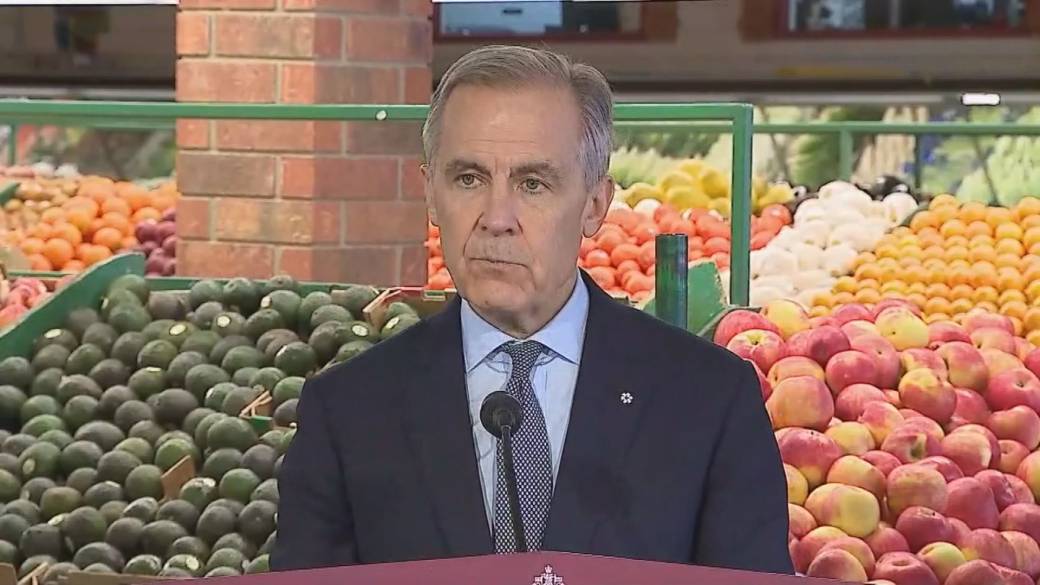

Gov. Tiff Macklem at the Bank of Canada said monetary policy, which includes adjusting interest rates if needed, can only do so much when it comes to counteracting the impacts from U.S. tariffs on Canada’s economy.

This comes after the Bank of Canada held its overnight benchmark interest rate at 2.25 per cent on Wednesday, which marked the second straight hold to borrowing rates.

“Monetary policy cannot compensate for the structural damage caused by tariffs, and it can’t target hard-hit sectors of the economy. But it can play a supporting role helping the economy through this period of structural adjustment while maintaining inflation,” said Macklem.

The current Canada-United States-Mexico Trade Agreement (CUSMA) is set for renegotiation later this year, and depending on how these events evolve, the Bank says it’s “ready to respond” by adjusting rates accordingly.

“As the Canadian economy continues to adjust to U.S. trade restrictions, we expect the economy to grow modestly and inflation to stay close to our two per cent target. However, uncertainty around our forecast is heightened. The range of possible outcomes is wider than usual. U.S. trade policy remains unpredictable and geopolitical risks are elevated,” said Macklem.

Story continues below advertisement

“Governing Council judges the current policy rate remains appropriate, conditional on the economy evolving broadly in line with the outlook we published today with heightened uncertainty. We are monitoring risks closely if the outlook changes. We are prepared to respond.”

Although they considered multiple scenarios regarding the outcome of tariff negotiations, the Bank’s current projections for the Canadian economy are based on the scenario where tariffs that are currently in place remain in place.

“What that means is that the tariffs on the hard hit sectors stay, the CUSMA exemptions for everything else remain in place. That could change with the review,” said Macklem.

1:05

Carney links Trump’s latest tariff threat to CUSMA negotiations

In its projections, the Bank of Canada says economic growth, as measured by GDP, will “pick up gradually” over time, but will be weaker this year. 2025 is still expected to show about 1.7 per cent growth for the full year, 2026 will be up by 1.1 per cent and 1.5 per cent in 2027.

Story continues below advertisement

Lowering rates further could provide a boost for the economy, but there is a risk that inflation could accelerate.

Get daily National news

Get the day’s top news, political, economic, and current affairs headlines, delivered to your inbox once a day.

“With inflation slightly above target and economic momentum still intact, keeping rates on hold preserves room to respond if trade conditions deteriorate later in the year, at that point, lowering rates could provide further stimulus for the Canadian economy,” said David-Alexandre Brassard, chief economist at Chartered Professional Accountants of Canada in a written note.

More on Money

More videos

“Trade frictions have created real challenges for specific industries, but the overall Canadian economy has absorbed the shock better than anticipated, thanks in part to carveouts under CUSMA.”

Following Wednesday’s announcement, the Bank of Canada released a statement detailing the economic conditions which led to Wednesday’s decision.

“The outlook for the global and Canadian economies is little changed relative to the projection in the October Monetary Policy Report (MPR). However, the outlook is vulnerable to unpredictable U.S. trade policies and geopolitical risks,” said the Bank of Canada.

“U.S. trade restrictions and uncertainty continue to disrupt growth in Canada. After a strong third quarter, GDP growth in the fourth quarter likely stalled. Exports continue to be buffeted by U.S. tariffs, while domestic demand appears to be picking up. Employment has risen in recent months. Still, the unemployment rate remains elevated at 6.8 per cent and relatively few businesses say they plan to hire more workers.”

Story continues below advertisement

Canada’s GDP, or Gross Domestic Product, showed the economy shrank 0.3 per cent in October, and the labour market showed signs of weakening in December, when the unemployment rate increased to 6.8 per cent from 6.5 per cent in November, according to Statistics Canada.

Consumer inflation was last measured at 2.4 per cent in December, which is roughly in line with the Bank of Canada’s two per cent target.

Trending Now

-

1 person shot, in critical condition in incident involving U.S. Border Patrol

-

What is Nipah virus? What to know about the disease as India faces outbreak

“Despite mounting signs of the country’s weakening labour market, the Bank opted for the wait-and-see approach today [Wednesday]. It isn’t surprising — headline inflation may be within target thresholds, but when you look under the hood, some essential outliers, particularly where foods costs are concerned, are worrisome,” said financial expert Shannon Terrell at NerdWallet Canada in a written note.

“Stability matters for an economy being tugged in different directions by shifting trade relationships.”

2:34

Business Matters: Home sales expected to bounce back in 2026, CREA says

What this all means for borrowers

When the Bank of Canada adjusts its key policy rate, commercial lenders like the major banks will modify the rates they offer to customers based off any changes that the central bank makes.

Story continues below advertisement

Since there were no changes to the Bank’s benchmark, borrowing costs are staying unchanged, for now.

This means Canadians applying for a loan like a mortgage or for a car would likely get the same rates now as they would have before the announcement, and those with variable rate loans will wind up paying the same as they have been unless rates change again or loans need to be modified.

For those struggling with debt and the higher cost of living in Canada, that might also mean there’s no financial relief from the Bank of Canada this time around.

“For Canadian households, holding rates steady doesn’t fix the problem, it freezes it. Costs are still high, income growth is uneven, and there’s no clear moment where things start to feel easier,” said personal finance and debt expert Stacy Yanchuk Oleksy at Money Mentors in a written note.

“Even small inflation bumps land harder now because families don’t have the buffer they used to. What we’re seeing is a lot of people stuck in place. They’re not in crisis, but they’re not moving forward either, and that constant state of ‘almost okay’ is what keeps financial stress elevated.”

© 2026 Global News, a division of Corus Entertainment Inc.