The global economy will get no help from China if growth in the US gives way

- Official PMI data to show China’s economy remains near standstill in June

- S&P Global PMIs this week showed Europe idling while the US soldiers on

- Citigroup analytics warn US momentum is ebbing, flagging recession risk

The United States continues to carry global economic growth on its shoulders, according to purchasing managers index (PMI) data reported by S&P Global this week. In the weak ahead, analog data tracking China’s performance is expected to underscore as much yet again.

The US, China, and the Eurozone account for a hefty 58% of global gross domestic product (GDP). Much of the remaining 42% are vendor countries that rely on feeding demand from the “big three” economies to generate their contributions to overall growth. If all three of the engines powering demand misfire a worldwide recession is inevitable.

PMI data to show China’s economy probably remains near standstill

The latest batch of S&P Global data put the Eurozone near standstill for a second consecutive month in June. The composite index subsuming the manufacturing and service sectors registered at 50.2 for a second consecutive month, a hair above the 50 “boom-bust” level where economic activity is neither growing nor contracting.

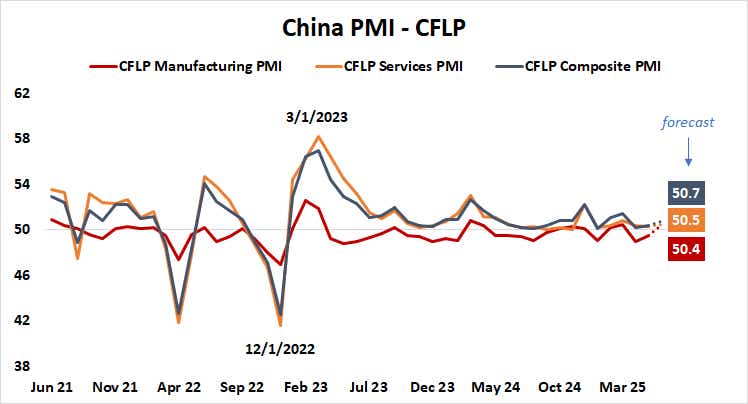

CFLP, NBS

CFLP, NBS

The China Federation for Logistics and Purchasing (CFLP) alongside the National Bureau of Statistics (NBS) are expected to produce similar results with Beijing’s official PMI data. The composite gauge here is expected to come in at 50.7 in June. Despite a slight uptick from 50.4 in May, this would still make for near-idle growth conditions.

These soggy readings are hardly unusual. Eurozone composite PMI has averaged 50.1 for the past 12 months. China’s CFLP composite PMI has averaged 50.7 over the same period. Another version of the same measure from S&P Global and Caixin has averaged a seemingly more encouraging 51.5, but that mostly reflects higher volatility in the data.

The US is the single point of failure for global growth. Is it wobbling?

US PMI figures paint a decidedly brighter picture. The economy’s performance has undeniably cooled since the second half of last year, when the booming service sector produced the fastest expansion in two years. Nevertheless, with a composite PMI reading at 52.8 in June, activity growth looks solid and near the top of the range for 2025 so far.

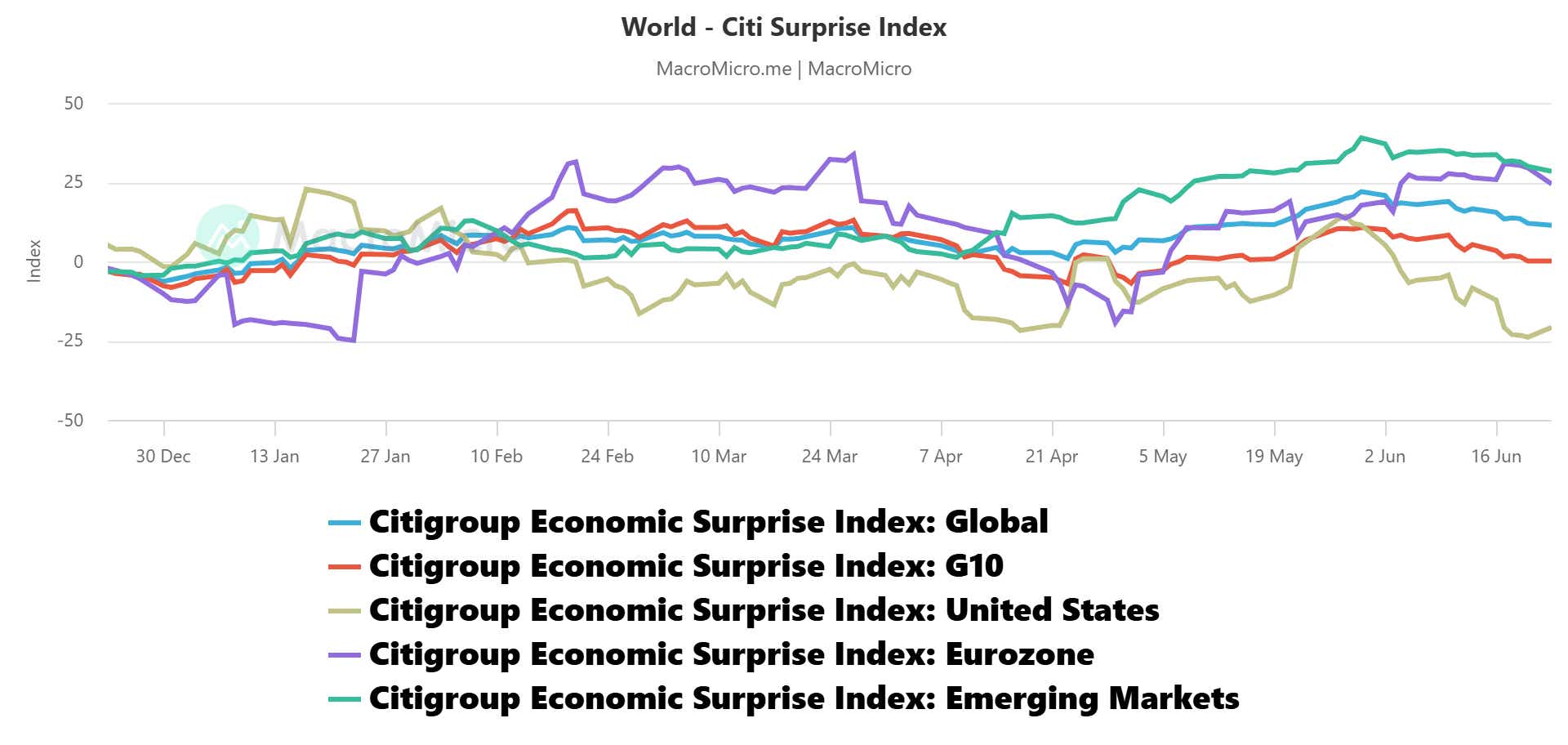

In all, this means that global growth hinges on that of the US, with no safety net from Europe or China in the event that something goes awry. As it happens, analytics from Citigroup warn that US economic data has increasingly disappointed relative to baseline forecasts over the past month. The stage-setting for a global recession may be taking shape.

MacroMicro

MacroMicro

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts #Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.