France has officially authorised the sale of a 32% stake in transport operator Transdev to the German conglomerate Rethmann, giving the German firm majority ownership. A definitive step in the privatisation of one of France’s key international transport players, the move will likely fuel further tension at home as Transdev tries to chip away at SNCF’s dominance.

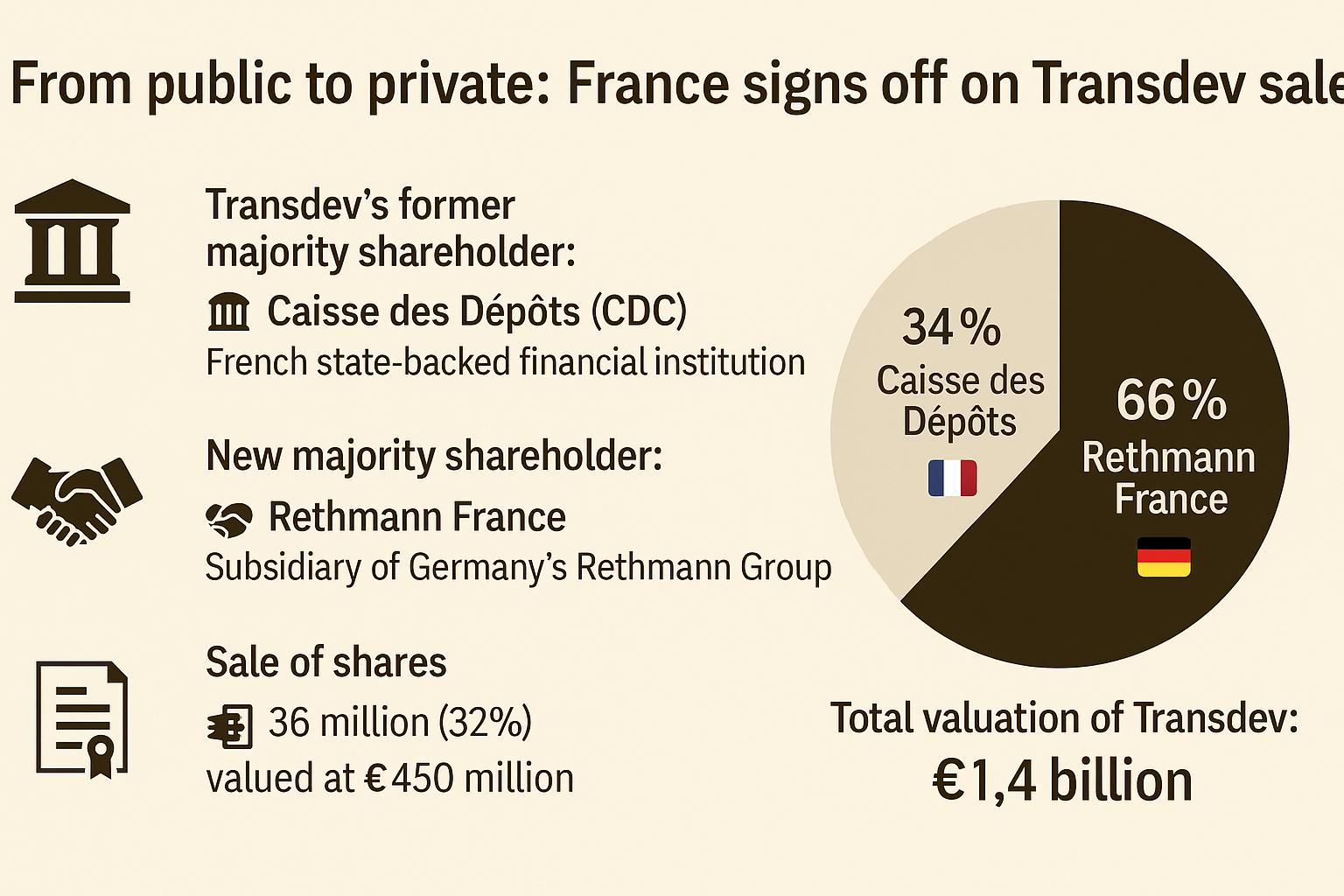

A decree published in France’s Journal Officiel on Saturday confirms that Bercy, the French Ministry of the Economy, has approved the sale of more than 36 million shares in Transdev Group to Rethmann France. The stake was sold by state-backed financial institution Caisse des Dépôts (CDC) for 450 million euros, with Transdev valued at 1.4 billion euros. The German group will now hold 66% of the company, with CDC retaining 34%.

