On the other hand, he also holds three master’s degrees: 1) International Geostrategy and Jihadist Terrorism (INISEG, Madrid), 2) Applied Economics (UNED, Madrid), and 3) Security and Intelligence Studies (Bellevue University, Nebraska).

Currently pursuing a Ph.D. in Intelligence Studies and Global Security at Capitol Technology University in Maryland, his research focuses on Israel’s ‘Doctrine of the Periphery’ and the impact of the Abraham Accords on regional stability.

A former sergeant in the IDF Special Forces “Ghost” Unit and a U.S. veteran, Jose integrates academic rigor, field experience, and intelligence-driven analysis in his work.

Fluent in several languages, he has authored over 250 publications, is a member of the Association for Israel Studies, and collaborates as a geopolitical analyst for Latin American radio and television, bridging scholarship and real-world strategic insight.