With employment data coming in within expectation, markets are betting the RBA will cut interest rates at the next meeting in July. Pic: Getty Images

- Markets pricing a 78pc chance of rate cut following labour data

- Unemployment levels remained steady

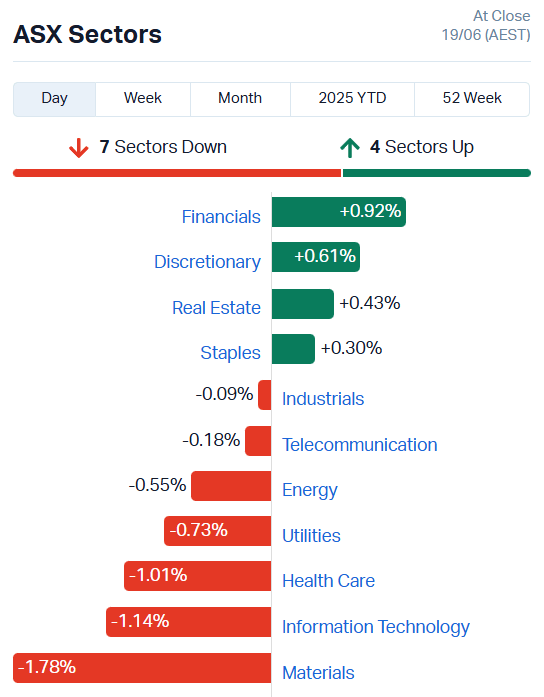

- ASX dips on broad weakness in tech, resources and healthcare stocks

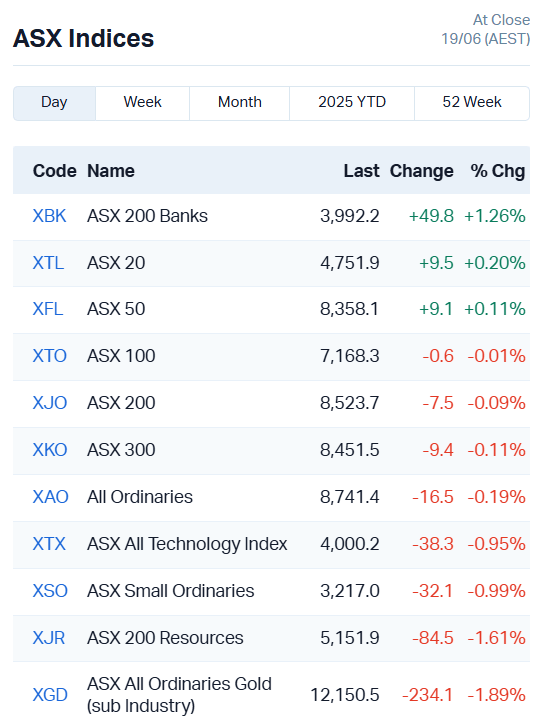

The ASX ended up in negative territory this afternoon, but not by much (-0.09%). It wasn’t the worst performance, considering how many headwinds global markets are dealing with at present.

There’s the lingering threat of more tariffs from the US alongside the more pointed tension between China and America, the four-year saga of the war between Ukraine and Russia, and now the Israel-Iran conflict has turned up the heat even more.

In that context, losing just 0.48% over the last five trading days doesn’t sound too bad.

Financials, and particularly the seven big banking stocks on our ASX200 Banks index, were the bright spot in today’s subdued market.

Source: Market Index

Source: Market Index

They couldn’t outweigh falls in info tech, materials, utilities and healthcare, but Commonwealth Bank (ASX:CBA) added 1.48%, NAB (ASX:NAB) 1% and Westpac (ASX:WBC) 1.7%.

Source: Market Index

Source: Market Index

The All Ords Gold index was an anchor for the ASX, shedding 1.79% and dragging the 200 Resources and Small Ords down with it.

