Research listed top taxpayers from the worlds of music and the arts, high finance and the high street, as well as billionaire aristocrats and rags-to-riches entrepreneurs

Erling Haaland’s bumper wages meant he was liable for hefty tax bill too (Image: Copa/Getty Images)

Premier League superstars Erling Haaland and Mohamed Salah have been listed among Britain’s biggest taxpayers.

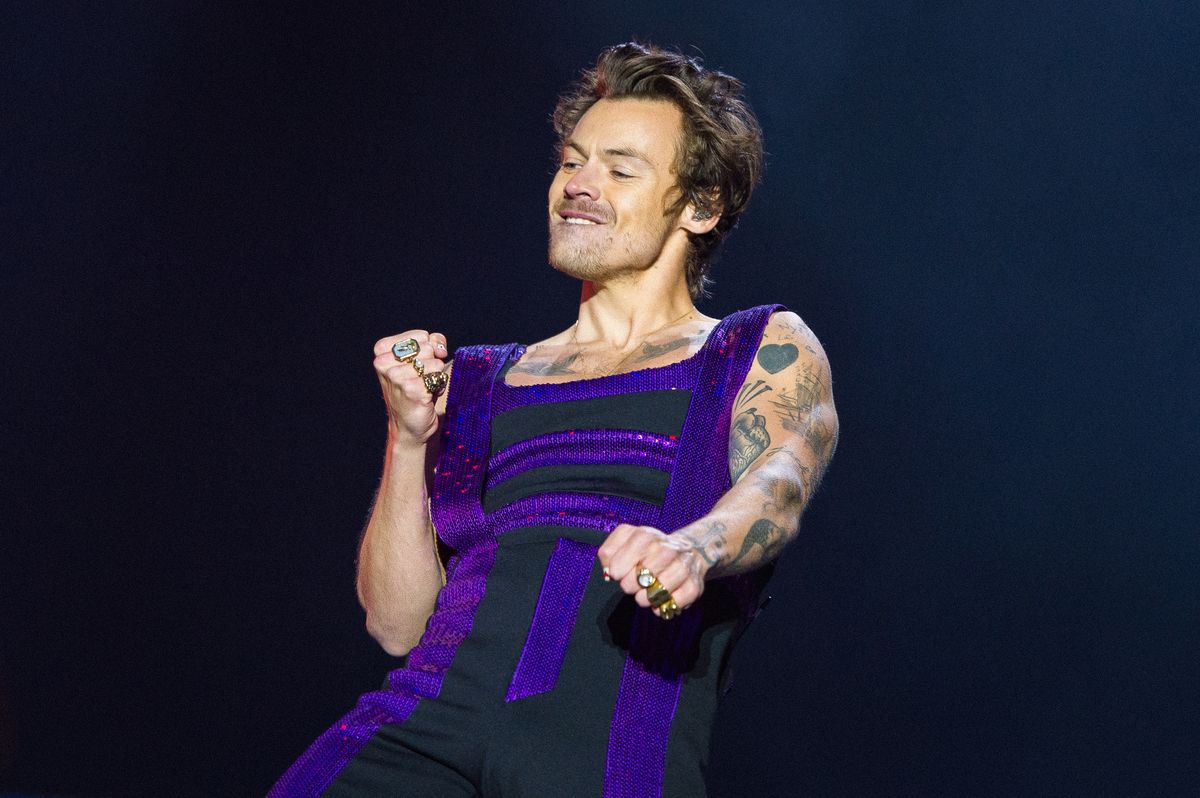

Others in the top 100 include Former One Direction singer Harry Styles, Harry Potter author JK Rowling and stadium-filling musician Ed Sheeran. They have been named as among the wealthy individuals or families in this year’s Sunday Times Tax List. The research takes in a variety of different ways in which they have contributed to the taxman’s coffers.

Some are directly, for example through taxes they were liable for on bumper salaries and bonuses, or such as levies on dividend windfalls raked in. But in the case of mega-wealthy individuals from the worlds of business and finance, it also covers what their companies were simply required to collect on behalf of the Treasury in the form of everything from corporation tax to employers’ national insurance.

The authors of the report then calculated a figure relative to what chunk of the firm they own. The eighth edition of the Tax List – released on the deadline for millions of people to submit their annual self-assessment tax return – features figures from music and arts, high finance and the high street, as well as billionaire aristocrats and rags-to-riches entrepreneurs.

READ MORE: HMRC 1.3m letters ‘need action by Saturday’ after tax threshold freezeREAD MORE: HMRC to roll out penalty points system – and you risk £200 fine for mistakes

Top scorer Mo Salah was also reckoned to have netted nearly £17m for the taxman (Image: Getty)

For the first time, gambling founders Fred and Peter Done of Betfred top the rankings, with an estimated contribution of £400.1million, up from £273.4million a year ago. The brothers started the company in 1967 and it is headquartered in Warrington, Cheshire. In their case, the research also includes a percentage of how much Betfred handed over in gambling duties.

