2h agoTue 22 Jul 2025 at 9:28pmMarket snapshot

- ASX 200 futures: +0.5% to 8,681 points

- Australian dollar: Flat at 65.52 US cents

- S&P 500: +0.1% to 6,310 points

- Nasdaq: -0.4% to 20,893 points

- FTSE: +0.1% to 9,024 points

- EuroStoxx: -0.4% to 544 points

- Spot gold: +1% to $US3,431/ounce

- Brent crude: -0.6% to $US68.79/barrel

- Iron ore: -0.2% to $US100.00/tonne

- Bitcoin: -0.2% to $US119,594

Prices current around 7:25am AEST.

Live updates on the major ASX indices:

3m agoTue 22 Jul 2025 at 11:53pmTrump strikes tariff deal with Japan

President Donald Trump on Tuesday said the US and Japan had struck a trade deal that included a 15% tariff that would be levied on US imports from the country.

In a post on Truth Social, Trump said the deal would include $US550 billion of Japanese investments in the United States.

He also said that Japan would increase market access to American producers of cars, trucks, rice and certain agricultural products, among other items.

Trump’s post made no mention of easing tariffs on Japanese automobiles, which account for more than a quarter of all the country’s exports to the United States and are currently subject to a 25% tariff.

Reuters could not immediately confirm the elements of the deal announced by Trump, and details were scant.

The White House did not immediately respond to a request for additional details, while the Japanese foreign ministry did not immediately respond to a request for comment on Trump’s announcement.

“This is a very exciting time for the United States of America, and especially for the fact that we will continue to always have a great relationship with the Country of Japan,” Trump said.

Trump’s announcement follows a meeting with Japan’s top tariff negotiator, Ryosei Akazawa, at the White House on Tuesday, according to a person familiar with the matter.

Reuters

41m agoTue 22 Jul 2025 at 11:15pmMortgage serviceability buffer to remain at 3pc

Banking regulator Australian Prudential Regulation Authority (APRA) has decided to keep the buffer applied when lenders assess home loans steady.

That means banks will need to continue assessing most mortgages based on a borrower’s ability to repay the loan at 3 percentage points above the current interest rate.

So, for example, if you are applying for a home loan with 5 per cent rate, the lender will check you can still repay it at an 8 per cent rate as part of the approval process.

Announcing the decision, APRA said its policies are aimed at “mitigating financial stability risks at a system-wide level to promote a safe and stable financial system that enables households and businesses to confidently borrow, save and invest for the future”.

The regulator noted that bank lending standards remain sound and non-performing loans remain low, but said there was an “elevated” risk of economic shocks due to geopolitical uncertainty.

APRA chair John Lonsdale said the current level of the buffer has not been restrictive on new credit to the household sector.

“Over recent months, we have seen credit continuing to flow to different borrower segments, including to first home buyers…

“Looking ahead, however, should interest rates fall significantly further while labour markets remain robust, that has historically led to higher credit growth and leverage, higher house prices and often more risky lending, such as high debt-to-income and investor lending.

“The potential for a recurrence of these trends is something both APRA and the Council of Financial Regulators are carefully monitoring.

“High household debt is a key vulnerability in our financial system, which has more exposure to residential mortgages than any comparable country.”

There have been calls from some sectors for the mortgage serviceability buffer to increase, including from the Coalition during the election campaign earlier this year.

You can read more on the potential impact of a lower serviceability buffer from current blog master and business editor Michael Janda here:

43m agoTue 22 Jul 2025 at 11:12pm

Alan Kohler on yesterday’s market action

As we get ready for the local market to open today, here’s the best way to catch up on the highlights from yesterday’s trade.

Loading…

1h agoTue 22 Jul 2025 at 10:32pm

Will Donald Trump destroy a multinational tax deal years in the making?

Nassim Khadem looks at the fallout from Donald Trump’s move to have US multinationals excluded from a 15% global minimum corporate tax.

She speaks to one of the people who helped design the scheme.

