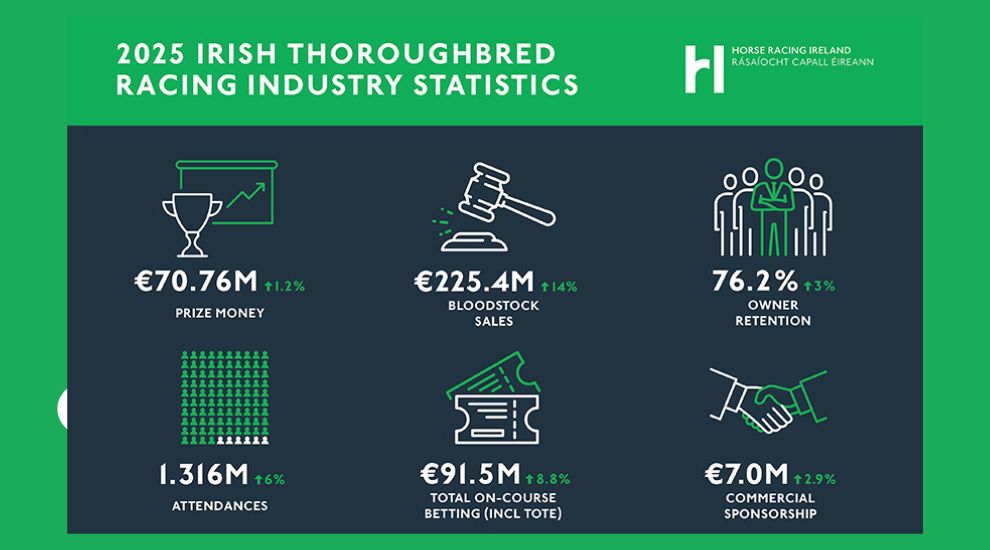

Racecourse attendances, betting turnover and commercial revenues all rose last year as Ireland’s horse racing and breeding industry delivered another strong performance across a wide range of key indicators.

Figures for 2025, published yesterday by Horse Racing Ireland, show growth in most of the sport’s core economic and participation measures, with particularly significant gains recorded in bloodstock sales, attendances and owner retention.

The standout increase came in the combined value of bloodstock sold at public auction, which climbed by 14% year-on-year to €225.4 million, underlining the continued global demand for Irish-bred horses and the strength of the country’s breeding sector.

For context, in another story on Sport for Business this morning, that figure is just short of the total sponsorship spend across all sectors in Ireland in 2025.

Attendances across Ireland’s 26 racecourses also continued to trend upward. A total of 1.316 million people attended races in 2025, up 6% from the previous year, across 390 fixtures nationwide. Growth was evident at both major festivals and regional meetings, reinforcing the sport’s appeal as a live sporting and social experience.

Betting activity through the Tote recorded similarly positive movement. Overall, Tote turnover reached €81.3 million, up 7.2% from 2024. This included €10.6 million wagered on-course, up by 1.9%, and €62.8 million bet off-course on Irish pools, an increase of 9.0%. Betting through the World Pool on some of Ireland’s flagship Flat fixtures generated €7.9 million in turnover, up 1.3% year-on-year.

Commercial income also continued to grow. Sponsorship revenues rose by 2.9% to €7.0 million, while support from the Irish European Breeders’ Fund increased by 6.9% to €3.1 million, reflecting sustained confidence from commercial partners in the sport’s reach and value.

Prize money offered across Irish racing totalled €70.76 million in 2025, an increase of 1.2% on the previous year. Irish-trained horses earned exactly £20 million in prize money in Britain, a slight decrease of 2% on 2024, but performances elsewhere on the international stage helped offset that decline, with prize money won by Irish horses worldwide rising by 35.8%.

On the racing side, average field sizes increased slightly to 11.51 runners per race. While the overall volume of entries dipped by 5.1%, the total number of runners at 33,230 was virtually unchanged year-on-year, suggesting a broadly stable competitive landscape.

Racehorse ownership figures offered further encouragement. The total number of owners increased by 1.1% to 4,791, while owner retention improved by three percentage points to 76.2%. Although the recruitment of new owners slipped to 790 — down 5.7% from 2024 and 3.5% from two years ago — the number of companies registered as owners rose sharply by 15.1% to 206, pointing to growing long-term engagement with the sport.

Speaking on the release of the figures, Suzanne Eade, Horse Racing Ireland CEO, said the data showed an industry that continued to perform well across multiple fronts.

“The industry figures for 2025 reveal a racing and breeding industry that performed well,” she said. “Attendances were strong, and many tracks around the country showed increased attendance figures year-on-year.”

She highlighted the role of major fixtures in driving that growth, noting that several of Ireland’s best-known meetings recorded significant increases. “The bigger festivals performed strongly, and Punchestown’s festival being up by over 15% to more than 136,000 patrons is a good example,” she said.

Eade also pointed to gains at the Irish Derby weekend at the Curragh, the Galway Races, Listowel’s Harvest meeting and Leopardstown’s Christmas Festival, all of which posted attendance increases and contributed to the overall rise in footfall.

“Prize money, betting turnover, the value of bloodstock sales and sponsorship all moved in a positive direction, too,” she added. “These are indicators that our sport is in good health and that it continues to hold a broad appeal.”

While acknowledging that challenges remain, Eade said HRI’s strategic focus was firmly on sustaining and building on those gains. The organisation’s budget for the current year, she said, is aligned with addressing key pressure points across the industry, from participation and ownership to competitiveness and international positioning.

“The targets laid out in our Strategic Plan 2024–2028 are designed to enhance how all aspects of the industry perform,” she said. “As we get closer to these stated aims, these improvements, we believe, will yield even stronger results in the years to come.”

Taken together, the 2025 figures suggest an industry that continues to balance tradition with commercial momentum, buoyed by strong public engagement, robust international demand for Irish bloodstock and growing confidence from sponsors and owners alike.

A timely reminder of the popularity of the sport as we head into the weekend of the Dublin Racing Festival at Leopardstown.

Image Credit: Horse Racing Ireland

Event Tickets

Upcoming Events

SPORT FOR BUSINESS

Sport for Business is Ireland’s leading platform focused on the commercialstrategic and societal impact of sport. It connects decision-makers across governing bodies, clubs, brands, agencies and public institutions through high-quality journalism, events and insight. Sport for Business explores how sport drives economic value, participation, inclusion and national identity, while holding organisations to account on governance and sustainability.

Through analysis, storytelling and convening the sector, it helps leaders understand trends, share best practice and make better-informed decisions. Its work positions sport not just as entertainment, but as a vital contributor to Ireland’s social and economic fabric.

Find out more about becoming a member today.

Or sign up for our twice-daily bulletins to get a flavour of the material we cover.

Sign up for our News Bulletins here.