ERD officials attribute this to the end of grace periods for several mega projects and budget support loans, compounded by high market-based interest rates

TBS Report

22 June, 2025, 07:35 pm

Last modified: 22 June, 2025, 11:20 pm

Infographic: ERD

“>

Infographic: ERD

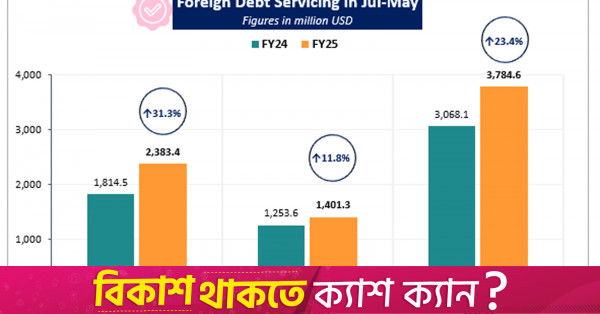

Bangladesh’s foreign debt repayments have surged to a record $3.784 billion in July-May period of the current fiscal year, marking a 23.4% year-on-year increase, according to a report released today (22 June) by the Economic Relations Division (ERD).

This is the highest amount ever repaid by Bangladesh in a single fiscal period. In comparison, the country repaid $3.068 billion during the same period last fiscal year. For the entire FY24, total repayments stood at $3.37 billion.

ERD officials, however, attributed the rise to repayment pressure which they said is gradually increasing with the grace periods for several previously undertaken mega projects and budget support loans coming to an end.

The pressure is being further intensified by high market-driven interest rates.

Keep updated, follow The Business Standard’s Google news channel

According to ERD data, between July and May of FY25, principal repayments rose by 32.86% as the government paid $2.383 billion to various development partners. In comparison, during the same period in the previous fiscal, $1.814 billion was repaid.

Meanwhile, during the same period, interest payments by the government increased by 31.3%, totalling $1.40 billion compared to $1.253 billion in FY24.

Economists warned that the repayment burden is likely to grow in the coming years as grace periods for major loans – such as the one for the Rooppur Nuclear Power Plant – are set to expire.

They noted that many of the major loans Bangladesh took in recent years came with tough conditions, such as shorter repayment periods and higher interest rates, intensifying the repayment pressure on the government.

M Masrur Reaz, chairman and CEO of Policy Exchange Bangladesh, noted that the country’s debt discipline has been under pressure since FY17 due to indiscriminate borrowing for megaprojects.

“Some of these projects were unnecessary or overestimated in cost, lacking economic returns and proper feasibility studies or quality control,” he told The Business Standard.

“Since domestic revenue collection remains under pressure, foreign loans were often the go-to solution. As a result, in the past seven years, our external debt has doubled, a trend that is both rapid and concerning,” he added.

Masrur Reaz further noted that the volume of hard-term loans has also increased. These loans typically carry higher interest rates, shorter grace periods, and tight repayment timelines.

In response to economic stress following Covid-19 and the Russia-Ukraine war, Bangladesh took several budget support loans with short repayment windows, which are now coming due.

“This situation has strained our fiscal discipline and reduced fiscal space,” he said, adding, “We now need a coordinated fiscal strategy that considers both our repayment capacity and future borrowing needs.”

Decline in disbursements

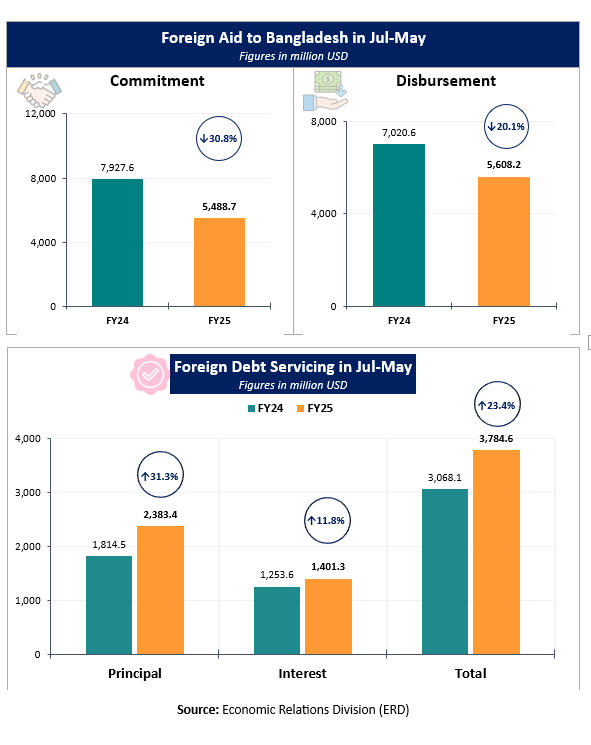

From July to May of the current fiscal year, Bangladesh received commitments worth $5.488 billion from development partners, down from $7.927 billion during the same period last year.

In terms of actual disbursement, development partners released $5.608 billion in foreign loans during the July–May period, compared to $7.02 billion disbursed in the corresponding period of the previous fiscal year.

According to ERD officials, the decline is due to political and administrative uncertainties since the interim government assumed power, which has slowed project implementation and affected donor confidence.

They also noted that the interim government had adopted a conservative borrowing policy, leading to fewer loan agreements being signed.

However, some agreements for human capital, employment, and rural development projects may still be finalised by the end of the fiscal year.

ERD expects a surge in loan commitments and disbursements this month, driven by budget support loans from major development partners.

They noted that agreements totalling around $2 billion are either signed or underway with the World Bank, Asian Development Bank, Japan, and the Asian Infrastructure Investment Bank.