Bets on for July rate cut as employment remains steady

The ABS released its Labour Force Australia survey today, revealing unemployment levels have largely remained steady in May.

Looking at the seasonally adjusted numbers, both the participation and underemployment rate fell slightly, down just 0.1 point, but the overall number of unemployed people fell by about 2,600 individuals, or 0.4%.

Analysts say that’s about as expected, as the past 12 months of strong job uptake levels out to more average numbers.

“Looking ahead, the labour market’s strong run over the past 12 months will slowly fade. Global uncertainty is clouding business decisions and prompting many firms to temper hiring plans,” Oxford Economics Australia economist Kar Chong Low told the ABC.

Bloomberg’s numbers say traders reckon this is a green light for another interest rate cut in the RBA’s July meeting, with the market pricing a 78% chance.

Going by historical correlation, if the market sentiment stays that high right up until the meeting day, a cut is as close to certain as anything can be in this economy.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Making news…

Amplia Therapeutics (ASX:ATX) has achieved a second complete response in its 55-patient Accent trial evaluating FAK inhibitor narmafotinib in combination with chemotherapy in advanced pancreatic cancer.

It’s big news, as complete responses are very rare in patients with advanced pancreatic cancer. A complete response (CR) means a disappearance of all tumour lesions has been maintained for more than two months.

A seminal study demonstrating the effect of chemotherapies gemcitabine and Abraxane in advanced pancreatic cancer reported only one complete response out of 431 patients.

Peak Minerals (ASX:PUA) reckons it’s sitting on a monazite-heavy mineral assemblage at Minta Est, part of the Minta rutile project in Cameroon.

The company’s sampling has revealed monazite content levels of up to 73%, alongside 35% rutile and 28% zircon. Monazite is valued at about 3-fold rutile and zircon, offering a potentially lucrative opportunity. PUA also averaged 2.4% heavy mineral content over 47 drill holes covering 121 square kilometres, with every hole returning mineralisation.

Surefire Resources (ASX:SRN) has kicked off 5,000m of drilling at its Yidby gold project in WA, looking to expand the project’s gold footprint.

The drill bit will also be testing new targets at the Fender and Marshall prospects and an extensive gold geochemical anomaly at the Money target, which will feel the drill’s bite for the first time.

Hydralite, better known as The Hydration Pharmaceuticals Company (ASX:HPC) on the ASX raked in US$308k in unaudited sales for the month of May, up 34% on April and 18% on May last year.

It’s a milestone for the company as the highest monthly total for the 2025 FY, underpinned by gross margins of 66.5%.

Resources & Energy Group (ASX:REZ) is poised to receive a cash injection of $1 million and 33 million QMines (ASX:QML) shares after getting the green light for the sale of the Mount Mackenzie gold project from due diligence teams.

The shares will be voluntarily be held in escrow for 12 months, offering REZ upside to whatever QML finds at Mount Mackenzie through its new share holding in the company.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

IN CASE YOU MISSED IT

ADX Energy (ASX:ADX) has progressed its shallow gas ambitions in Austria with the maturing of seven prospects to drill-ready status. The prospects hold mean prospective resources totalling 29 billion cubic feet of gas.

EZZ Life Science (ASX:EZZ) has officially entered the US with four new supplements under its new brand, EZZDAY.

TRADING HALTS

African Gold Ltd (ASX:A1G) – resource upgrade

Alligator Energy Ltd (ASX:AGE) – cap raise

Estrella Resources Ltd (ASX:ESR) – exploration update

Microba Life Sciences Ltd (ASX:MAP) – cap raise

Prominence Energy Ltd (ASX:PRM) – acquisition & cap raise

Universal Biosensors Inc (ASX:UBI) – cap raise

Magellan Asset Management (AASF) – operational issues

Savana US Small Caps Active ETF (ASX:SVNP) – IT/maker disruptions

At Stockhead, we tell it like it is. While ADX Energy and EZZ Life Science are a Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.