Fellow gambling dynasty Denise, John and Peter Coates of rival Bet365 make fifth spot, with £227.1million. It recently emerged that Denise Coates had netted another £260million in salary and dividends last year, taking her payouts over 15 years to £2.7billion.

Harry Styles – whose recently announced world tour includes a record 12-night residency at Wembley Stadium – is a new entry at number 54, paying £24.7million in tax last year.

Also appearing for the first time are two footballers: Manchester City striker Erling Haaland (number 72), who earns £500,000 a week plus £10million in extras, with an estimated tax payment of £16.9million. Liverpool ace Mohamed Salah (number 81), whose £400,000-a-week basic salary plus an estimated £10million in bonuses and additional payments results in an estimated tax bill of £14.5million.

Other famous names on the list include JK Rowling – at number 36 with a £47.5million contribution, and Ed Sheeran (number 64 and £19.9million). Heavyweight boxing champion Anthony Joshua (number 100 and £11million). recently cheated death in a car crash in Nigeria in which two of his close friends were killed.

Top taxpayers from the world of showbiz said to include chart-topped Harry Styles (Image: GETTY)

The 100 wealthy individuals or families in this year’s Sunday Times Tax List paid an estimated total of £5.758billion of tax, up from £4.985billion a year ago.

Robert Watts, who compiled The Sunday Times Tax List, said: “This is an increasingly diverse list with Premier League footballers and world famous pop stars lining up alongside aristocrats and business owners selling pies, pillows and baby milk. This year there’s been a big jump in the amount of tax we’ve identified – largely because of higher corporation tax rates.

“All of the 100 individuals and families who appear delivered at least £11million to the Exchequer over the past year.”

Among the top 100, 45 were found to have paid more tax than last year, fuelled by the rate of corporation tax jumping from 19% to 25% in 2023/24, and a higher tax rate on dividends.

Construction was the best represented sector of the economy, accounting for 10 of the entries. Eight are from the world of finance, including a new entry from Russian-born Nik Storonksy, founder of banking service group Revolut, in 20th place and an estimated £81.3million contribution in different ways.

Twenty-one entries were London-based, with a further 11 from the south-east. But 14 came from the north-west, including publicity-shy billionaire Tom Morris and family, in seventh place on the list and £209.1million. Ex-market trader Mr Morris, who founded discount chain Home Bargains and is known as Liverpool’s richest man, has amassed an estimated fortune of almost £7billion in the previously published separate Sunday Times Rich List.

Mr Watts added: “One in nine of the people who make the Tax List are no longer listed as resident here in the UK, instead choosing to live in Monaco, Dubai, Switzerland, Cyprus, Portugal, the United States or the Channel Islands. Clearly the Tax Listers who have moved offshore are still delivering huge sums to HM Treasury through their businesses, but the Chancellor would no doubt be raising even more money from these people had they chosen to stay put and remain liable for personal tax here.

Andrew Speke, interim director for the High Pay Centre, said: “One thing which is always notable when the Sunday Times Tax List is published is how few of those heading the Rich List are also at the top of the Tax List.

“This year, only three of those in the top 20 of the Rich List are also in the top 20 of the Tax List.

“Given that those who come out to bat in defence of the super rich are so keen to point to how much tax they pay, the lack of correlation between these two lists raises important questions about how effectively large concentrations of wealth are taxed. Because much wealth is held in assets that are lightly taxed or only taxed when sold, vast fortunes do not necessarily translate into large annual tax bills – highlighting the potential scale of tax revenue being lost through the under-taxation of wealth.”

The Top 20 Taxpayers in Britain 2026

1. Fred and Peter Done and family

Gambling

£400.1m

2. Alex Gerko

Financial trading

£331.4m

3. Chris Rokos

Hedge fund

£330m

4. Stephen Rubin and family

Sportswear

£325.6m

5. Denise, John and Peter Coates

Gambling

£227.1m

6. Peter Hargreaves

Finance

£210m

7. Tom Morris and family

Retail

£209.1m

8. Sir Tim Martin

Pubs

£199.7m

9. Mike Ashley

Sports equipment and fashion

£175.9m

10. Dame Mary and Douglas Perkins and family

Opticians

£121.7m

11. Suneil Setiya

Hedge fund

£114.2m

12. Greg Skinner

Hedge fund

£114.2m

13. Leonie Schroder and family

Finance

£113.4m

14. Sir James Dyson

Technology

£100m

15. Glenn Gordon and family

Distilling

£93.8m

16. Sir John Timpson and family

Retail

£86.7m

17. John Bloor

Housebuilding and motorbikes

£86m

18. Sir Chris Hohn

Hedge fund

£85.4m

19. Lady Philomena Clark and family

Car sales

£81.3m

20. Nik Storonksy

Financial services

£81.3m