The move transforms Transdev from a semi-public operator into a privately controlled company for the first time, ending a chapter in which it served as a state-influenced counterbalance to the SNCF. Although Transdev had long operated as a commercially oriented transport company, the CDC’s majority stake since 2017 gave it a firm French public backbone — one that weakened not through formal divestment until 2024, but as Transdev’s focus increasingly shifted toward international markets.

The Transdev deal broken down. © ProMedia with visuals created by ChatGPT

The Transdev deal broken down. © ProMedia with visuals created by ChatGPT

The privatisation decree stipulates that Transdev’s current management will remain in place, with the company also saying its HQ would remain in France in past statements. Rethmann, whose holdings span recycling, logistics, water, and food sectors in Germany, has apparently committed to long-term continuity — both in operations and in leadership. It is also set to receive an additional payment from the 2026 dividend, tied to Transdev’s performance in 2025.

‘Not the best majority shareholder’

The sale had been flagged since late 2024, when CDC CEO Eric Lombard — now France’s Economy Minister — said publicly that the institution was no longer the “best majority shareholder” for a company whose growth was increasingly driven by foreign markets. Only about one-third of Transdev’s business is now conducted in France.

Indeed, following its 2023 acquisition of US operator First Transit, Transdev became the largest private public transport operator in North America, employing more than 100,000 people across 19 countries. In 2024, the group passed 10 billion euros in annual revenue, posting a 31% rise in operating income to 222 million euros and doubling its net income despite asset impairments.

Several suitors reportedly approached CDC during the sale process, but Rethmann was selected for its alignment with Transdev’s existing structure, with CDC citing “shareholder continuity” as a decisive factor.

From public pride to foreign control

The partial state backing of Transdev, formed in 1992 and expanded through a merger with Veolia Transport in 2011, was partly always a political move; it was a way to shape France’s public transport model while competing with SNCF on domestic and foreign routes. However, with a majority-German shareholder and a boardroom ever more independent of French state control, Transdev’s ambitions to grow its footprint in France’s liberalising regional rail market now take on new significance.

Indeed, Transdev has become the poster child for France’s cautious experiment with rail liberalisation — and for its challenges. In 2021, it beat SNCF and Trenitalia’s Thello in a landmark tender to operate the Marseille–Nice TER route, now scheduled to launch on 29 June 2025. The ten-year, 50-million-euro contract marked the first time a regional French rail service would be run by someone other than the national rail incumbent.

A messy start in France

But progress has been messy. As RailTech reported earlier this year, only eight of the sixteen new Alstom Omneo trains will be delivered in time for the launch. With French regions unwilling to delay the transition, Transdev is now sourcing additional rolling stock through inter-regional leasing, while union officials continue to criticise the idea of SNCF lending trains to its private rival.

Nonetheless, Transdev insists it is ready. The company received the first unit in mid-May and has committed to launching 14 daily return trips and doubling service frequency from day one. It has also submitted bids for multiple RATP bus packages in the Paris region and is selectively engaging in other TER tenders.

And as the company distances itself from state ownership and seeks to prove its value as a leaner, foreign-led alternative, the battle with SNCF is set to intensify — not just on the tracks, but in the political imagination of what the future of French rail should look like. Despite SNCF’s pushback, rail liberalisation appears to be officially on the menu in France.

Read more:

This is an exclusive article.

Subscribe to gain access to all news.

Already have a subscription? Log in.

Choose your subscription

Or

Want to read this article for free?

You can read one free article per month. Enter your email and we’ll send you a free link to access the full article. No payment required.