Loading…

1h agoTue 22 Jul 2025 at 10:26pm

‘Only have two more rate cuts to come’, warns ANZ chief economist

ANZ’s chief economist Richard Yetsenga told The Business that the RBA’s minutes provided more clarity on why the majority of the Monetary Policy Board elected to hold rates steady earlier this month.

Although the decision shocked traders and most economists, Mr Yetsenga said it was probably the market that had got ahead of itself, rather than poor communication by the RBA.

“Potentially the bank has been surprised by how persistent the market has been in pricing easings,” he told the program.

Loading…

“Our view is that we only have two more cuts to come,” he added.

ANZ expects those cuts to come in August and November, which are the meetings that follow forecast updates by RBA staff.

If correct, that would see the cash rate bottom out at 3.35 per cent, just 1 percentage point off its recent high.

1h agoTue 22 Jul 2025 at 10:16pm

Business lobby leader Innes Willox cautiously hopeful on Economic Reform Roundtable

Kirsten Aiken had AiGroup CEO Innes Willox on The Business last night to discuss his approach to the federal government’s Economic Reform Roundtable next month.

Willox is one of a handful (or small roomful) of invited guests, and Kirsten asked him whether he was happy to receive a “golden ticket” to the forum.

“I hope it’s a golden ticket and not a booby prize,” he semi-joked.

Loading…

He’s not expecting consensus, given that worker representatives will also have a strong presence at the forum, but is hopeful on some progress around key issues that need to be addressed.

“If we don’t get deregulation right, we’re in a lot of trouble,” he argued.

“Deregulation doesn’t mean no regulation, it just means better, smarter regulation, where the states and the federal government don’t fall over each other.”

1h agoTue 22 Jul 2025 at 10:02pm

Trump’s uphill legal battle with Rupert Murdoch explained

US law experts say Donald Trump faces significant hurdles in his $10 billion case against Rupert Murdoch’s Wall Street Journal over reports he sent a birthday message to Jeffrey Epstein with a sexually suggestive drawing.

The lawsuit, filed in the Florida Supreme Court, claims the Wall Street Journal “failed to show proof that President Trump authored or signed any such letter and failed to explain how this letter was obtained”.

But experts say defamation cases, brought forward by public figures, are notoriously hard to prove in the US, and they rarely make it to a jury.

The paper has said it was prepared to “vigorously” defend its journalism.

If the case does go to trial, Mr Trump may be forced to provide information about the nature of his relationship with the convicted paedophile and billionaire, and the Journal may be asked to show how it obtained the letter or proved its existence.

Read the full explainer by my colleague Georgie Hewson.

2h agoTue 22 Jul 2025 at 9:51pmTariff impacts start to be felt, GM reports earnings hit

While the S&P 500 eked out a fresh high, it wasn’t smooth sailing for all major companies on the market.

“Tariff impacts are now starting to be felt and reported by firms,” noted NAB’s Tapas Strickland in the bank’s morning note.

“GM shares fell -8.1% after it reported a $US1.1bn tariff hit as it absorbed most of the tariff increases as it waits for the finalisation of trade deals with South Korea, Canada and Mexico before making firmer decisions.

“GM expects a greater tariff hit in coming quarters, and it is worth noting GM imports around half of the vehicles it sells in the US.”

At $US48.49, GM shares are about midway between where they were pre-“liberation day” and the low point they reached following Donald Trump’s shock tariff announcements on April 2.

