Major central banks around the globe are heading to a week of their respective committee meetings, trying to stay firm on their policy path and goals of keeping inflation at bay in the face of ever-growing risks – from U.S. President Donald Trump’s tariffs to fresh conflict in the Middle East.

The U.S. central bank will lead the way and is likely to announce after the second day of its meeting on June 18 that it would keep interest rates unchanged for a fourth straight time, despite Trump’s push for rate cuts, as officials contend with uncertainty sparked by the Republican’s tariffs.

While the independent U.S. Federal Reserve (Fed) has started lowering rates from recent highs, officials have held the level steady this year as Trump’s tariffs began rippling through the world’s biggest economy.

The Fed has kept interest rates between 4.25% and 4.50% since December, while it monitors the health of the jobs market and inflation.

“The hope is to stay below the radar screen at this meeting,” KPMG chief economist Diane Swonk told Agence France-Presse (AFP).

“Uncertainty is still very high.”

“Until they know sufficiently, and convincingly that inflation is not going to pick up” either in response to tariffs or related threats, “they just can’t move,” she said.

Later during the week, the Bank of England (BoE), the Central Bank of the Republic of Türkiye (CBRT), and the Bank of Japan (BOJ) would also share their decisions on the interest rates.

Both the BoE and the Turkish central bank have their monetary policy meetings (MPC) on Thursday at midday, while Japanese policymakers would gather on Friday.

The Bank of England has cut the U.K.’s official interest rate by a quarter point to 4.25% last month as it sees the potential impact of U.S. tariffs on growth.

Despite a divided 5-4 vote in favor of cutting borrowing costs, this decision has proven to be timely, as recent data showed that the output of the British economy contracted by 0.3% in April, the same month in which Trump introduced his sweeping tariffs on most nations.

Economists, however, expect the bank to pause its easing this week.

Bank of England Governor Andrew Bailey looks on during the Monetary Policy Report news conference, London, U.K., May 8, 2025. (Reuters Photo)

All 60 economists polled by Reuters expect the BoE to keep rates on hold at 4.25% this month, and almost all expect the next quarter-point rate cut to come in August.

So far, the central bank has taken what it calls a “gradual and careful” approach to cutting rates due to persistent inflation pressures and wage growth, only reducing rates four times, or every quarter, since August 2024.

Since returning to the presidency, Trump has slapped a 10% tariff on most U.S. trading partners, including the U.K. and Türkiye.

