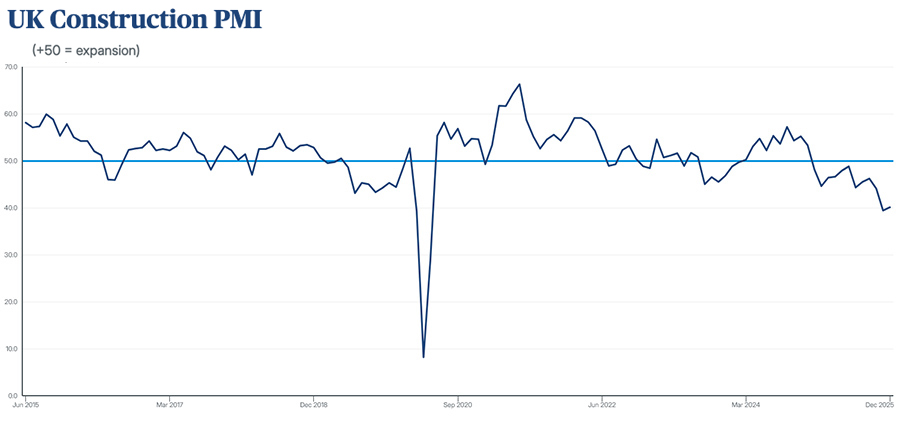

Construction tender prices could rise by more than 5% in 2026, threatening the cost and viability of major UK programmes. New analysis from Turner & Townsend suggests that in combination with a tumbling purchasing manager’s index for the sector, there could be a coming crunch for the consulting sector as a whole.

Examining December’s S&P Construction PMI, Turner & Townsend found that it remains firmly below the 50.0 threshold, indicating continued contraction in workloads over the past 12 months. Civil engineering was the weakest performing sector, while two subsectors (residential and commercial) recorded the sharpest drop in activity since May 2020, accompanied by significant declines in new orders and employment.

The survey’s respondents attributed the current outlook to weak market confidence and slow progression on the pipeline. However, looking ahead, firms expecting increased activity over the next 12 months slightly outnumbered those predicting a decline. The UK’s long-term economic prospects, falling inflation and lower borrowing costs were seen as key drivers of the future workload.

Source: Turner & Townsend

Stephanie Marshall, UK managing director of real estate cost management at Turner & Townsend, added, “It was an uncertain final quarter of last year – from the chancellor’s budget to geopolitical tensions which have very much continued into 2026. It’s no surprise then that clients remain nervous about committing to projects.”

While this outlook might seem bleak, Marshall also noted that “the demand is there, both from public and private sectors, as the country works to revive economic growth”. In particular, there are a number of major programmes set out in the UK government’s spending review, expected to come online in the next 24 months – but in the meantime, “we can’t afford for the construction sector to wait for the real capacity crunch to hit.”

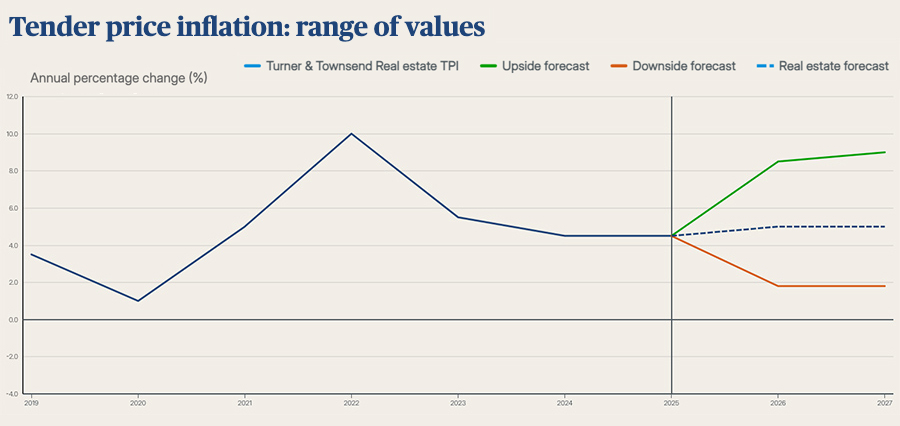

First, the sector will have to reckon with the fact that construction tender prices are set to rise. According to the researchers, it could lift by over 5% this year, threatening costs for key UK programmes and challenging project viability in the infrastructure segment in particular – though that will be a lower 3.5% in the real estate sector. While these both represent only a modest 0.5% lift from the TPI rates experienced last year, sustained cost escalation is putting pressure on the viability of new projects at a time of economic uncertainty.

Source: Turner & Townsend

Marshall added, “Clients need to grasp the nettle and get ahead to ensure programmes get off the ground and stay on track. In today’s complex environment of cost inflation, capacity challenges and regulatory reforms, close tracking of viability can’t be limited to the procurement phase or a single ‘go / no go’ moment – it needs constant review throughout the programme. Engaging with the supply chain early and working with them as true partners, rather than just suppliers, will also help in horizon scanning and addressing problems quickly. There are significant opportunities facing our industry – to make the most of these and deliver for the wider UK economy, we need to get the right business cases, models and skills in place now.”

The UK has one of the highest rates of builder collapses in the G7, and some of the worst payment times – resulting in poor cash-flow throughout the supply chain. While larger construction firms are working to preserve working capital to deal with this, it is especially bad news for the small businesses who make up 98% of the construction sector.

With a fall in output – the S&P Global UK Construction Purchasing Managers’ Index argued that November saw output sink to its lowest level since 2020 – and with Turner & Townsend forecasting tender prices are set to jump further, a construction crunch may be on the horizon. In recent weeks, two large construction firms have entered administration. Warwick Ward, a major construction plant dealer, was placed into administration in December after 55 years of trading, followed by Caldwell Construction – which provides groundworks services for several national housebuilders and employs more than 400 people – less than a month later.