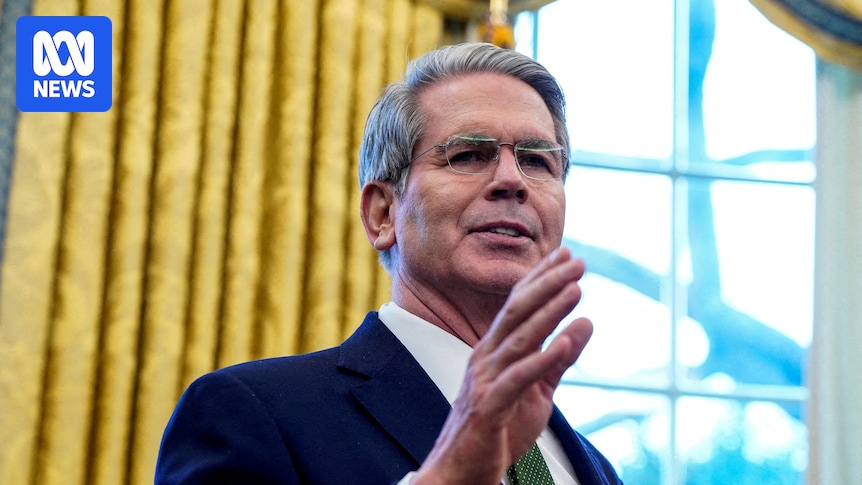

While there is increasing optimism that America’s trade war with China will be kicked down the road a bit further, senior Trump administration officials such as Treasury Secretary Scott Bessent are making strong noises that the August 1 deadline won’t be shifted for most countries.

“Tariffs remain front and centre ahead of August 1 and August 12,” noted Strickland.

“Bessent indicated that the August 12 deadline for China is likely to be extended: ‘China, that deal expires on Aug. 12 and I’m going to be in Stockholm on Monday and Tuesday with my Chinese counterparts. And we’ll be working out what is likely an extension then’.

“A US-Philippines deal was also unveiled, and last week’s US-Indonesia was confirmed, both at a 19% tariff rates. Tariffs so far appear to be settling around 20% which is at the higher end of the post-Liberation Day expectations.”

So, absolutely nothing to worry about then …

Loading

2h agoTue 22 Jul 2025 at 9:40pm

RBA publishes minutes, doesn’t record votes by name

#ICYMI yesterday arvo, I had a story on the RBA minutes.

They were worth reading as they outlined more detail about the reasons for the split in votes between the majority of six who opted to hold and the minority of three who wanted to cut rates.

Last meeting was the first time that the Reserve Bank has published the voting numbers on its monetary policy decision.

Previously, the media had generally been left under the impression that decisions were reached by consensus, although I understand this has not been the case at many meetings and the Reserve Bank Act 1959 requires a vote to be taken.

However, the act does not specify any requirements around minuting that vote, and it seems the RBA doesn’t.

A Freedom of Information request by my colleague Ben Butler for a document “recording the names of the Monetary Policy Board members who voted a) for and b) against the decision of the board to leave the cash target rate unchanged at its meeting on 8 July 2025” was met with the following response from RBA secretary Anthony Dickman.

“We have undertaken a search of our records and have not been able to identify any documents relevant to your request,” he responded.

“No document was created that recorded by name any vote cast by members of the Monetary Policy Board.“

So, not only does the RBA refuse to publish an attributed record of the vote, as does the US Federal Reserve or Bank of England, but it doesn’t even bother to note for its own records who voted which way.

2h agoTue 22 Jul 2025 at 9:15pmTrade deal trickle, falling Fed fears keep Wall St around record highs

Good morning, and welcome to another day on the markets.

I’ll be taking you through the morning before Emily Stewart joins you for the afternoon.

It was a pretty quiet night on Wall Street, with the major themes of recent days dominating — trade talks and discussion over Fed chair Jerome Powell’s future.

On both fronts, the news was seen as mildly positive.

Trade deals have been reached between the US and both Indonesia and the Philippines, according to President Donald Trump, while Treasury Secretary Scott Bessent raised the possibility that an August 12 deadline to reach a China trade deal could be extended.

Bessent also said the relationship between the US and China was in a “very good place”, while President Trump has indicated he may soon visit China to meet with his counterpart there Xi Jinping.

The US Treasury secretary also stated that Fed chair Jerome Powell should be able to see out his term (which ends in May next year) if he wants to, providing markets further comfort that the administration won’t try to remove him early.

Combined with a slew of company earnings results, the news flow was enough to see the S&P 500 edge 0.1% higher to a fresh record of 6,310 points, although the Nasdaq eased 0.4% to 20,893.

Load up the caffeine, put on some Black Sabbath (vale Ozzy), and let’s…

Loading