SINGAPORE – The Central Provident Fund (CPF) has rolled out a new digital platform that gives members access to financial planning tools to make better use of their savings.

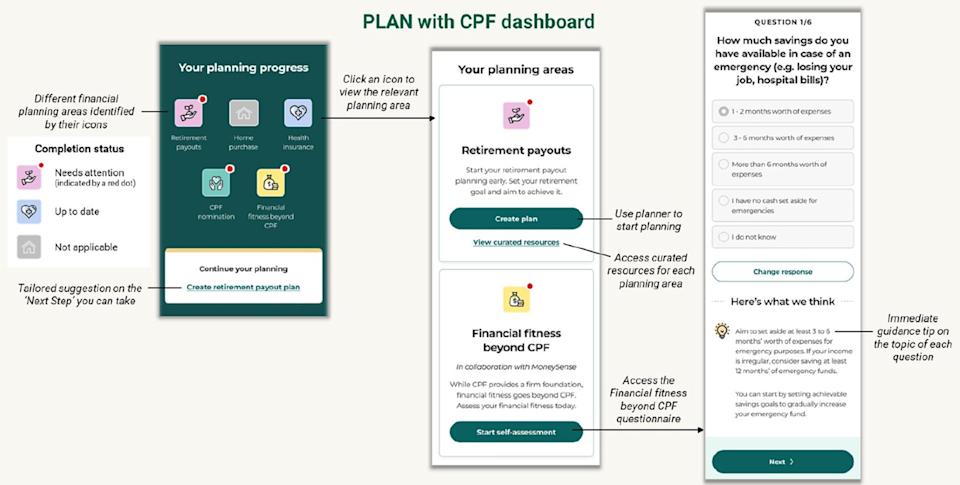

With the “PLAN (Plan Life Ahead, Now!) with CPF” platform, which is available on the CPF website, members can project their retirement savings and payout, calculate their home purchase budget and assess the affordability of health insurance premiums.

Members using the platform will see a personalised dashboard, with content and resources tailored to their current life stage.

The platform was rolled out on July 5 during CPF’s 70th anniversary commemorative book launch event.

CPF Board chief executive Melissa Khoo said “PLAN with CPF” is being rolled out to empower members to take charge of their financial health.

With the retirement payout planner, members can map out their payout goals and explore ways to leverage CPF to achieve their goals, such as through top-ups.

The home purchase planner shows CPF members their home purchase budget, loan options and how their housing decisions can impact their retirement payouts.

With the health insurance planner, members can compare premiums and key features across different Integrated Shield Plans and make informed decisions about their healthcare coverage, CPF said.

The platform also provides educational resources on financial planning and a financial fitness questionnaire that allows users to assess their overall financial health beyond CPF matters.

The “PLAN with CPF” platform features a personalised dashboard for CPF members, with content and resources tailored to their current life stage.

Developed in collaboration with national financial education programme MoneySense, it asks questions such as “How much savings do you have available in case of an emergency?” and provides relevant tips.

In her speech at the event, Ms Khoo said CPF has a deep sense of purpose in being a cornerstone of Singapore’s social security system, adding that the fund will continue to innovate as part of a commitment to its members.

“As retirement aspirations become more diverse and with healthier longevity, I believe these values will continue to steer us in meeting future needs,” she said.

Members can project their retirement savings and payout, calculate their home purchase budget and assess the affordability of health insurance premiums.

To commemorate its 70th anniversary, CPF Board on July 5 launched a book, titled Save & Sound: 70 Years Of CPF, which chronicles the organisation’s journey through the years.

It includes behind-the-scenes perspectives from current and former ministers, and leaders and staff of CPF Board, as well as stories from people of how CPF has impacted their lives.

The book is not for sale. A digital copy is available at cpf.gov.sg/member/infohub/cpf70

Members of the public can visit an exhibition about CPF’s history at Our Tampines Hub till July 10, where they can also try the “PLAN with CPF” platform. Talks on housing, healthcare and retirement will be available on July 5 and 6.

Source: The Straits Times © SPH Media Limited. Permission required for reproduction

Discover how to enjoy other premium articles here