The Texas Employment Forecast indicates jobs will increase 1.7 percent in 2025, with an 80 percent confidence band of 1.3 to 2.1 percent. The forecast is based on an average of four models that include projected U.S. gross domestic product, oil futures prices and the Texas and U.S. leading indexes. The forecast implies 244,600 jobs will be added in Texas this year, and employment in December 2025 will be 14.5 million (Chart 1).

The Texas labor market weakened broadly in June, with employment declining an annualized 1.3 percent. May employment growth was revised down to 2.1 percent.

“Employment fell in June for the first time in a year, with the state losing 15,500 jobs. With the slowing, job growth in the first half of 2025 now stands at 1.8 percent, just below its long-term trend of 2.0 percent,” said Jesus Cañas, Dallas Fed senior business economist. “June declines were largely broad based across sectors, led by cuts in the oil and gas and professional business services sectors. The only sectors that added jobs last month were information services, education and health, and government. Additionally, employment fell in all major Texas metros except San Antonio,” he added.

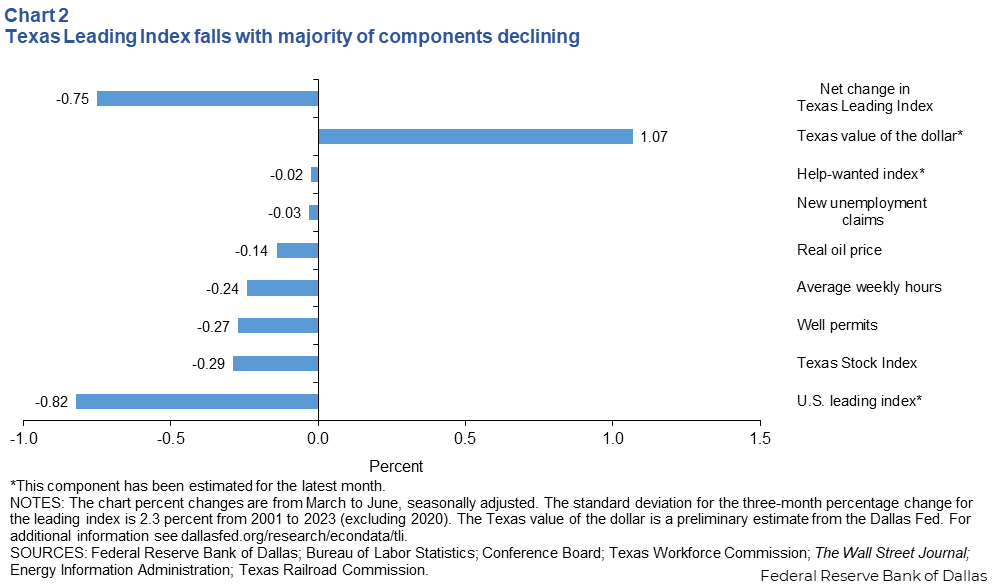

The Texas Leading Index decreased over the three months through June. (Chart 2). Most of the components fell, led by the decline in the U.S. leading index and the Texas Stock Index. Decreases in well permits, average weekly hours, real oil prices, and an increase in new unemployment claims, also dragged the index down. A drop in the Texas value of the dollar was the only positive contributor to the index.

Next release: August 15, 2025

Methodology

The Dallas Fed’s Texas Employment Forecast projects job growth for the calendar year and is estimated as the 12-month change in payroll employment from December to December.

The forecast is based on the average of four models. Three models are vector autoregressions for which Texas payroll employment is regressed on the lags of West Texas Intermediate (WTI) oil prices, the U.S. leading index and the Texas Leading Index. The fourth model is an autoregressive distributed lag model with regression of payroll employment on lags of payroll employment, current and lagged values of U.S. GDP growth and WTI oil prices, and Texas COVID-19 hospitalizations through March 2023. Forecasts of Texas payroll employment from this model also use forecasts of U.S. GDP growth from Blue Chip Economic Indicators and WTI oil price futures as inputs. All models include four COVID-19 dummy variables (March–June 2020).

For additional details, see dallasfed.org/research/forecast/.

Contact Information

For more information about the Texas Employment Forecast, contact Jesus Cañas at jesus.canas@dal.frb.org.