The UK market has been experiencing some turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market concerns, penny stocks remain an intriguing area for investors seeking opportunities in smaller or less-established companies. While the term “penny stock” might seem outdated, it still captures the potential for discovering value in firms with solid financials and growth prospects.

Name

Share Price

Market Cap

Financial Health Rating

DSW Capital (AIM:DSW)

£0.55

£13.82M

★★★★★★

Brickability Group (AIM:BRCK)

£0.516

£166.33M

★★★★★☆

Foresight Group Holdings (LSE:FSG)

£4.17

£476.49M

★★★★★★

Ingenta (AIM:ING)

£0.995

£15.02M

★★★★★★

System1 Group (AIM:SYS1)

£2.24

£28.42M

★★★★★★

Integrated Diagnostics Holdings (LSE:IDHC)

$0.6275

$364.78M

★★★★★☆

Michelmersh Brick Holdings (AIM:MBH)

£0.85

£77.06M

★★★★★★

Impax Asset Management Group (AIM:IPX)

£1.586

£192.08M

★★★★★★

Spectra Systems (AIM:SPSY)

£1.47

£70.97M

★★★★★☆

Begbies Traynor Group (AIM:BEG)

£1.185

£190.7M

★★★★★☆

Click here to see the full list of 283 stocks from our UK Penny Stocks screener.

Let’s take a closer look at a couple of our picks from the screened companies.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Borders & Southern Petroleum plc is an independent oil and gas exploration company operating in the Falkland Islands with a market cap of £81.29 million.

Operations: Borders & Southern Petroleum plc has not reported any revenue segments.

Market Cap: £81.29M

Borders & Southern Petroleum, with a market cap of £81.29 million, is a pre-revenue oil and gas exploration company operating in the Falkland Islands. The company remains debt-free and has sufficient cash runway for over a year based on its current free cash flow. Its board of directors is experienced, with an average tenure of 5.2 years. Despite these strengths, Borders & Southern faces challenges such as high share price volatility and an unprofitable status with no significant revenue streams reported. Earnings are forecasted to decline by 9.1% annually over the next three years, highlighting potential risks for investors.

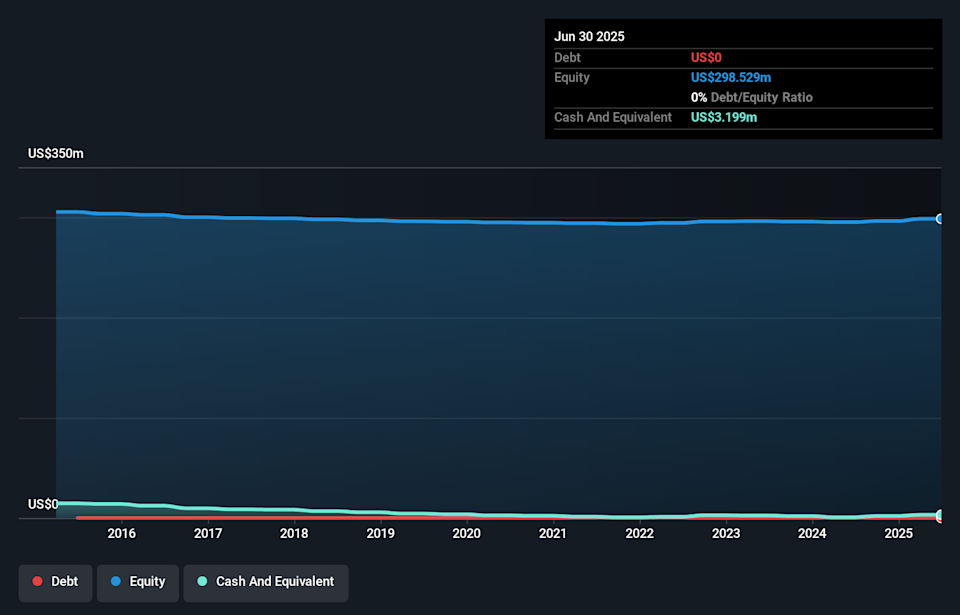

AIM:BOR Debt to Equity History and Analysis as at Feb 2026

AIM:BOR Debt to Equity History and Analysis as at Feb 2026

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ZOO Digital Group plc, along with its subsidiaries, offers productivity tools and media services across the United Kingdom, United States, India, Italy, Germany, South Korea, and other international markets with a market cap of £13.52 million.

Story Continues

Operations: The company’s revenue is primarily derived from three segments: Localisation ($24.56 million), Media Services ($18.88 million), and Software Solutions ($0.95 million).

Market Cap: £13.52M

ZOO Digital Group, with a market cap of £13.52 million, operates across various international markets and derives revenue from Localisation, Media Services, and Software Solutions segments. Despite being unprofitable with a negative return on equity of -36.43%, it has no debt and maintains a cash runway exceeding three years. Recent earnings reported sales of US$22.39 million for the half-year ending September 2025, showing improvement in net loss compared to the previous year. However, its share price remains highly volatile over recent months. The experienced management team averages 3.1 years in tenure, while the board averages 7.5 years.

AIM:ZOO Debt to Equity History and Analysis as at Feb 2026

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CAB Payments Holdings Limited operates through its subsidiaries to offer foreign exchange and cross-border payment services to banks, fintech companies, supranationals, and governments both in the United Kingdom and internationally, with a market cap of approximately £206.14 million.

Operations: The company’s revenue segment is primarily derived from Unclassified Services, amounting to £88.73 million.

Market Cap: £206.14M

CAB Payments Holdings, with a market cap of £206.14 million, recently faced the cancellation of a significant M&A transaction by Helios Investors. Despite this setback, the company has strengthened its position through strategic partnerships and regulatory advancements, notably securing a Category 2 Financial Services Permission from ADGM for its Middle Eastern subsidiary. While CAB Payments is debt-free and forecasts suggest earnings growth of 30.93% annually, it faces challenges such as negative earnings growth over the past year and declining profit margins from 21.9% to 7.1%. Its board and management team are relatively inexperienced with short average tenures.

LSE:CABP Debt to Equity History and Analysis as at Feb 2026

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:BOR AIM:ZOO and LSE:CABP.

This article was originally published by Simply Wall St.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com