SUMMARY

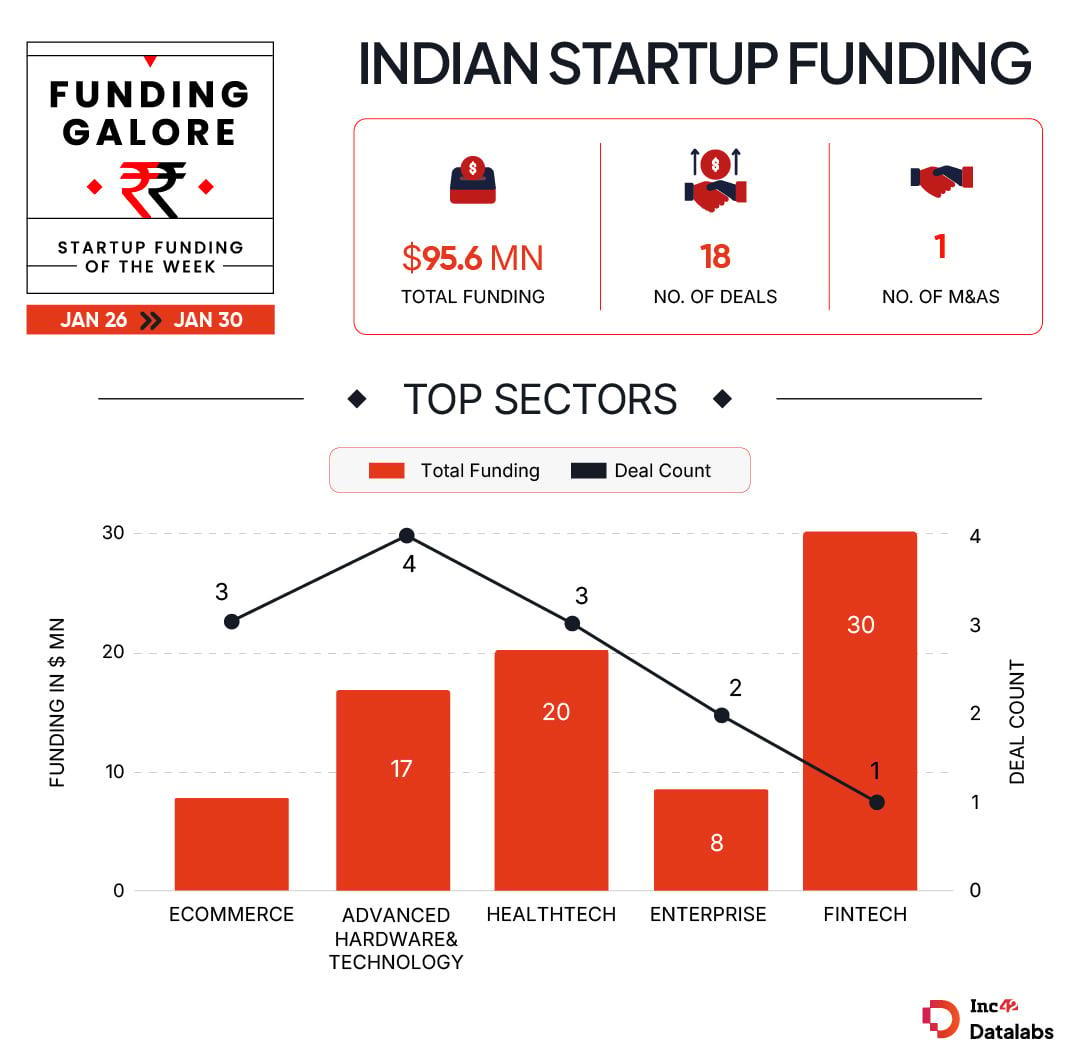

Between January 26- 30, Indian startups raised a total of $ 95.6 Mn, marking a decline of 68% from the $302.8 Mn cumulatively raised by Indian startups

Advanced Hardware & Technology segment saw the highest four deals materialise this week, with startups raising $17 Mn in cumulative funding.

Ace investor Ashish Kacholia emerged as the most active investor this week with two investments – 4baseCare and 1Buy.AI

As industries buckle up for Union Budget 2026, to be tabled by Finance Minister Nirmala Sitharaman tomorrow, the funding activity in the Indian startup ecosystem took a back seat this week.

Between January 26- 30, Indian startups raised a total of $ 95.6 Mn, marking a decline of 68% from the $302.8 Mn cumulatively raised by Indian startups. The deal count stood at 18 this week.

Funding Galore: Indian Startup Funding Of The Week [Jan 26 – 30]

*Part of larger round

Key Startup Funding Highlights Of The Week

- Easy Home Finance raised $30 Mn in its Series C funding round led by Investcorp this week. On the back of this round, fintech became the most funded startup sector this week.

- In terms of deal count, the Advanced Hardware & Technology segment saw the highest four deals materialise this week, with startups raising $17 Mn in cumulative funding.

- Seed stage funding slumped 40% week-on-week, with three startups at this stage raising $12.9 Mn.

- Ace investor Ashish Kacholia emerged as the most active investor this week with two investments – 4baseCare and 1Buy.AI.

Startup IPO Updates This Week

Other Developments Of The Week

- Navam Capital, which counts Ather Energy in its portfolio, marked the final close of its maiden alternative investment fund (AIF), at INR 315 Cr to back Indian deeptech startups building for global markets. The fund, which had a target corpus of INR 250 Cr, was oversubscribed and closed at INR 315 Cr following the exercise of green shoe option.

]]>