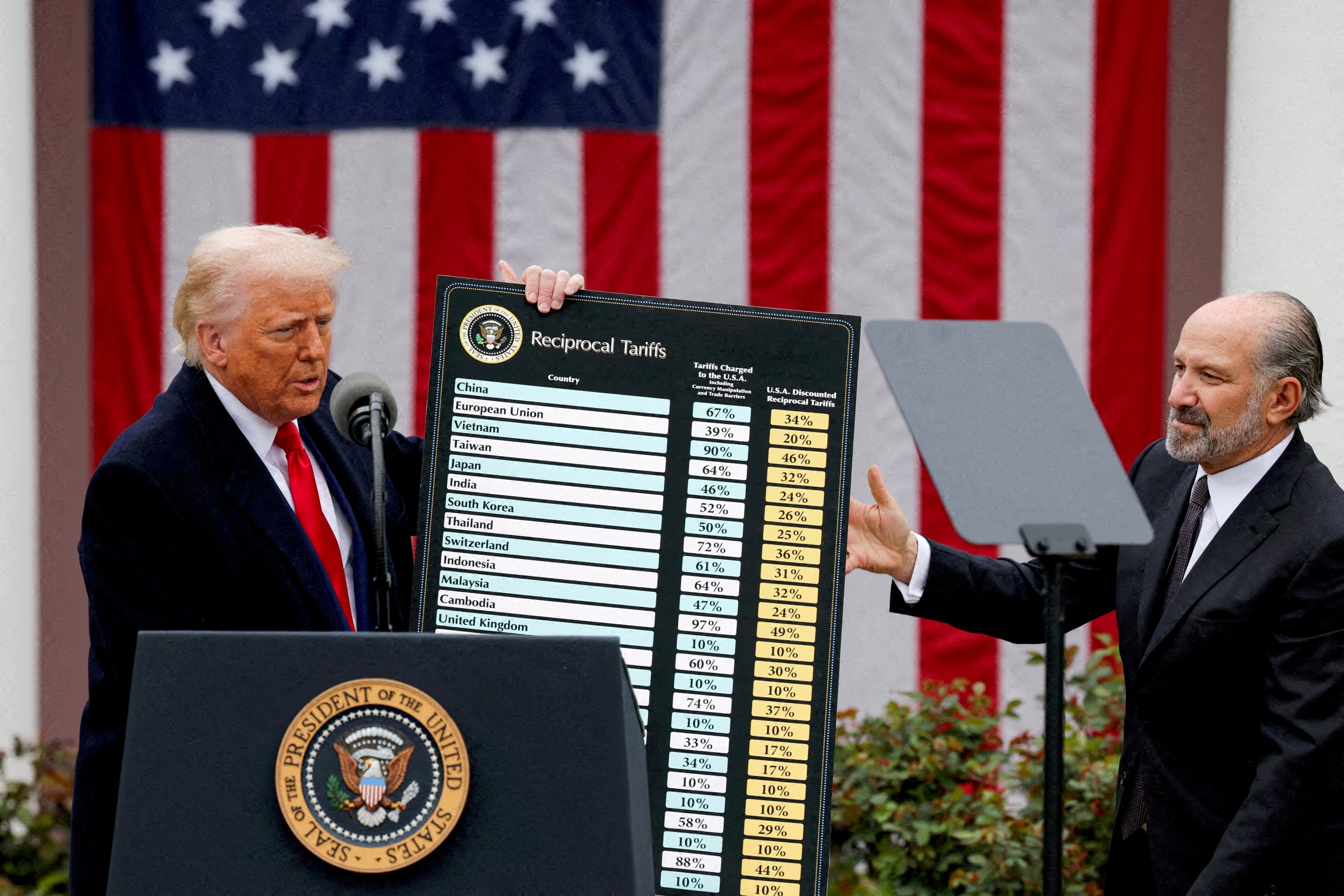

U.S. President Donald Trump holds a chart next to his Secretary of Commerce Howard Lutnick as Trump delivers remarks on tariffs at the White House, Washington, D.C., U.S., April 2, 2025. (Reuters Photo)

Higher rates in dozens of economies will take effect in July, unless an existing pause is extended.

Trump has also engaged in a tit-for-tat tariff war with China and imposed levies on steel, aluminum and automobile imports, rattling financial markets and tanking consumer sentiment.

Major financial institutions from the World Bank to the Organisation for Economic Co-operation and Development (OECD) have warned of a slowdown in global economic growth due to levies and accompanying uncertainty, which makes it difficult for companies and investors to plan long-term.

The World Bank in its latest report lowered the global growth forecast for 2025 by four-tenths of a percentage point to 2.3%, citing that higher tariffs and heightened uncertainty posed a “significant headwind” for nearly all economies. It projected that the global economy was set for its worst run since the 2008 financial crisis.

Coupled with other risks, including impacts on energy markets from fresh conflict between Israel and Iran, Israel’s ongoing Gaza attacks, as well as the Russia-Ukraine war, the central banks thus find themselves in a constant precautionary state with less space for maneuver.

CBRT likely to keep rate unchanged

The Turkish central bank is also expected to keep the policy interest rate unchanged this week, according to a recent poll by the Anadolu Agency (AA).

Despite inflation easing to the lowest since late 2021, the CBRT is likely to maintain rates at 46%, according to 19 of 23 economists polled by AA. Others projected a rise ranging from 100 to 350 basis points.

CBRT Governor Fatih Karahan speaks during a news conference, Istanbul, Türkiye, May 22, 2025. (Reuters Photo)

A rate cut is seen as a possibility at the next meeting on July 24, given that the bank is expected to restart its easing cycle this summer. Reuters poll shows that the easing cycle, once restored, would continue until at least mid-2026.

The average year-end forecast among the surveyed economists by AA is 35.5%.

Annual inflation in Türkiye eased to a lower-than-expected 35.41% in May, according to the official data.

The Daily Sabah Newsletter

Keep up to date with what’s happening in Turkey,

it’s region and the world.

SIGN ME UP

You can unsubscribe at any time. By signing up you are agreeing to our Terms of Use and Privacy Policy.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.